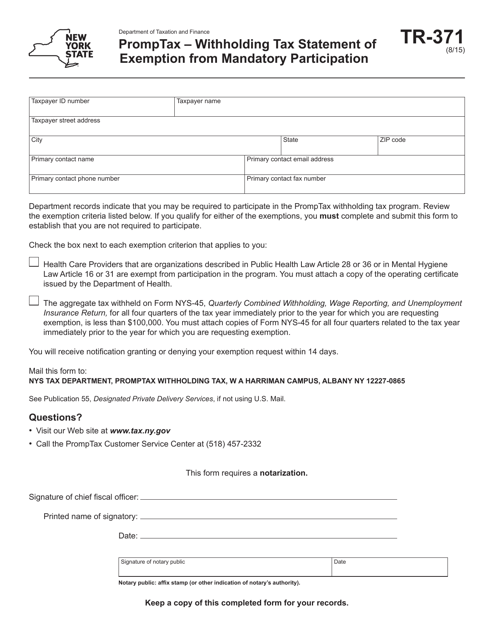

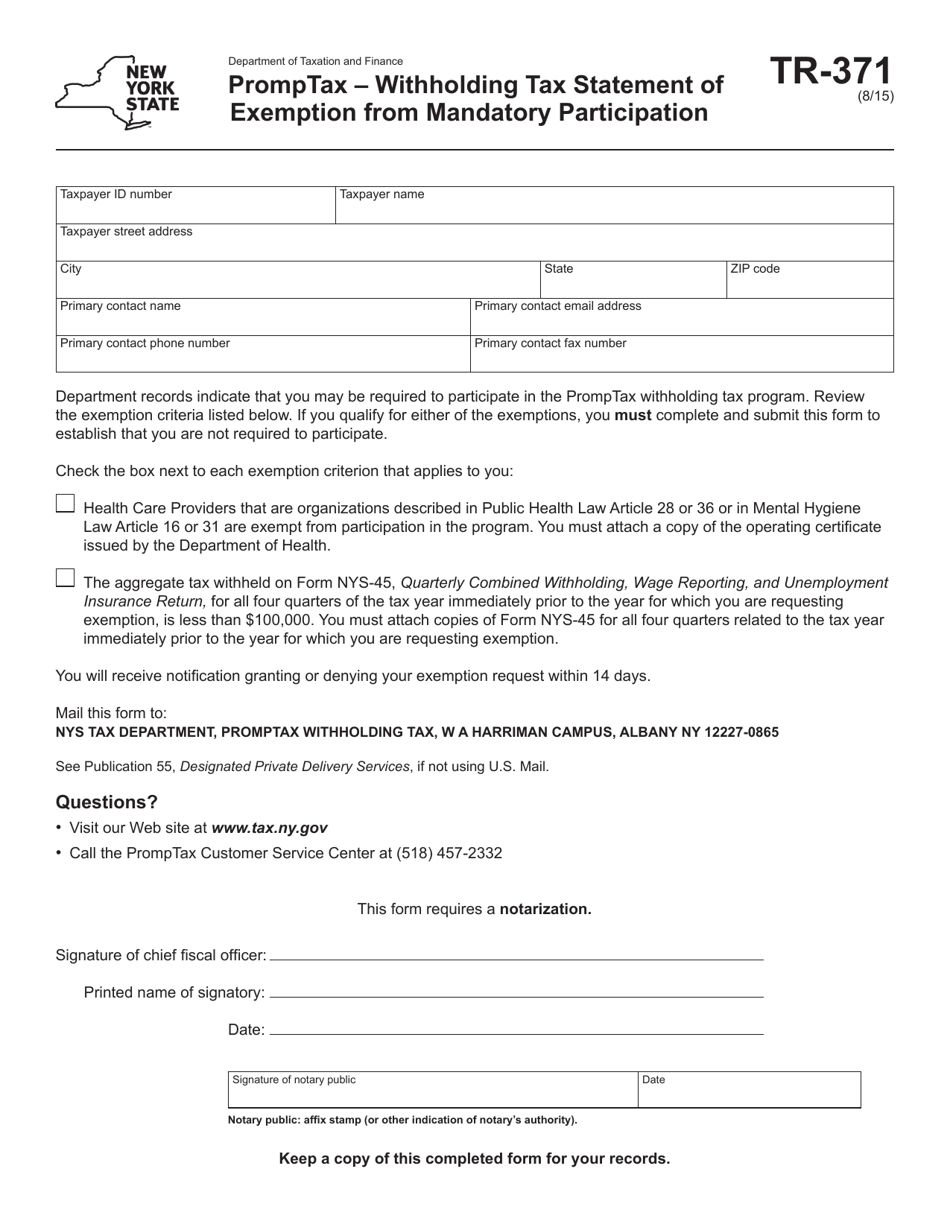

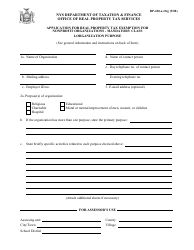

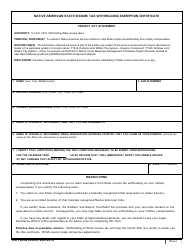

Form TR-371 Promptax - Withholding Tax Statement of Exemption From Mandatory Participation - New York

What Is Form TR-371?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form TR-371 Promptax?

A: The Form TR-371 Promptax is a withholding tax statement of exemption from mandatory participation in New York.

Q: Who is required to fill out the Form TR-371 Promptax?

A: The Form TR-371 Promptax is required to be filled out by individuals seeking exemption from mandatory participation in New York withholding taxes.

Q: What is the purpose of the Form TR-371 Promptax?

A: The purpose of the Form TR-371 Promptax is to provide documentation to claim exemption from mandatory participation in New York withholding.

Q: Is the Form TR-371 Promptax specific to New York?

A: Yes, the Form TR-371 Promptax is specific to exemption from mandatory participation in New York withholding taxes.

Form Details:

- Released on August 1, 2015;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TR-371 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.