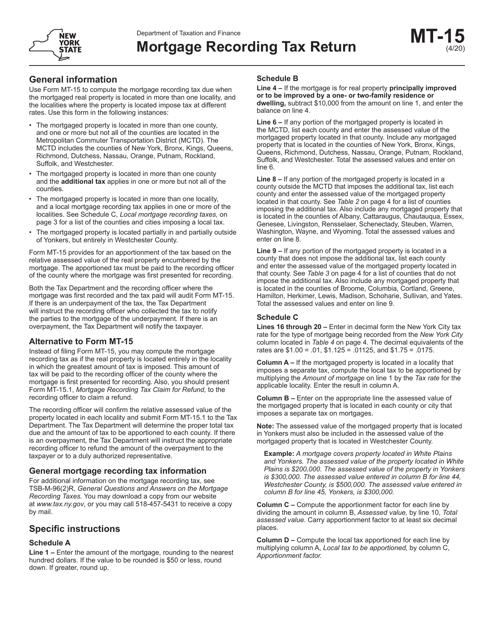

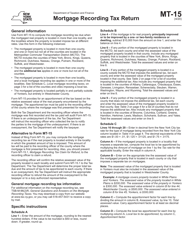

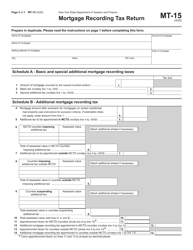

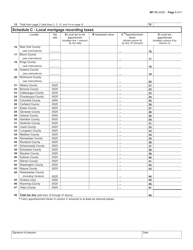

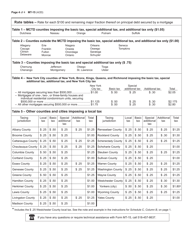

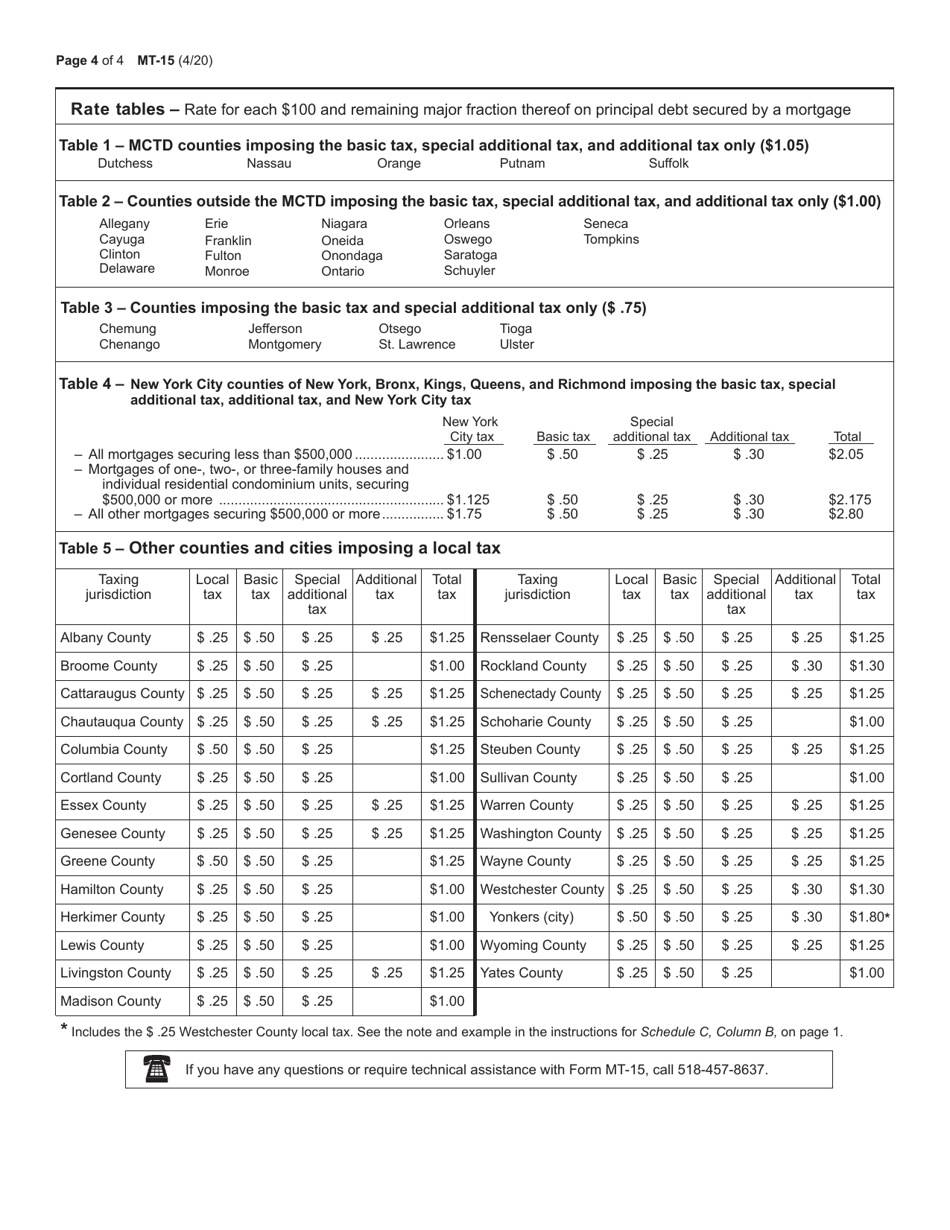

Form MT-15 Mortgage Recording Tax Return - New York

What Is Form MT-15?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MT-15?

A: Form MT-15 is the Mortgage Recording Tax Return for the state of New York.

Q: Who needs to file Form MT-15?

A: Lenders who are recording a mortgage in New York need to file Form MT-15.

Q: What is the purpose of Form MT-15?

