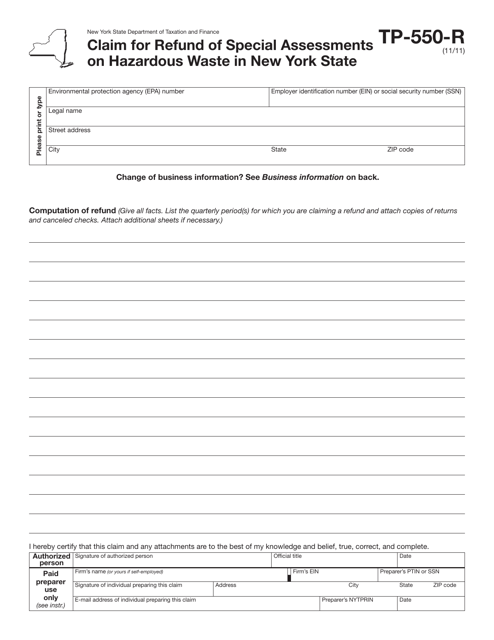

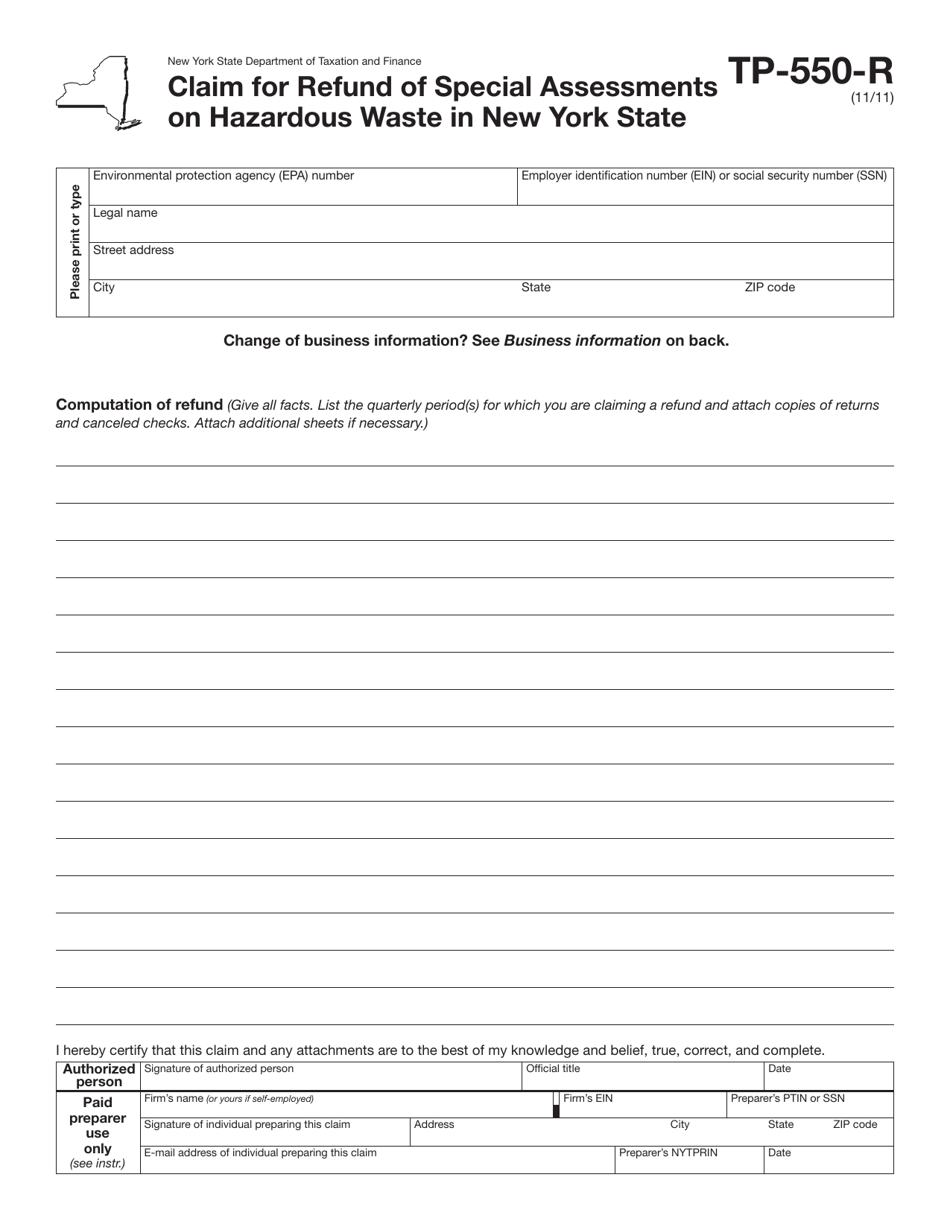

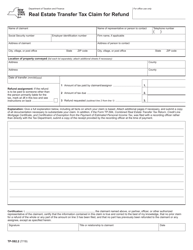

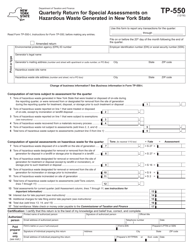

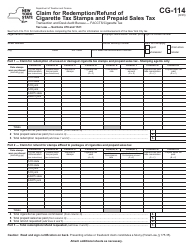

Form TP-550-R Claim for Refund of Special Assessments on Hazardous Waste in New York State - New York

What Is Form TP-550-R?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form TP-550-R?

