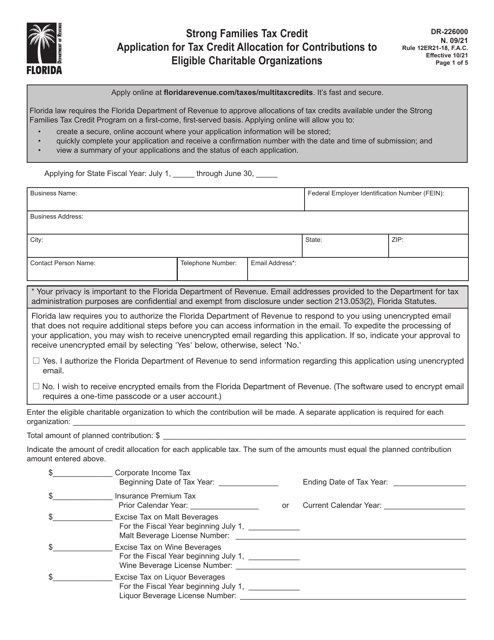

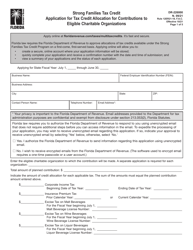

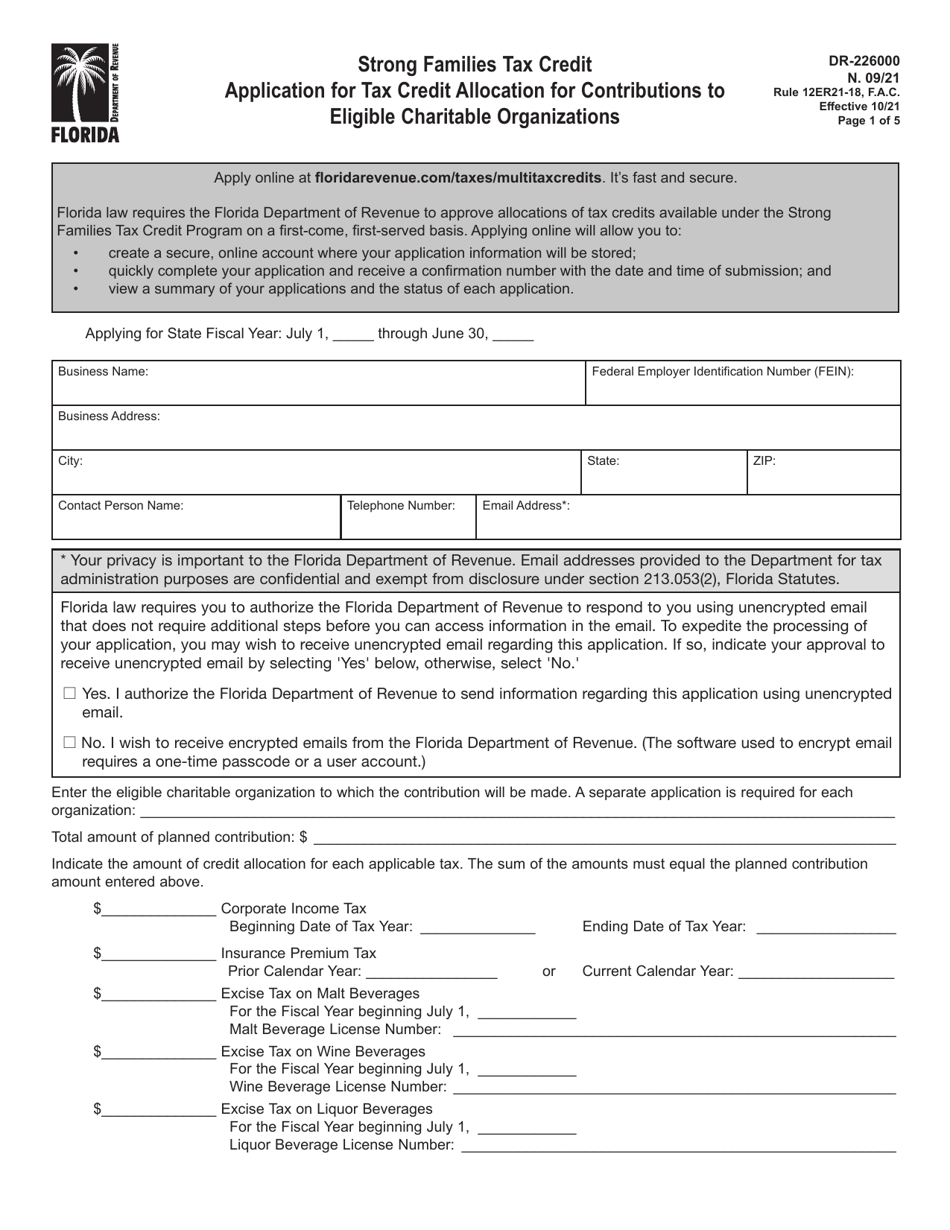

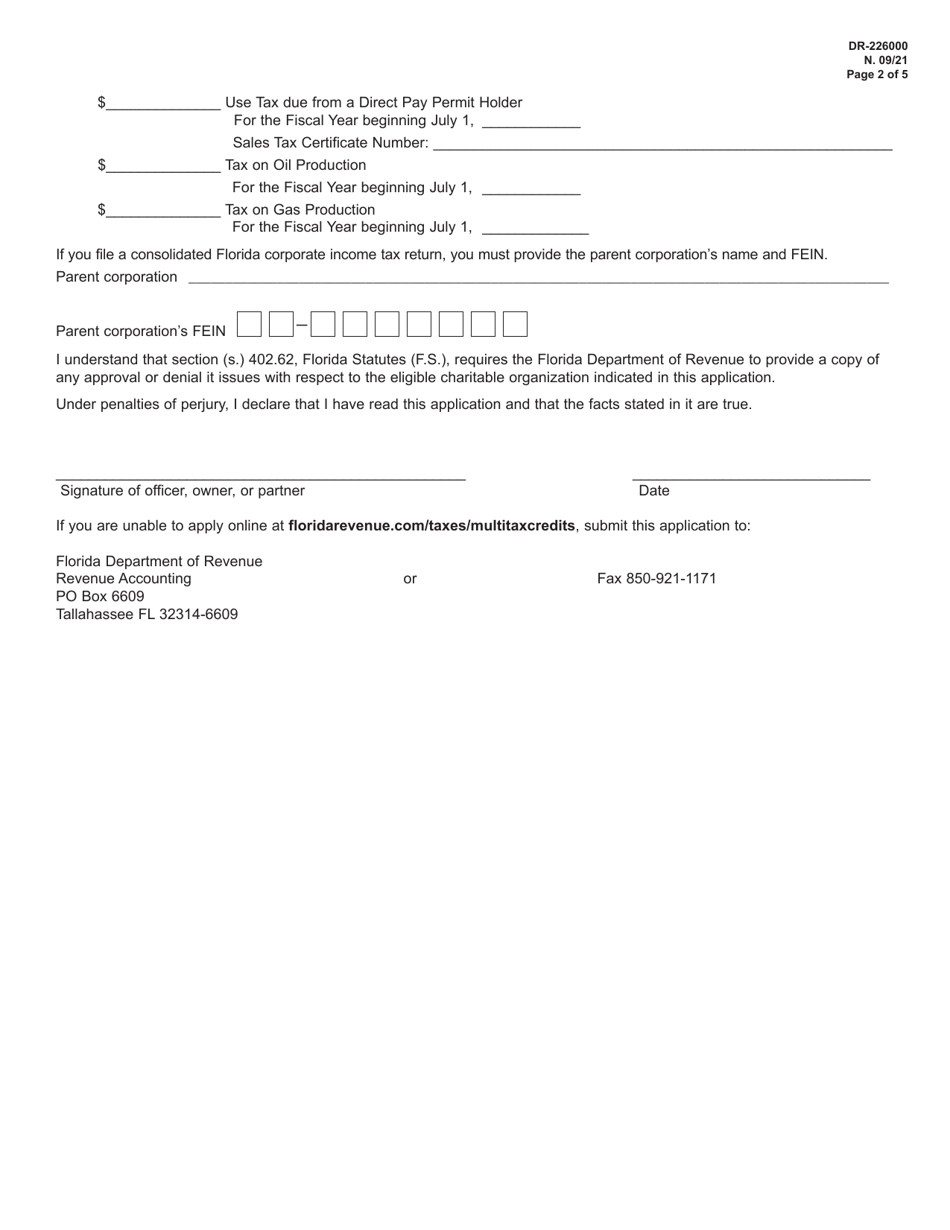

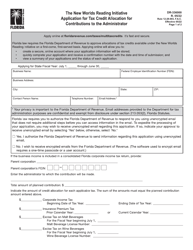

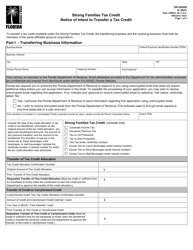

Form DR-226000 Strong Families Tax Credit Application for Tax Credit Allocation for Contributions to Eligible Charitable Organizations - Florida

What Is Form DR-226000?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-226?

A: Form DR-226000 is the application for the Strong Families Tax Credit in Florida.

Q: What is the Strong Families Tax Credit?

