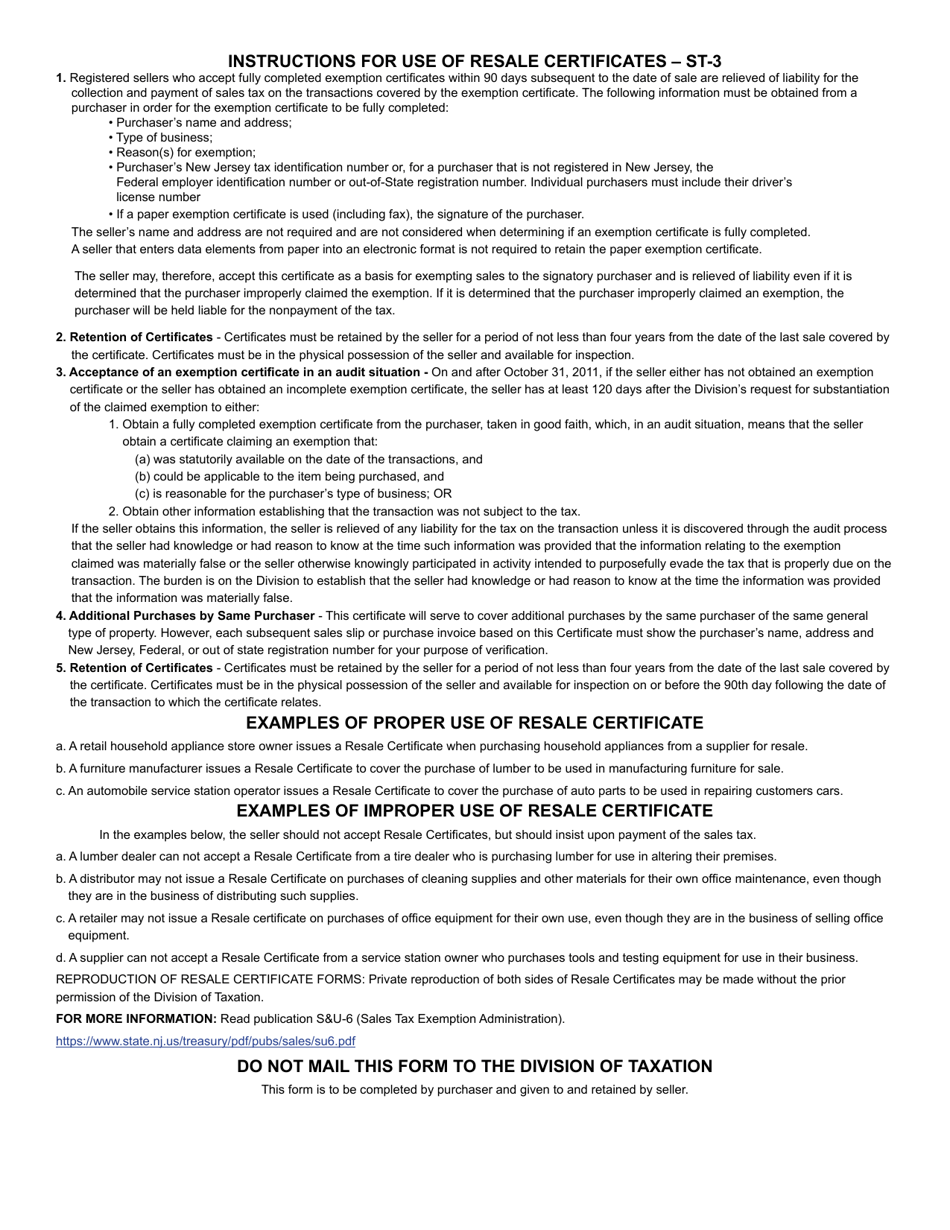

This version of the form is not currently in use and is provided for reference only. Download this version of

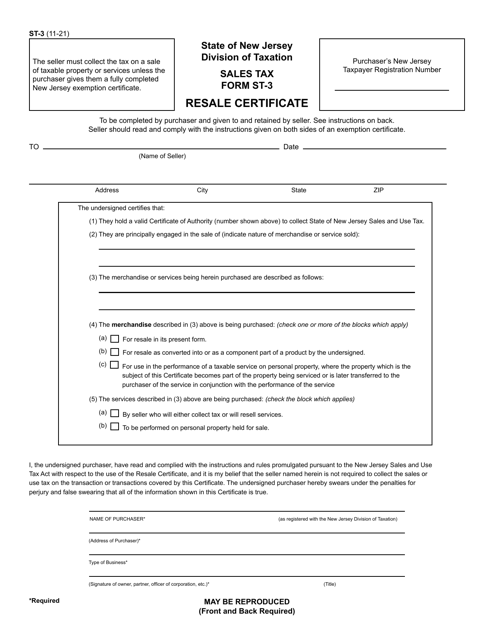

Form ST-3

for the current year.

