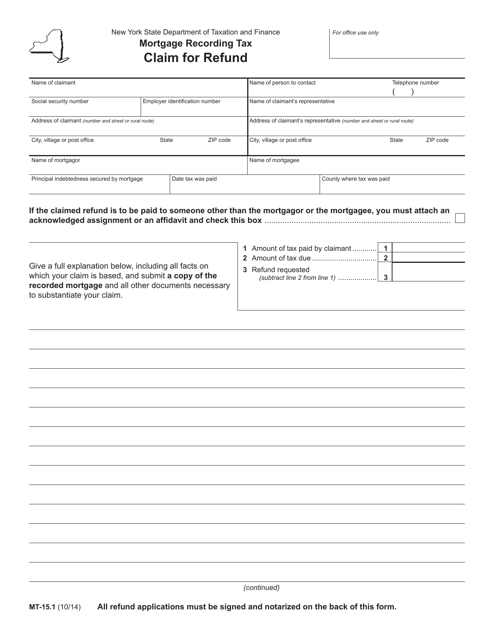

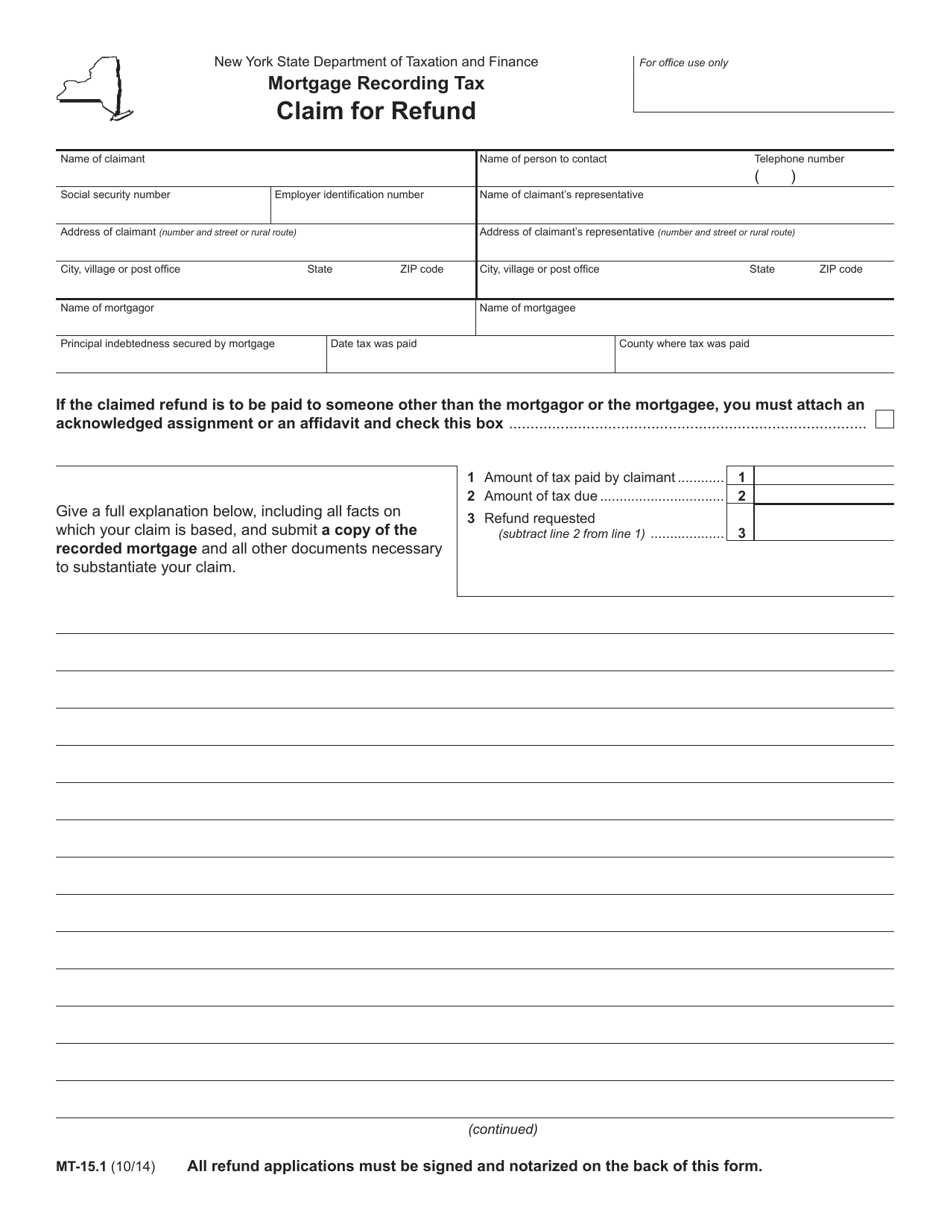

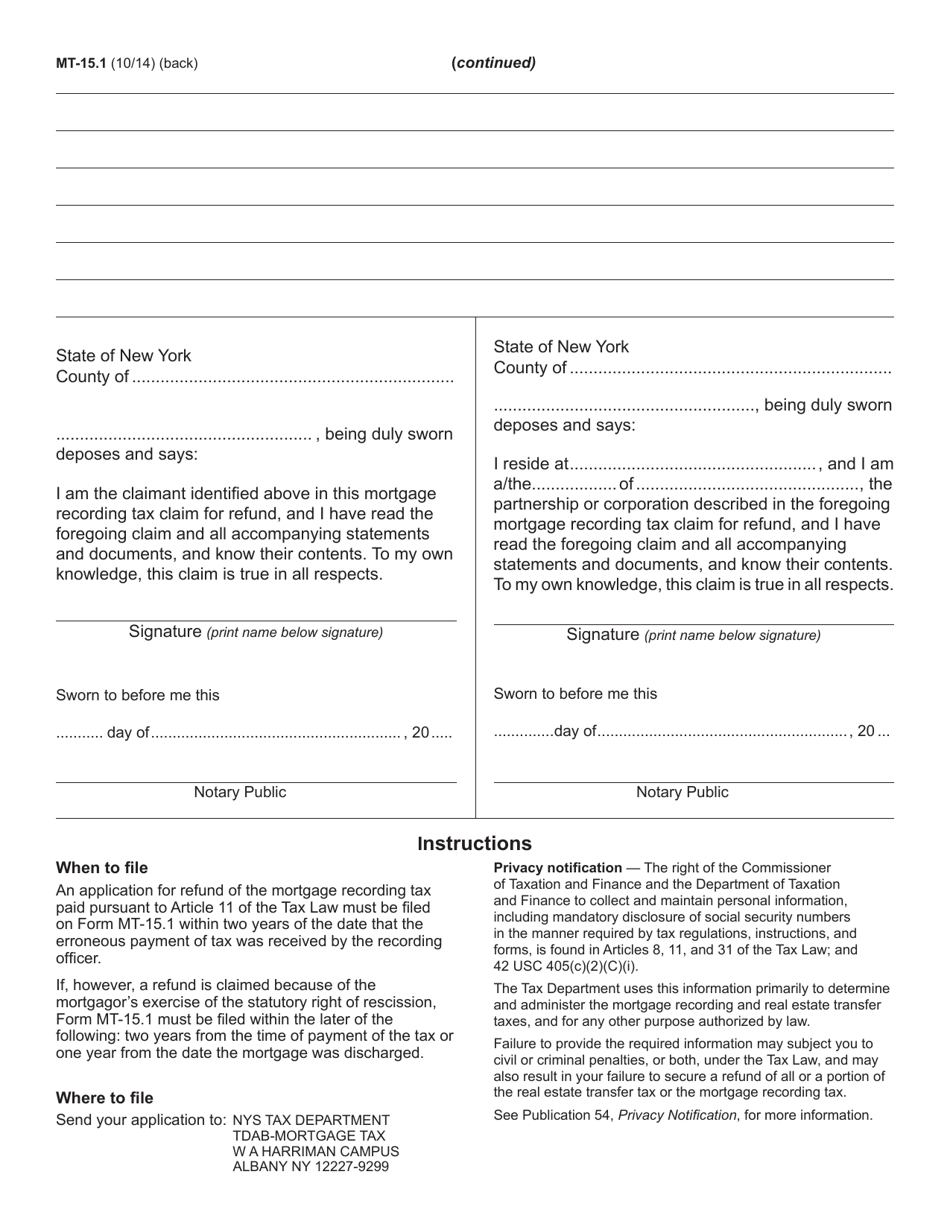

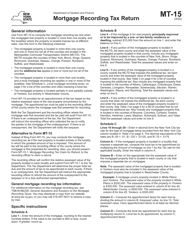

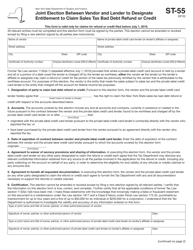

Form MT-15.1 Mortgage Recording Tax Claim for Refund - New York

What Is Form MT-15.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MT-15.1?

A: Form MT-15.1 is the Mortgage Recording Tax Claim for Refund form in New York.

Q: What is the purpose of Form MT-15.1?

A: The purpose of Form MT-15.1 is to claim a refund for mortgage recording taxes in New York.

Q: Who can use Form MT-15.1?

A: Form MT-15.1 can be used by individuals or businesses who paid mortgage recording taxes in New York.

Q: What information do I need to complete Form MT-15.1?

A: You will need to provide information such as your name, contact information, details of the mortgage transaction, and supporting documentation.

Q: Are there any deadlines for filing Form MT-15.1?

A: Yes, Form MT-15.1 must be filed within three years from the date of payment of the mortgage recording taxes.

Q: Is there a fee to file Form MT-15.1?

A: No, there is no fee to file Form MT-15.1.

Q: How long does it take to receive a refund after submitting Form MT-15.1?

A: The processing time for a refund claim can vary, but it typically takes several weeks to process.

Q: Can I check the status of my refund claim?

A: Yes, you can check the status of your refund claim by contacting the New York State Department of Taxation and Finance.

Form Details:

- Released on October 1, 2014;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MT-15.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.