This version of the form is not currently in use and is provided for reference only. Download this version of

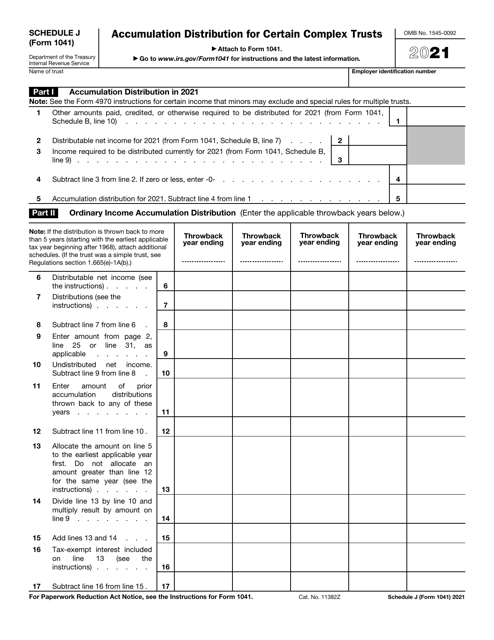

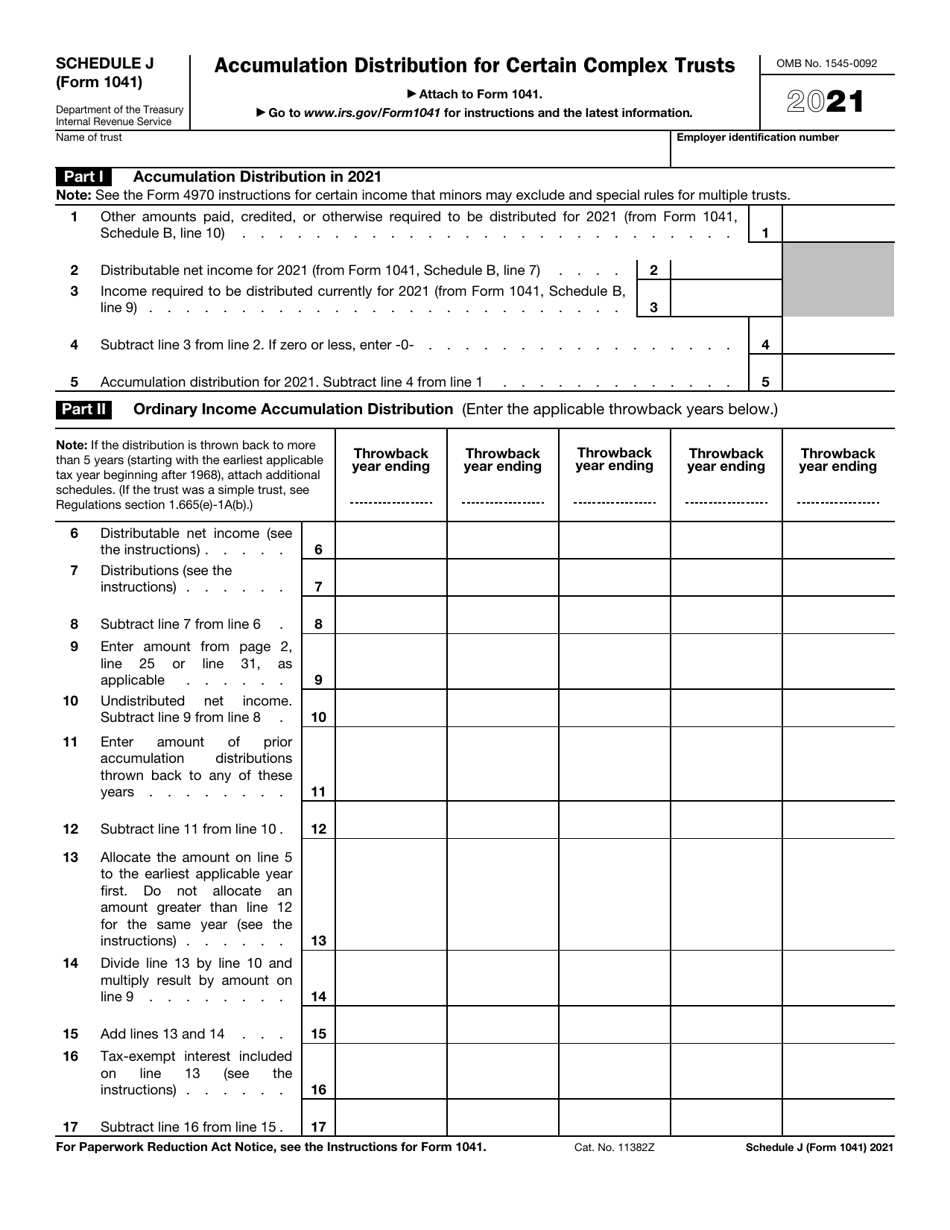

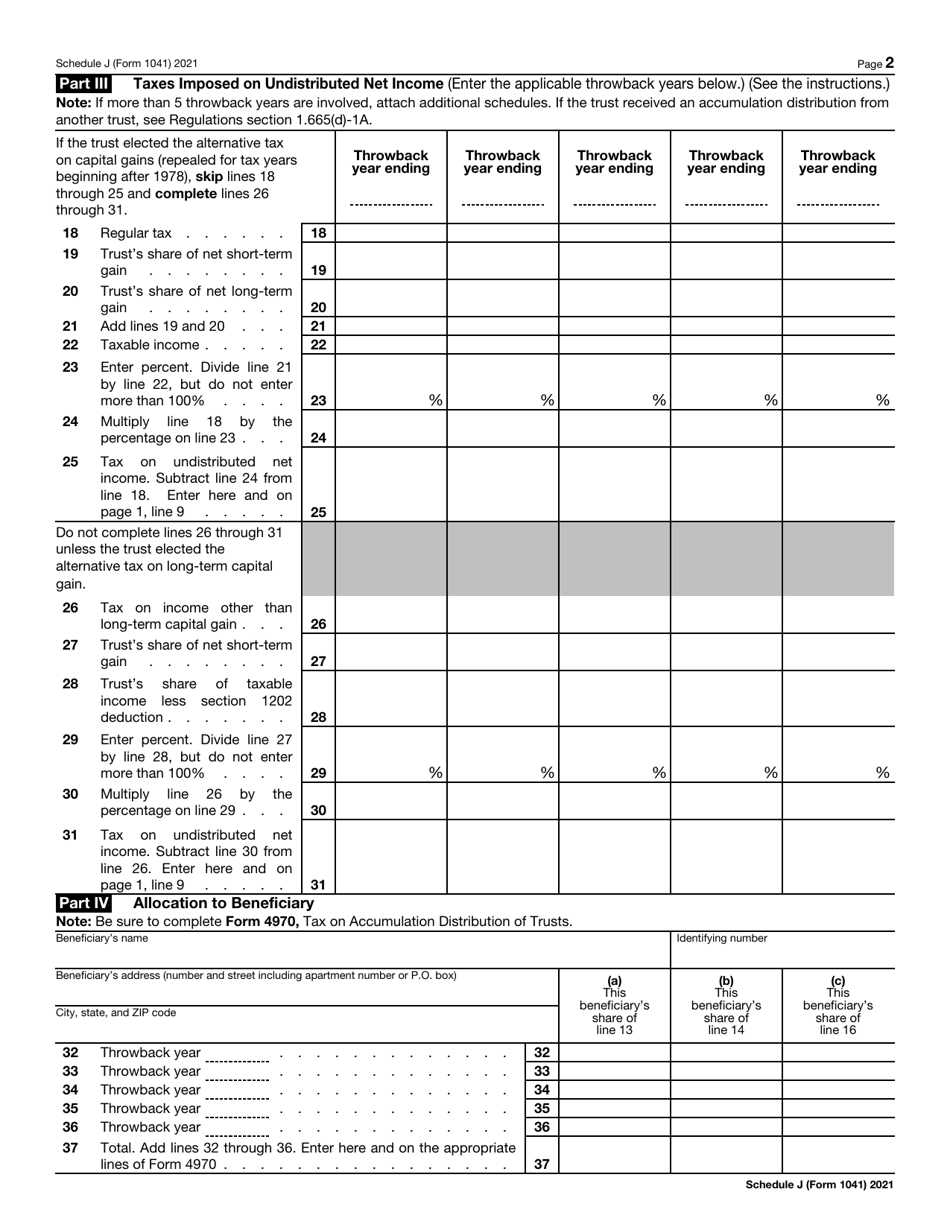

IRS Form 1041 Schedule J

for the current year.

IRS Form 1041 Schedule J Accumulation Distribution for Certain Complex Trusts

What Is IRS Form 1041 Schedule J?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1041 Schedule J?

A: IRS Form 1041 Schedule J is a tax form used by certain complex trusts to report accumulation distributions.

Q: What are accumulation distributions?

A: Accumulation distributions are amounts of a trust's income that have not been distributed to beneficiaries and are subject to taxation.

Q: Which trusts use IRS Form 1041 Schedule J?

A: Certain complex trusts that have made accumulation distributions during the tax year use IRS Form 1041 Schedule J.

Q: What information is required on IRS Form 1041 Schedule J?

A: IRS Form 1041 Schedule J requires information about the accumulation distribution, including the trust's tax identification number, the amount distributed, and details about the beneficiaries.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1041 Schedule J through the link below or browse more documents in our library of IRS Forms.