This version of the form is not currently in use and is provided for reference only. Download this version of

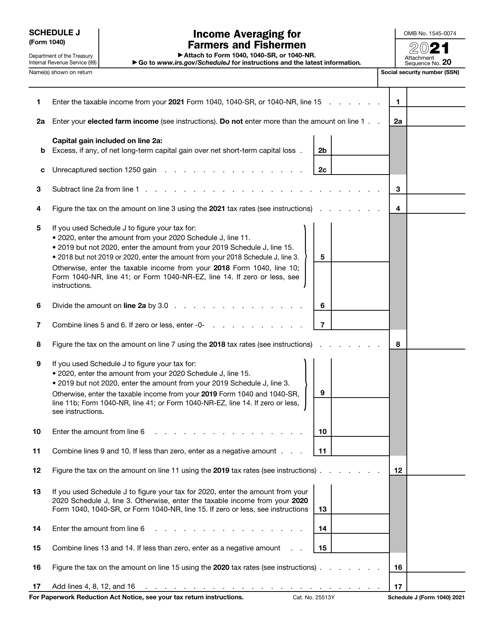

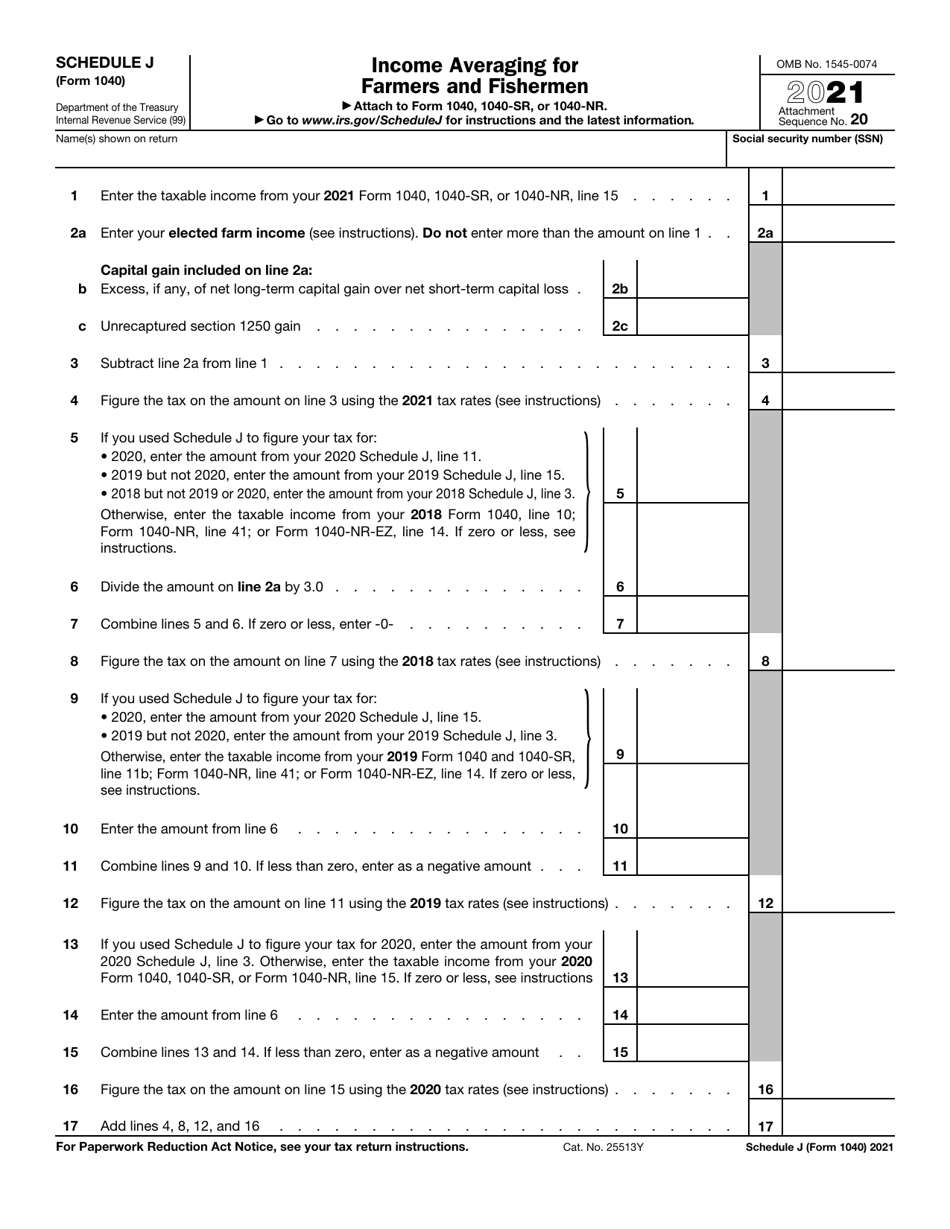

IRS Form 1040 Schedule J

for the current year.

