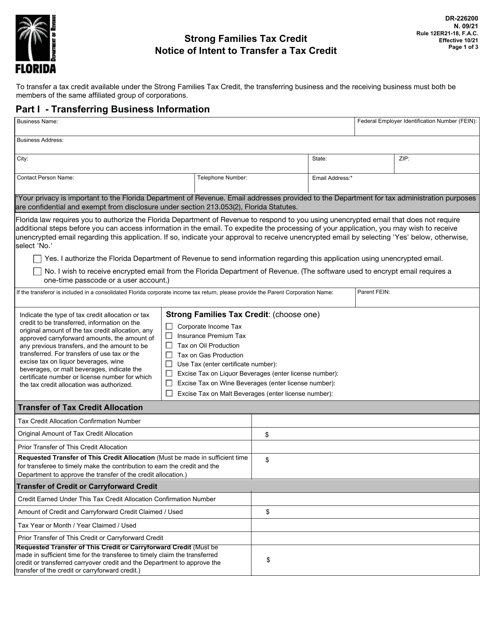

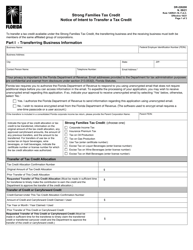

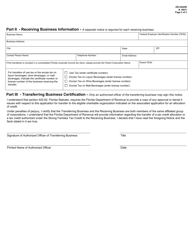

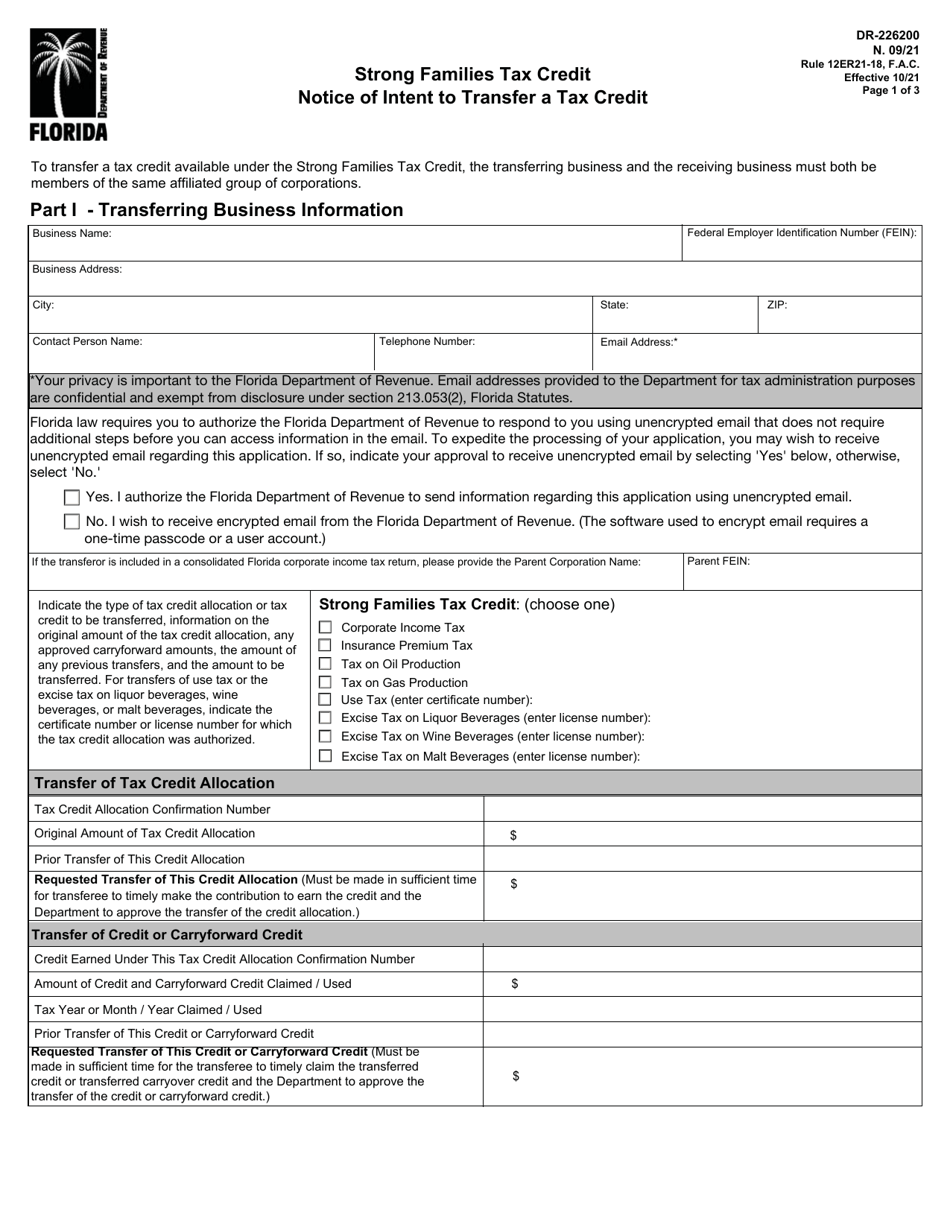

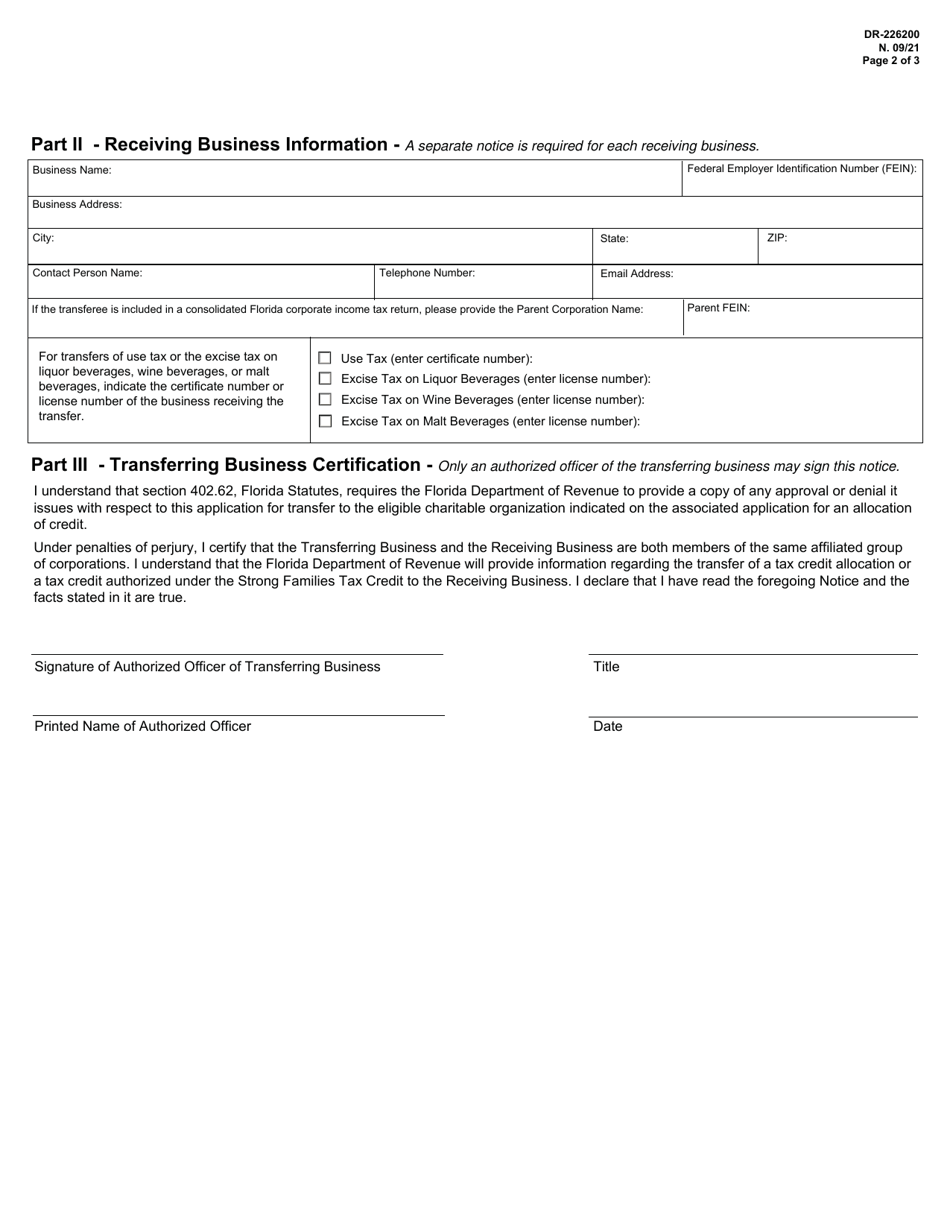

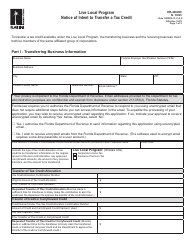

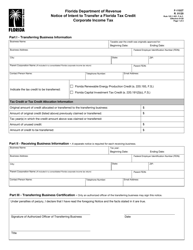

Form DR-226200 Strong Families Tax Credit Notice of Intent to Transfer a Tax Credit - Florida

What Is Form DR-226200?

