This version of the form is not currently in use and is provided for reference only. Download this version of

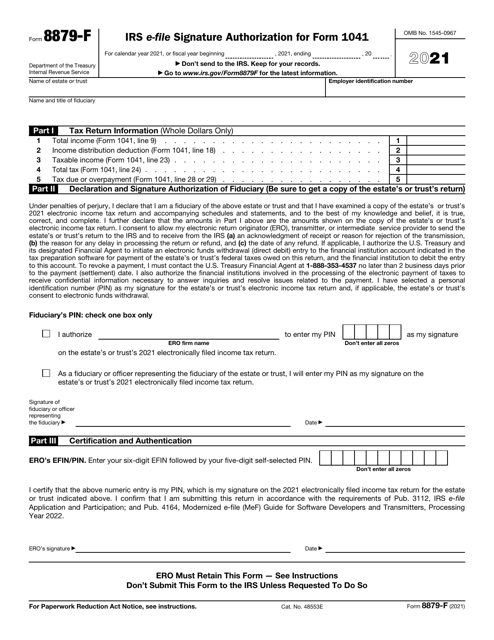

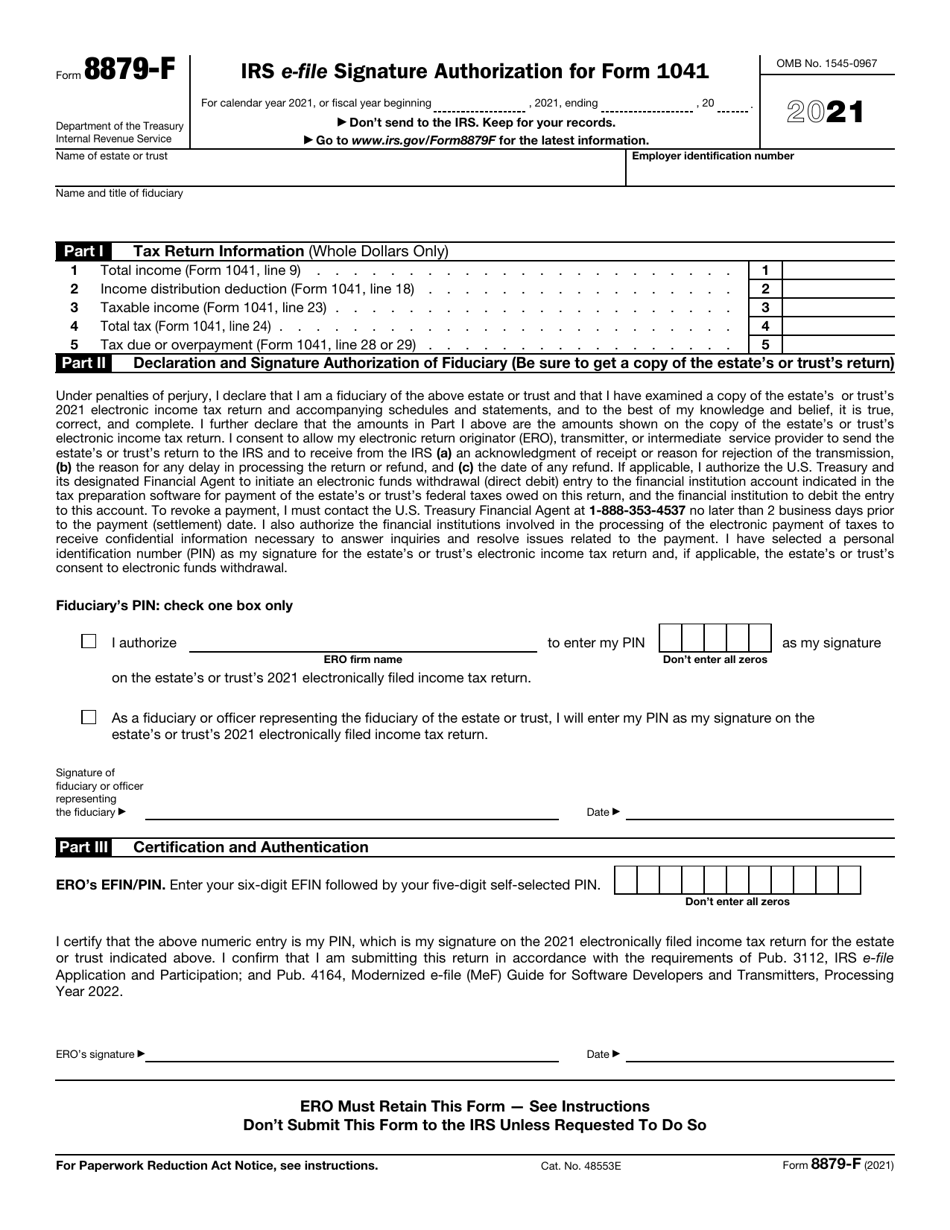

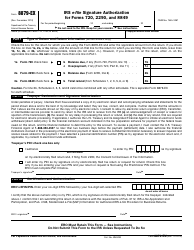

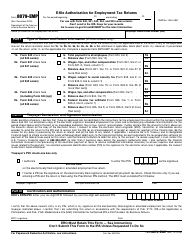

IRS Form 8879-F

for the current year.

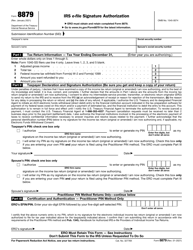

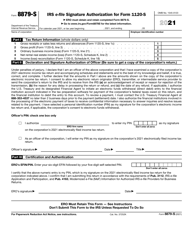

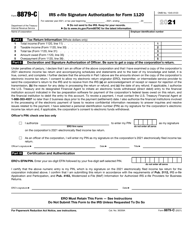

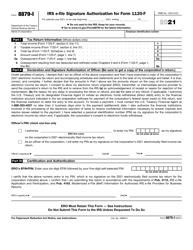

IRS Form 8879-F IRS E-File Signature Authorization for Form 1041

What Is IRS Form 8879-F?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

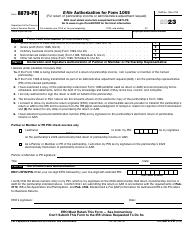

Q: What is IRS Form 8879-F?

A: IRS Form 8879-F is the IRS E-File Signature Authorization for Form 1041.

Q: What is the purpose of IRS Form 8879-F?

A: The purpose of IRS Form 8879-F is to authorize the electronic filing of Form 1041, U.S. Income Tax Return for Estates and Trusts.

Q: Who needs to use IRS Form 8879-F?

A: Any taxpayer or authorized representative who wants to electronically file Form 1041 must use IRS Form 8879-F.

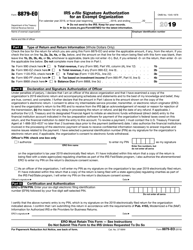

Q: How do I complete IRS Form 8879-F?

