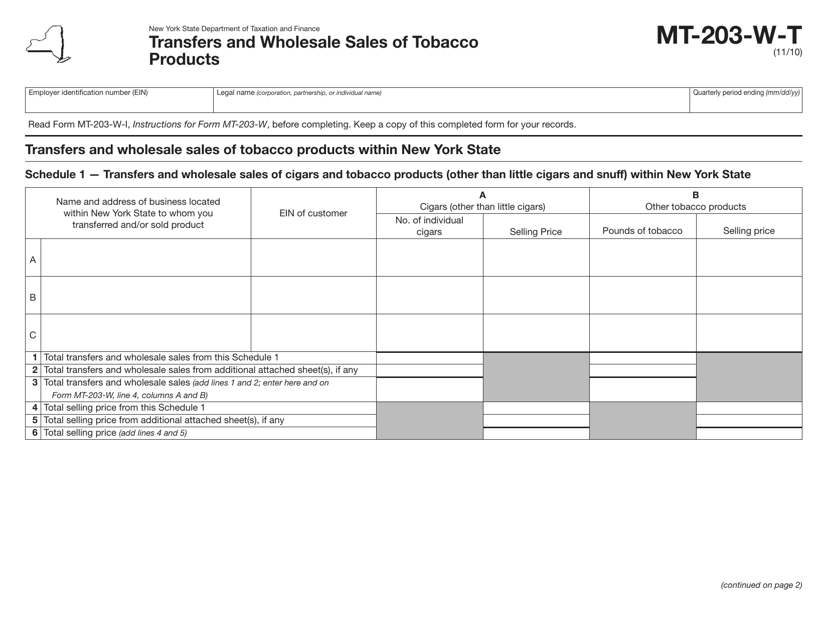

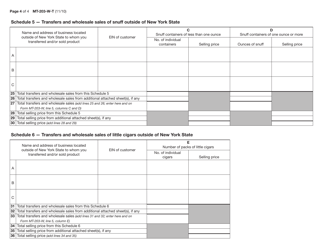

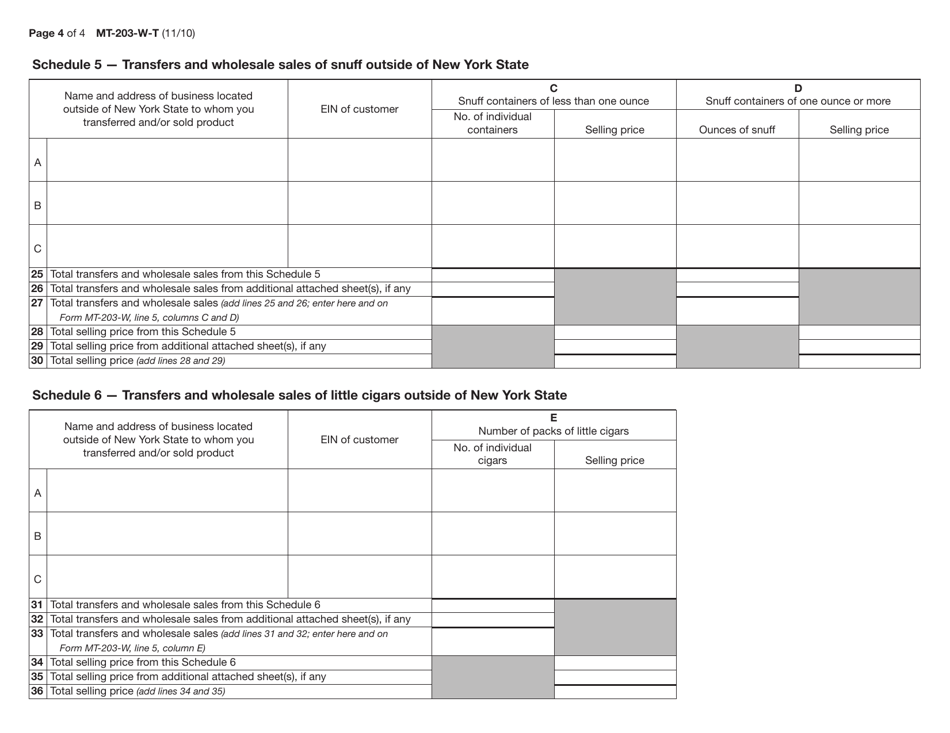

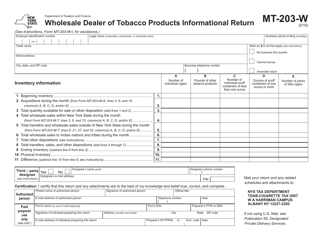

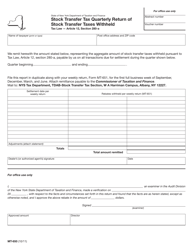

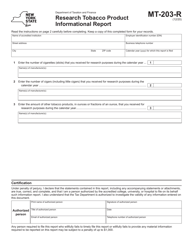

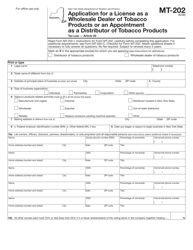

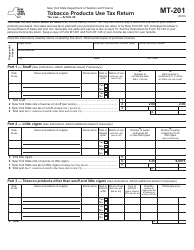

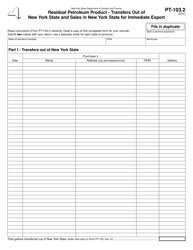

Form MT-203-W-T Transfers and Wholesale Sales of Tobacco Products - New York

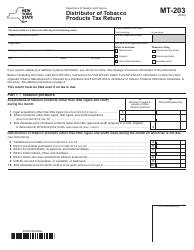

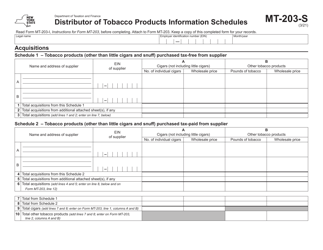

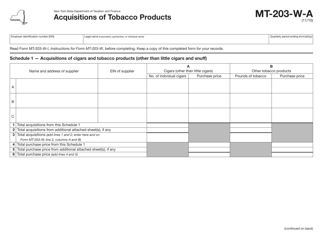

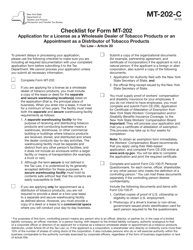

What Is Form MT-203-W-T?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form MT-203-W-T?

A: Form MT-203-W-T is a document used for reporting transfers and wholesale sales of tobacco products in New York.

Q: Who needs to file Form MT-203-W-T?

A: Wholesale dealers, distributors, and manufacturers of tobacco products in New York need to file Form MT-203-W-T.

Q: What information is required on Form MT-203-W-T?

