This version of the form is not currently in use and is provided for reference only. Download this version of

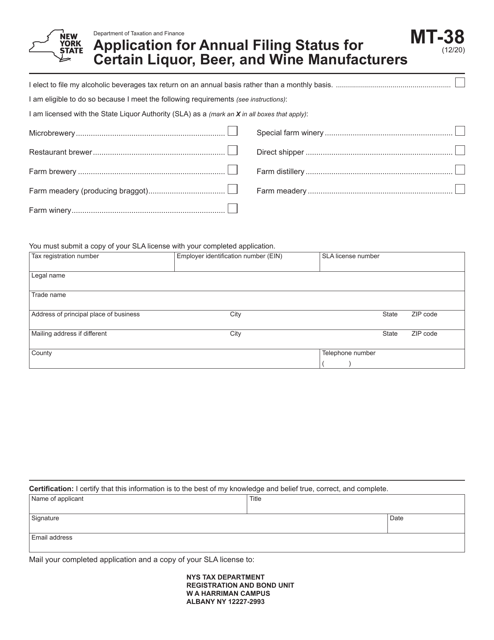

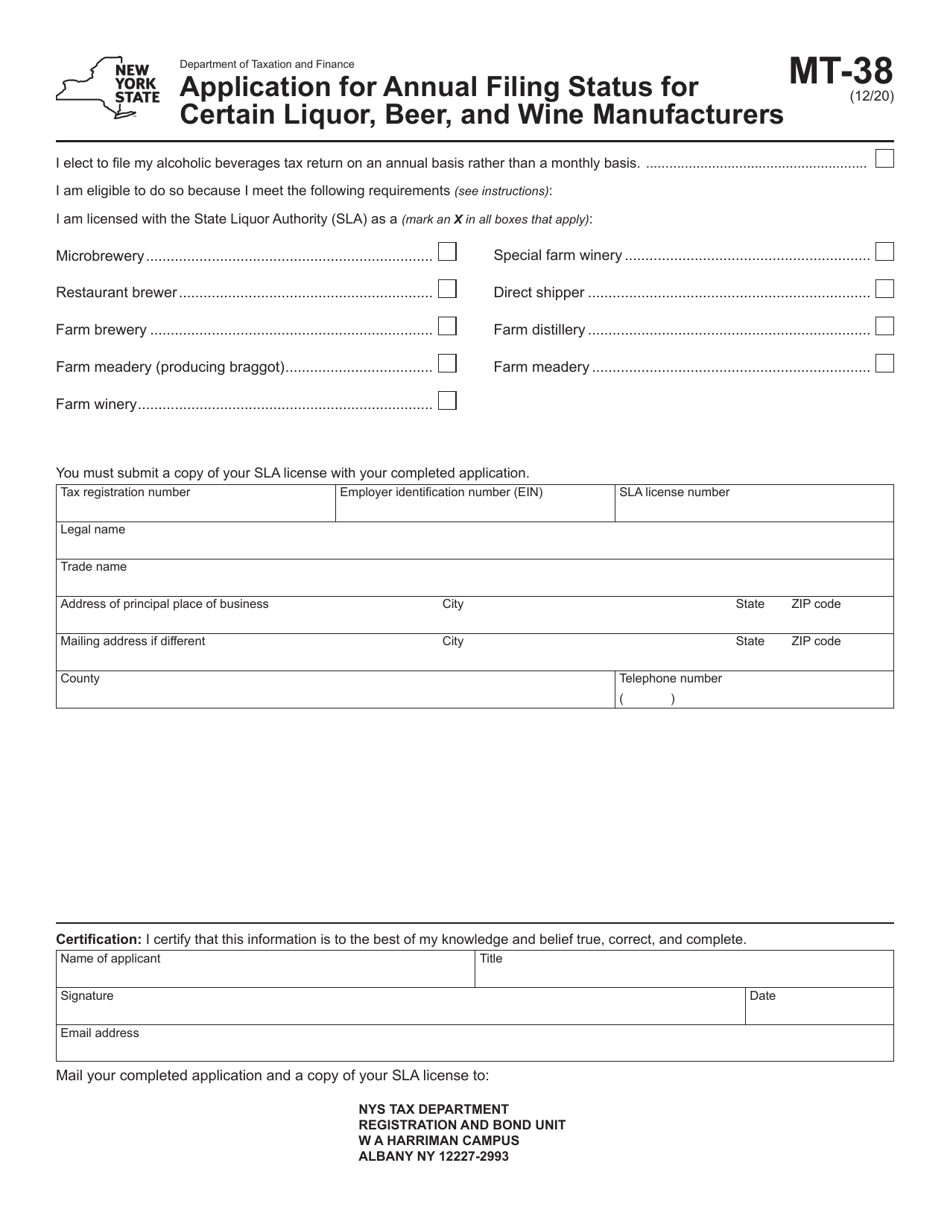

Form MT-38

for the current year.

Form MT-38 Application for Annual Filing Status for Certain Liquor, Beer, and Wine Manufacturers - New York

What Is Form MT-38?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MT-38?

A: Form MT-38 is the application for annual filing status for certain liquor, beer, and wine manufacturers in New York.

Q: Who needs to file Form MT-38?

A: Liquor, beer, and wine manufacturers in New York who meet the eligibility criteria are required to file Form MT-38.

Q: What is the purpose of Form MT-38?

A: The purpose of Form MT-38 is to apply for annual filing status as a liquor, beer, or wine manufacturer in New York.

Q: When should Form MT-38 be filed?

A: Form MT-38 should be filed annually, according to the specific deadlines set by the New York State Liquor Authority.

Q: What are the consequences of not filing Form MT-38?

A: Failure to file Form MT-38 may result in penalties, loss of annual filing status, or other enforcement actions by the New York State Liquor Authority.

Q: Are there any eligibility criteria for filing Form MT-38?

A: Yes, there are specific eligibility criteria that liquor, beer, and wine manufacturers in New York must meet in order to file Form MT-38.

Q: Can I request an extension for filing Form MT-38?

A: No, extensions are generally not granted for filing Form MT-38. It is important to adhere to the specified deadlines.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MT-38 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.