Form ST-3 Resale Certificate - New Jersey

What Is Form ST-3?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

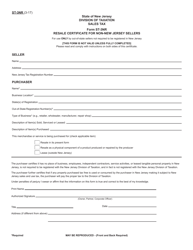

Q: What is a Form ST-3?

A: Form ST-3 is a resale certificate for New Jersey.

Q: What is a resale certificate?

A: A resale certificate is a document that allows businesses to make tax-exempt purchases of items they intend to resell.

Q: Who can use Form ST-3?

A: Only registered businesses in New Jersey can use Form ST-3.

Q: What is the purpose of Form ST-3?

A: The purpose of Form ST-3 is to certify that the items being purchased will be resold and not used for personal consumption.

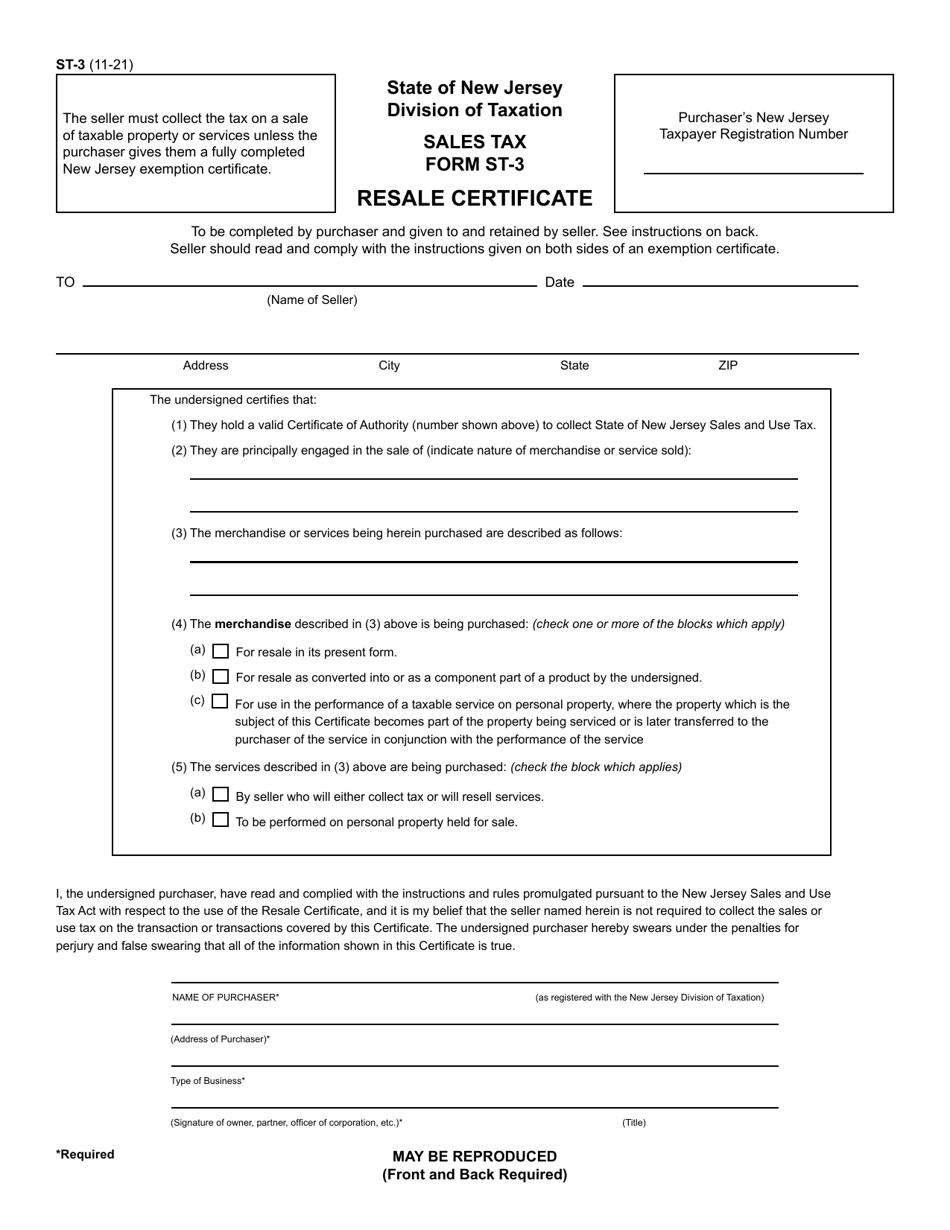

Q: What information is required on Form ST-3?

A: Form ST-3 requires the business's name, address, and registration number, as well as a description of the items being purchased.

Q: Are there any exemptions for using Form ST-3?

A: Yes, certain items, such as vehicles, fuel, and meals, are not eligible for resale exemption.

Q: How long is a Form ST-3 certificate valid?

A: A Form ST-3 certificate is valid for four years from the date of issuance.

Q: What happens if I misuse a Form ST-3?

A: Misusing a Form ST-3 can result in penalties and possible legal consequences.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-3 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.