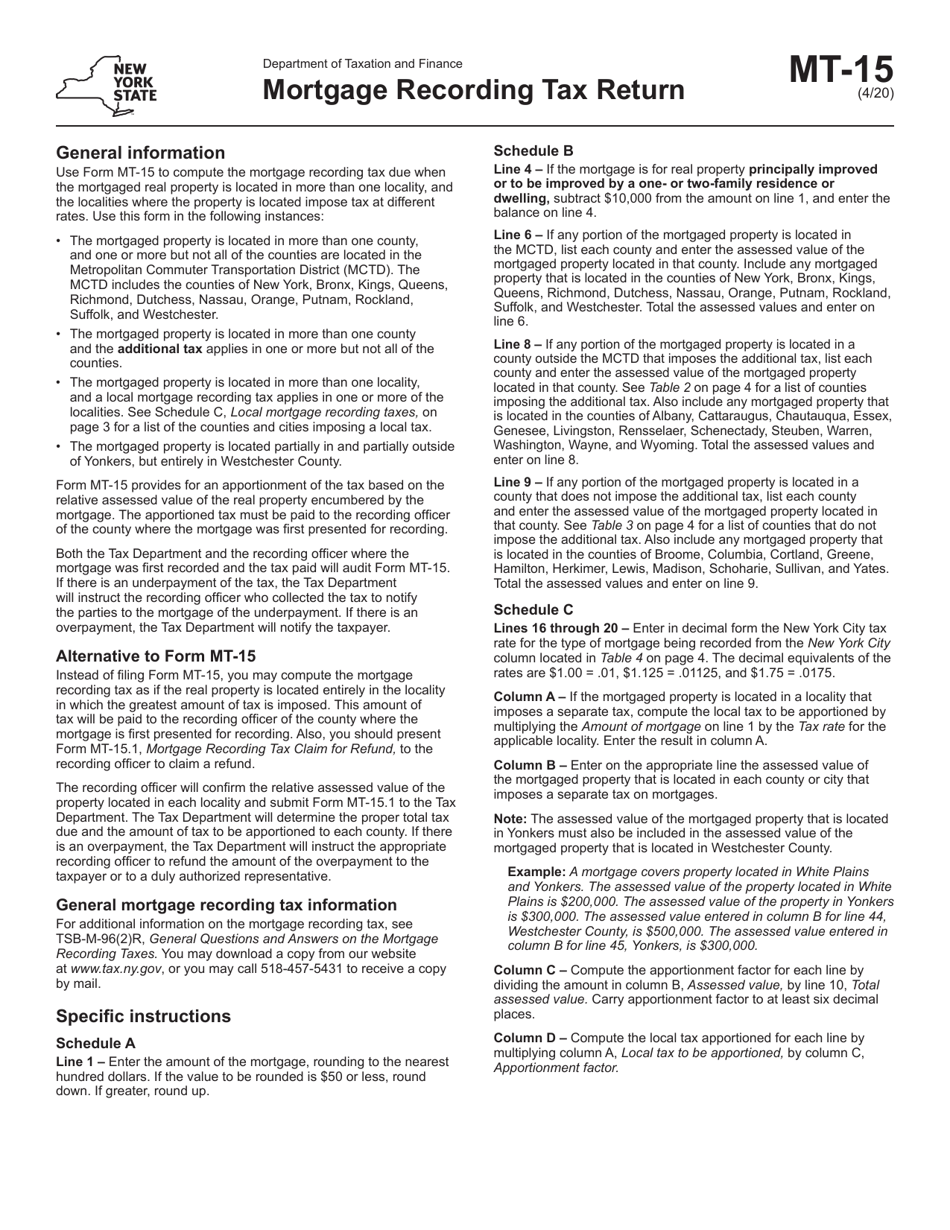

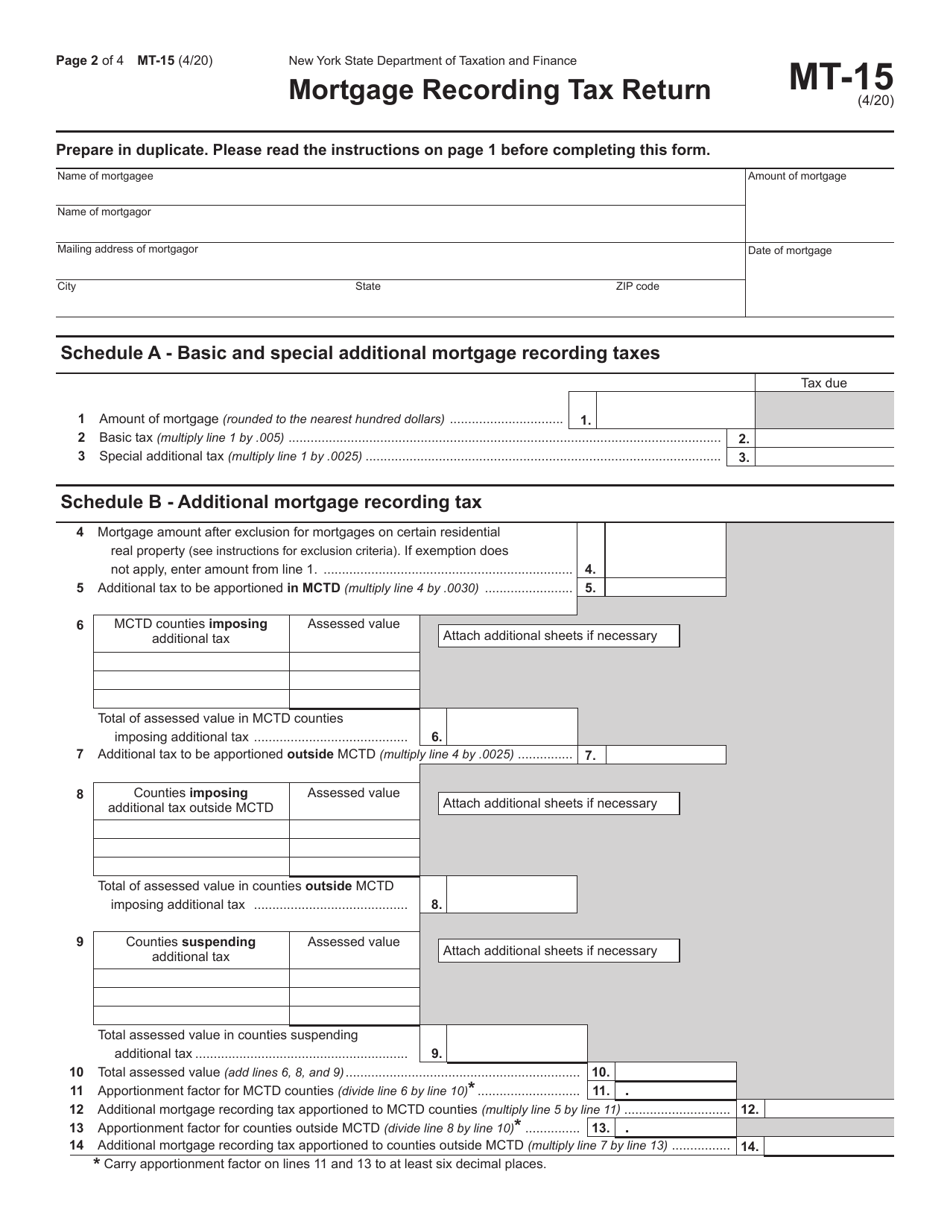

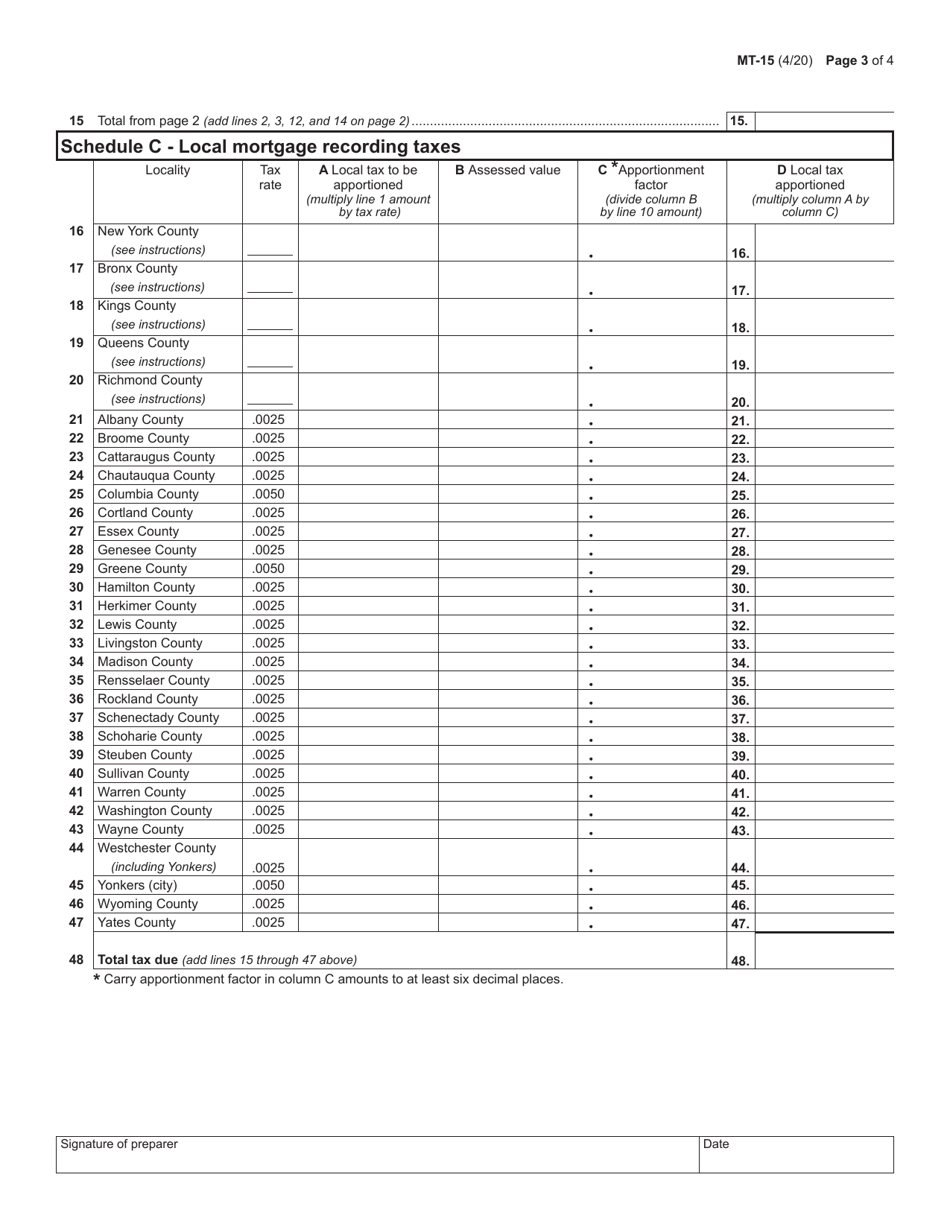

A: Form MT-15 is used to report and pay the mortgage recording tax to the state of New York.

Q: What information is required on Form MT-15?

A: Form MT-15 requires information about the lender, borrower, mortgage amount, and property location.

Q: Are there any exemptions or deductions available for mortgage recording tax?

A: Yes, there are certain exemptions and deductions available for mortgage recording tax in New York. You should consult the instructions for Form MT-15 or seek professional advice to determine if you qualify for any exemptions or deductions.

Q: When is Form MT-15 due?

A: Form MT-15 is generally due within 30 days from the date of recording the mortgage.

Q: What happens if I do not file Form MT-15?

A: Failure to file Form MT-15 or pay the mortgage recording tax can result in penalties and interest charges.

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MT-15 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.