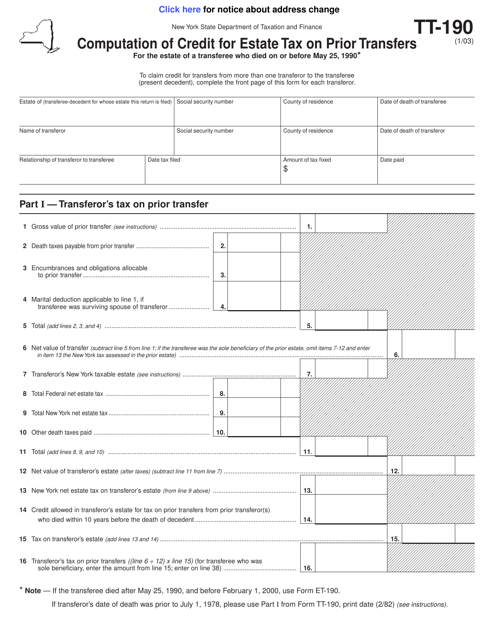

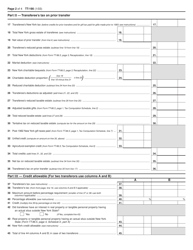

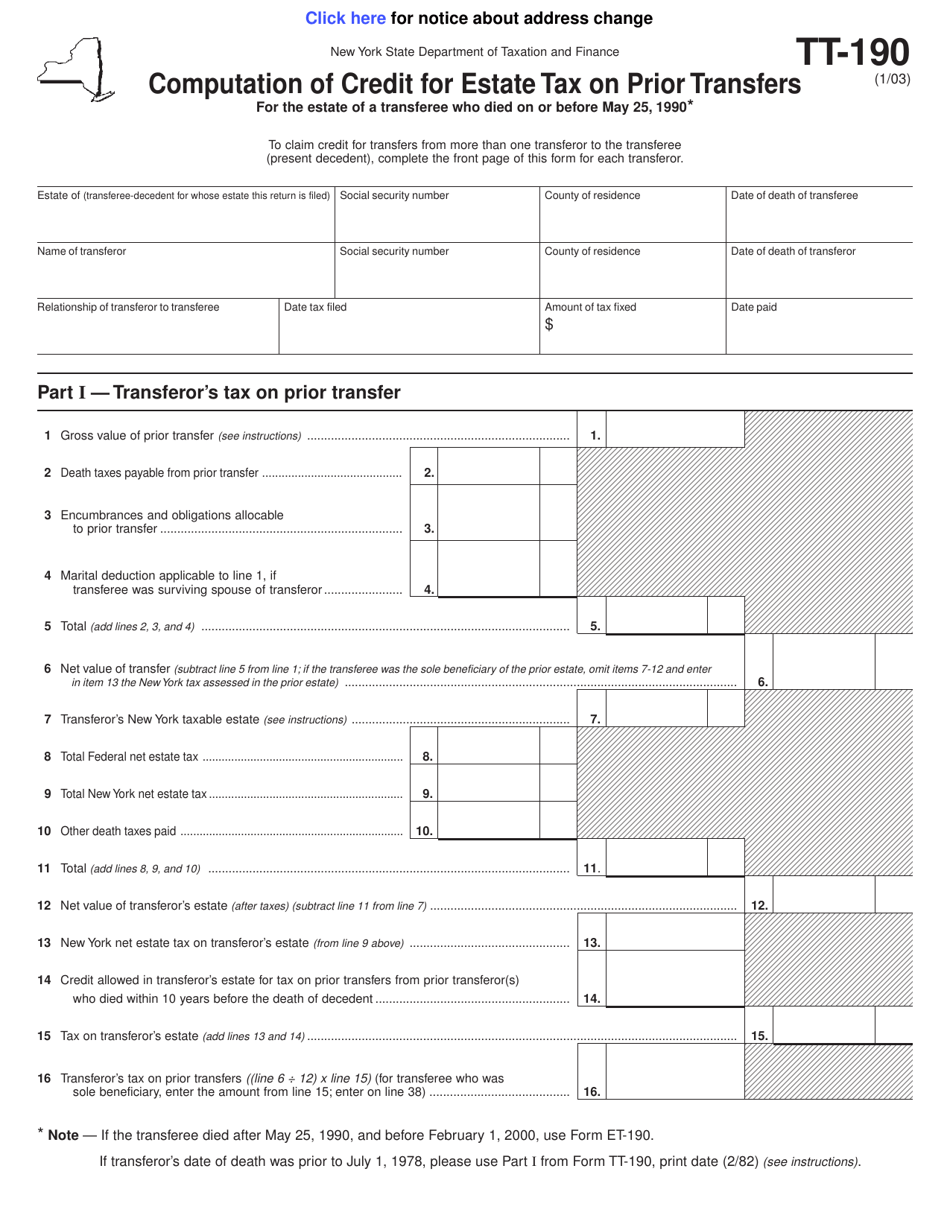

