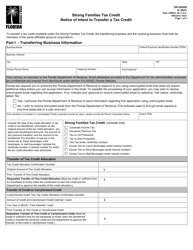

This version of the form is not currently in use and is provided for reference only. Download this version of

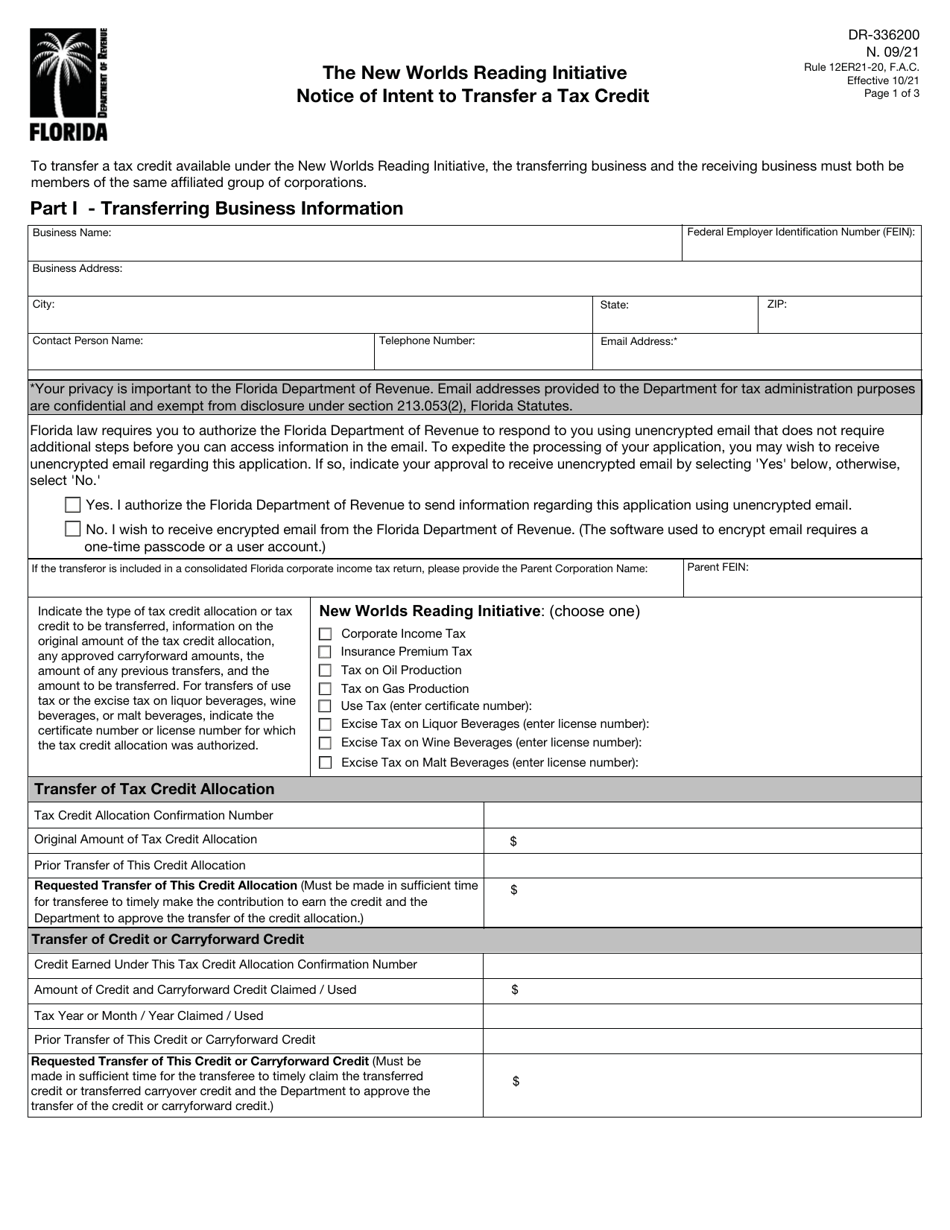

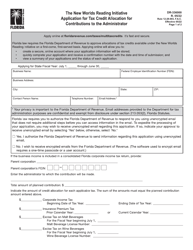

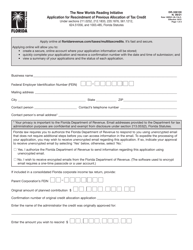

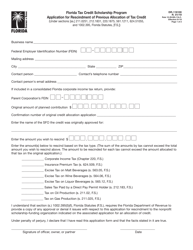

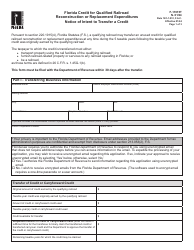

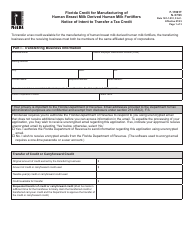

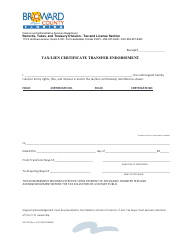

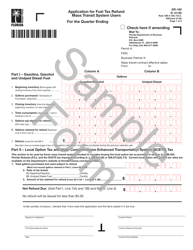

Form DR-336200

for the current year.

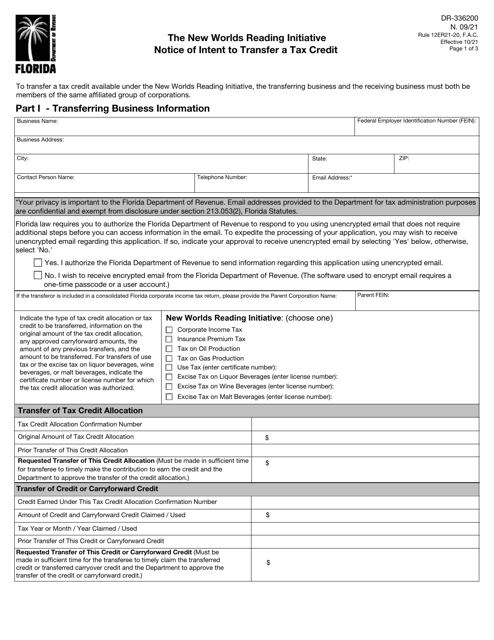

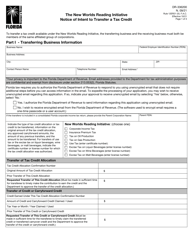

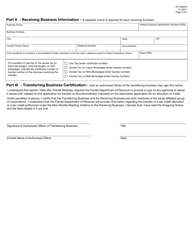

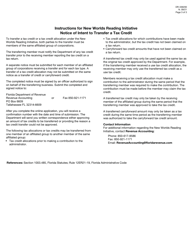

Form DR-336200 The New Worlds Reading Initiative Notice of Intent to Transfer a Tax Credit - Florida

What Is Form DR-336200?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

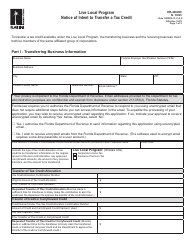

Q: What is Form DR-336200?

A: Form DR-336200 is the New Worlds Reading Initiative Notice of Intent to Transfer a Tax Credit in Florida.

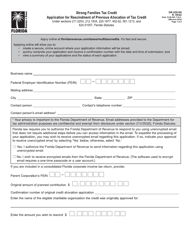

Q: What is the New Worlds Reading Initiative?

A: The New Worlds Reading Initiative is a program in Florida that offers tax credits to individuals and businesses who donate to approved organizations supporting literacy programs.

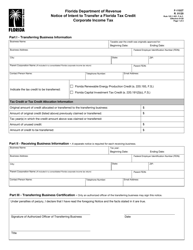

Q: What is the purpose of the Notice of Intent to Transfer a Tax Credit?

A: The Notice of Intent to Transfer a Tax Credit is used to inform the Florida Department of Revenue of your intention to transfer a tax credit earned through the New Worlds Reading Initiative.

Q: Who needs to file Form DR-336200?

A: Individuals or businesses who have earned a tax credit through the New Worlds Reading Initiative and want to transfer it to another entity need to file Form DR-336200.

