This version of the form is not currently in use and is provided for reference only. Download this version of

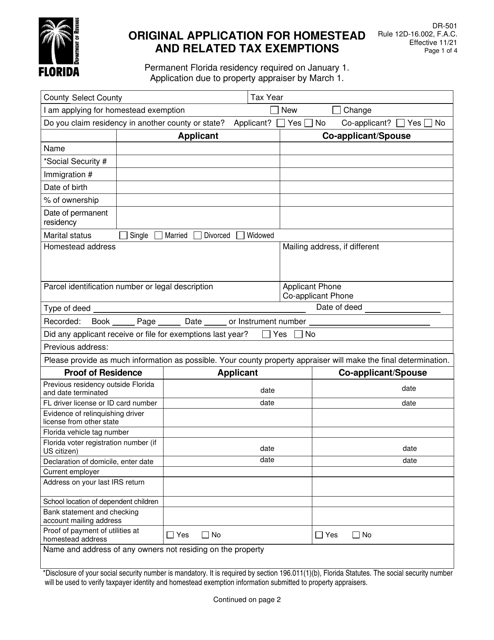

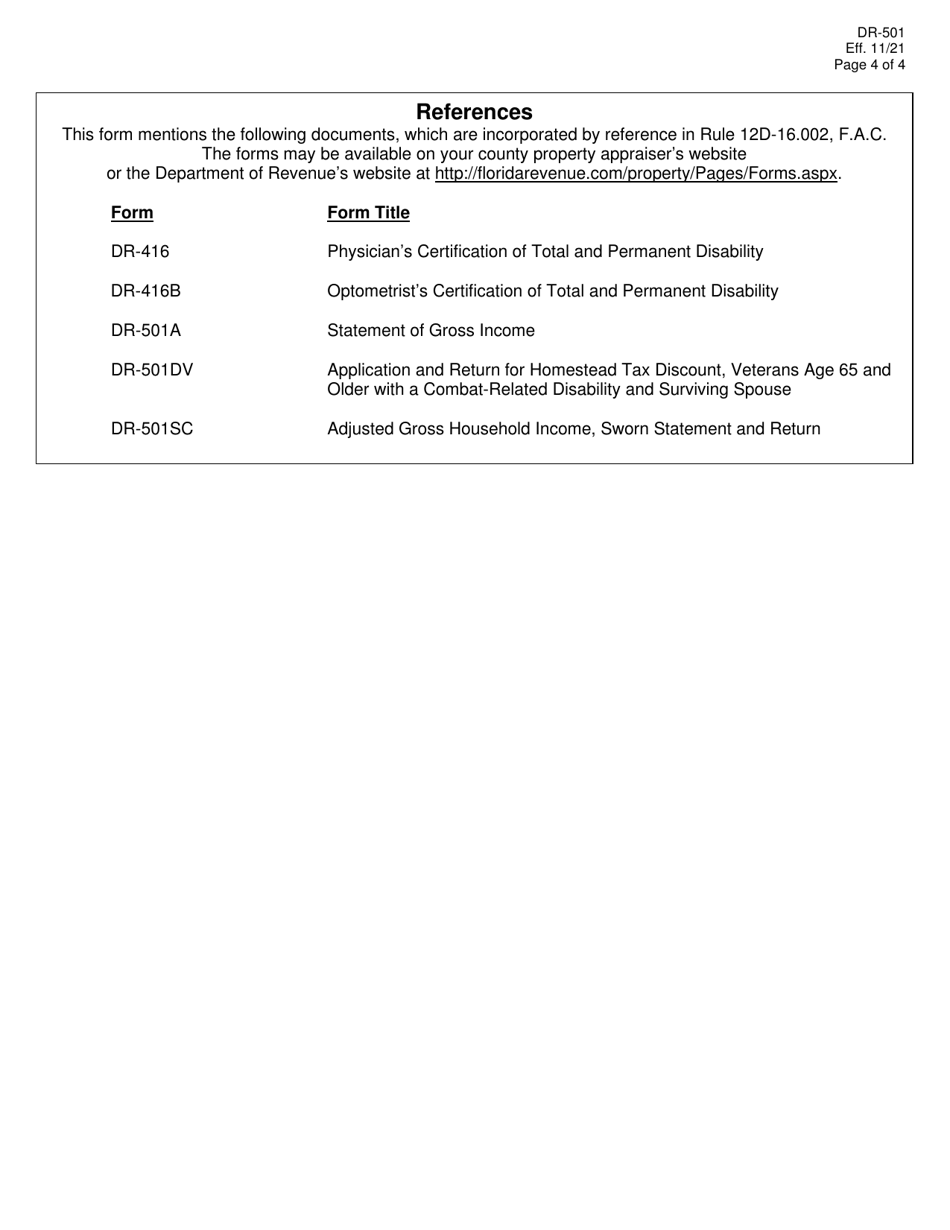

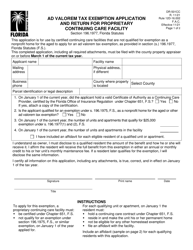

Form DR-501

for the current year.

