This version of the form is not currently in use and is provided for reference only. Download this version of

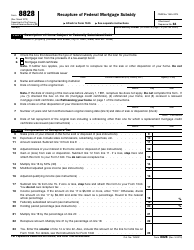

IRS Form 1040 Schedule R

for the current year.

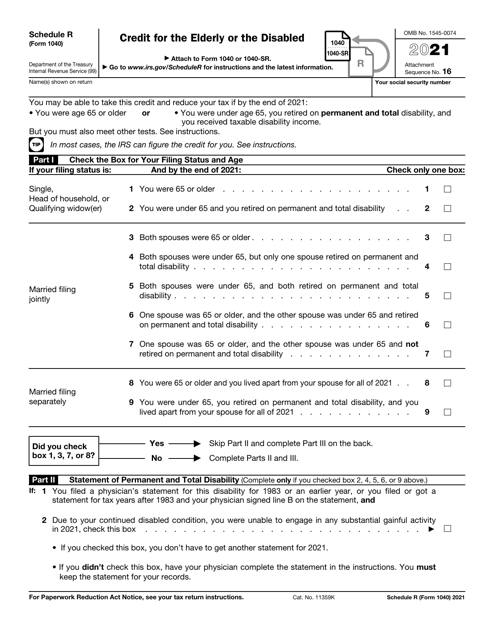

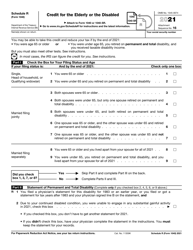

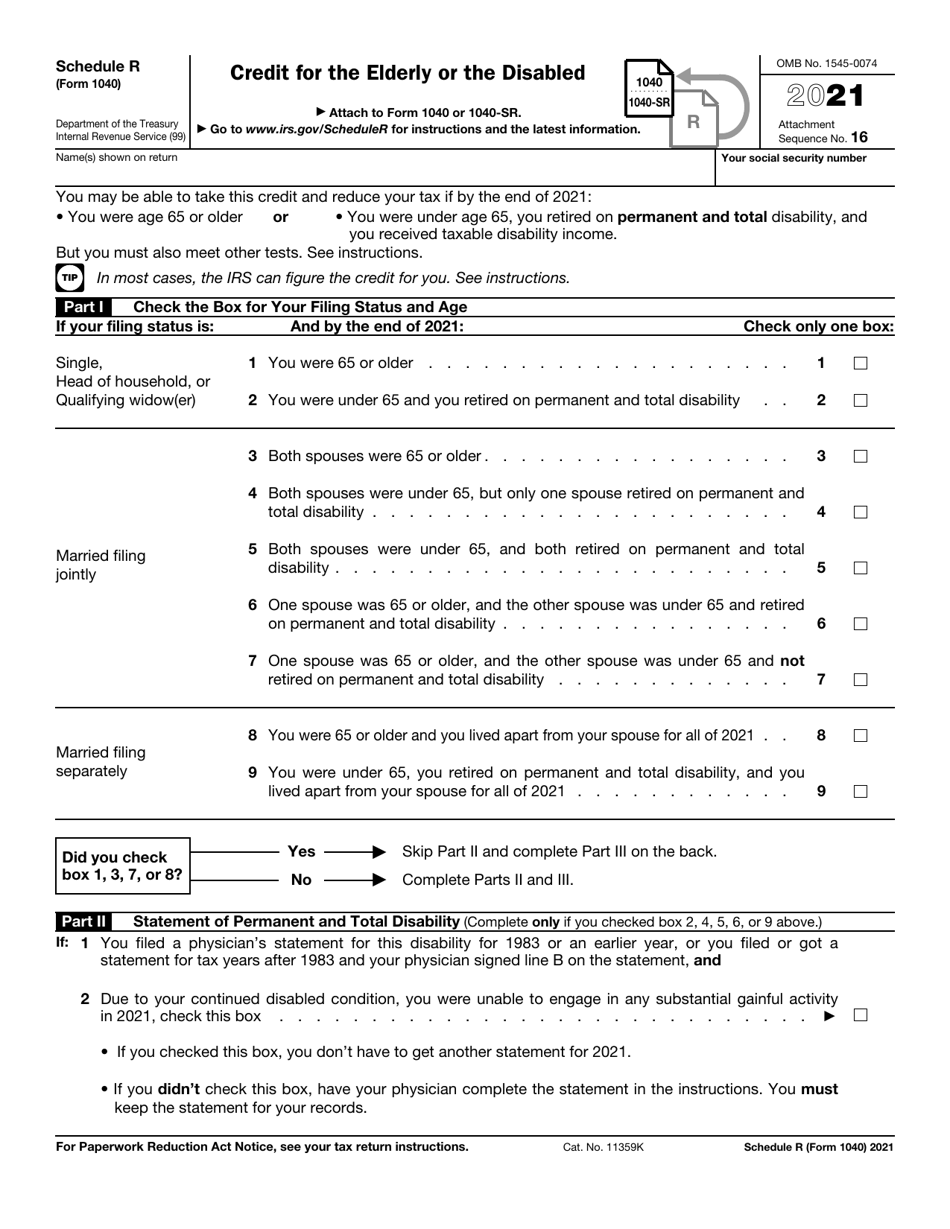

IRS Form 1040 Schedule R Credit for the Elderly or the Disabled

What Is IRS Form 1040 Schedule R?

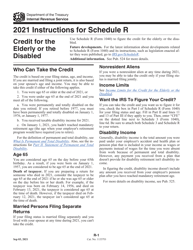

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1040 Schedule R?

