This version of the form is not currently in use and is provided for reference only. Download this version of

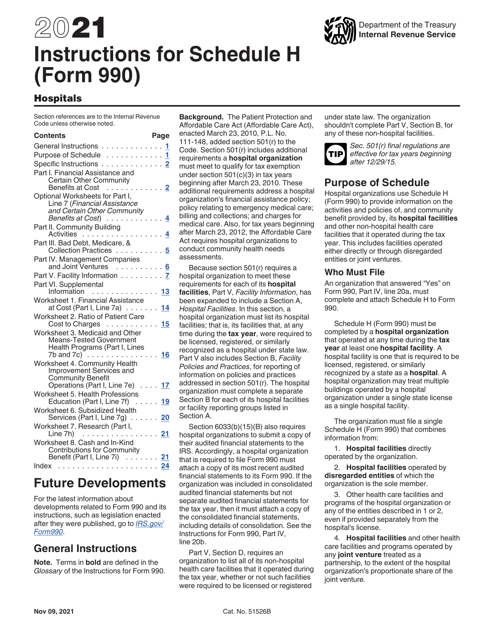

Instructions for IRS Form 990 Schedule H

for the current year.

Instructions for IRS Form 990 Schedule H Hospitals

This document contains official instructions for IRS Form 990 Schedule H, Hospitals - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is Form 990 Schedule H?

A: Form 990 Schedule H is a supplemental schedule that must be filed with the IRS Form 990 by tax-exempt hospitals.

Q: Who needs to file Form 990 Schedule H?

A: Tax-exempt hospitals are required to file Form 990 Schedule H.

Q: What information is reported on Form 990 Schedule H?

A: Form 990 Schedule H requires reporting on a variety of topics including community benefits, charity care, and executive compensation.

Q: When is Form 990 Schedule H due?

A: Form 990 Schedule H is due at the same time as the organization's Form 990, which is typically the 15th day of the 5th month after the end of the tax year.

Q: Is Form 990 Schedule H publicly available?

A: Yes, most of the information reported on Form 990 Schedule H is publicly available and can be accessed by anyone.

Instruction Details:

- This 24-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.