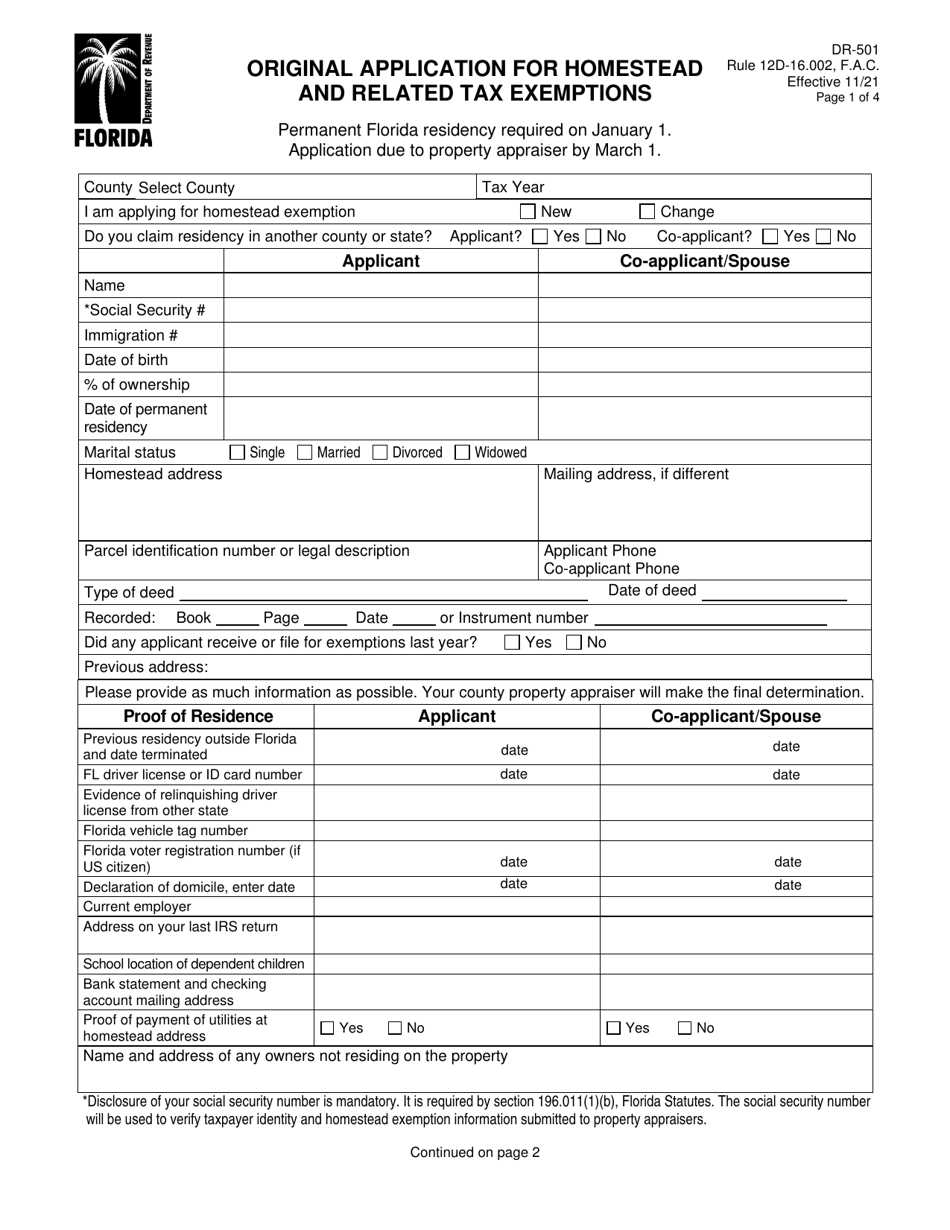

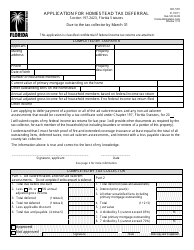

Form DR-501 Original Application for Homestead and Related Tax Exemptions - Florida

What Is Form DR-501?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-501?

A: Form DR-501 is the original application for homestead and related tax exemptions in Florida.