A: IRS Form 1040 Schedule R is a form used to calculate the Credit for the Elderly or the Disabled.

Q: Who is eligible for the Credit for the Elderly or the Disabled?

A: Individuals who meet certain age and disability requirements may be eligible for the Credit for the Elderly or the Disabled.

Q: What is the purpose of the Credit for the Elderly or the Disabled?

A: The purpose of the Credit for the Elderly or the Disabled is to provide tax relief for individuals who are elderly or have a permanent and total disability.

Q: How do I qualify for the Credit for the Elderly or the Disabled?

A: To qualify, you must meet certain age and disability requirements, as well as have a certain amount of income.

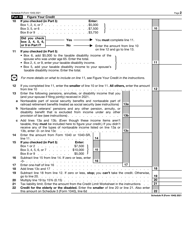

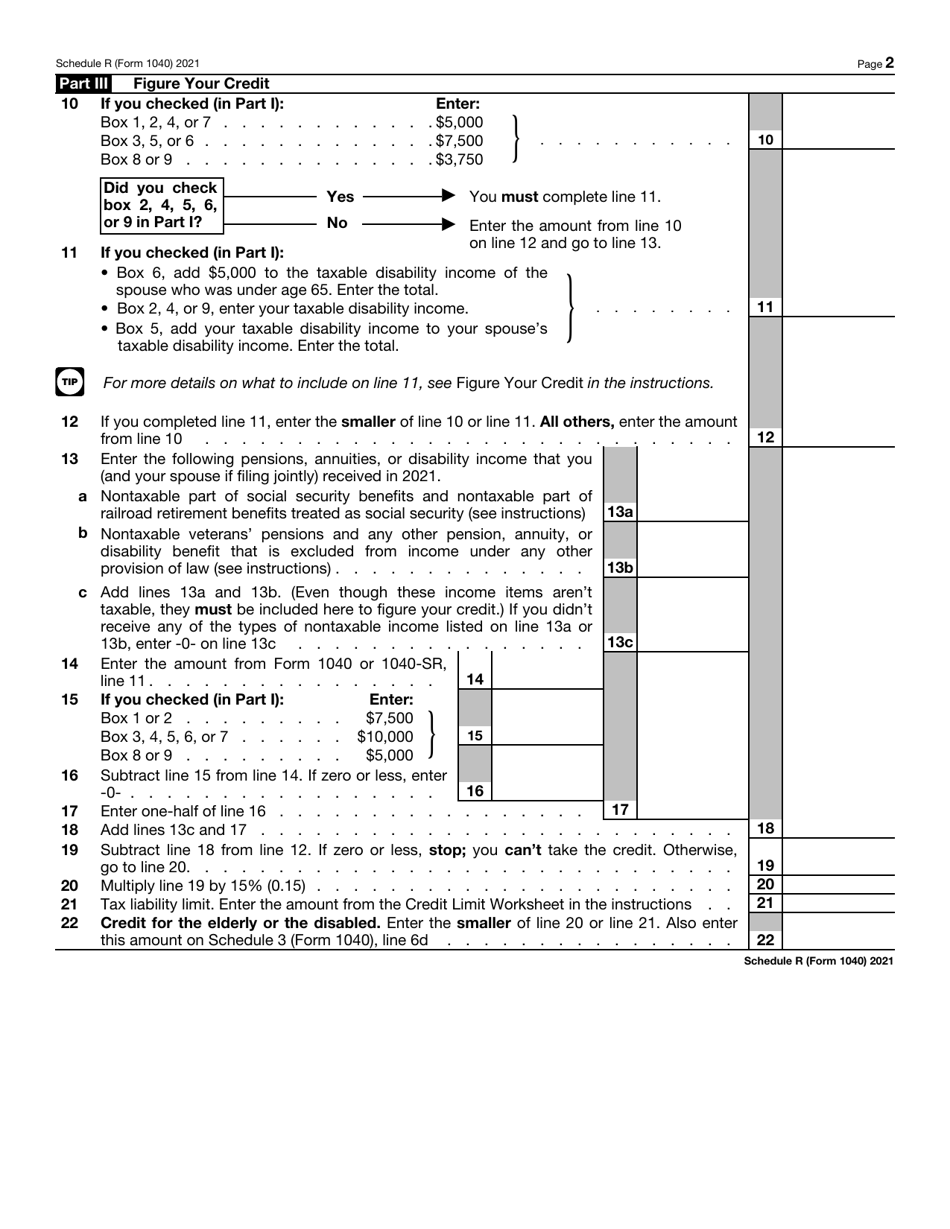

Q: How do I calculate the Credit for the Elderly or the Disabled?

A: You can calculate the credit using IRS Form 1040 Schedule R. The form has specific instructions on how to calculate the credit.

Q: Is the Credit for the Elderly or the Disabled refundable?

A: No, the Credit for the Elderly or the Disabled is not refundable. It can only be used to reduce your tax liability.

Q: What other documents do I need to file for the Credit for the Elderly or the Disabled?

A: In addition to IRS Form 1040 Schedule R, you may need to include other supporting documents such as proof of age or disability.

Q: Can I claim the Credit for the Elderly or the Disabled for someone else?

A: No, the Credit for the Elderly or the Disabled is only available for individuals who meet the age and disability requirements.

Q: Are there any income limits to qualify for the Credit for the Elderly or the Disabled?

A: Yes, there are income limits to qualify for the Credit for the Elderly or the Disabled. The specific limits may vary each year.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 Schedule R through the link below or browse more documents in our library of IRS Forms.