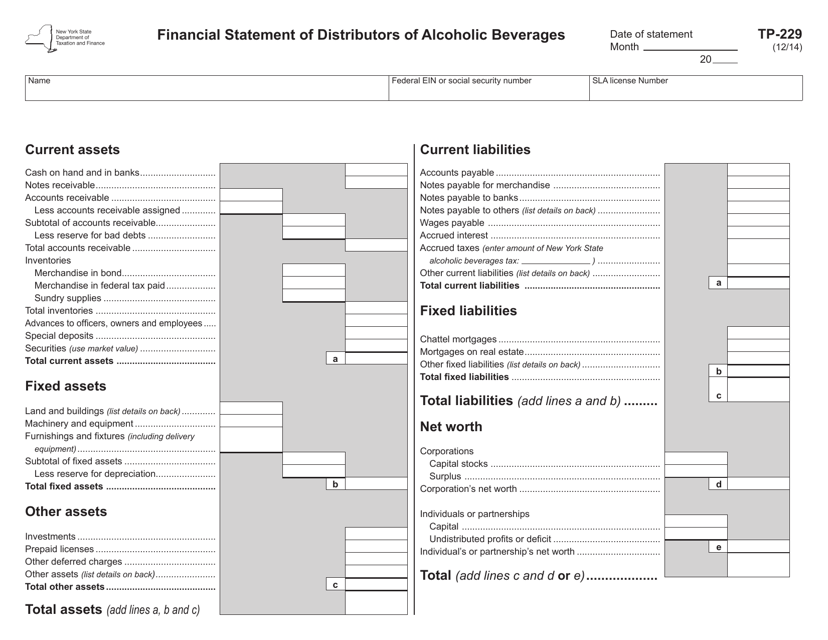

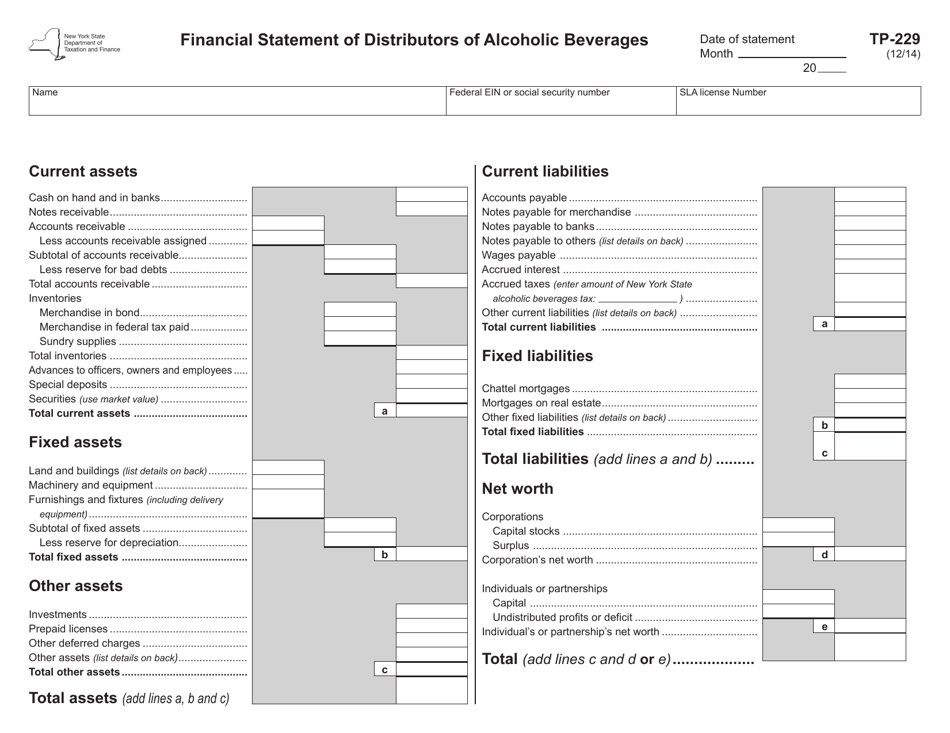

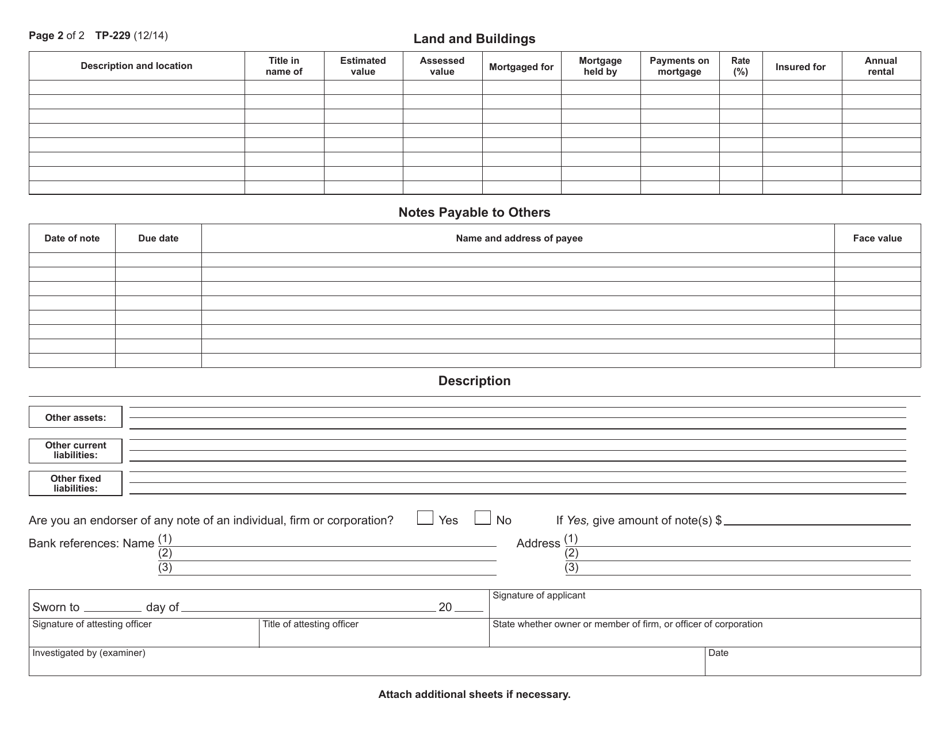

Form TP-229 Financial Statement of Distributors of Alcoholic Beverages - New York

What Is Form TP-229?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TP-229?

A: Form TP-229 is the Financial Statement of Distributors of Alcoholic Beverages in New York.

Q: Who needs to file Form TP-229?

A: Distributors of alcoholic beverages in New York need to file Form TP-229.

Q: What is the purpose of Form TP-229?

A: The purpose of Form TP-229 is to report financial information and activity related to the distribution of alcoholic beverages in New York.

Q: When is Form TP-229 due?

A: Form TP-229 is due annually and must be filed by the 20th day of the fourth month following the end of the distributor's fiscal year.

Q: Are there any penalties for late or non-filing of Form TP-229?

A: Yes, there may be penalties for late or non-filing of Form TP-229. It is important to file the form on time to avoid any potential penalties.

Q: Is there a fee for filing Form TP-229?

A: No, there is no fee for filing Form TP-229. However, distributors may be subject to other fees and taxes related to the distribution of alcoholic beverages in New York.

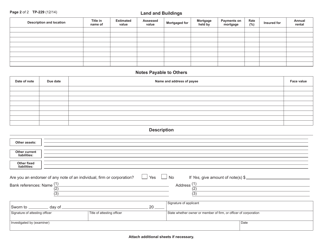

Q: What supporting documents are required to be submitted with Form TP-229?

A: The specific supporting documents required may vary, but generally distributors are required to submit a balance sheet, income statement, and other financial records.

Q: Who should I contact for more information about Form TP-229?

A: For more information about Form TP-229, you can contact the New York State Department of Taxation and Finance.

Form Details:

- Released on December 1, 2014;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TP-229 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.