This version of the form is not currently in use and is provided for reference only. Download this version of

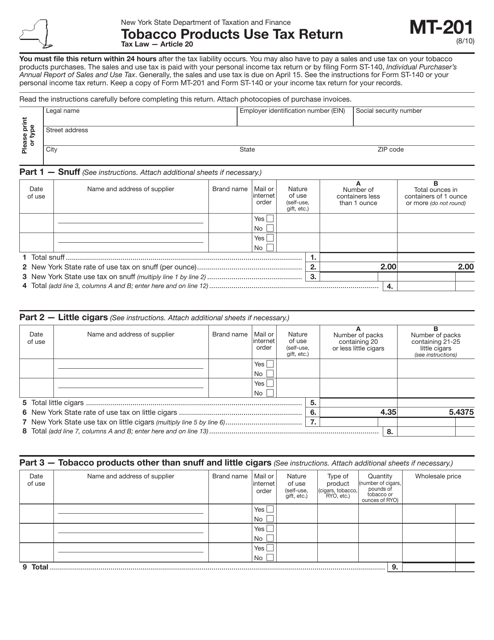

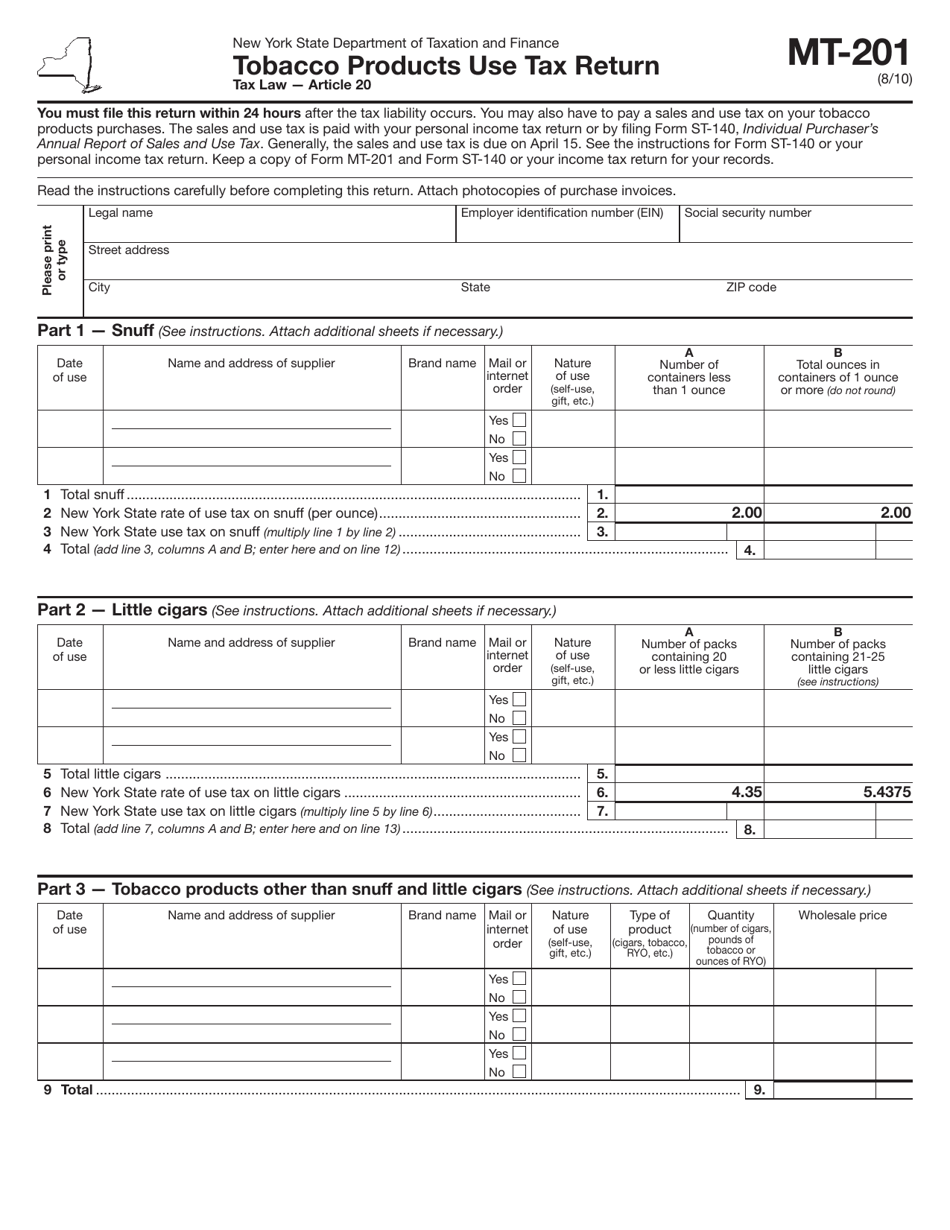

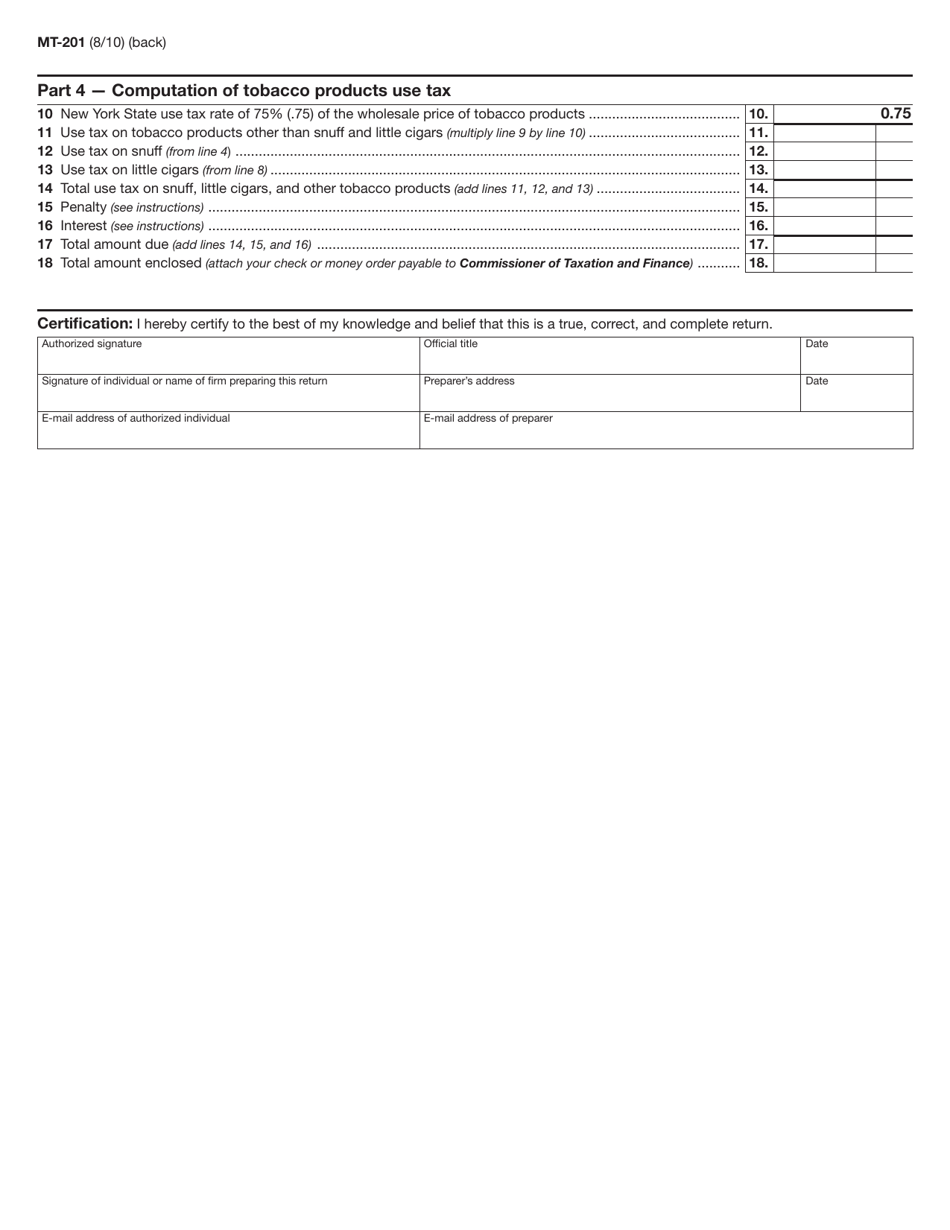

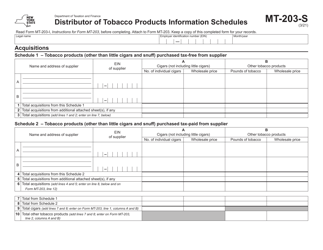

Form MT-201

for the current year.

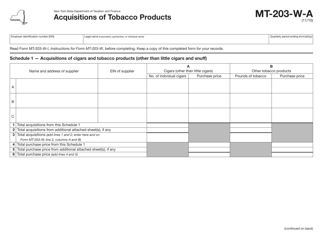

Form MT-201 Tobacco Products Use Tax Return - New York

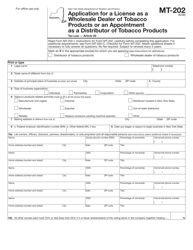

What Is Form MT-201?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form MT-201?

A: Form MT-201 is the Tobacco Products Use Tax Return in New York.

Q: Who needs to file Form MT-201?

A: Any individual or business that sells or uses tobacco products in New York needs to file Form MT-201.

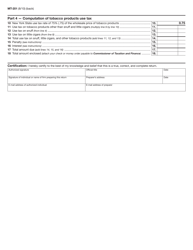

Q: What is the purpose of Form MT-201?

A: Form MT-201 is used to report and pay the tobacco products use tax to the New York State Department of Taxation and Finance.

Q: What are tobacco products?

A: Tobacco products include cigarettes, cigars, smoking tobacco, chewing tobacco, and snuff.

Q: When is Form MT-201 due?

A: Form MT-201 is due on a quarterly basis. The due dates are April 20, July 20, October 20, and January 20.

Q: Are there any penalties for late filing or payment?

A: Yes, late filing or payment can result in penalties, interest, and enforcement actions.

Form Details:

- Released on August 1, 2010;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MT-201 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.