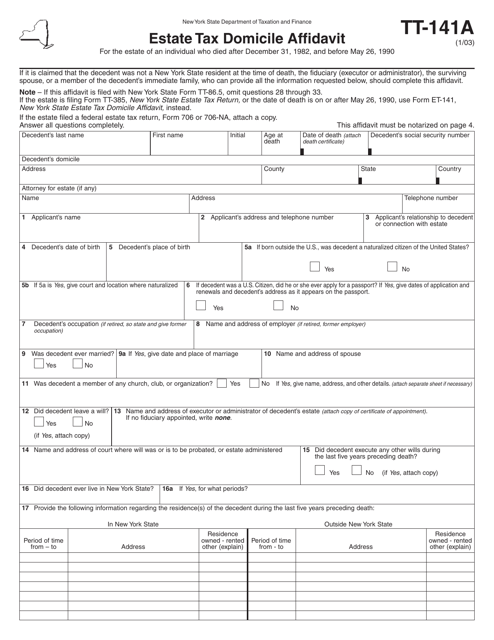

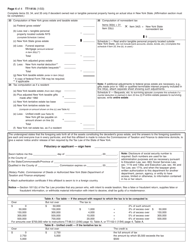

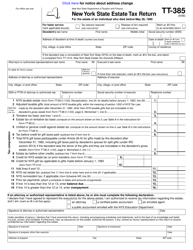

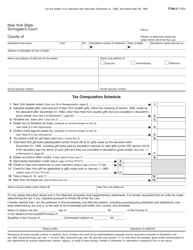

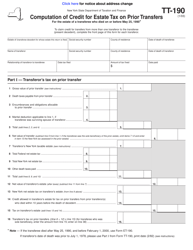

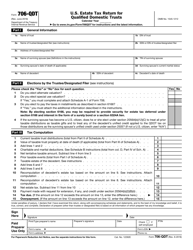

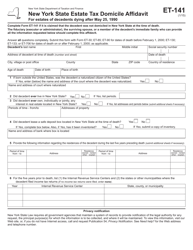

Form TT-141A Estate Tax Domicile Affidavit - New York

What Is Form TT-141A?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TT-141A?

A: Form TT-141A is the Estate Tax Domicile Affidavit for the state of New York.

Q: What is the purpose of Form TT-141A?

A: The purpose of Form TT-141A is to establish a decedent's domicile for estate tax purposes.

Q: Who needs to file Form TT-141A?

A: Form TT-141A must be filed by the executor or administrator of a decedent's estate.

Q: When should Form TT-141A be filed?

A: Form TT-141A should be filed within 9 months after the decedent's death.

Form Details:

- Released on January 1, 2003;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TT-141A by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.