A: To complete IRS Form 8879-F, you must provide your name, taxpayer identification number, and signature, as well as the name of the authorized electronic return originator.

Q: Can I submit IRS Form 8879-F electronically?

A: Yes, IRS Form 8879-F can be submitted electronically along with the electronic filing of Form 1041.

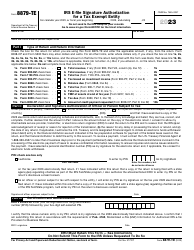

Q: When is IRS Form 8879-F due?

A: IRS Form 8879-F is generally due on the same date as the filing of Form 1041, which is usually April 15th for calendar yearestates and trusts.

Q: Are there any penalties for not filing IRS Form 8879-F?

A: Failure to file IRS Form 8879-F may result in the rejection of the electronic filing of Form 1041. It is important to submit the form to ensure the electronic filing is accepted.

Q: Can I amend IRS Form 8879-F?

A: No, IRS Form 8879-F cannot be amended. If any changes need to be made after it has been submitted, a new signed form must be filed.

Q: Can I e-sign IRS Form 8879-F?

A: Yes, IRS Form 8879-F can be electronically signed using a Personal Identification Number (PIN) or an Electronic Filing Identification Number (EFIN).

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8879-F through the link below or browse more documents in our library of IRS Forms.