This version of the form is not currently in use and is provided for reference only. Download this version of

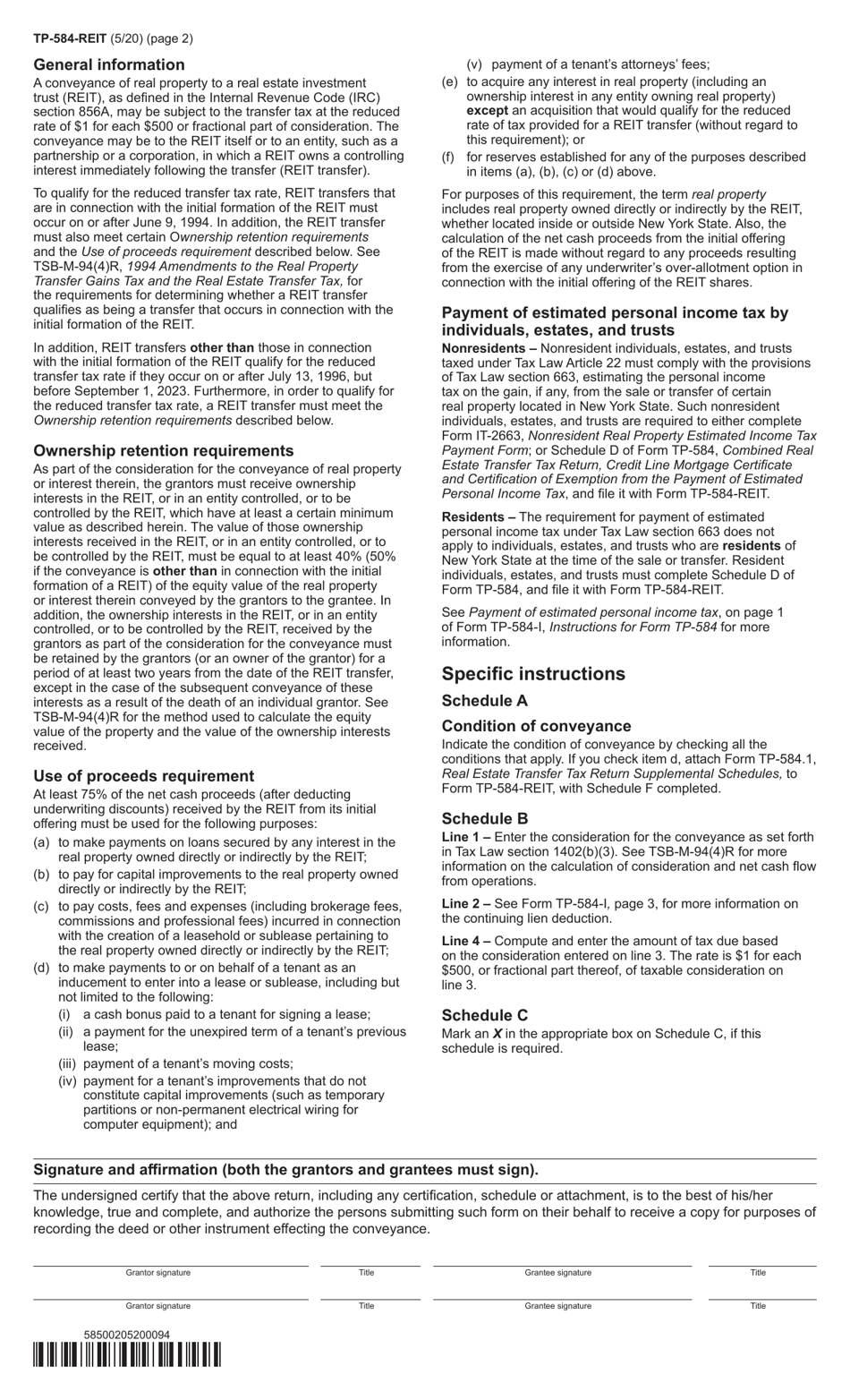

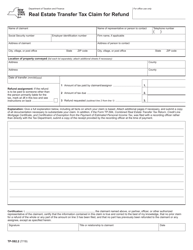

Form TP-584-REIT

for the current year.