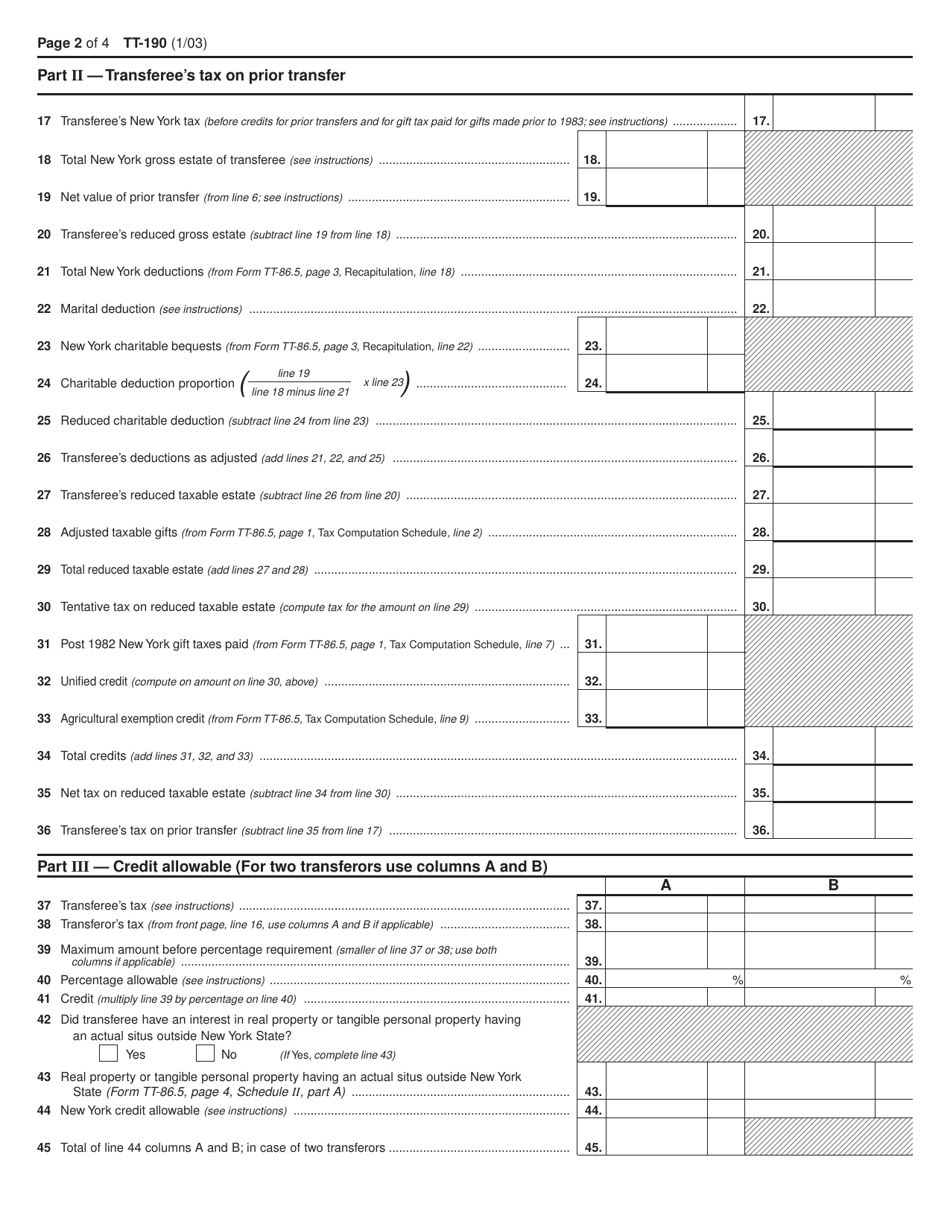

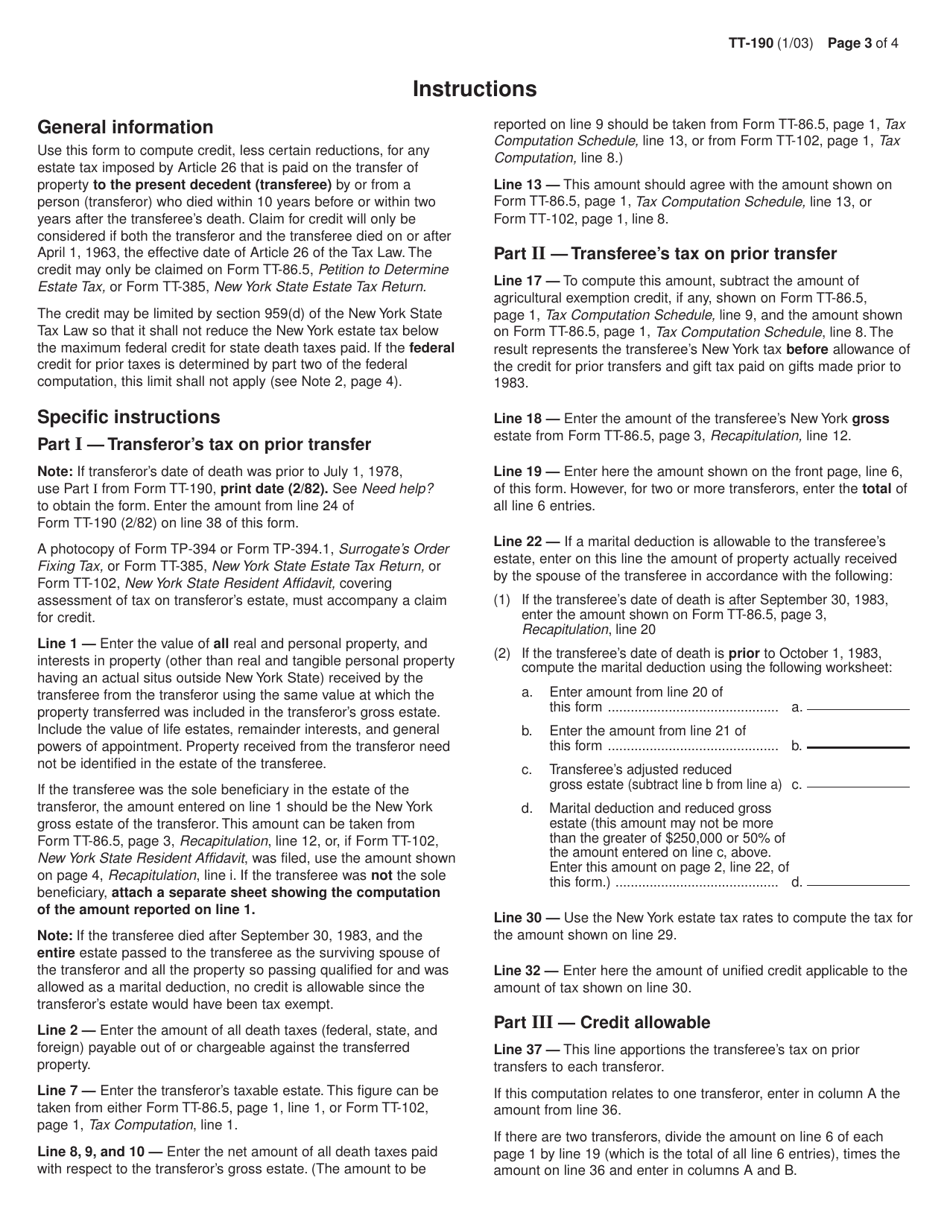

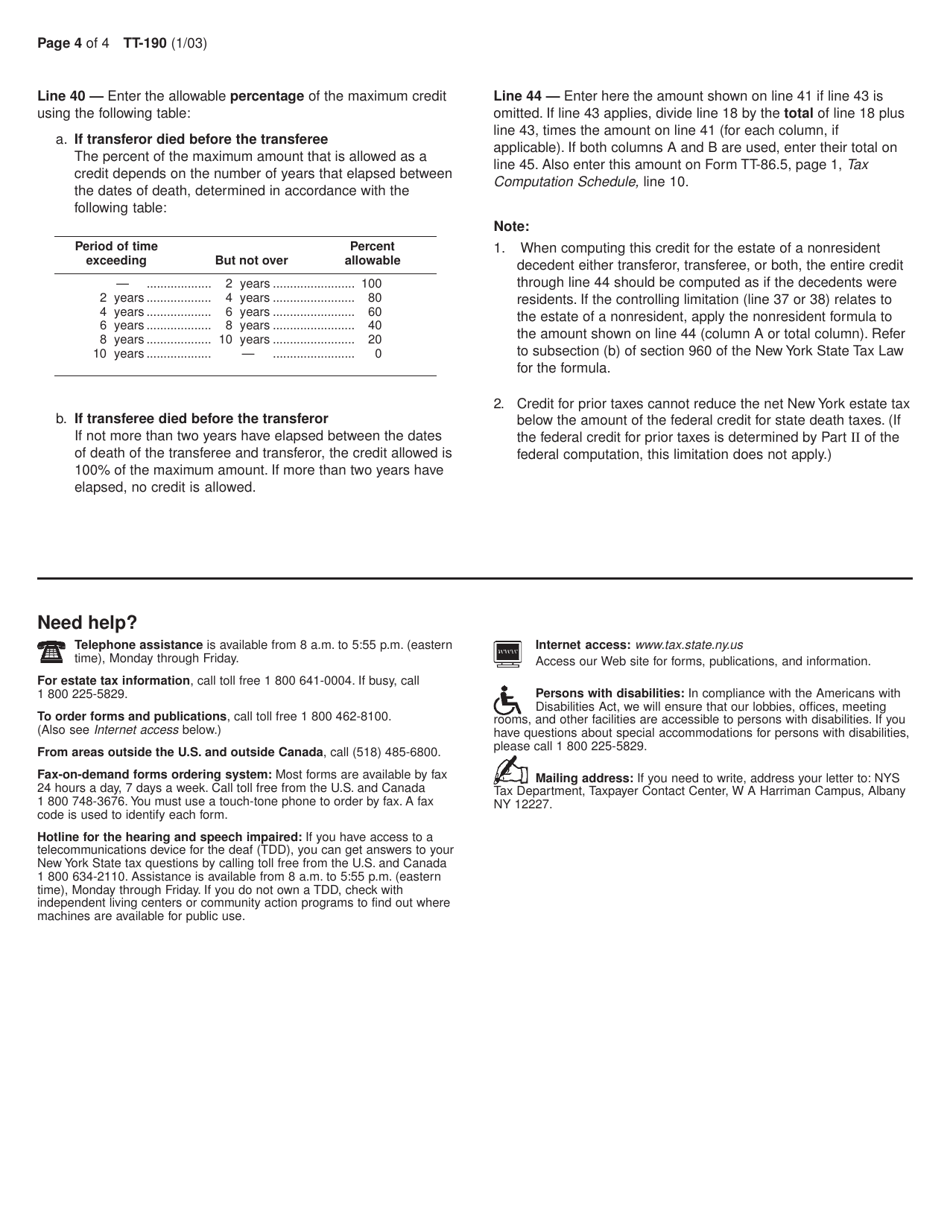

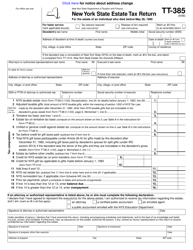

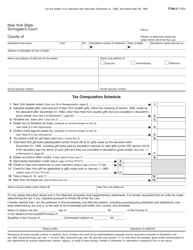

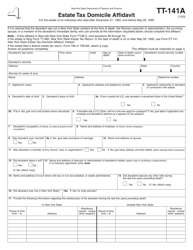

Form TT-190 Computation of Credit for Estate Tax on Prior Transfers for the Estate of a Transferee Who Died on or Before May 25, 1990 - New York

What Is Form TT-190?

