This version of the form is not currently in use and is provided for reference only. Download this version of

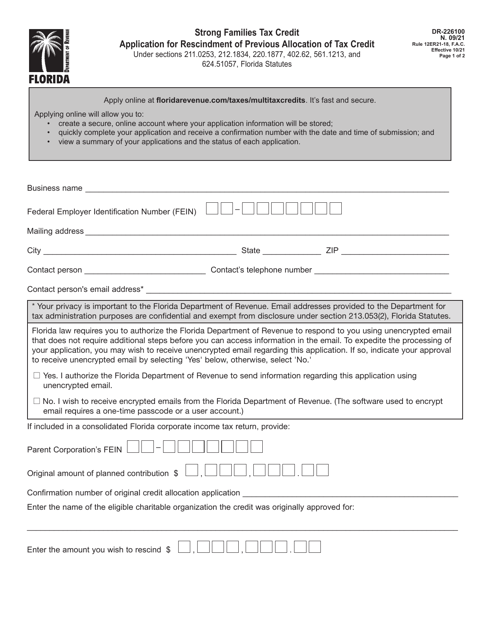

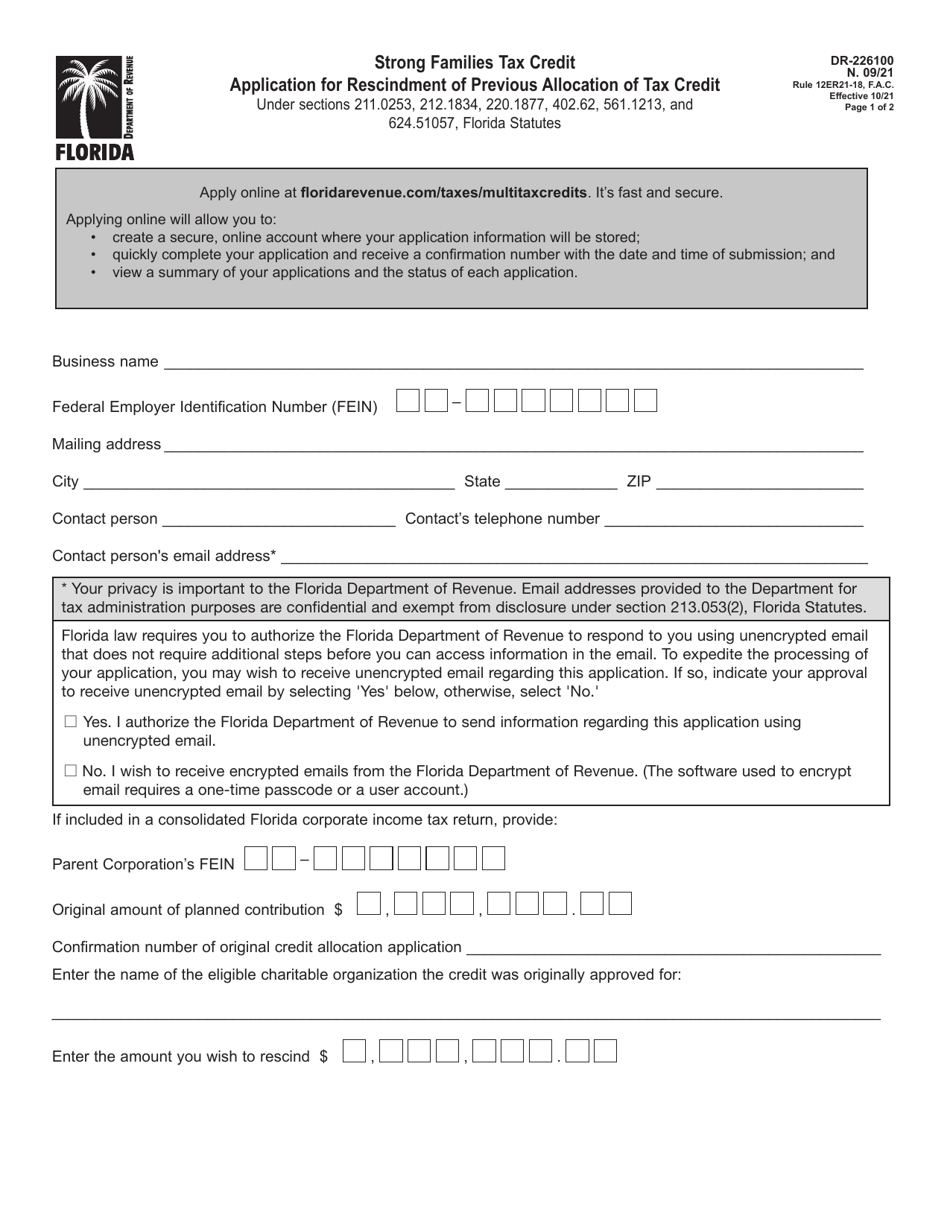

Form DR-226100

for the current year.