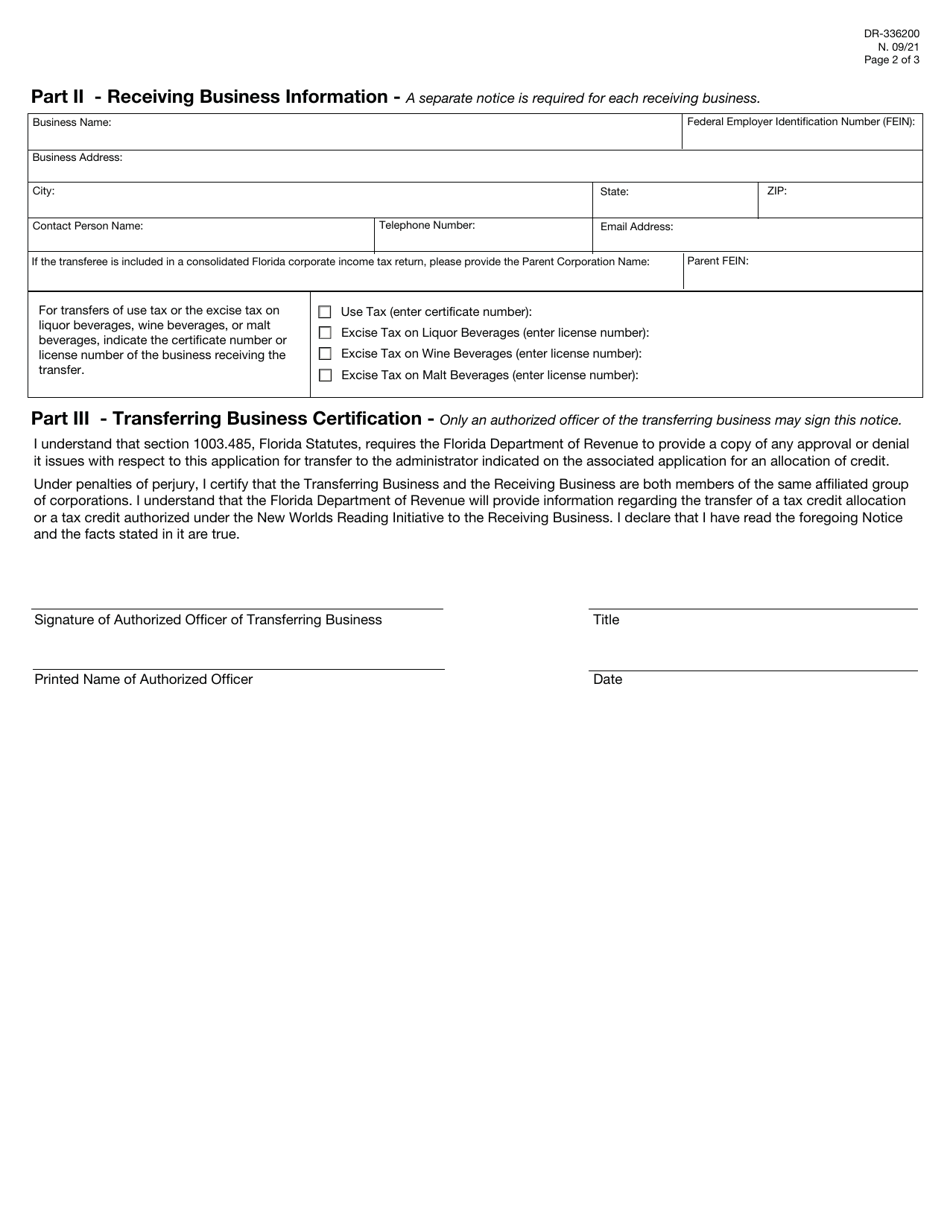

Q: Are there any requirements or qualifications to transfer a tax credit?

A: Yes, there are eligibility requirements and qualifications that must be met in order to transfer a tax credit earned through the New Worlds Reading Initiative.

