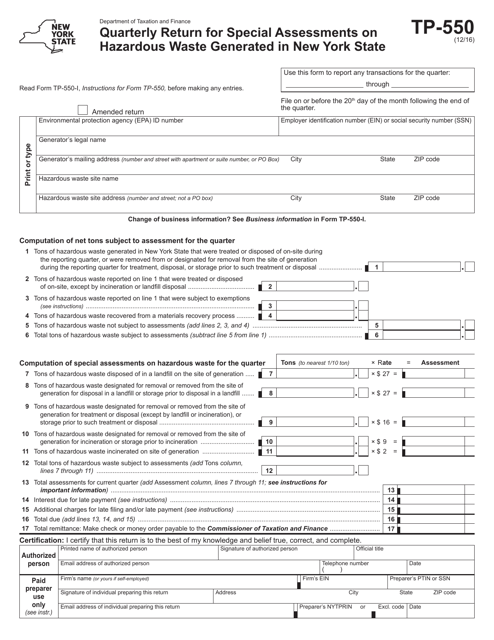

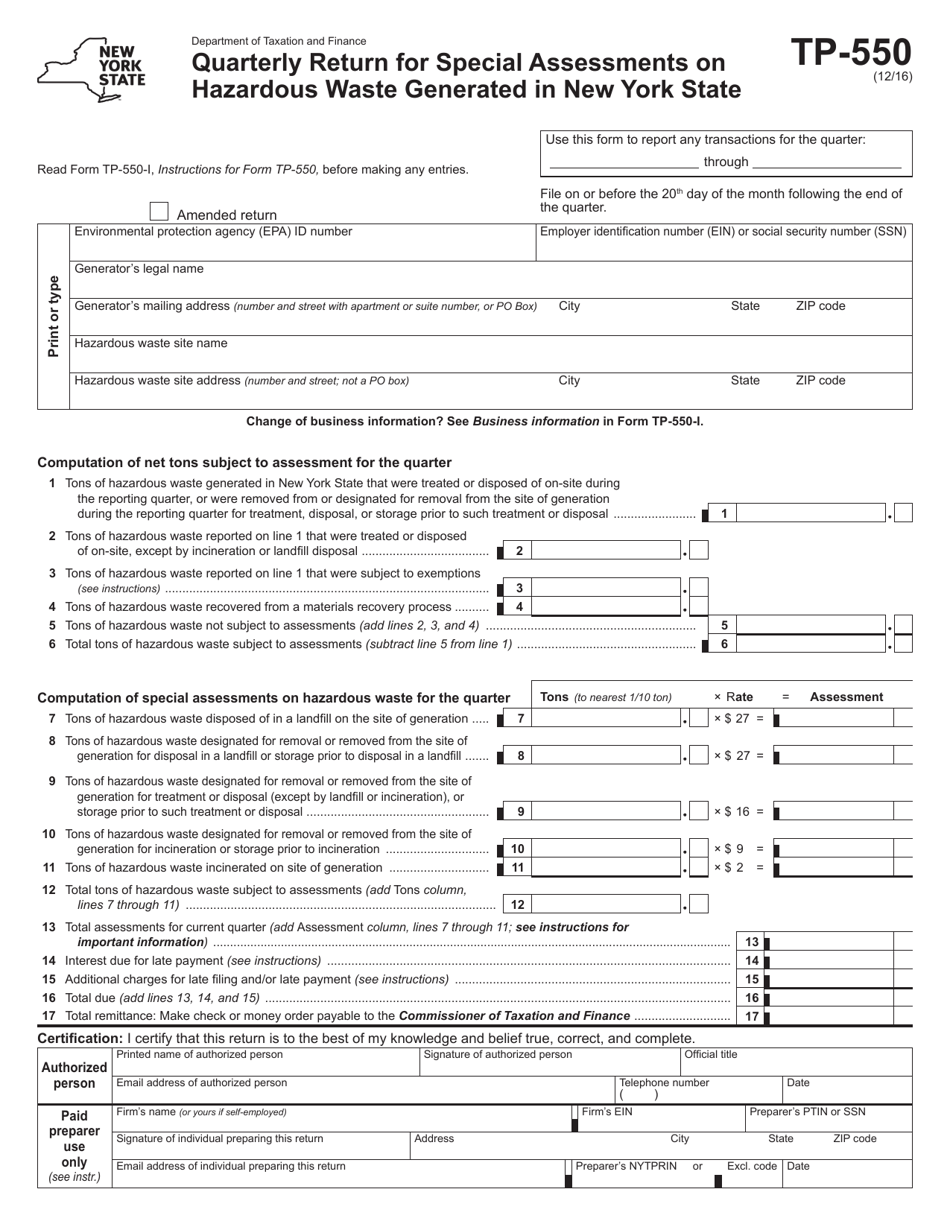

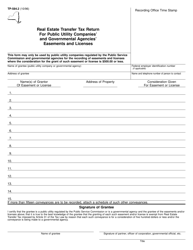

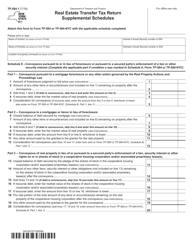

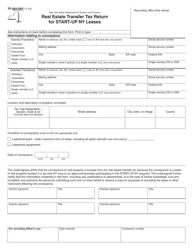

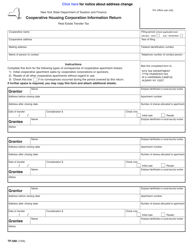

Form TP-550 Quarterly Return for Special Assessments on Hazardous Waste Generated in New York State - New York

What Is Form TP-550?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form TP-550?