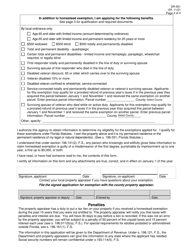

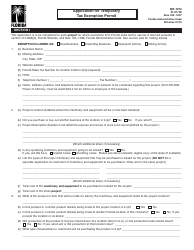

Q: What is a homestead exemption?

A: A homestead exemption is a tax benefit that reduces the taxable value of a property owner's primary residence.

Q: Who is eligible to apply for a homestead exemption in Florida?

A: To be eligible for a homestead exemption in Florida, you must be a permanent resident of Florida and use the property as your primary residence.

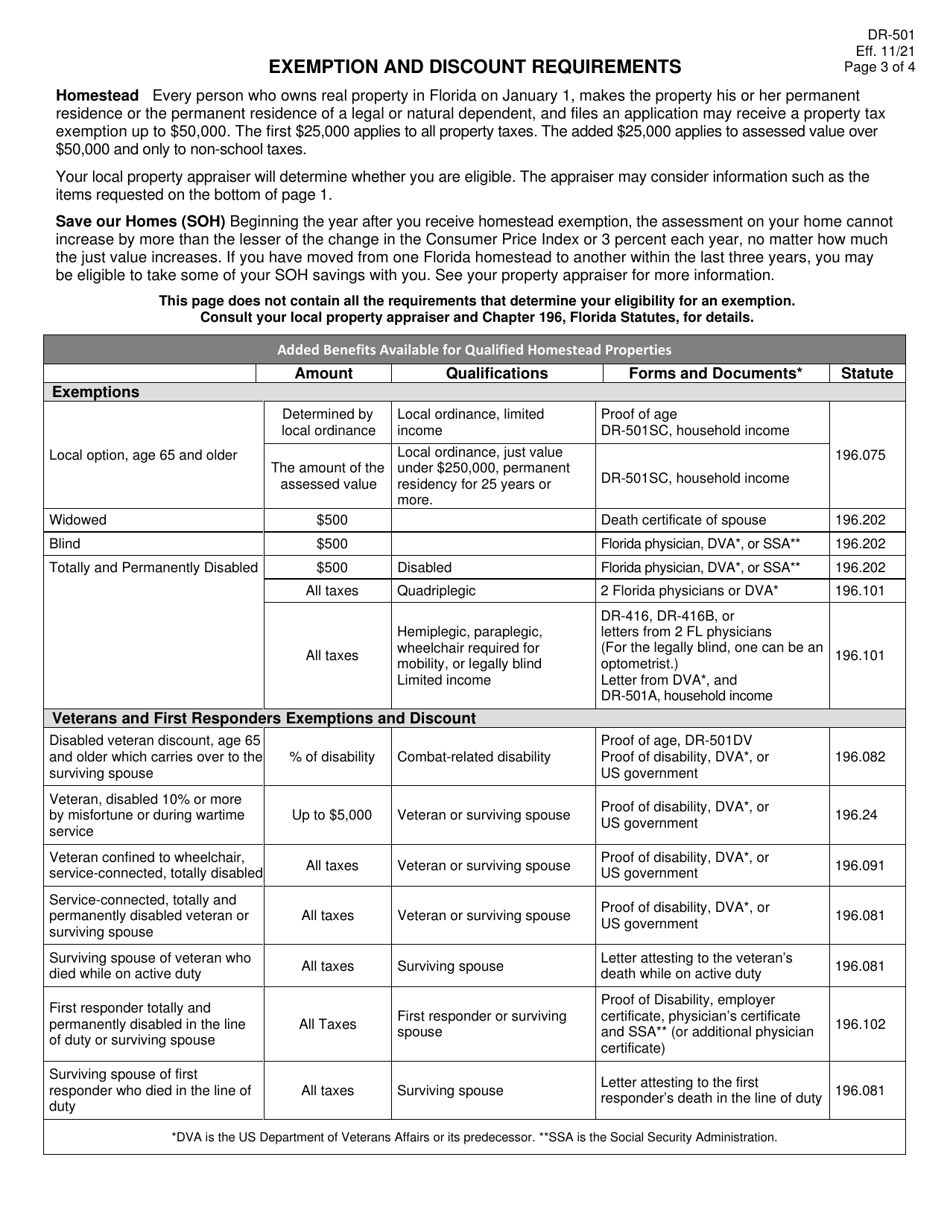

Q: What are the benefits of a homestead exemption?

A: The benefits of a homestead exemption in Florida include a reduction in the assessed value of your home for property tax purposes and protection against certain creditors.