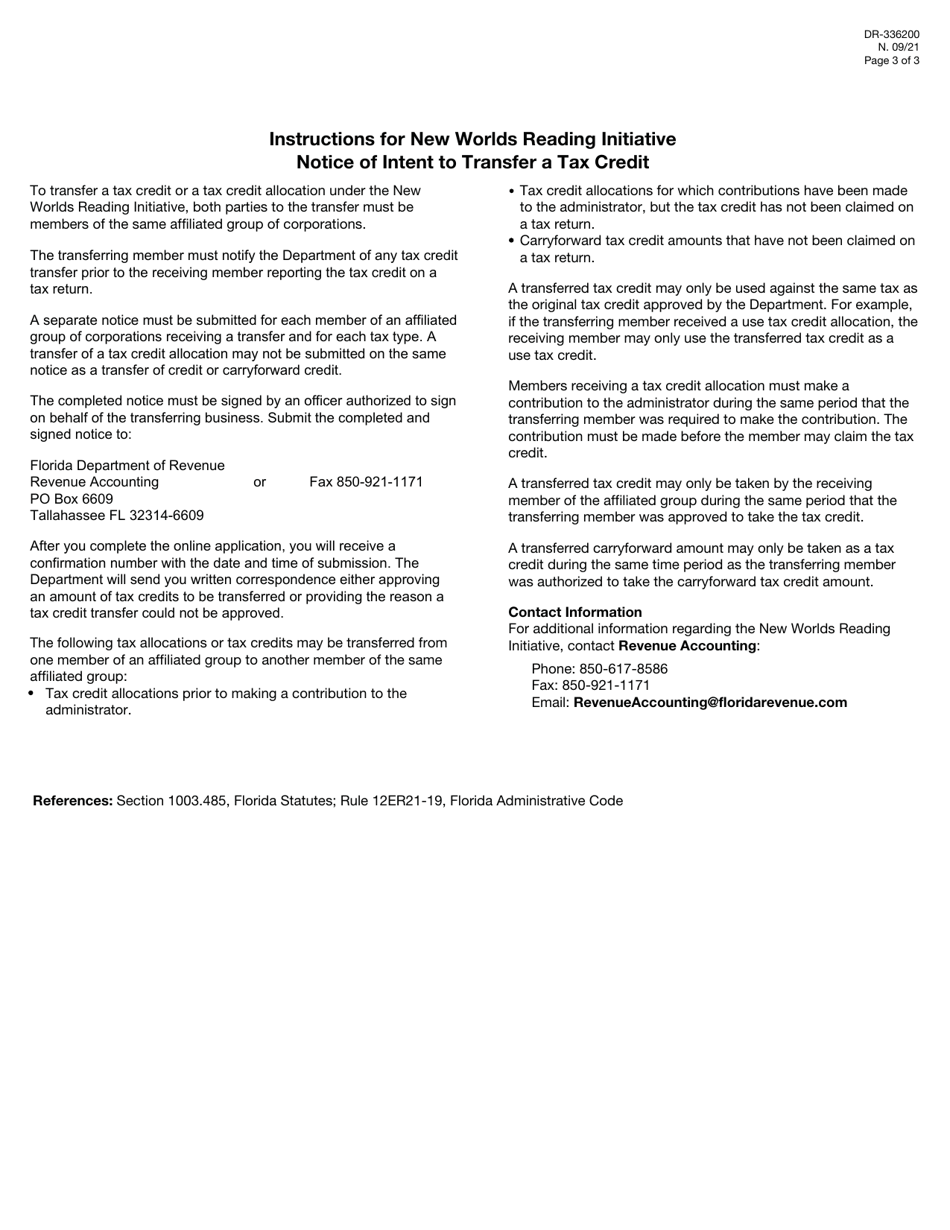

Q: Is there a deadline for filing Form DR-336200?

A: Yes, Form DR-336200 must be filed by the due date of the tax return for the year in which the tax credit was earned.

Q: What should I do after filing Form DR-336200?

A: After filing Form DR-336200, you should retain a copy for your records and await further instructions from the Florida Department of Revenue regarding the transfer of the tax credit.

Q: Can I transfer a tax credit to any entity?

A: No, the recipient of the transferred tax credit must be an eligible entity approved by the Florida Department of Education or the Department of Revenue.

Q: Can I transfer a tax credit to a family member or friend?

A: No, a tax credit cannot be transferred to a family member or friend. It can only be transferred to an eligible organization approved by the Florida Department of Education or the Department of Revenue.

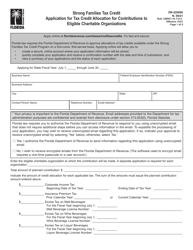

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-336200 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.