This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 2555

for the current year.

Instructions for IRS Form 2555 Foreign Earned Income

This document contains official instructions for IRS Form 2555 , Foreign Earned Income - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 2555 is available for download through this link.

FAQ

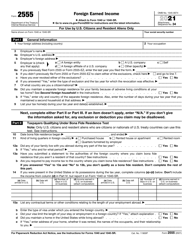

Q: What is IRS Form 2555?

A: IRS Form 2555 is a tax form used to report foreign earned income.

Q: Who needs to file Form 2555?

A: US citizens or resident aliens who have foreign earned income and meet certain criteria need to file Form 2555.

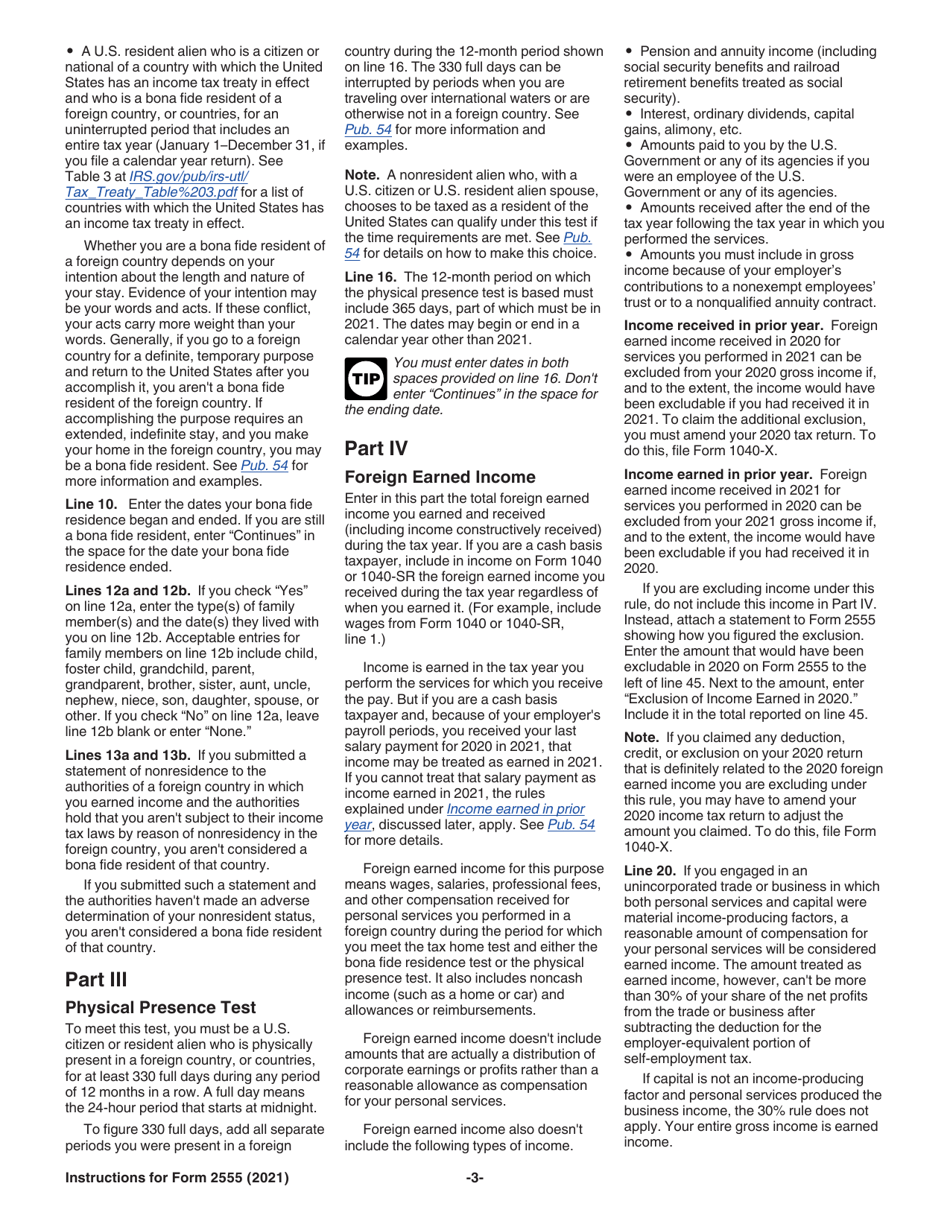

Q: What is foreign earned income?

A: Foreign earned income is income earned abroad by US citizens or resident aliens.

Q: What are the criteria to meet in order to file Form 2555?