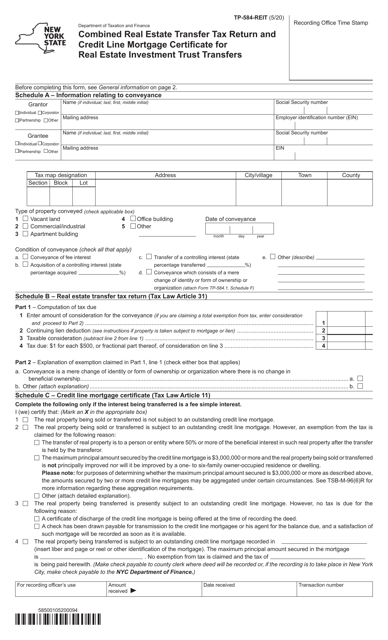

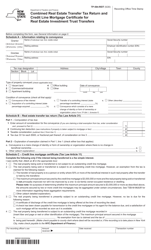

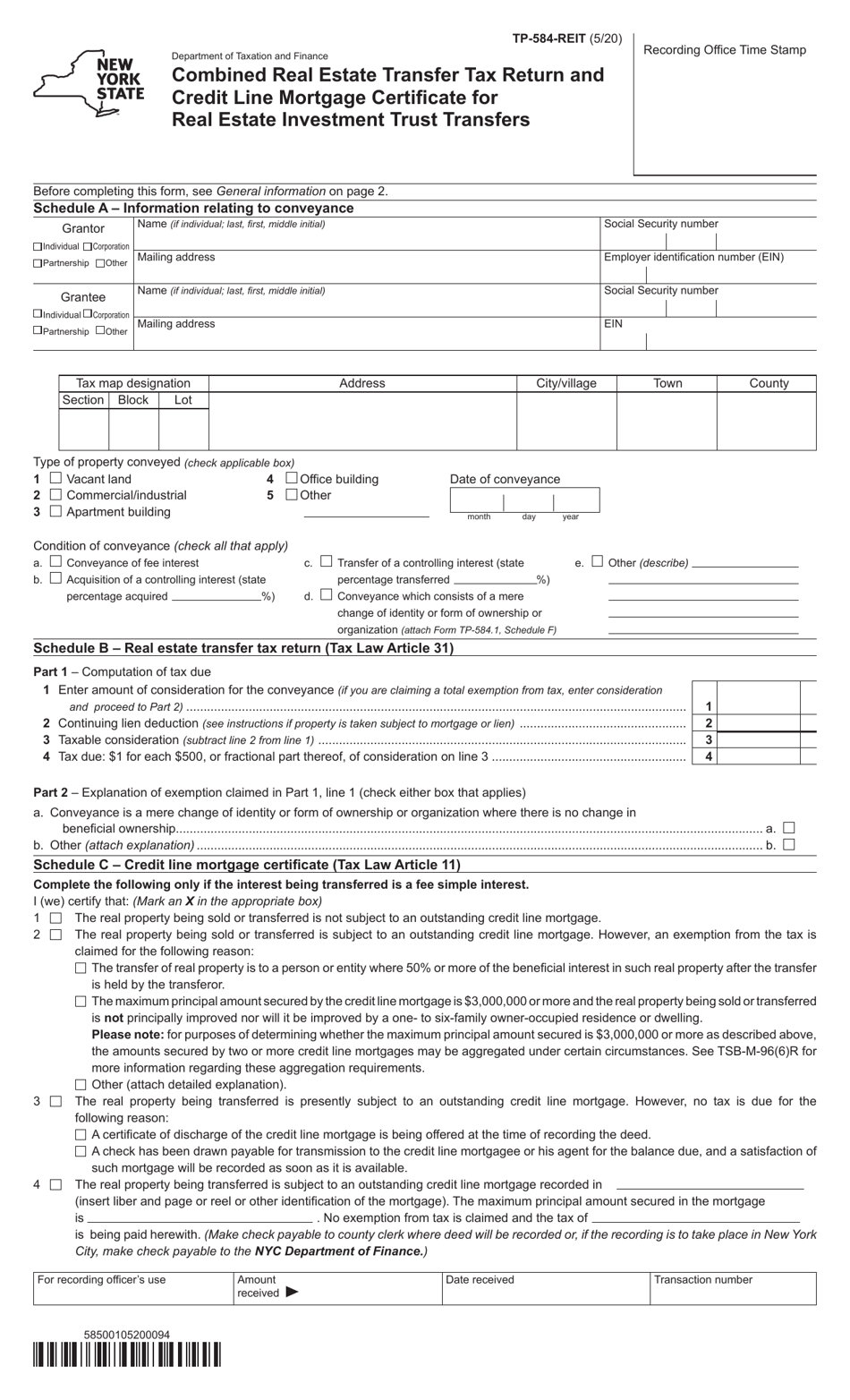

Form TP-584-REIT Combined Real Estate Transfer Tax Return and Credit Line Mortgage Certificate for Real Estate Investment Trust Transfers - New York

What Is Form TP-584-REIT?

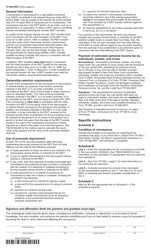

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TP-584-REIT?

A: Form TP-584-REIT is the Combined Real Estate Transfer Tax Return and Credit Line Mortgage Certificate specifically used for Real Estate Investment Trust (REIT) transfers in New York.

Q: What is the purpose of Form TP-584-REIT?

A: The purpose of Form TP-584-REIT is to document and calculate the real estate transfertax owed on the transfer of real property by a Real Estate Investment Trust (REIT) in New York.

Q: Who is responsible for filing Form TP-584-REIT?

A: The Real Estate Investment Trust (REIT) or the REIT's authorized representative is responsible for filing Form TP-584-REIT.

Q: What information is required on Form TP-584-REIT?

A: Form TP-584-REIT requires information about the transferor, transferee, property being transferred, consideration or mortgage information, and any exemptions claimed.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TP-584-REIT by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.