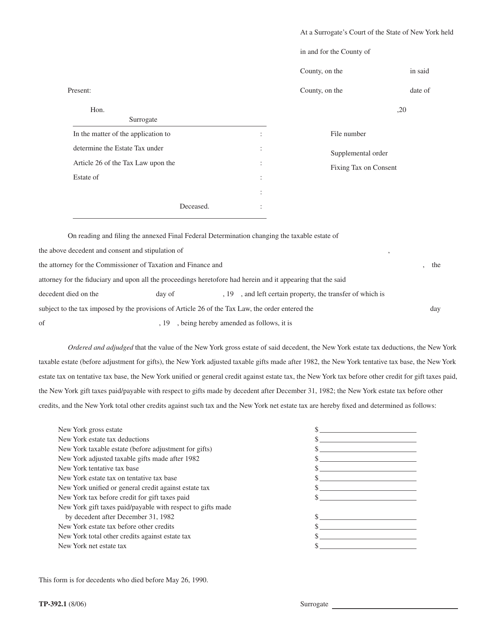

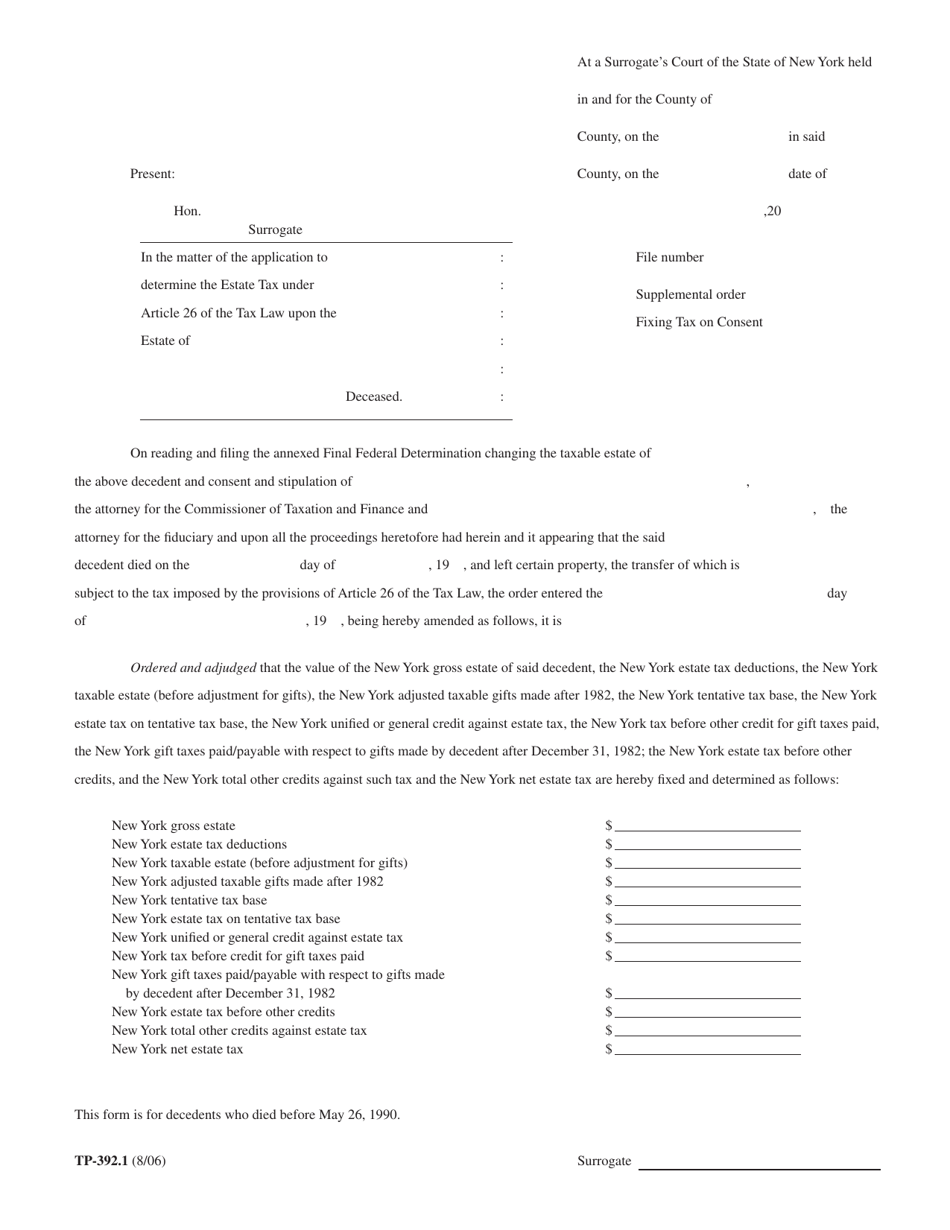

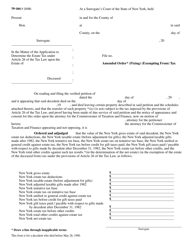

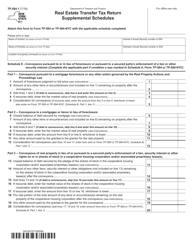

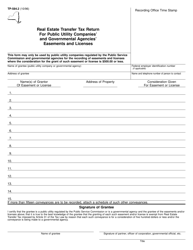

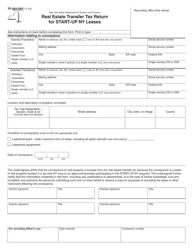

Form TP-392.1 Supplemental Order Fixing Tax on Consent - New York

What Is Form TP-392.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

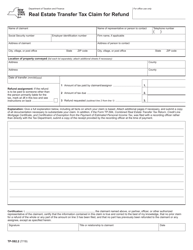

Q: What is Form TP-392.1 Supplemental Order Fixing Tax on Consent - New York?

A: Form TP-392.1 Supplemental Order Fixing Tax on Consent is a document used in New York to determine the tax due when a taxpayer voluntarily consents to an assessment.

Q: When is Form TP-392.1 Supplemental Order Fixing Tax on Consent used?

A: This form is used when a taxpayer agrees to an audit assessment and wants to pay the agreed-upon tax amount.

Q: What is the purpose of Form TP-392.1 Supplemental Order Fixing Tax on Consent?

A: The purpose of this form is to formalize the agreement between the taxpayer and the tax authority regarding the tax amount due.

Q: Are there any deadlines associated with Form TP-392.1 Supplemental Order Fixing Tax on Consent?

A: Yes, there may be specific deadlines for submitting this form. It is recommended to check the instructions provided with the form or consult with the New York State Department of Taxation and Finance.

Form Details:

- Released on August 1, 2006;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TP-392.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.