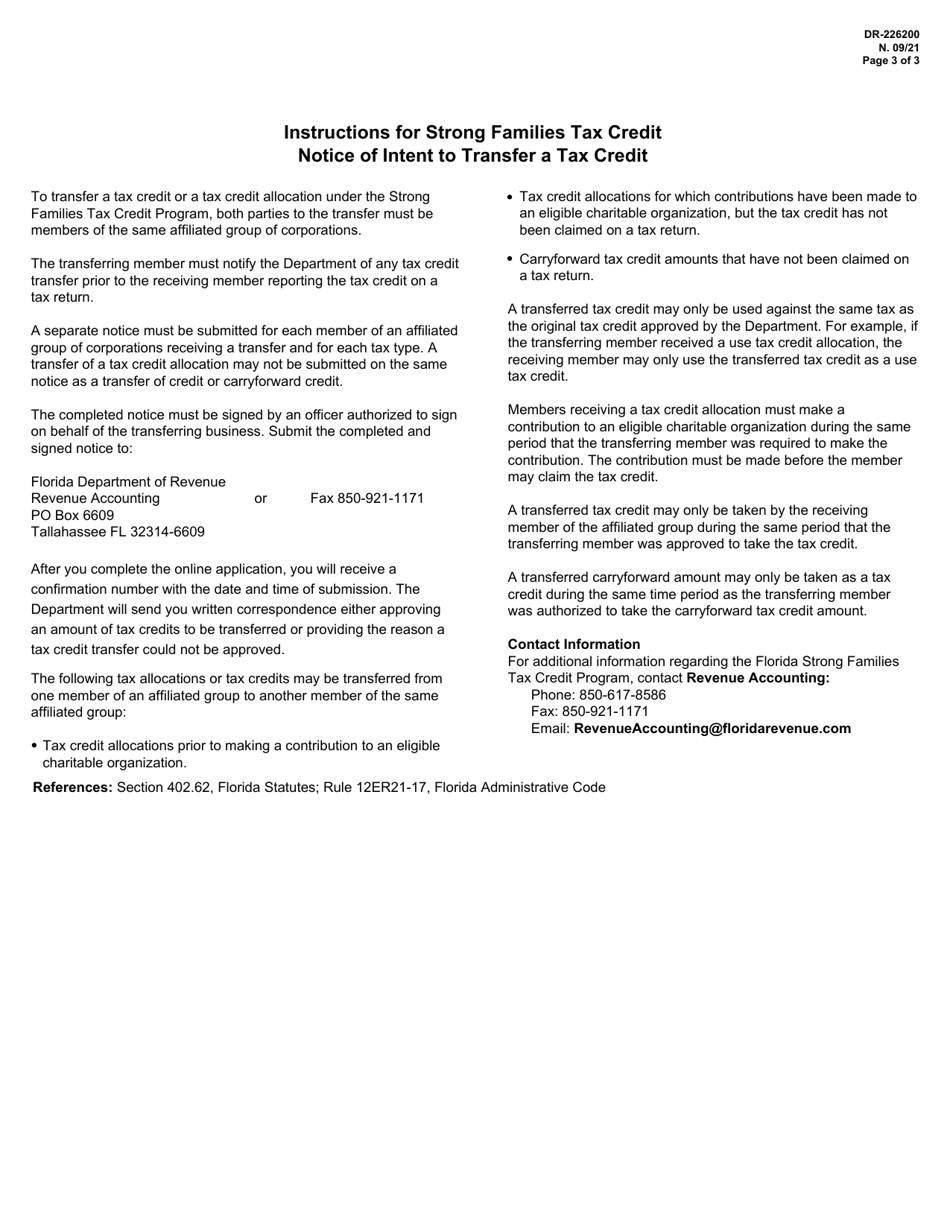

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-226200?

A: Form DR-226200 is the Notice of Intent to Transfer a Tax Credit in Florida.

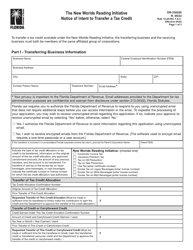

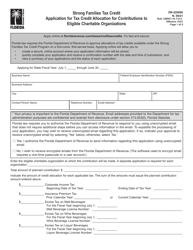

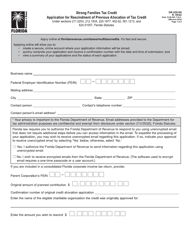

Q: What is the Strong Families Tax Credit?

A: The Strong Families Tax Credit is a tax credit offered in Florida.

Q: What is the purpose of Form DR-226200?

A: Form DR-226200 is used to notify the Florida Department of Revenue of the intent to transfer a tax credit.

Q: How do I transfer a tax credit in Florida?

A: To transfer a tax credit in Florida, you need to complete and submit Form DR-226200.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-226200 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.