A: Form TP-550 is the Quarterly Return for Special Assessments on Hazardous Waste Generated in New York State.

Q: Who needs to file Form TP-550?

A: Any person or entity who generates or manages hazardous waste in New York State and is subject to the special assessments on hazardous waste is required to file Form TP-550.

Q: What is the purpose of Form TP-550?

A: The purpose of Form TP-550 is to report and remit the special assessments on hazardous waste generated in New York State.

Q: When is Form TP-550 due?

A: Form TP-550 is due on a quarterly basis, with the due date being the last day of the month following the end of each quarter.

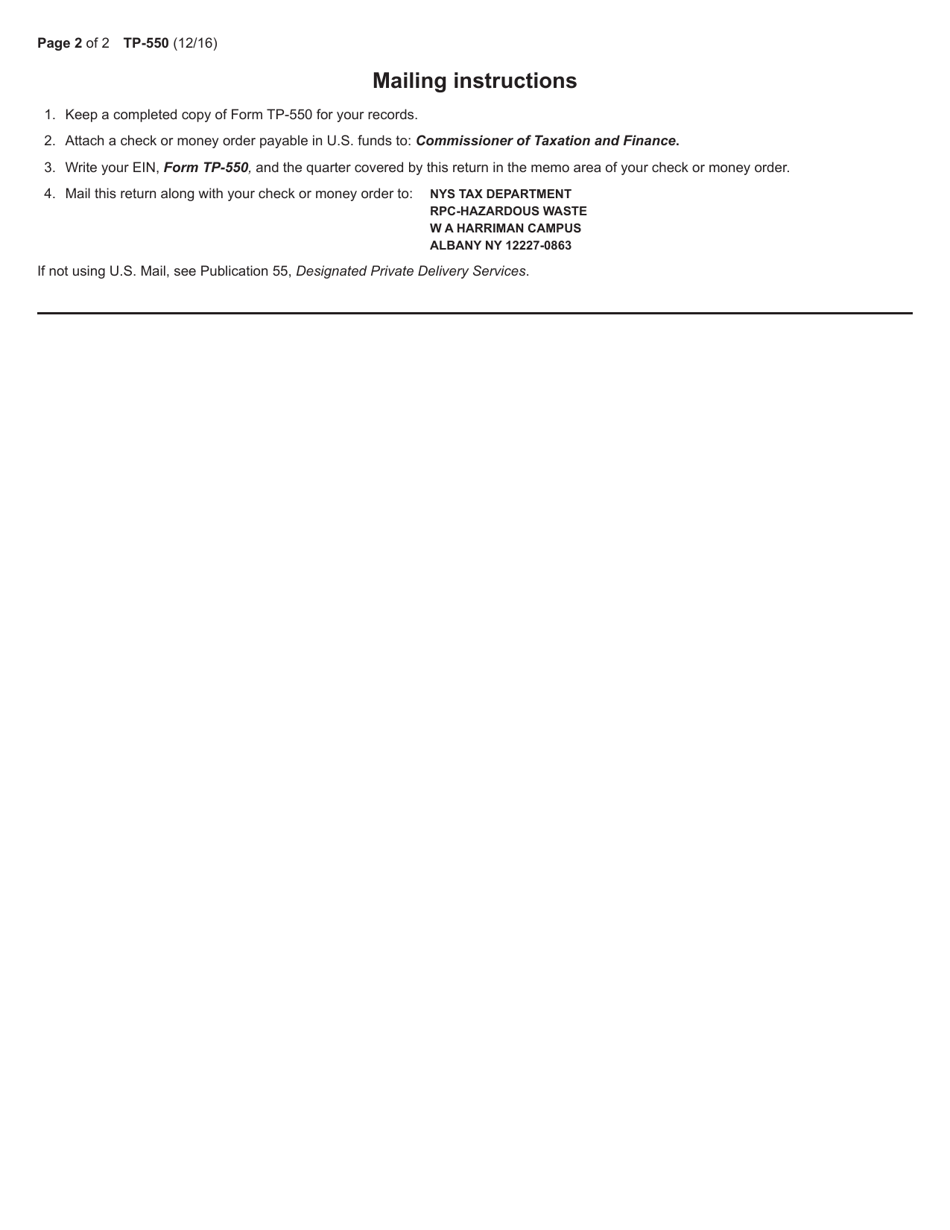

Q: Do I need to keep a copy of Form TP-550?

A: Yes, it is recommended to keep a copy of Form TP-550 and any supporting documents for at least six years in case of audit or review by the tax authorities.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing or non-compliance, including monetary fines and potential legal consequences. It is important to file Form TP-550 on time and accurately to avoid such penalties.

Q: Is there a fee for filing Form TP-550?

A: There is no fee for filing Form TP-550, but you may be subject to special assessments on the hazardous waste generated.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TP-550 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.