A: The Strong Families Tax Credit is a tax credit program in Florida that allows individuals and corporations to receive a tax credit for their contributions to eligible charitable organizations.

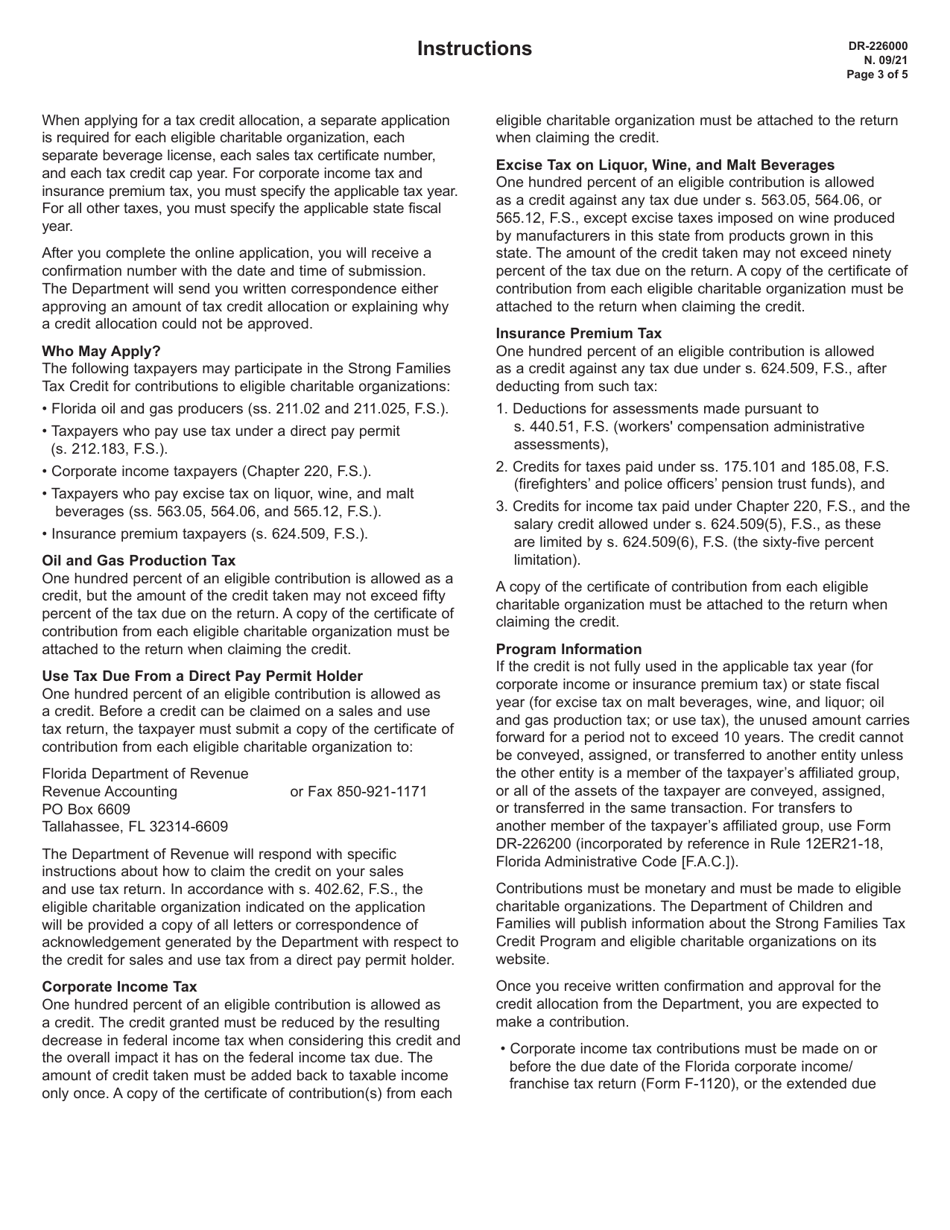

Q: Who can apply for the Strong Families Tax Credit?

A: Individuals and corporations in Florida can apply for the Strong Families Tax Credit.

Q: What is the purpose of the Strong Families Tax Credit?

A: The purpose of the Strong Families Tax Credit is to encourage contributions to eligible charitable organizations in Florida that provide services and support to families in need.

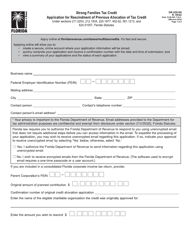

Q: What are eligible charitable organizations for the Strong Families Tax Credit?

A: Eligible charitable organizations for the Strong Families Tax Credit are those that provide services and support to families in need, as defined by Florida law.

Q: How can I apply for the Strong Families Tax Credit?

