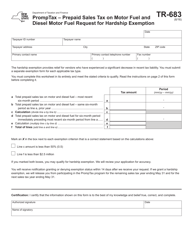

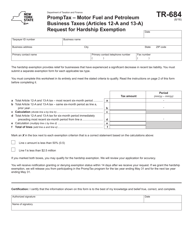

Form TR-685 Promptax - Sales and Compensating Use Tax Request for Hardship Exemption - New York

What Is Form TR-685?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TR-685 Promptax?

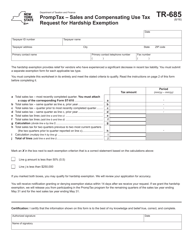

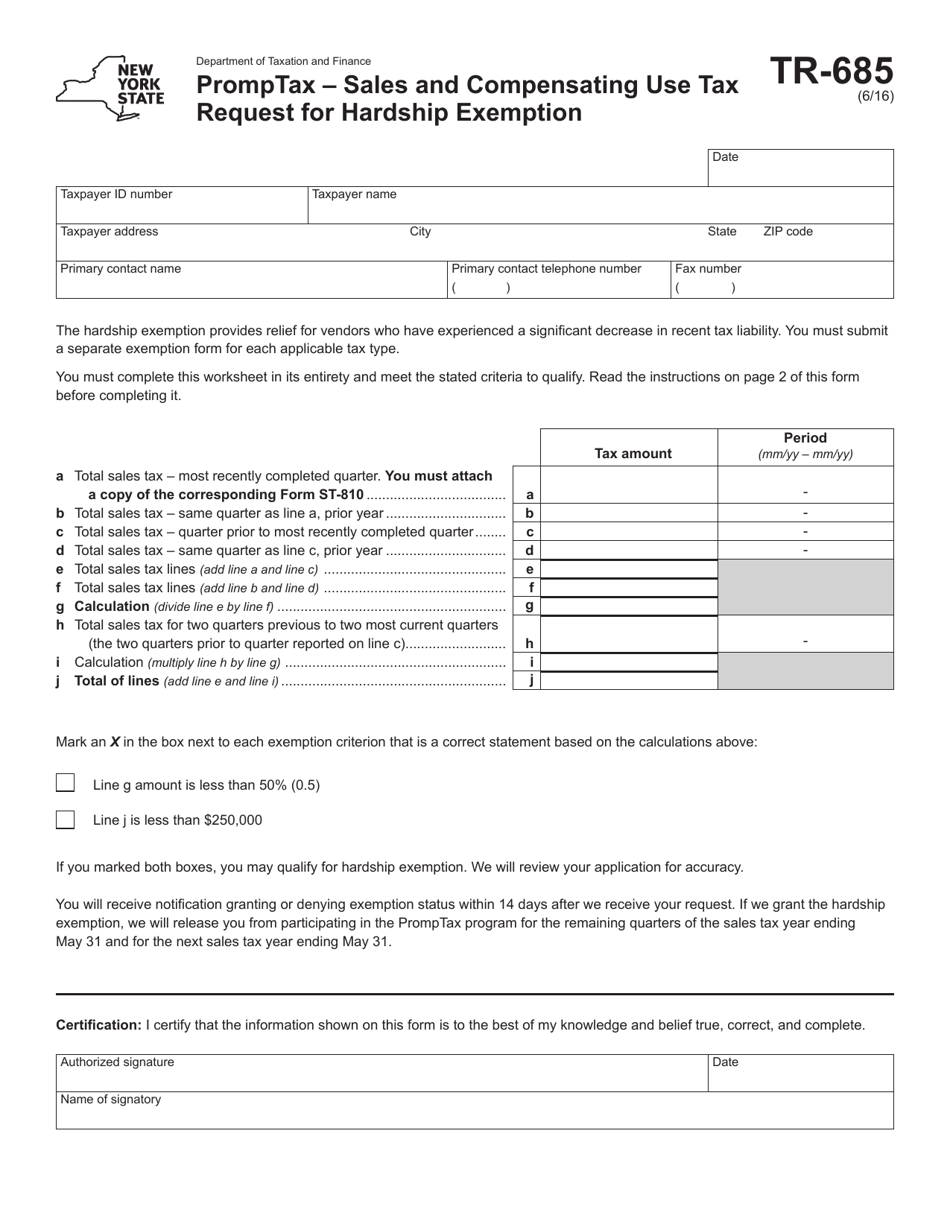

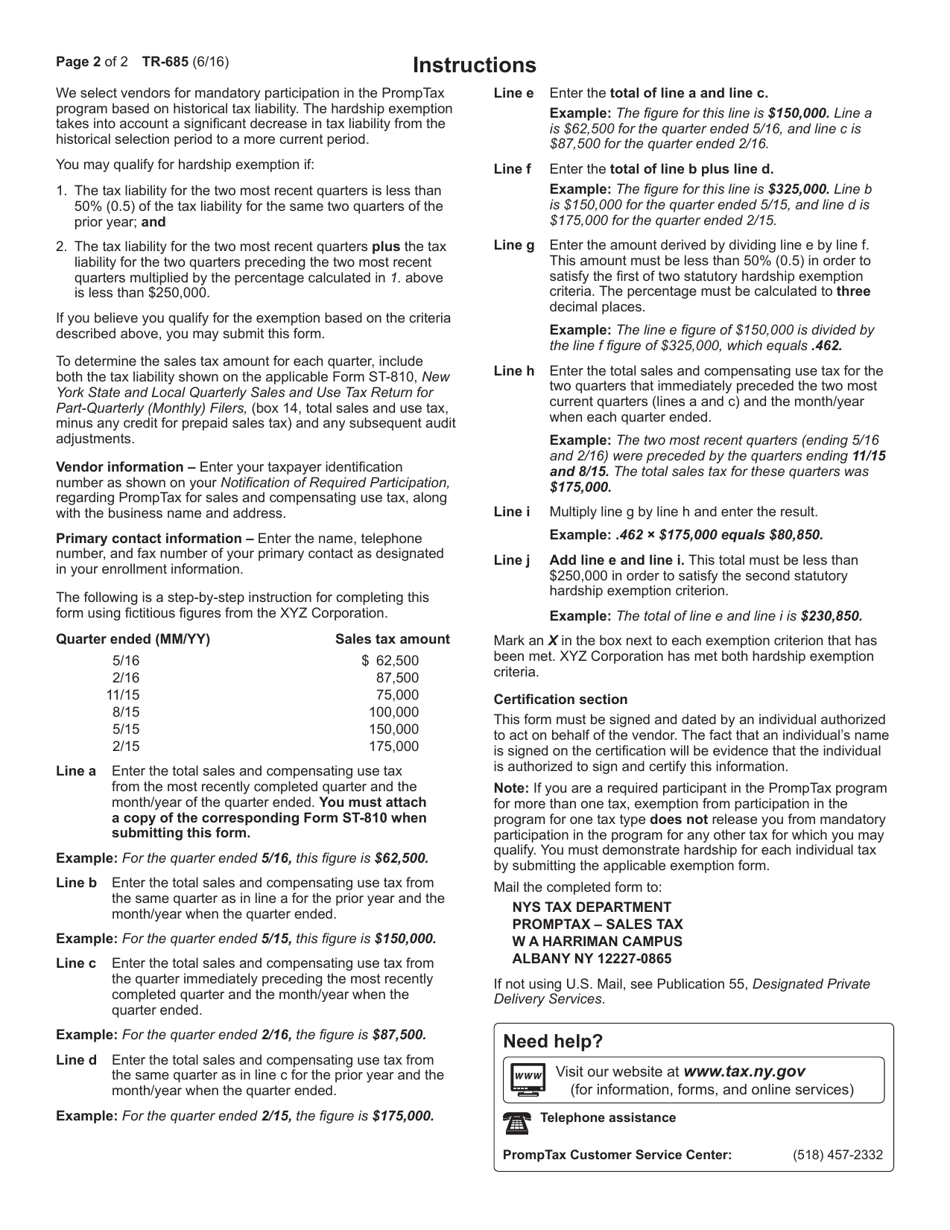

A: Form TR-685 Promptax is a form used in New York for requesting a hardship exemption for sales and compensating use tax.

Q: What is the purpose of Form TR-685 Promptax?

A: The purpose of this form is to request an exemption from sales and compensating use tax due to financial hardship in New York.

Q: Who needs to fill out Form TR-685 Promptax?

A: Individuals who are experiencing financial hardship and are unable to pay the required sales and compensating use tax in New York need to fill out this form.

Q: What type of exemption does Form TR-685 Promptax provide?

A: Form TR-685 Promptax provides a hardship exemption for sales and compensating use tax in New York.

Q: Is there a deadline for submitting Form TR-685 Promptax?

A: Yes, there is a deadline for submitting this form. It should be filed within 30 days of receiving a notice of sales and compensating use tax due.

Q: What supporting documentation is required with Form TR-685 Promptax?

A: Supporting documentation such as proof of financial hardship, income statements, and other relevant documents may be required to be submitted along with this form.

Q: Can I apply for a hardship exemption for sales and compensating use tax in New York?

A: Yes, if you are experiencing financial hardship and are unable to pay the required sales and compensating use tax, you can apply for a hardship exemption using Form TR-685 Promptax.

Q: What happens after I submit Form TR-685 Promptax?

A: After you submit this form, the New York State Department of Taxation and Finance will review your application and supporting documentation to determine if you qualify for the hardship exemption.

Q: Is the hardship exemption from sales and compensating use tax permanent?

A: No, the hardship exemption from sales and compensating use tax is not permanent. It is granted for a specific period of time based on the circumstances and may need to be renewed in the future.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TR-685 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.