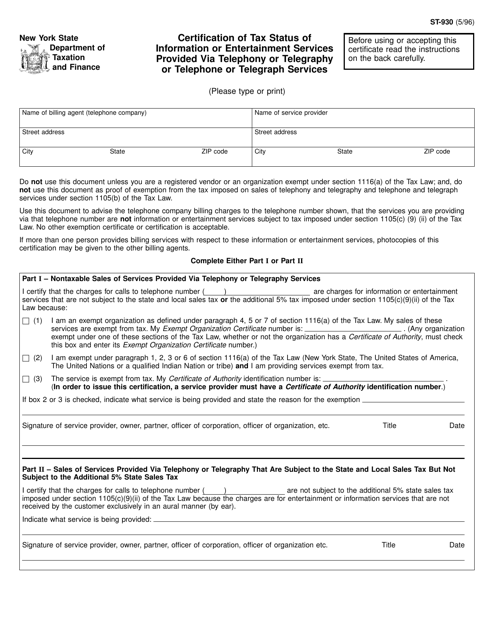

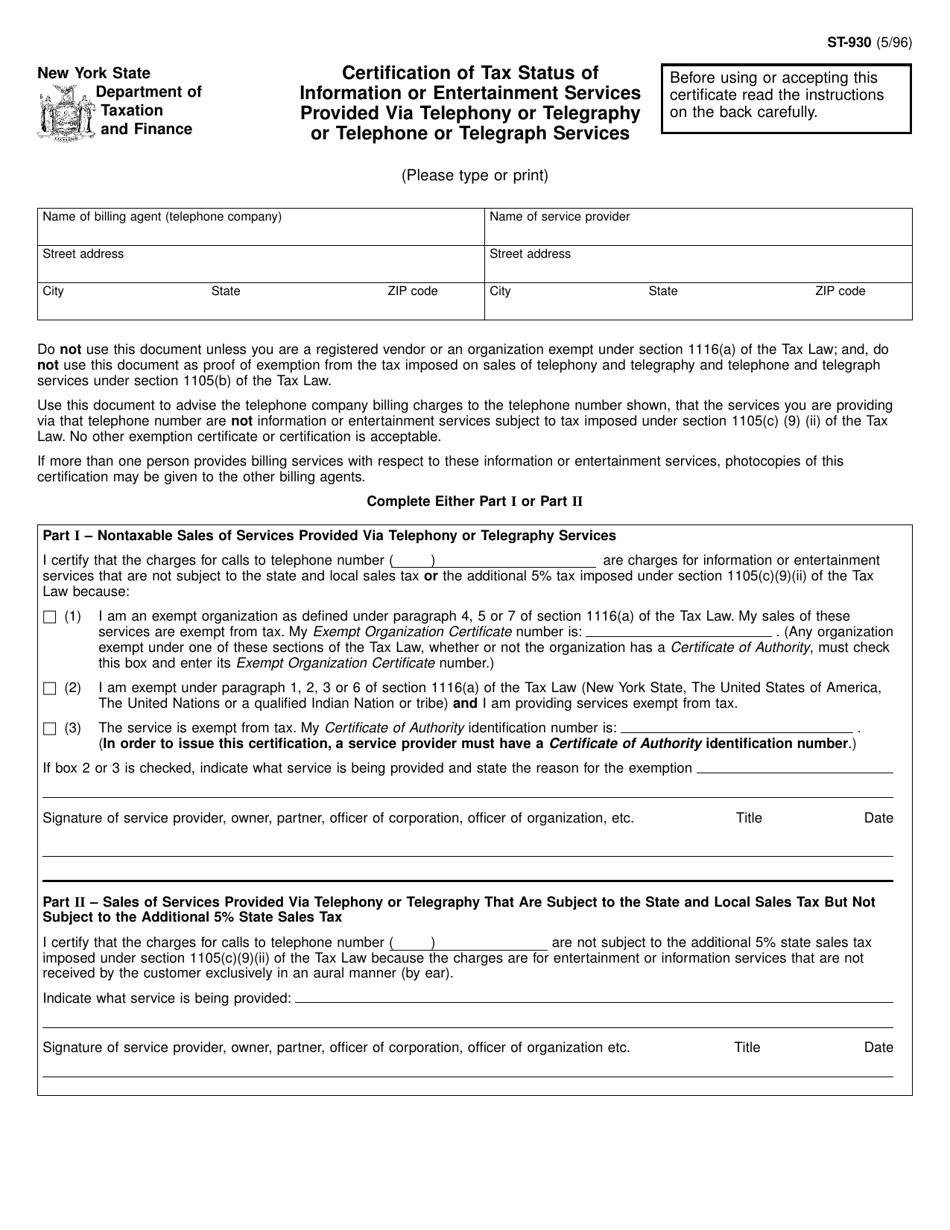

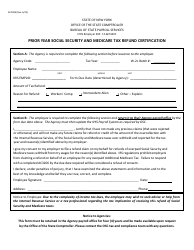

Form ST-930 Certification of Tax Status of Information or Entertainment Services Provided via Telephony or Telegraphy or Telephone or Telegraph Services - New York

What Is Form ST-930?