A: You can apply for the Strong Families Tax Credit by completing and submitting Form DR-226000.

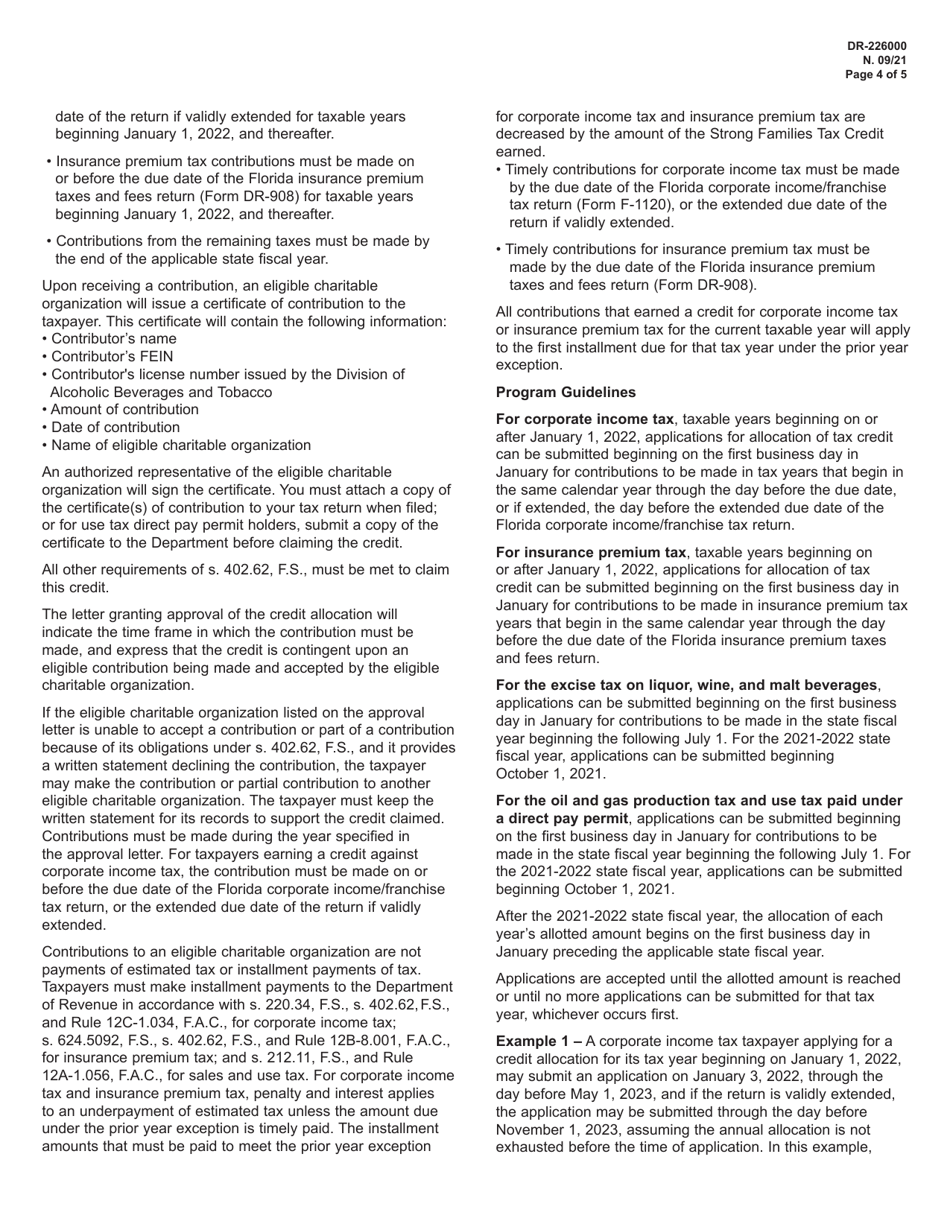

Q: Are there any deadlines for applying for the Strong Families Tax Credit?

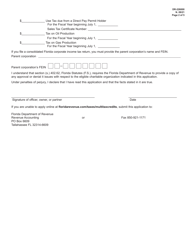

A: Yes, there are deadlines for applying for the Strong Families Tax Credit. The specific deadlines can be found in the instructions for Form DR-226000.

Q: Is there a limit on the tax credit amount for the Strong Families Tax Credit?

A: Yes, there is a limit on the tax credit amount for the Strong Families Tax Credit. The specific limit can be found in the instructions for Form DR-226000.

Q: What supporting documentation do I need to include with my application?

A: The supporting documentation that you need to include with your application for the Strong Families Tax Credit depends on your specific situation. The instructions for Form DR-226000 provide guidance on the required documentation.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-226000 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.