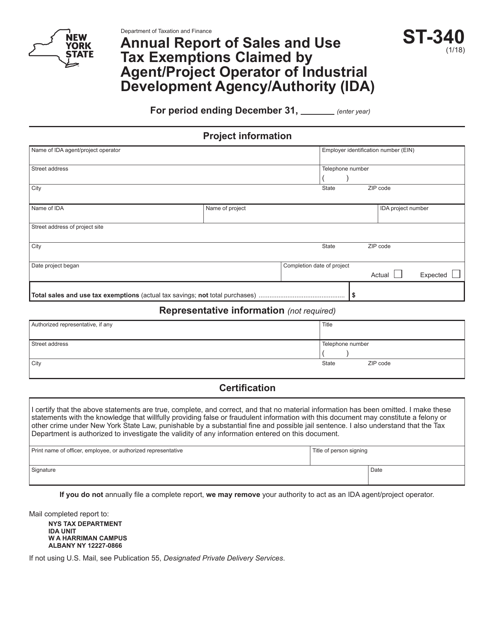

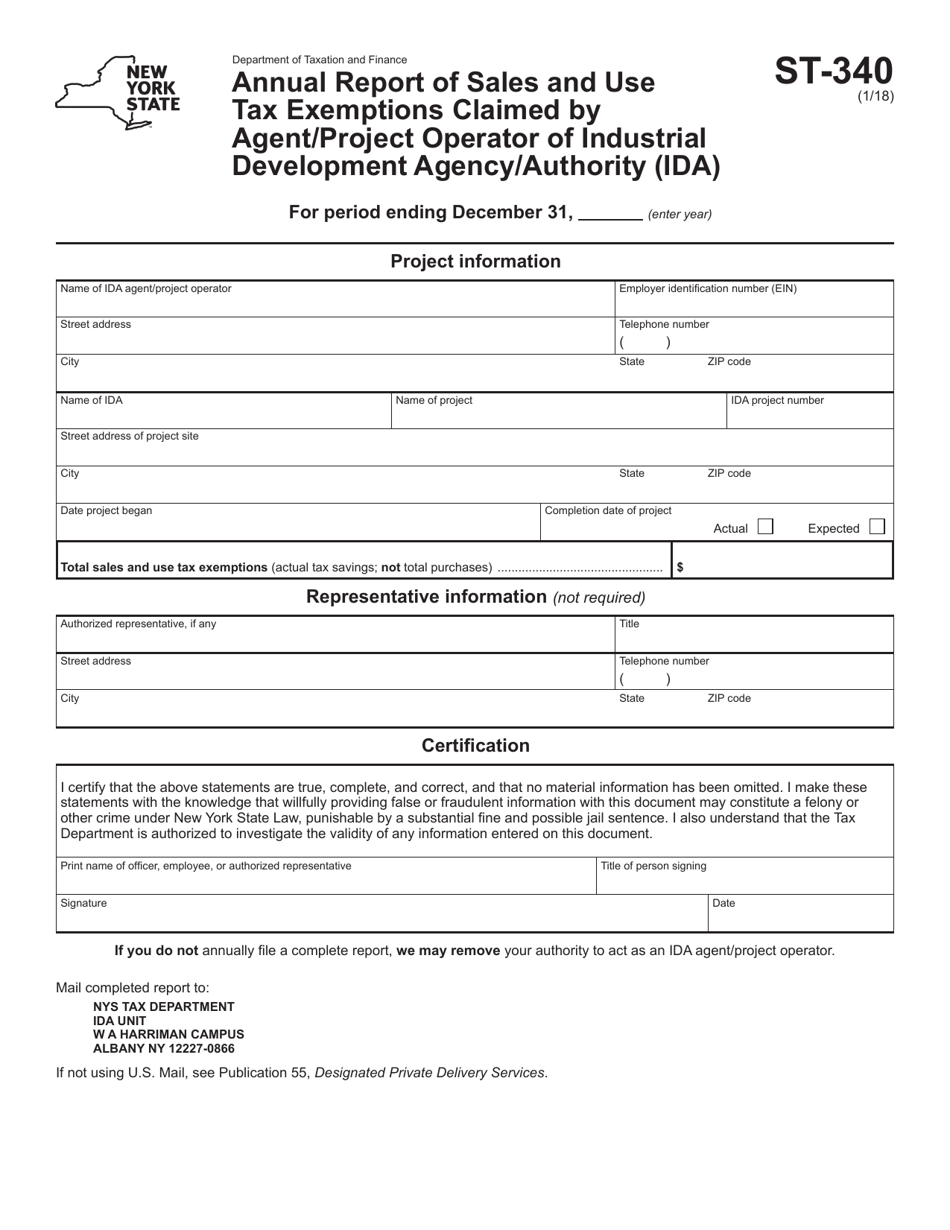

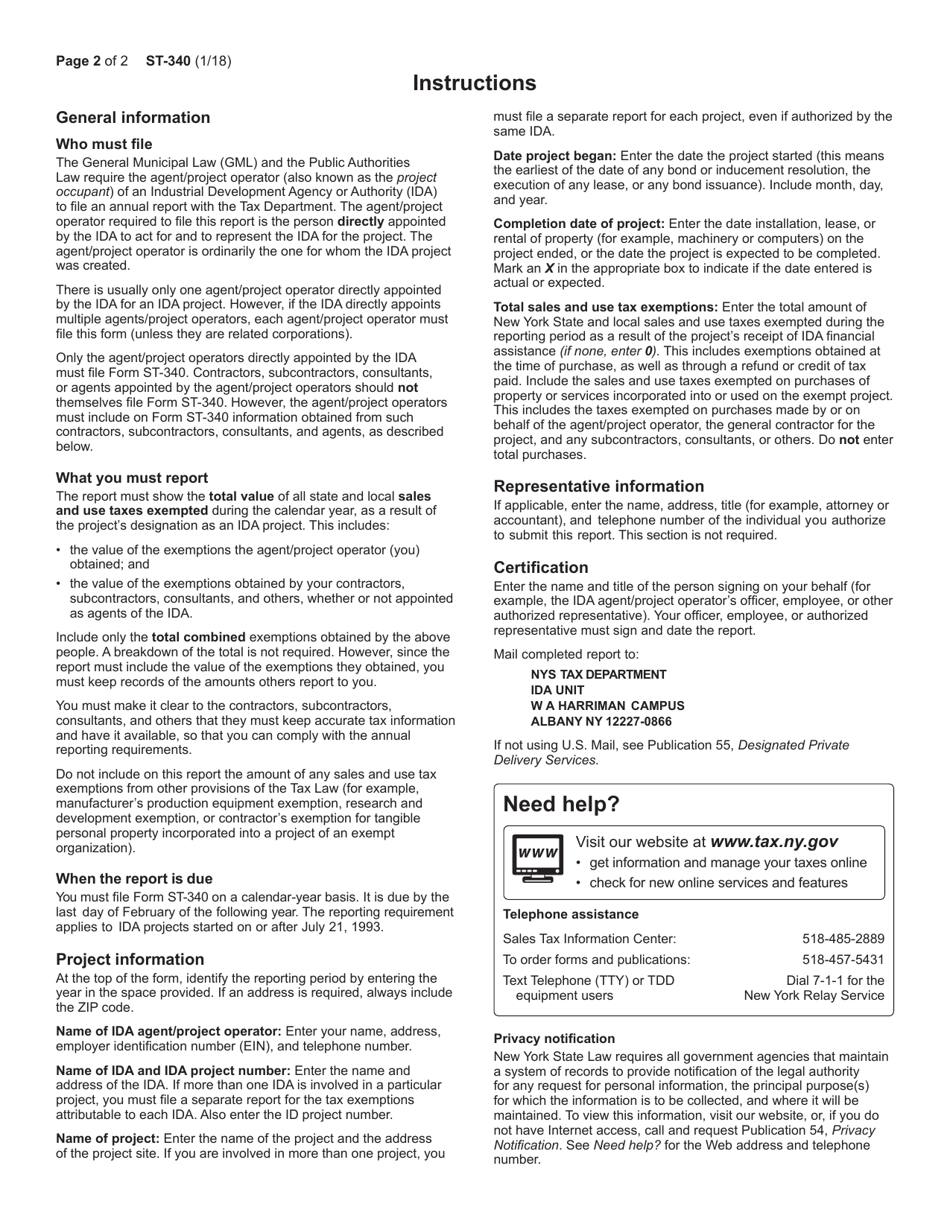

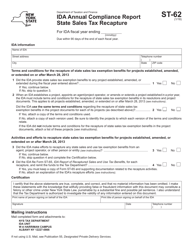

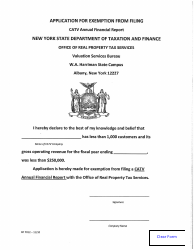

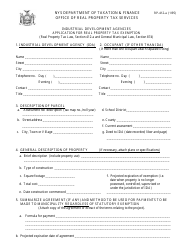

Form ST-340 Annual Report of Sales and Use Tax Exemptions Claimed by Agent / Project Operator of Industrial Development Agency / Authority (Ida) - New York

What Is Form ST-340?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-340?

A: Form ST-340 is the Annual Report of Sales and Use Tax Exemptions Claimed by Agent/Project Operator of Industrial Development Agency/Authority (IDA) in New York.

Q: Who needs to fill out Form ST-340?

A: Agents or project operators of Industrial Development Agencies/Authorities (IDA) in New York need to fill out Form ST-340.

Q: What is the purpose of Form ST-340?

A: The purpose of Form ST-340 is to report the sales and use tax exemptions claimed by agents/project operators of Industrial Development Agencies/Authorities (IDA) in New York.

Q: When should Form ST-340 be filed?

A: Form ST-340 should be filed annually by the due date specified by the New York State Department of Taxation and Finance.

Q: Are there any filing fees for Form ST-340?

A: No, there are no filing fees associated with filing Form ST-340.

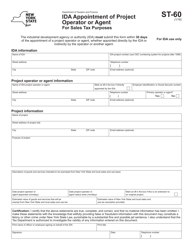

Q: What information is required on Form ST-340?

A: Form ST-340 requires information such as the IDA name, agent/project operator details, project information, and details of sales and use tax exemptions claimed.

Q: What happens if I don't file Form ST-340?

A: Failure to file Form ST-340 by the due date may result in penalties and interest imposed by the New York State Department of Taxation and Finance.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-340 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.