A: Form TP-550-R is the Claim for Refund of Special Assessments on Hazardous Waste in New York State.

Q: What is the purpose of Form TP-550-R?

A: The purpose of Form TP-550-R is to claim a refund for special assessments paid on hazardous waste in New York State.

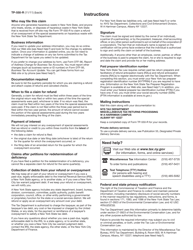

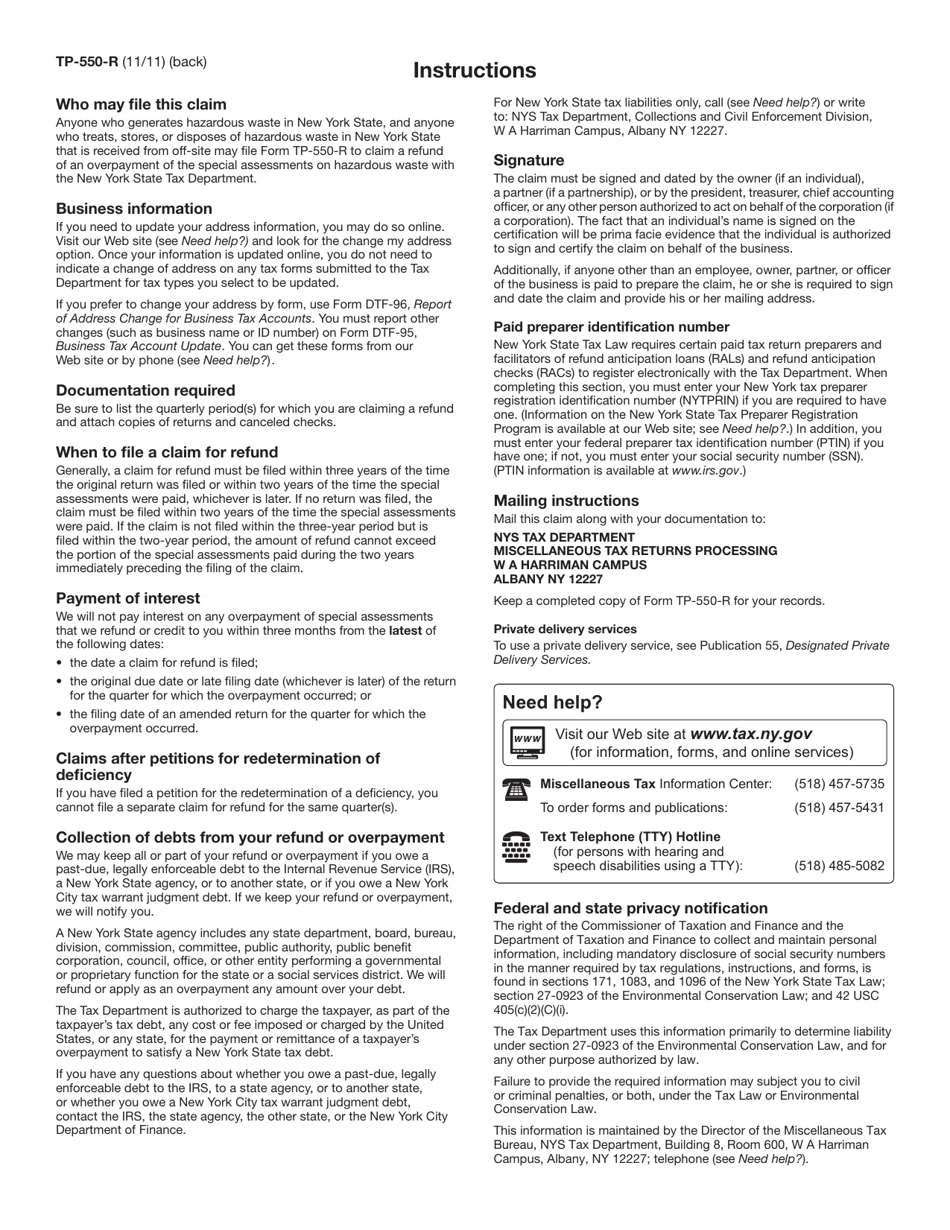

Q: Who can use Form TP-550-R?

A: Any individual or business that has paid special assessments on hazardous waste in New York State can use Form TP-550-R to claim a refund.

Q: When should I file Form TP-550-R?

A: You should file Form TP-550-R within three years from the date the special assessment was paid.

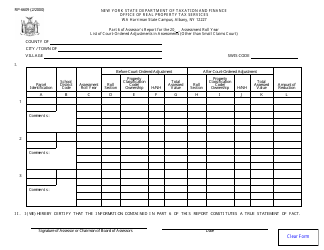

Q: How long does it take to process a refund claim using Form TP-550-R?

A: The processing time for a refund claim using Form TP-550-R can vary, but it is usually within a few weeks to a few months.

Q: What documentation do I need to submit with Form TP-550-R?

A: You will need to submit proof of payment for the special assessments, such as receipts or invoices.

Q: Is there a fee for filing Form TP-550-R?

A: No, there is no fee for filing Form TP-550-R.

Form Details:

- Released on November 1, 2011;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TP-550-R by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.