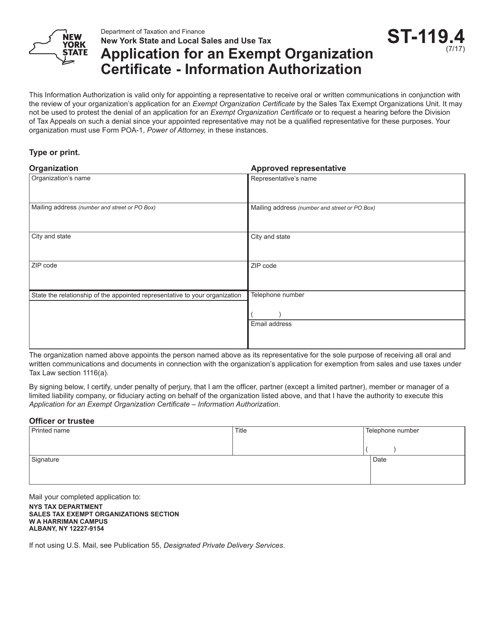

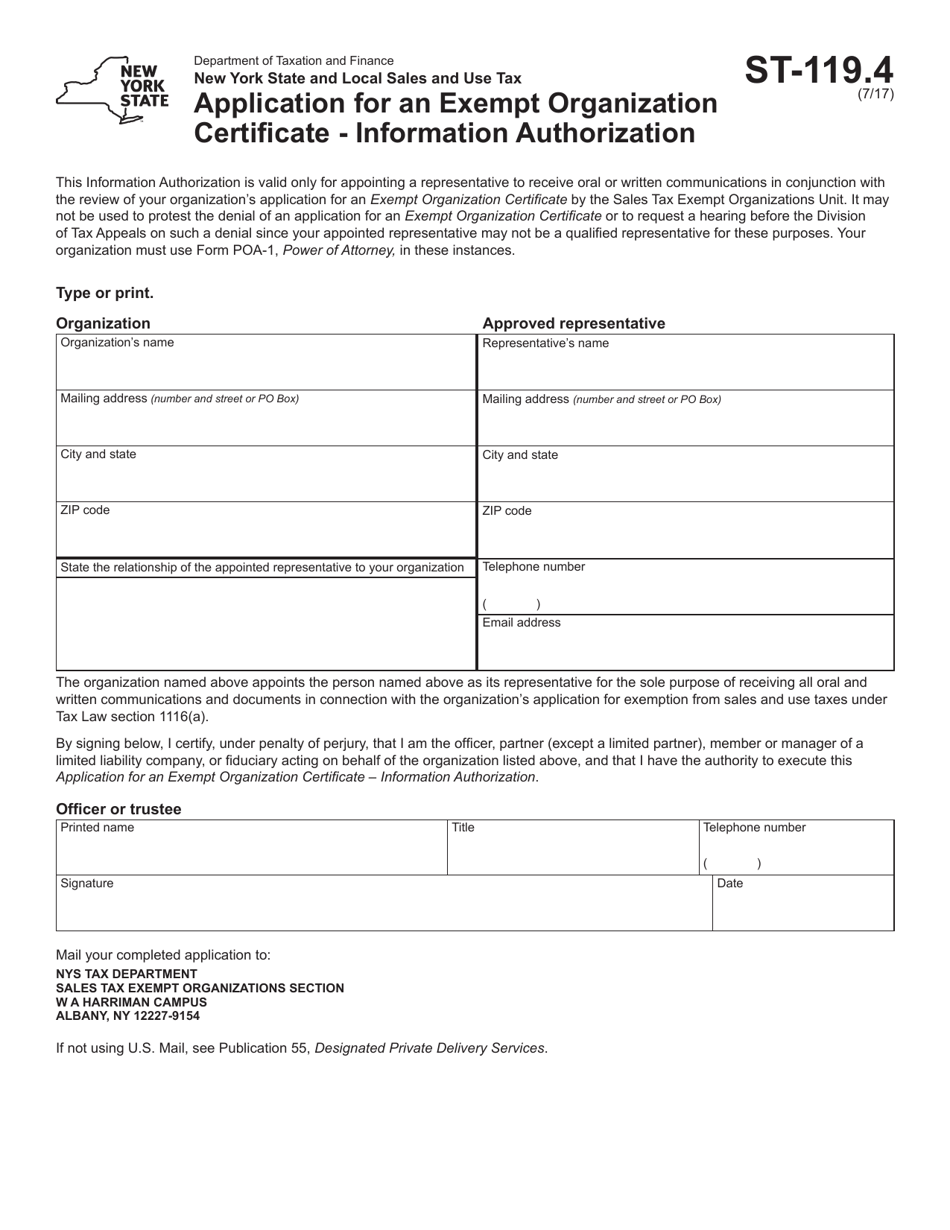

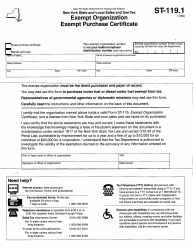

Form ST-119.4 Application for an Exempt Organization Certificate - Information Authorization - New York

What Is Form ST-119.4?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form ST-119.4?

A: Form ST-119.4 is an application for an Exempt Organization Certificate in New York.

Q: What is an Exempt Organization Certificate?

A: An Exempt Organization Certificate is a document that allows qualifying organizations to make tax-exempt purchases in the state of New York.

Q: Who should use Form ST-119.4?

A: Nonprofit organizations that are seeking tax-exempt status and wish to make tax-exempt purchases in New York should use Form ST-119.4.

Q: What is the purpose of the Information Authorization section?

A: The Information Authorization section allows the organization to grant permission for the New York State Tax Department to share information with designated individuals and entities.

Q: Is there a fee for filing Form ST-119.4?

A: No, there is no fee for filing Form ST-119.4.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-119.4 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.