This version of the form is not currently in use and is provided for reference only. Download this version of

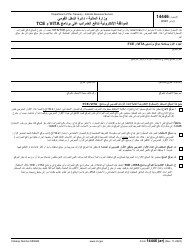

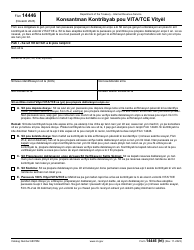

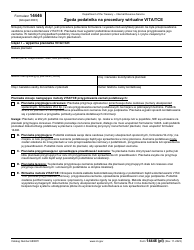

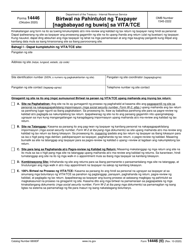

IRS Form 14446

for the current year.

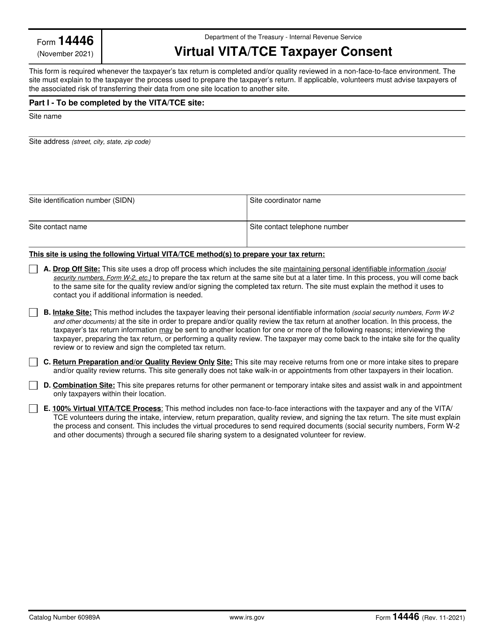

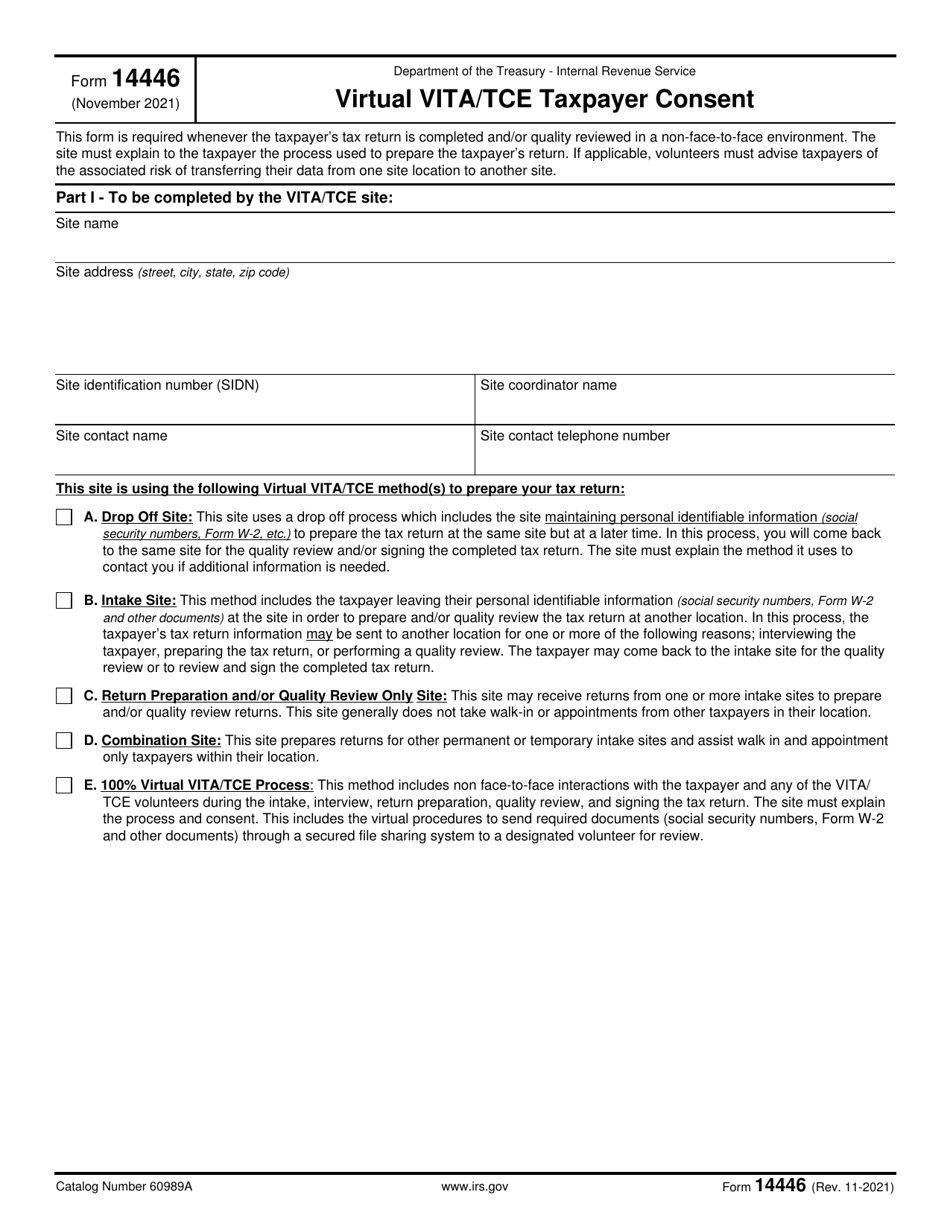

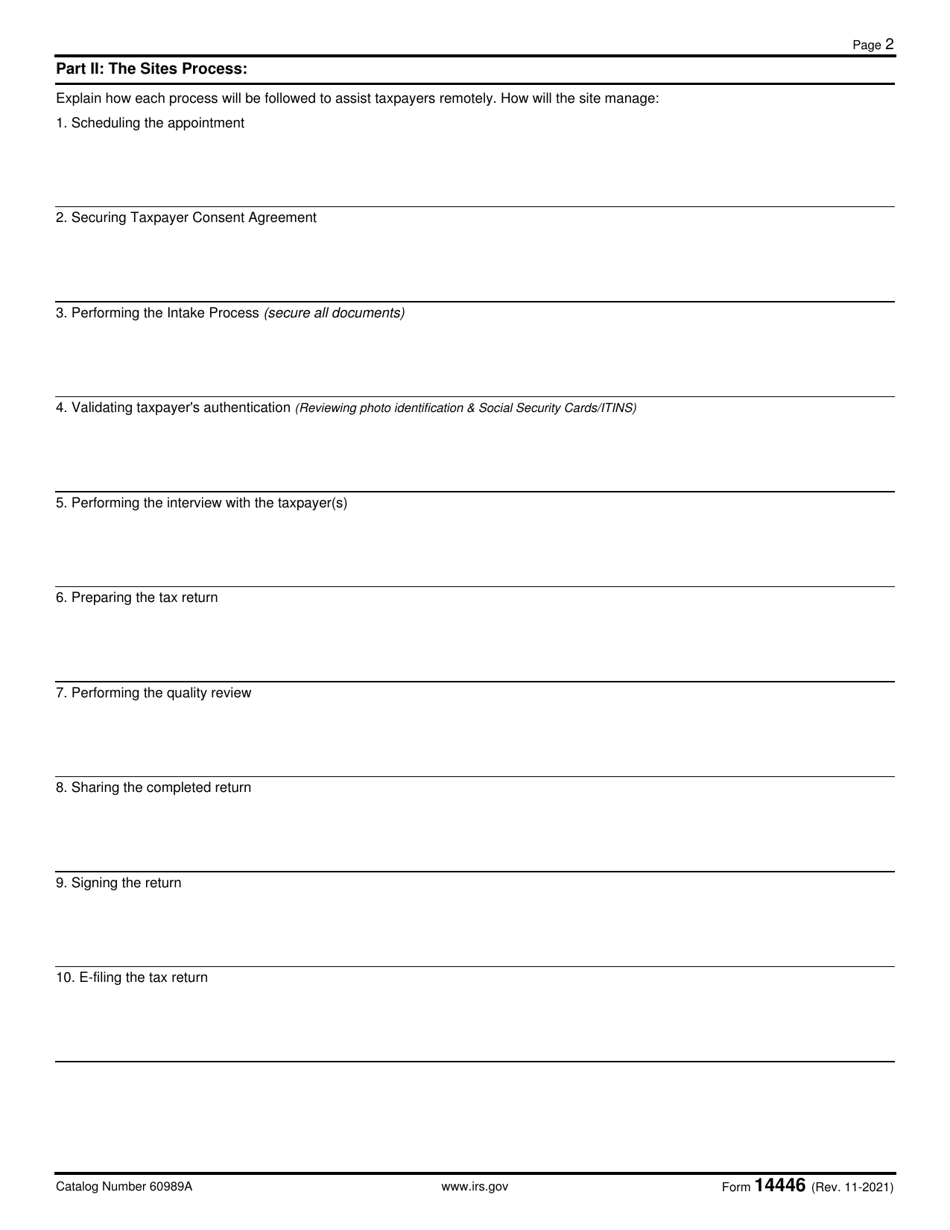

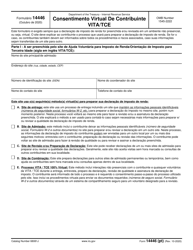

IRS Form 14446 Virtual Vita / Tce Taxpayer Consent

What Is IRS Form 14446?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2021. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14446?

A: IRS Form 14446 is used for Virtual Vita/Tce Taxpayer Consent.

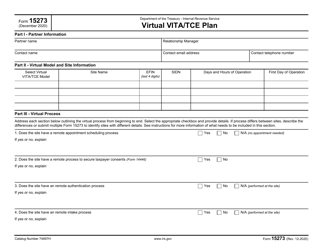