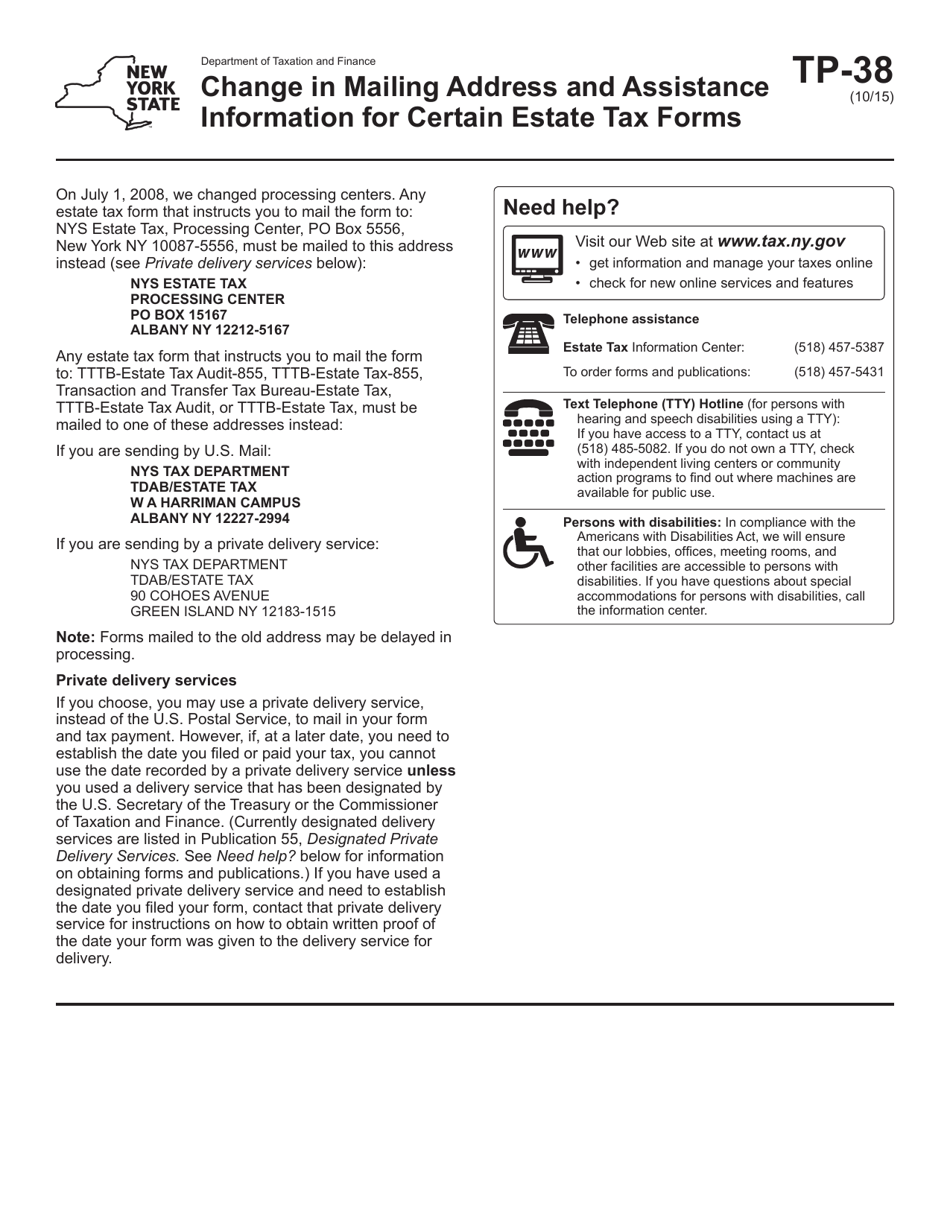

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TT-190?

A: Form TT-190 is a tax form used in New York to compute the credit for estate tax on prior transfers for the estate of a transferee who died on or before May 25, 1990.

Q: Who needs to use Form TT-190?

A: This form is used by estates in New York for computing the credit for estate tax on prior transfers if the transferee died on or before May 25, 1990.

Q: What is the purpose of Form TT-190?

A: The purpose of Form TT-190 is to calculate the credit for estate tax on prior transfers for estates in New York where the transferee died on or before May 25, 1990.

Q: When was the deadline to use Form TT-190?

A: There is no specific deadline mentioned for using Form TT-190. However, it is best to file the form within the required timeframe for estate tax filings in New York.

Form Details:

- Released on January 1, 2003;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TT-190 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.