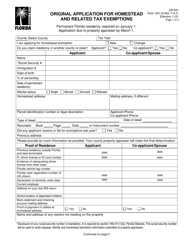

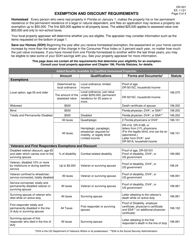

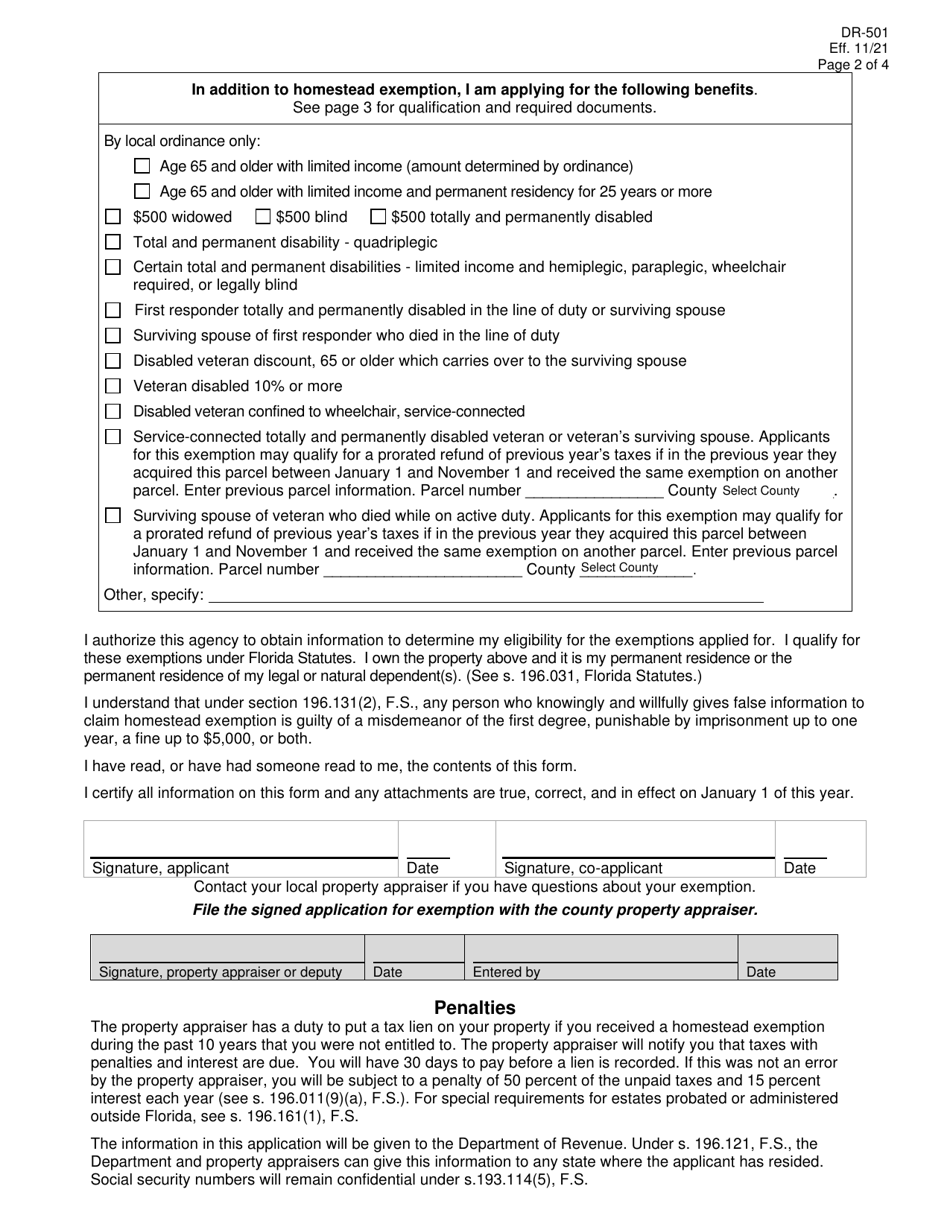

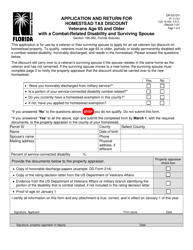

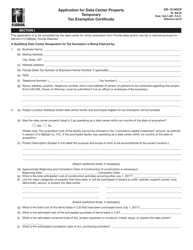

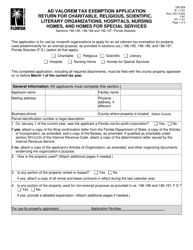

Q: What other tax exemptions are included in Form DR-501?

A: In addition to the homestead exemption, Form DR-501 also includes exemptions for widows/widowers, disabled veterans, and other categories.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR-501 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.