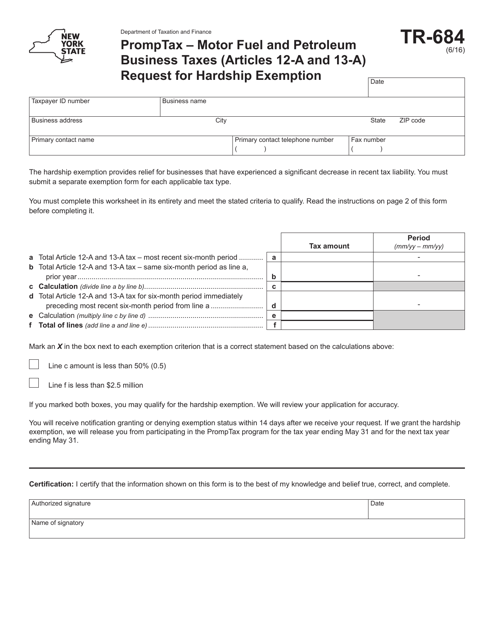

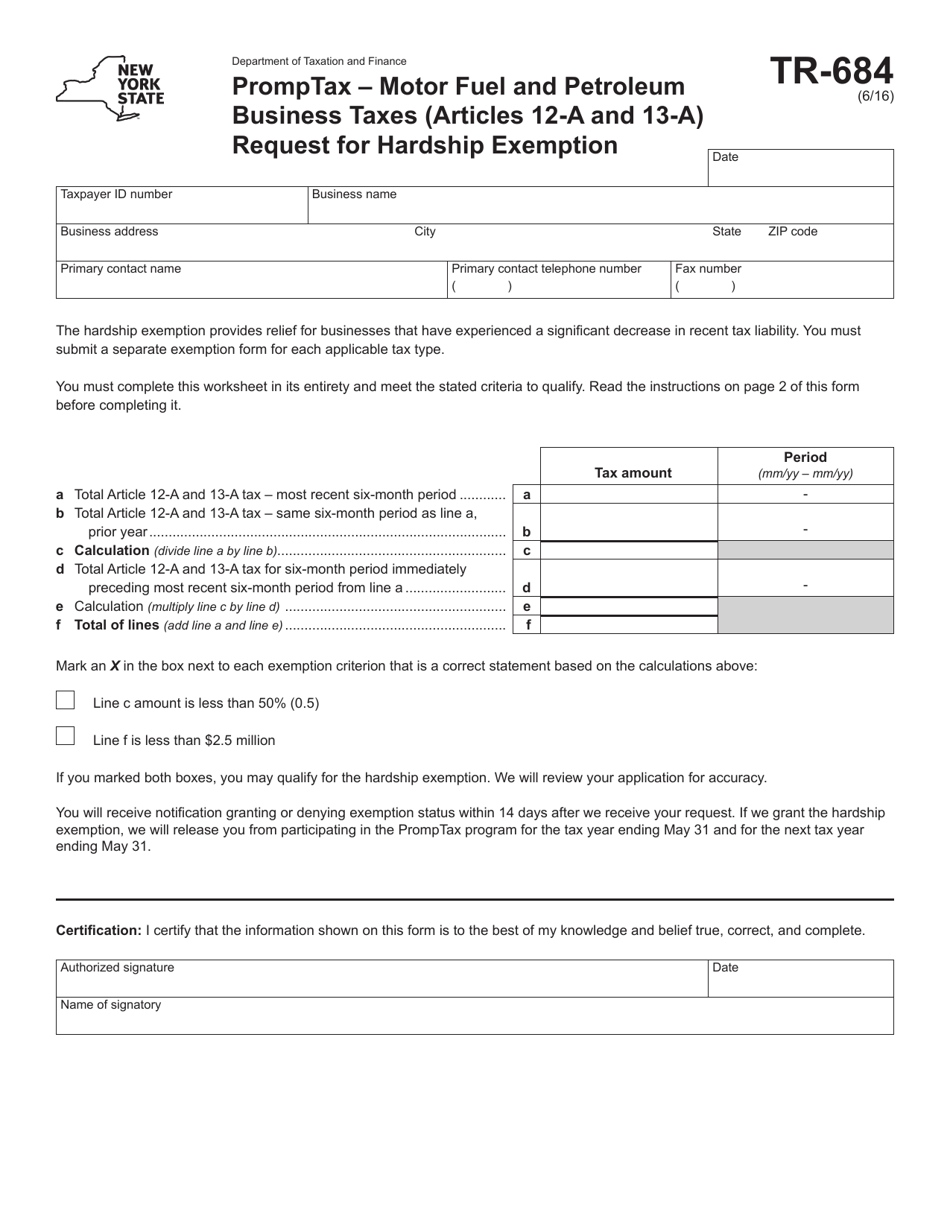

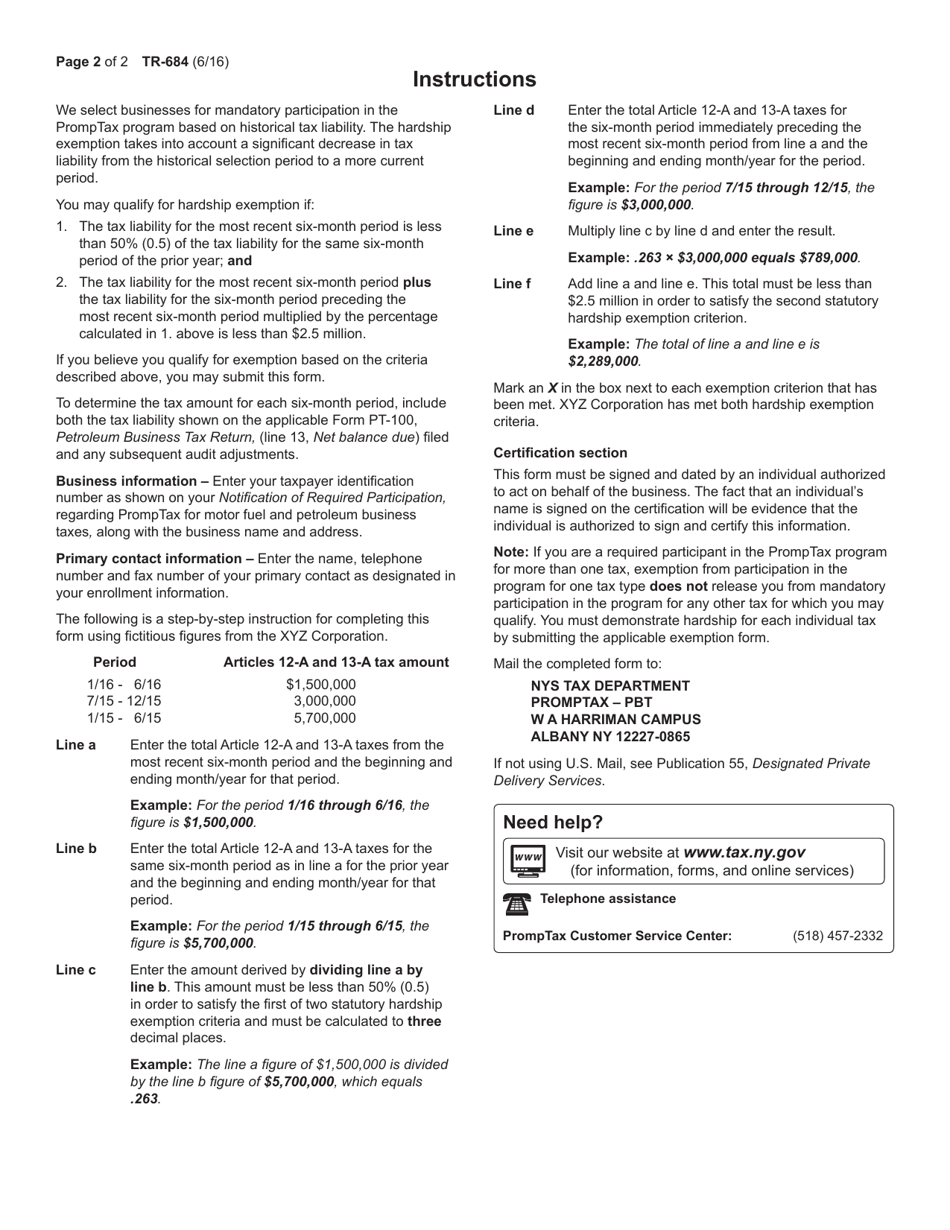

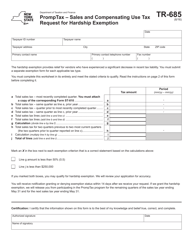

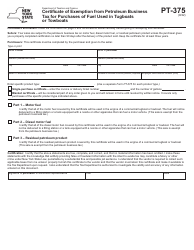

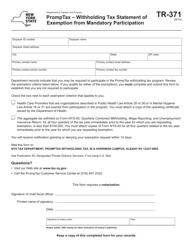

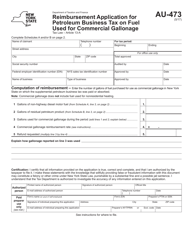

Form TR-684 Promptax - Motor Fuel and Petroleum Business Taxes (Articles 12-a and 13-a) Request for Hardship Exemption - New York

What Is Form TR-684?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TR-684 Promptax?

A: Form TR-684 Promptax is a form for requesting a hardship exemption for motor fuel and petroleum business taxes in New York.

Q: What taxes does Form TR-684 Promptax apply to?

A: Form TR-684 Promptax applies to motor fuel and petroleum business taxes under Articles 12-a and 13-a in New York.

Q: What is the purpose of the form?

A: The purpose of Form TR-684 Promptax is to request a hardship exemption from motor fuel and petroleum business taxes.

Q: Who needs to file Form TR-684 Promptax?

A: Anyone seeking a hardship exemption from motor fuel and petroleum business taxes in New York needs to file Form TR-684 Promptax.

Q: Are there any fees associated with filing Form TR-684 Promptax?

A: No, there are no fees associated with filing Form TR-684 Promptax.

Q: What is the deadline for filing Form TR-684 Promptax?

A: The deadline for filing Form TR-684 Promptax is determined by the New York State Department of Taxation and Finance and may vary.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TR-684 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.