Q: What is Virtual Vita/Tce?

A: Virtual Vita/Tce is a program that enables taxpayers to receive free tax help remotely.

Q: Why is taxpayer consent required?

A: Taxpayer consent is required to participate in the Virtual Vita/Tce program and receive assistance.

Q: Is there a fee for Virtual Vita/Tce tax help?

A: No, Virtual Vita/Tce tax help is provided free of charge.

Q: Can I opt out of the Virtual Vita/Tce program?

A: Yes, taxpayers can opt out of the program if they prefer to receive in-person assistance.

Q: Who is eligible for Virtual Vita/Tce tax help?

A: Virtual Vita/Tce tax help is available to taxpayers with low to moderate incomes.

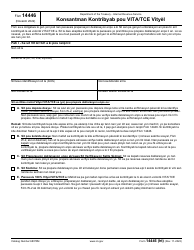

Q: What information is required on Form 14446?

A: Form 14446 requires the taxpayer's personal information and consent to participate in Virtual Vita/Tce.

Q: How long does it take to complete Form 14446?

A: The time required to complete Form 14446 varies depending on the taxpayer's individual circumstances.

Q: Can I submit Form 14446 electronically?

A: Yes, Form 14446 can be submitted electronically or by mail.

Form Details:

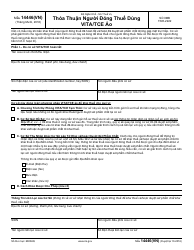

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

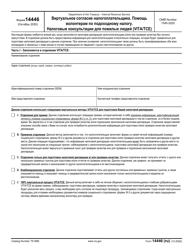

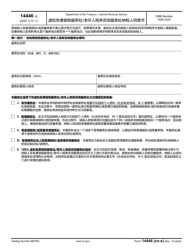

- A Spanish version of IRS Form 14446 is available for spanish-speaking filers;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14446 through the link below or browse more documents in our library of IRS Forms.