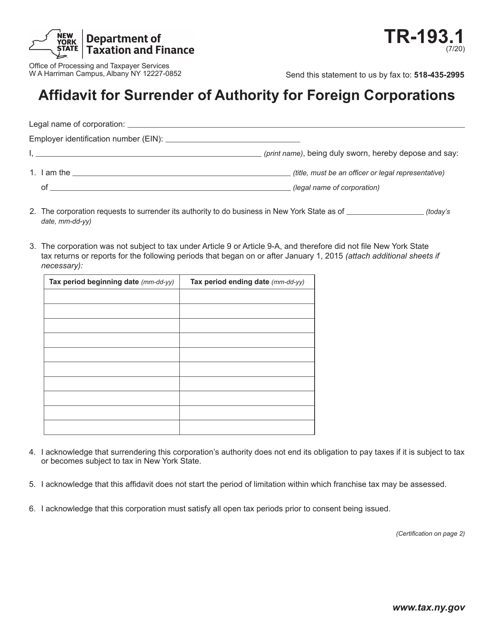

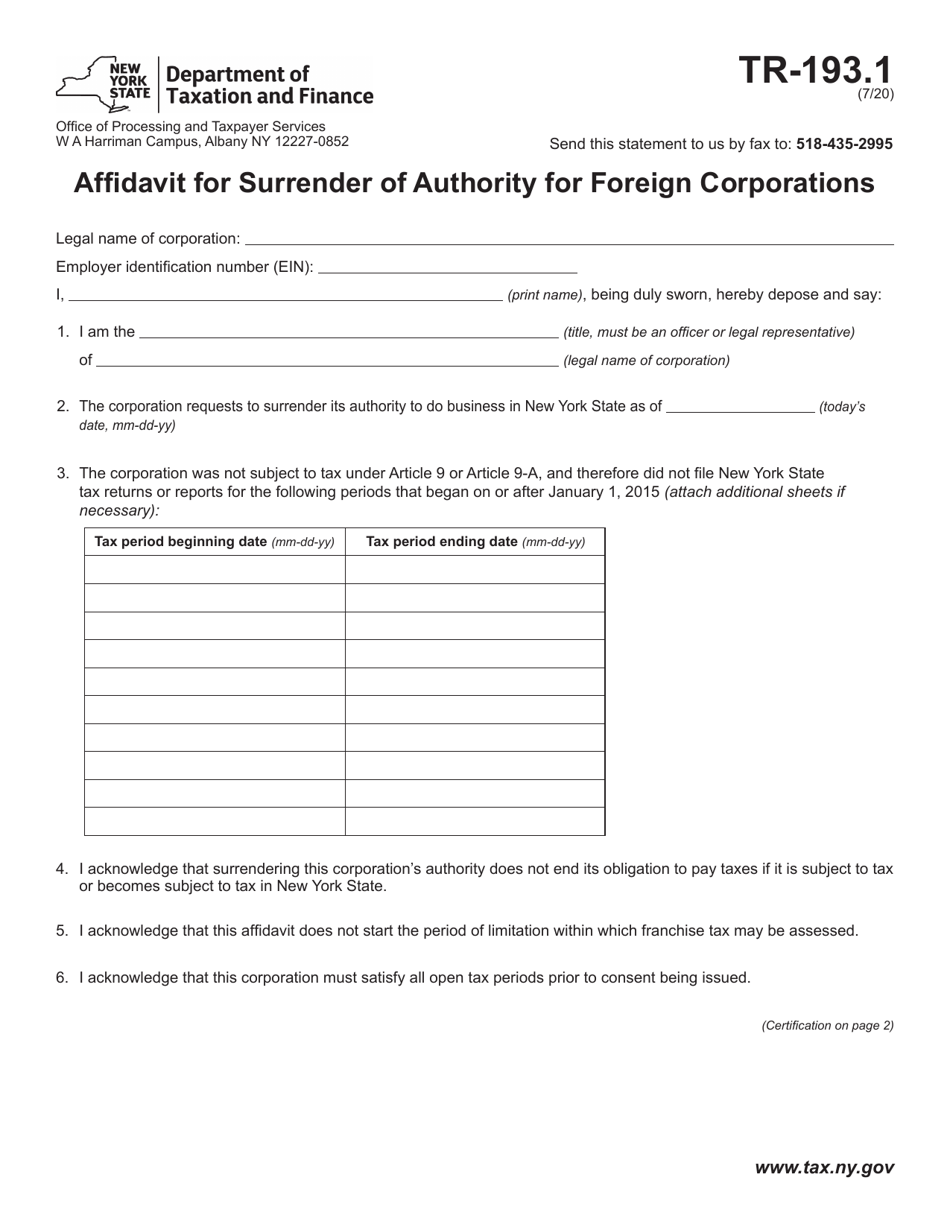

Form TR-193.1 Affidavit for Surrender of Authority for Foreign Corporations - New York

What Is Form TR-193.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TR-193.1?

A: Form TR-193.1 is an Affidavit for Surrender of Authority for Foreign Corporations in New York.

Q: Who needs to file Form TR-193.1?

A: Foreign corporations that want to surrender their authority to conduct business in New York need to file Form TR-193.1.

Q: What is the purpose of Form TR-193.1?

A: The purpose of Form TR-193.1 is to officially surrender the authority of a foreign corporation to conduct business in New York.

Q: What information is required on Form TR-193.1?

A: Form TR-193.1 requires information such as the name of the foreign corporation, the jurisdiction in which it was organized, and the reason for surrendering authority.

Q: Is there a deadline for filing Form TR-193.1?

A: There is no specific deadline for filing Form TR-193.1, but it should be filed as soon as a foreign corporation decides to surrender its authority.

Q: What happens after filing Form TR-193.1?

A: After filing Form TR-193.1, the New York Department of State will process the affidavit and update their records to reflect the surrender of authority for the foreign corporation.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TR-193.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.