This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8952

for the current year.

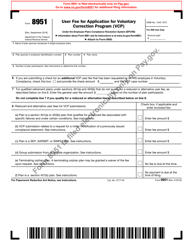

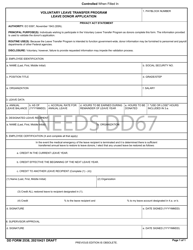

Instructions for IRS Form 8952 Application for Voluntary Classification Settlement Program (Vcsp)

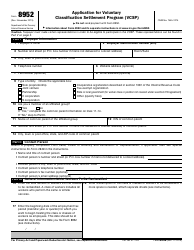

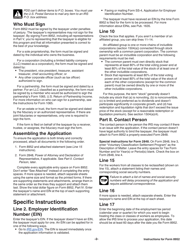

This document contains official instructions for IRS Form 8952 , Application for Voluntary Classification Settlement Program (Vcsp) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8952 is available for download through this link.

FAQ

Q: What is IRS Form 8952?

A: IRS Form 8952 is the Application for Voluntary Classification Settlement Program (VCSP).

Q: What is the Voluntary Classification Settlement Program (VCSP)?

A: VCSP is a program offered by the IRS that allows employers to reclassify their workers as employees for federal employmenttax purposes.

Q: Who can use Form 8952?

A: Employers who want to participate in the VCSP can use Form 8952.

Q: What is the purpose of Form 8952?

A: The purpose of Form 8952 is to apply for the Voluntary Classification Settlement Program and initiate the process of reclassification.

Q: What are the requirements to participate in the VCSP?

A: To participate in the VCSP, employers must have consistently treated their workers as non-employees and have filed all required Forms 1099 for the past three years.

Q: Is participation in the VCSP mandatory for employers?

A: No, participation in the VCSP is voluntary for employers.

Q: What are the benefits of participating in the VCSP?

A: Participating employers will receive certain relief from federal employment taxes for future periods and avoid IRS audits related to the worker classification issue.

Q: Are there any fees associated with the VCSP?

A: Yes, there is a fee for participating in the VCSP. The fee is based on the amount of the employer's federal employment tax liability for the most recent tax year.

Q: Can Form 8952 be filed electronically?

A: No, Form 8952 cannot be filed electronically. It must be mailed to the designated IRS address.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.