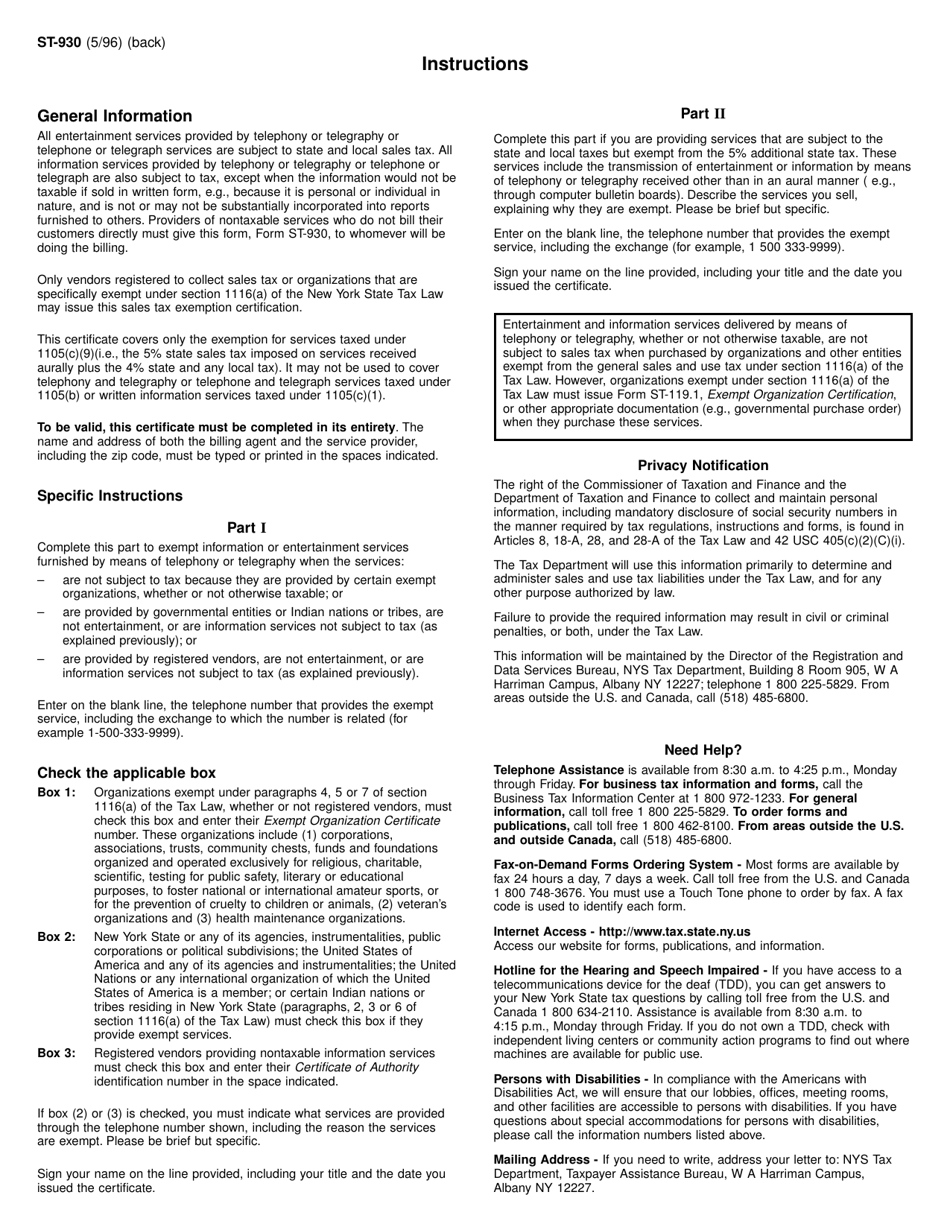

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form ST-930?

A: Form ST-930 is a Certification of Tax Status of Information or Entertainment Services Provided via Telephony or Telegraphy or Telephone or Telegraph Services in New York.

Q: Who needs to file Form ST-930?

A: Businesses providing information or entertainment services via telephony or telegraphy or telephone or telegraph services in New York need to file Form ST-930.

Q: What is the purpose of Form ST-930?

A: The purpose of Form ST-930 is to certify the tax status of the information or entertainment services provided via telephony or telegraphy or telephone or telegraph services in New York.

Q: When is Form ST-930 due?

A: Form ST-930 is due on or before the 20th day of the month following the end of the quarter.

Q: What information is required on Form ST-930?

A: Form ST-930 requires information such as the taxpayer's name, address, taxpayer identification number, account number, and the quarter for which the certification is being made.

Q: Are there any penalties for not filing Form ST-930?

A: Yes, failure to file Form ST-930 or providing false information may result in penalties and interest.

Form Details:

- Released on May 1, 1996;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-930 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.