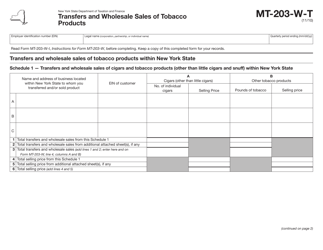

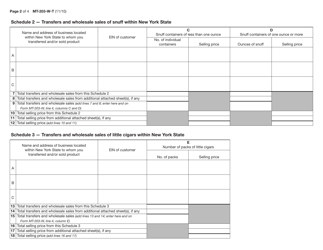

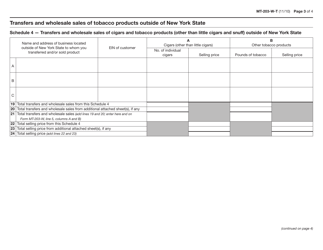

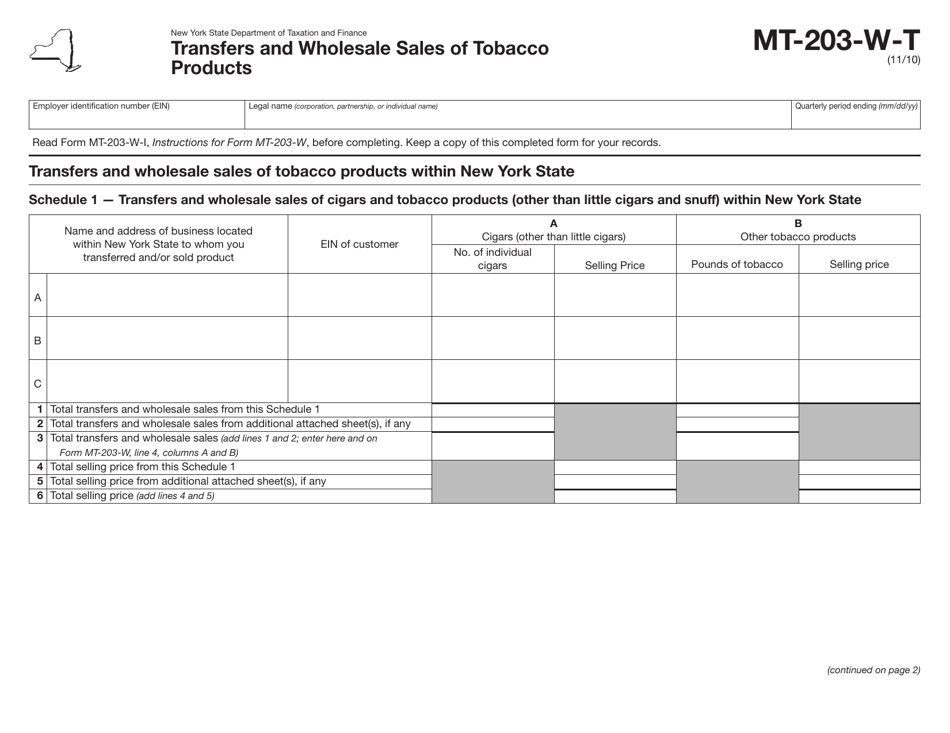

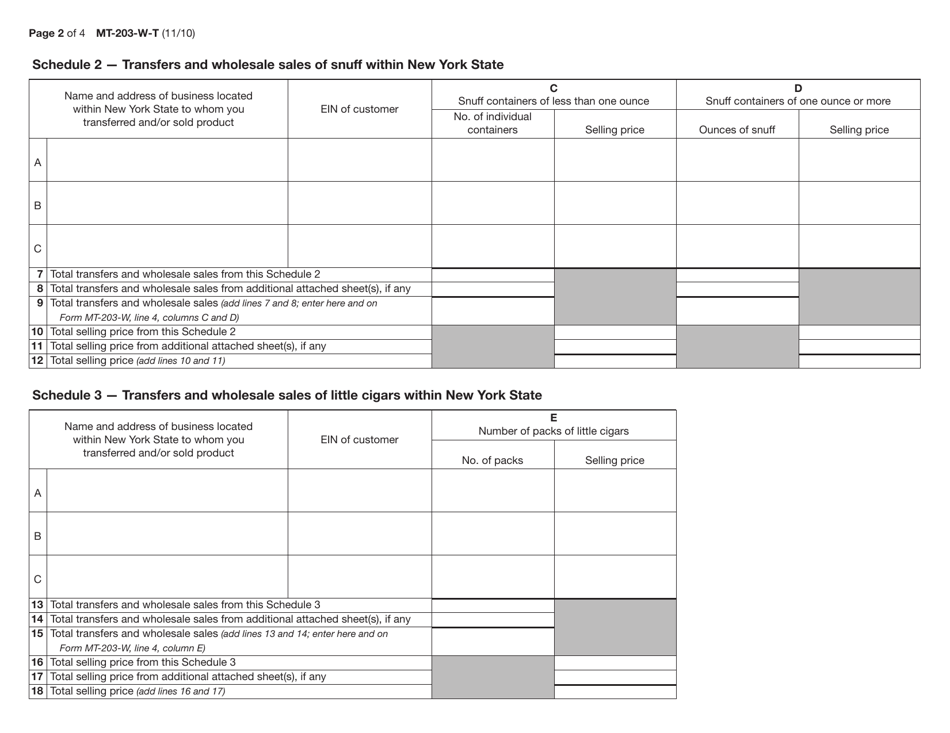

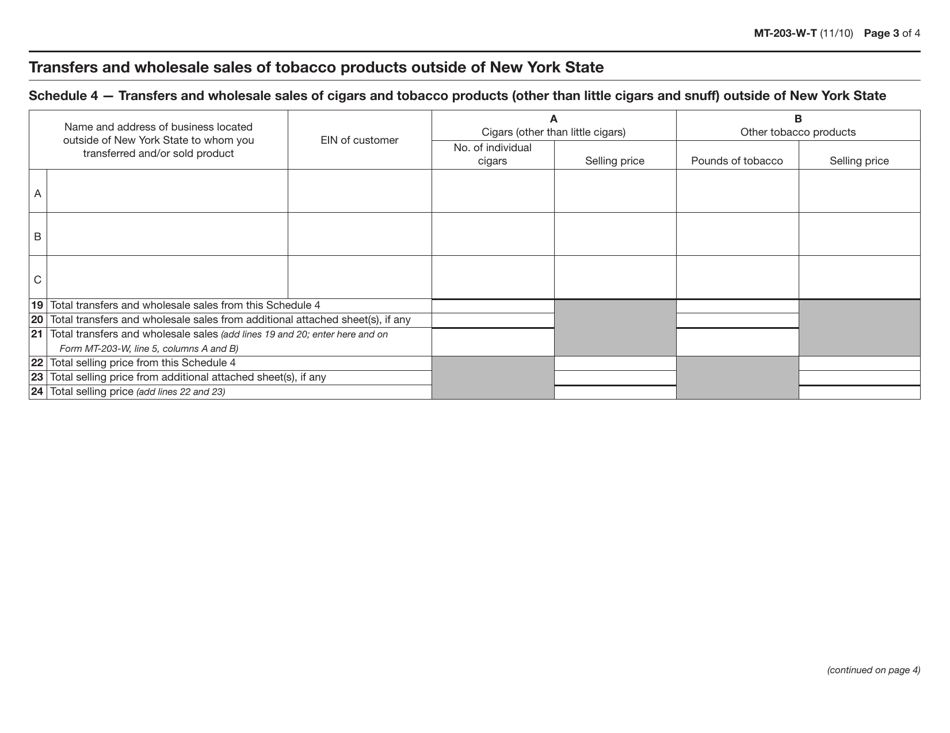

A: Form MT-203-W-T requires information such as the name and address of the seller and buyer, details of the tobacco products transferred or sold, and the total value of the transactions.

Q: When is Form MT-203-W-T due?

A: Form MT-203-W-T is due on or before the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for not filing Form MT-203-W-T?

A: Yes, failure to timely file Form MT-203-W-T may result in penalties and interest charges.

Q: Is Form MT-203-W-T specific to New York?

A: Yes, Form MT-203-W-T is specific to reporting transfers and wholesale sales of tobacco products in New York only.

Form Details:

- Released on November 1, 2010;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MT-203-W-T by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.