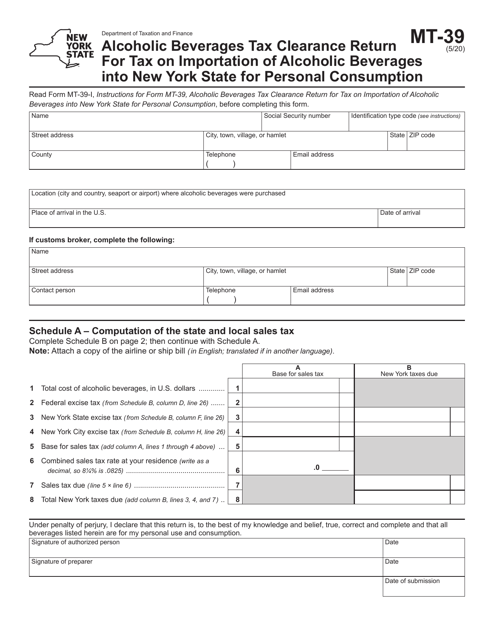

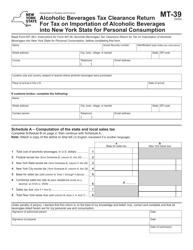

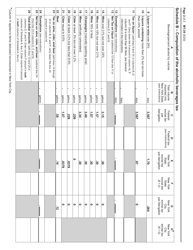

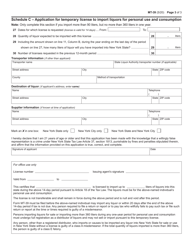

Form MT-39 Alcoholic Beverages Tax Clearance Return for Tax on Importation of Alcoholic Beverages Into New York State for Personal Consumption - New York

What Is Form MT-39?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form MT-39?

A: Form MT-39 is a tax clearance return for the importation of alcoholic beverages into New York State for personal consumption.

Q: What is the purpose of Form MT-39?

A: The purpose of Form MT-39 is to report and pay the tax on imported alcoholic beverages for personal consumption in New York State.

Q: Who needs to file Form MT-39?

A: Anyone who is importing alcoholic beverages into New York State for personal consumption needs to file Form MT-39.