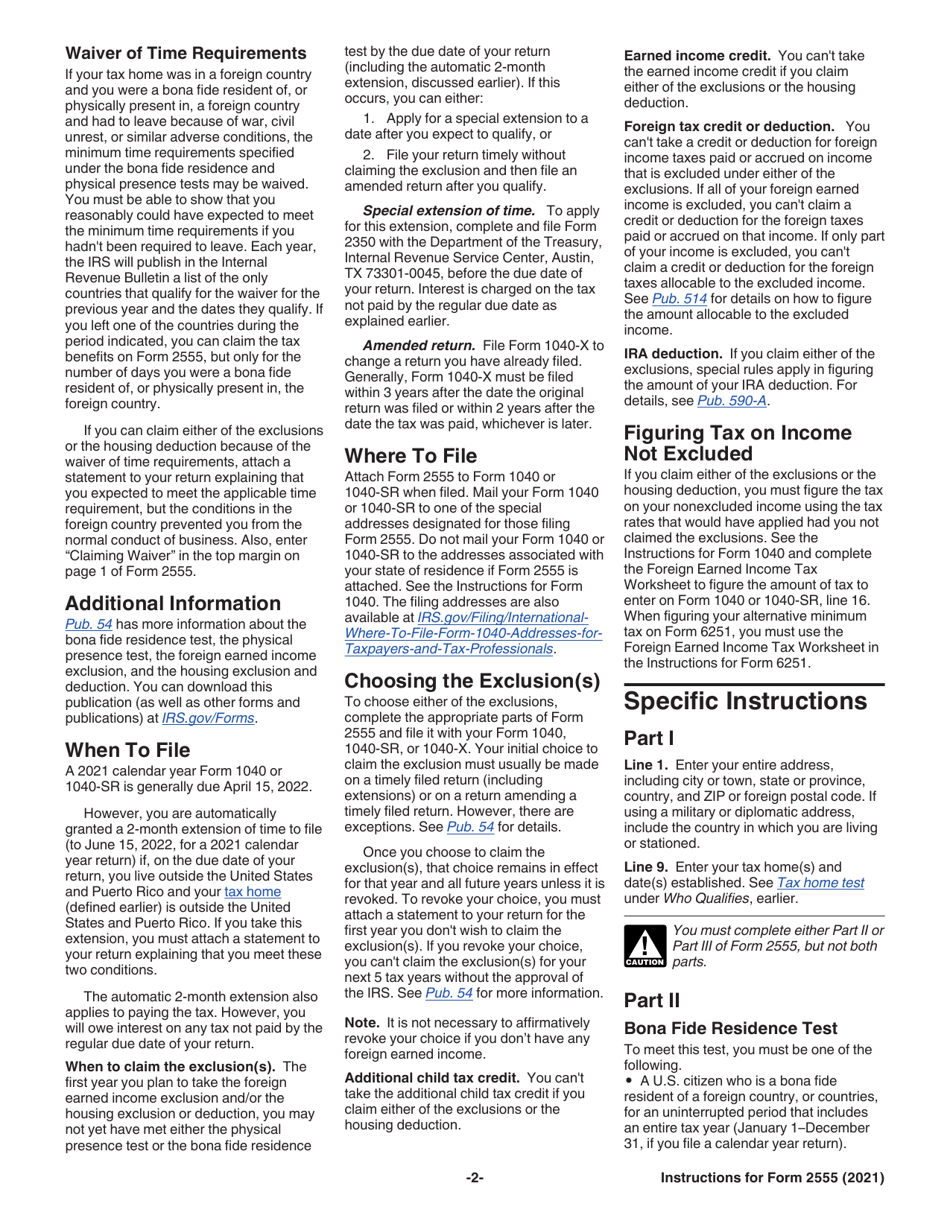

A: You need to meet either the bona fide residence test or the physical presence test.

Q: What is the bona fide residence test?

A: The bona fide residence test requires you to be a bona fide resident of a foreign country for a full tax year.

Q: What is the physical presence test?

A: The physical presence test requires you to be physically present in a foreign country for a specific amount of time during a tax year.

Q: What information is required to complete Form 2555?

A: You will need to provide details about your foreign earned income, foreign residency, and any tax exclusions or deductions you are claiming.

Q: When is the deadline to file Form 2555?

A: The deadline to file Form 2555 is the same as the regular tax return deadline, which is usually April 15th.

Q: Can I e-file Form 2555?

A: Yes, you can e-file Form 2555 along with your tax return.

Instruction Details:

- This 12-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.