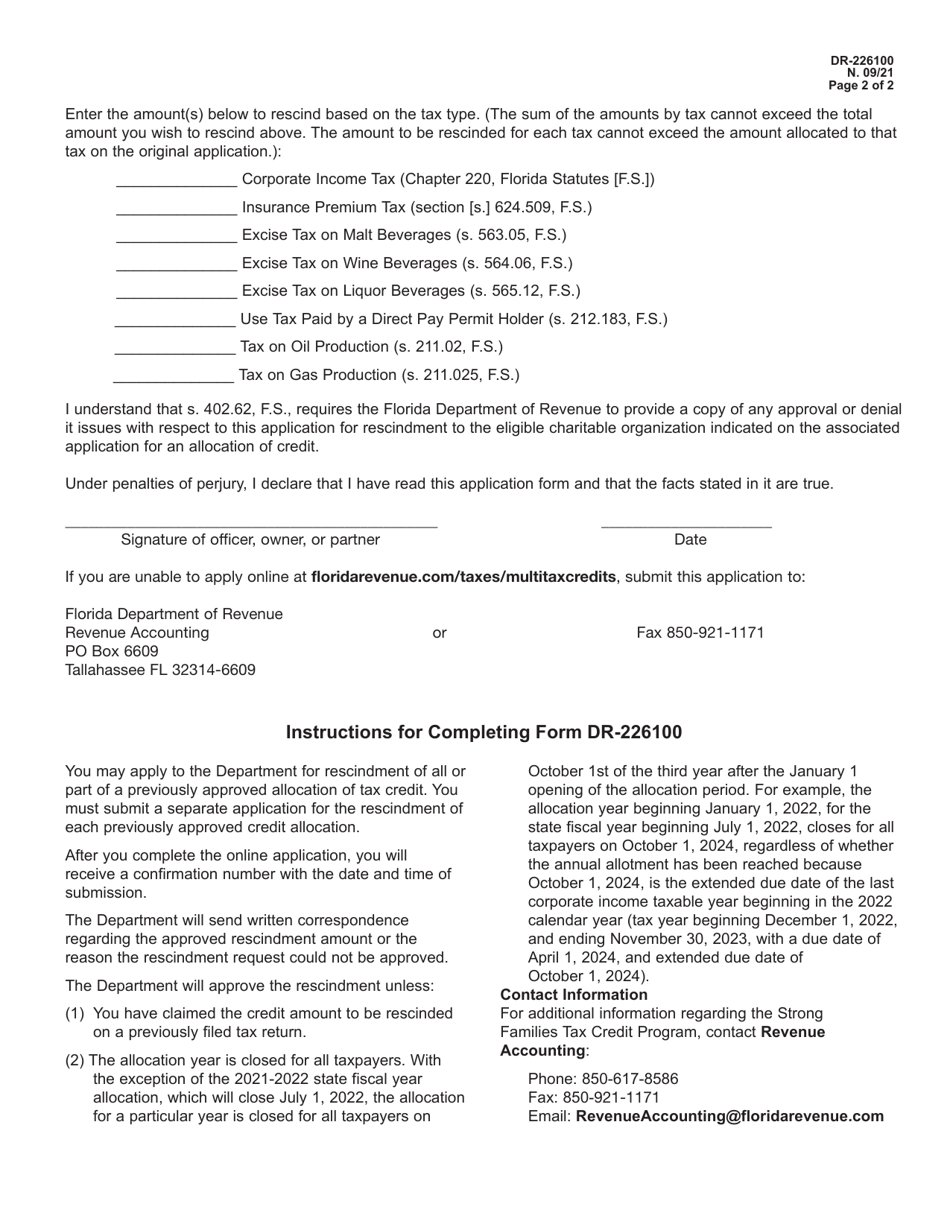

Form DR-226100 Strong Families Tax Credit Application for Rescindment of Previous Allocation of Tax Credit - Florida

What Is Form DR-226100?

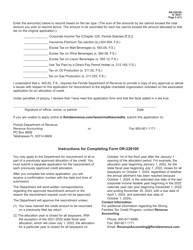

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-226100?

A: Form DR-226100 is an application for rescindment of previous allocation of the Strong Families Tax Credit in Florida.

Q: What is the Strong Families Tax Credit?

A: The Strong Families Tax Credit is a tax credit program in Florida that supports families with certain expenses related to child care and education.

Q: Who can use Form DR-226100?

A: Individuals who previously received an allocation of the Strong Families Tax Credit in error can use Form DR-226100 to apply for rescindment.

Q: What does rescindment mean in this context?

A: Rescindment means the cancellation or reversal of a previous allocation of the Strong Families Tax Credit.

Q: Is there a deadline for submitting Form DR-226100?

A: Yes, the deadline for submitting Form DR-226100 is typically stated on the form itself or in the instructions provided by the Florida Department of Revenue.

Q: Can I appeal a denial of my application for rescindment?

A: Yes, if your application for rescindment is denied, you have the right to appeal the decision by following the appropriate procedures outlined by the Florida Department of Revenue.

Q: Are there any fees associated with submitting Form DR-226100?

A: There are no fees associated with submitting Form DR-226100 for the rescindment of a previous allocation of the Strong Families Tax Credit.

Q: What should I do if I need assistance with completing Form DR-226100?

A: If you need assistance with completing Form DR-226100, you can contact the Florida Department of Revenue's customer service helpline for guidance.

Q: Do I need to provide any supporting documents with Form DR-226100?

A: It is possible that you may be required to provide supporting documents, such as proof of the error in the allocation of the Strong Families Tax Credit, when submitting Form DR-226100.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-226100 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.