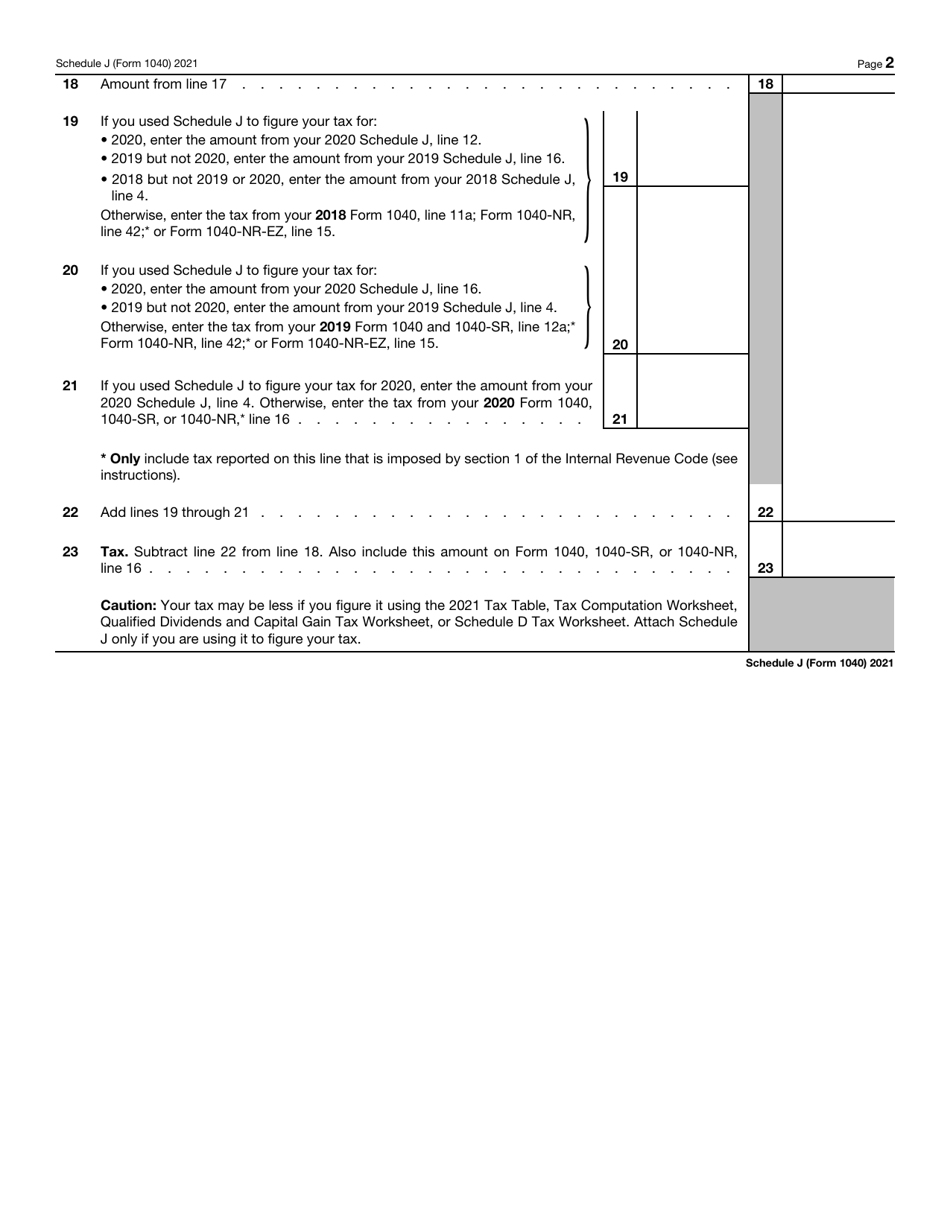

IRS Form 1040 Schedule J Income Averaging for Farmers and Fishermen

What Is IRS Form 1040 Schedule J?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1040 Schedule J?

A: IRS Form 1040 Schedule J is a form used for income averaging for farmers and fishermen.

Q: Who can use IRS Form 1040 Schedule J?

A: Farmers and fishermen can use IRS Form 1040 Schedule J.

Q: What is income averaging?

A: Income averaging is a method for farmers and fishermen to reduce their tax liability by spreading income over a number of years.

Q: How does income averaging work?

A: Income averaging allows farmers and fishermen to calculate their tax liability by averaging their income over the past three years.

Q: Why would a farmer or fisherman use income averaging?

A: Farmers and fishermen may choose to use income averaging to reduce their tax liability in years with significantly higher income.

Q: Are there any limitations to using income averaging?

A: There are some limitations to using income averaging, such as not being able to average income from non-farming or non-fishing activities.

Q: Is income averaging beneficial for all farmers and fishermen?

A: Income averaging may or may not be beneficial for all farmers and fishermen, as it depends on their individual financial circumstances.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 Schedule J through the link below or browse more documents in our library of IRS Forms.