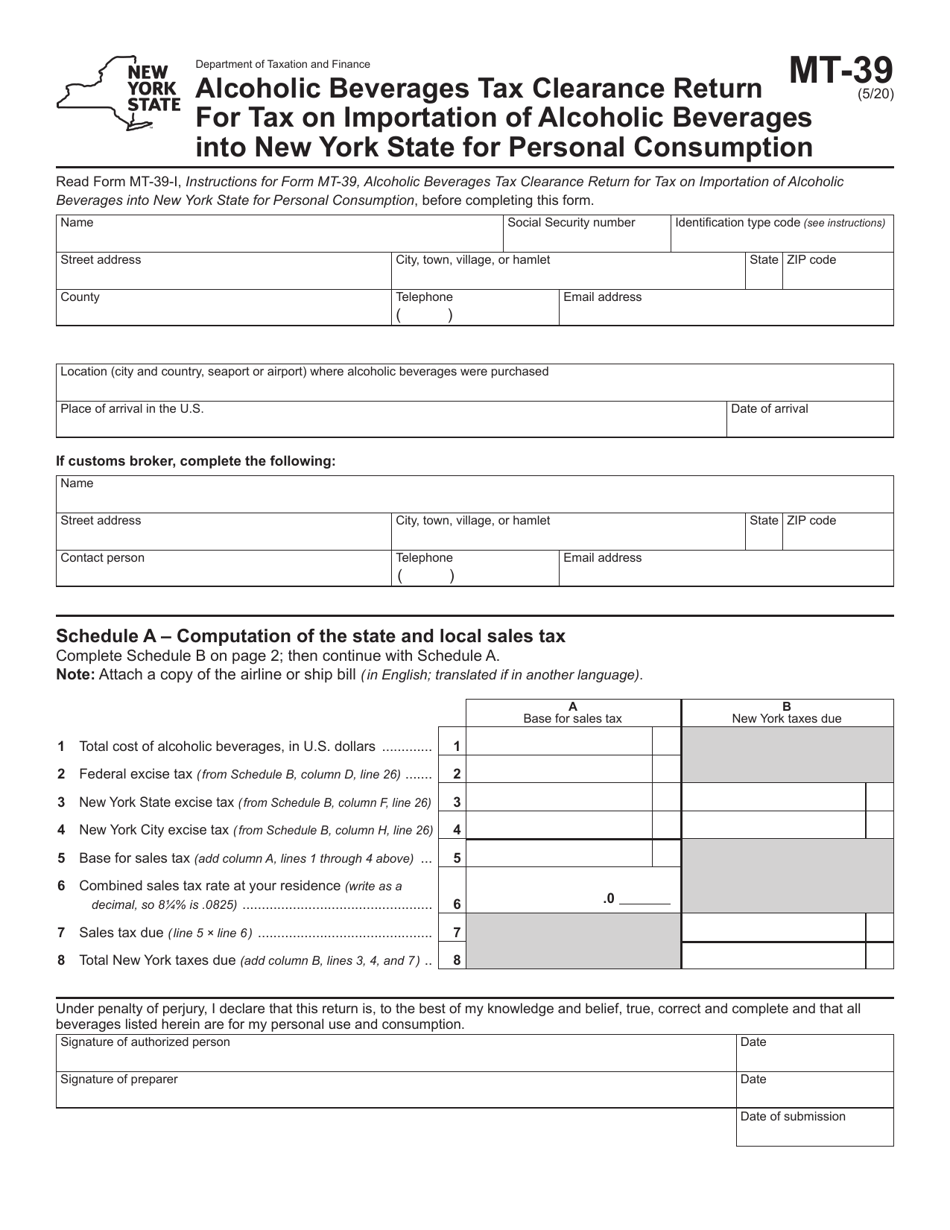

Q: What is the tax rate for imported alcoholic beverages in New York State?

A: The tax rate for imported alcoholic beverages in New York State varies depending on the type of beverage and the size of the container.

Q: When is the deadline to file Form MT-39?

A: The deadline to file Form MT-39 is the 20th day of the month following the month in which the alcoholic beverages were imported.

Q: What happens if I don't file Form MT-39?

A: If you fail to file Form MT-39 and pay the required tax, you may be subject to penalties and interest charges.

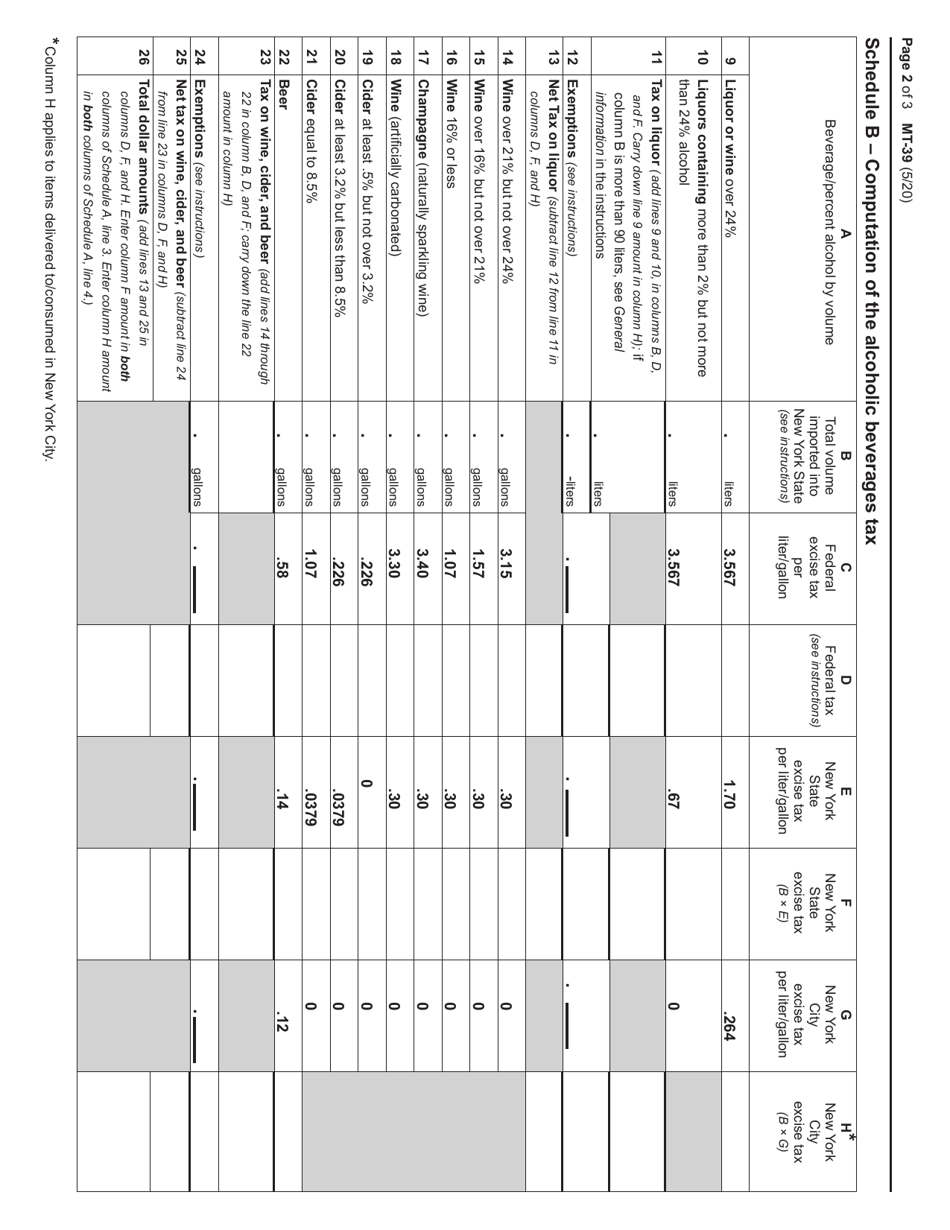

Q: Are there any exemptions from the tax on imported alcoholic beverages in New York State?

A: Yes, certain exemptions may apply, such as for alcoholic beverages imported by a licensed alcoholic beverage manufacturer for their own use.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MT-39 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.