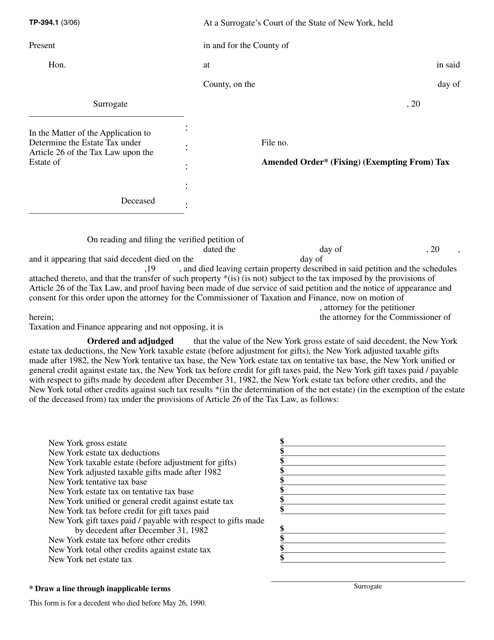

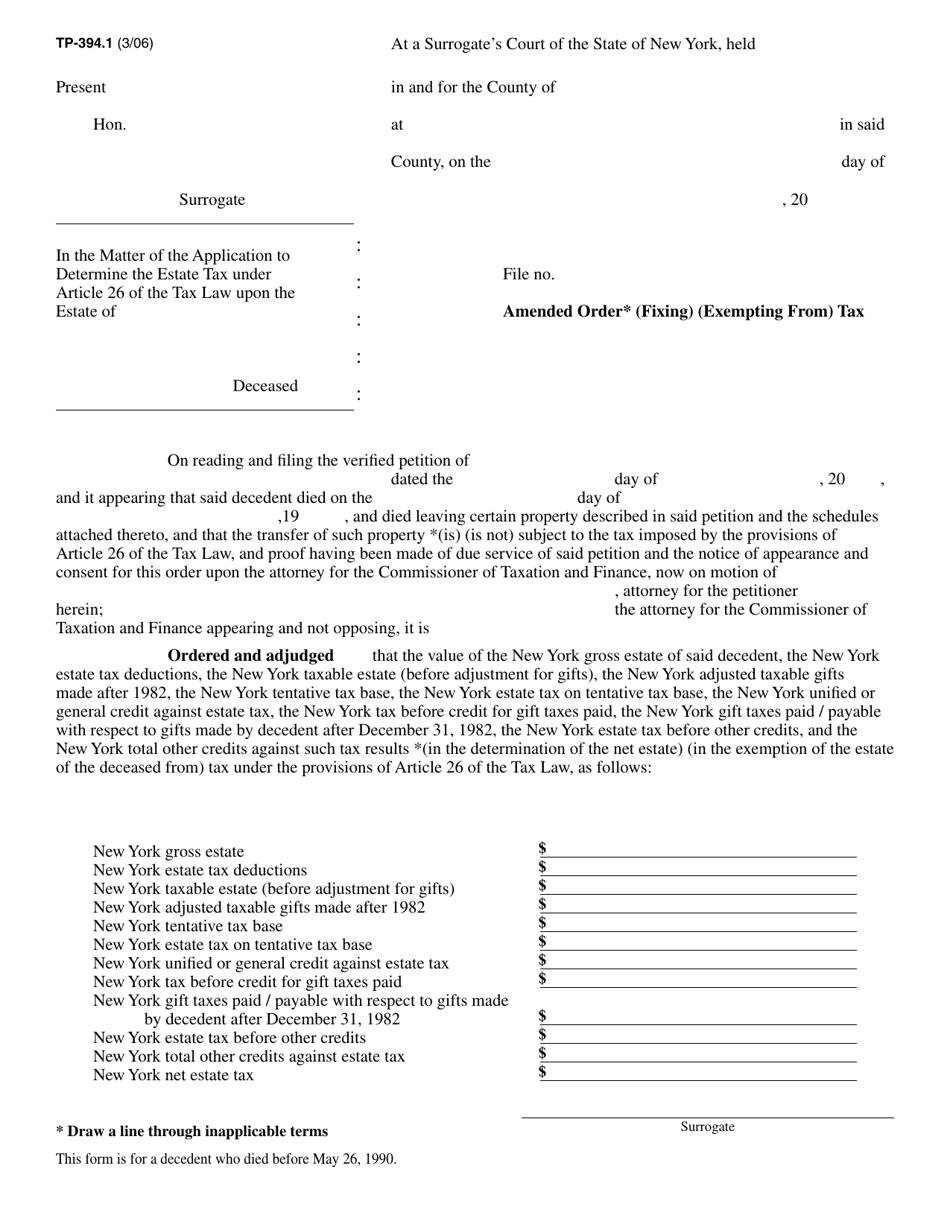

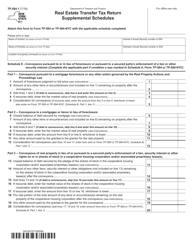

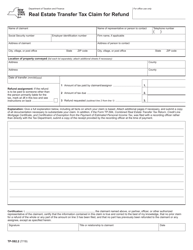

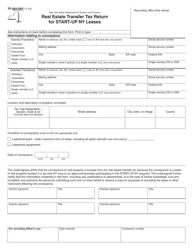

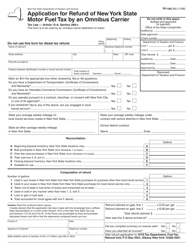

Form TP-394.1 Amended Order (Fixing) (Exempting From) Tax - New York

What Is Form TP-394.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TP-394.1?

A: Form TP-394.1 is a form used in New York to amend an order related to fixing or exempting from tax.

Q: What is the purpose of Form TP-394.1?

A: The purpose of Form TP-394.1 is to amend a previously issued order related to fixing or exempting from tax.

Q: When should I use Form TP-394.1?

A: You should use Form TP-394.1 when you need to make changes to an existing order related to fixing or exempting from tax.

Q: Are there any fees associated with filing Form TP-394.1?

A: There are no fees associated with filing Form TP-394.1.

Q: Are there any specific instructions for filling out Form TP-394.1?

A: Yes, there are specific instructions provided with Form TP-394.1 that should be followed when completing the form.

Q: Can I e-file Form TP-394.1?

A: No, Form TP-394.1 cannot be e-filed. It must be filed by mail or in person.

Q: Is there a deadline for filing Form TP-394.1?

A: There is no specific deadline for filing Form TP-394.1. It should be filed as soon as possible when changes to the existing order are needed.

Q: What should I do if I have additional questions about Form TP-394.1?

A: If you have additional questions about Form TP-394.1, you should contact the New York Department of Taxation and Finance for assistance.

Form Details:

- Released on March 1, 2006;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TP-394.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.