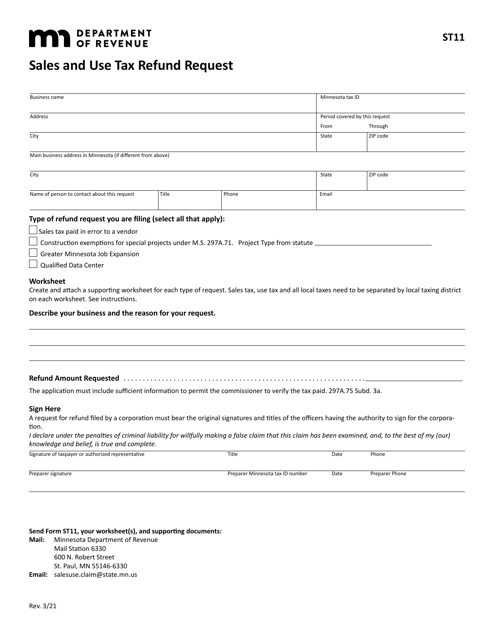

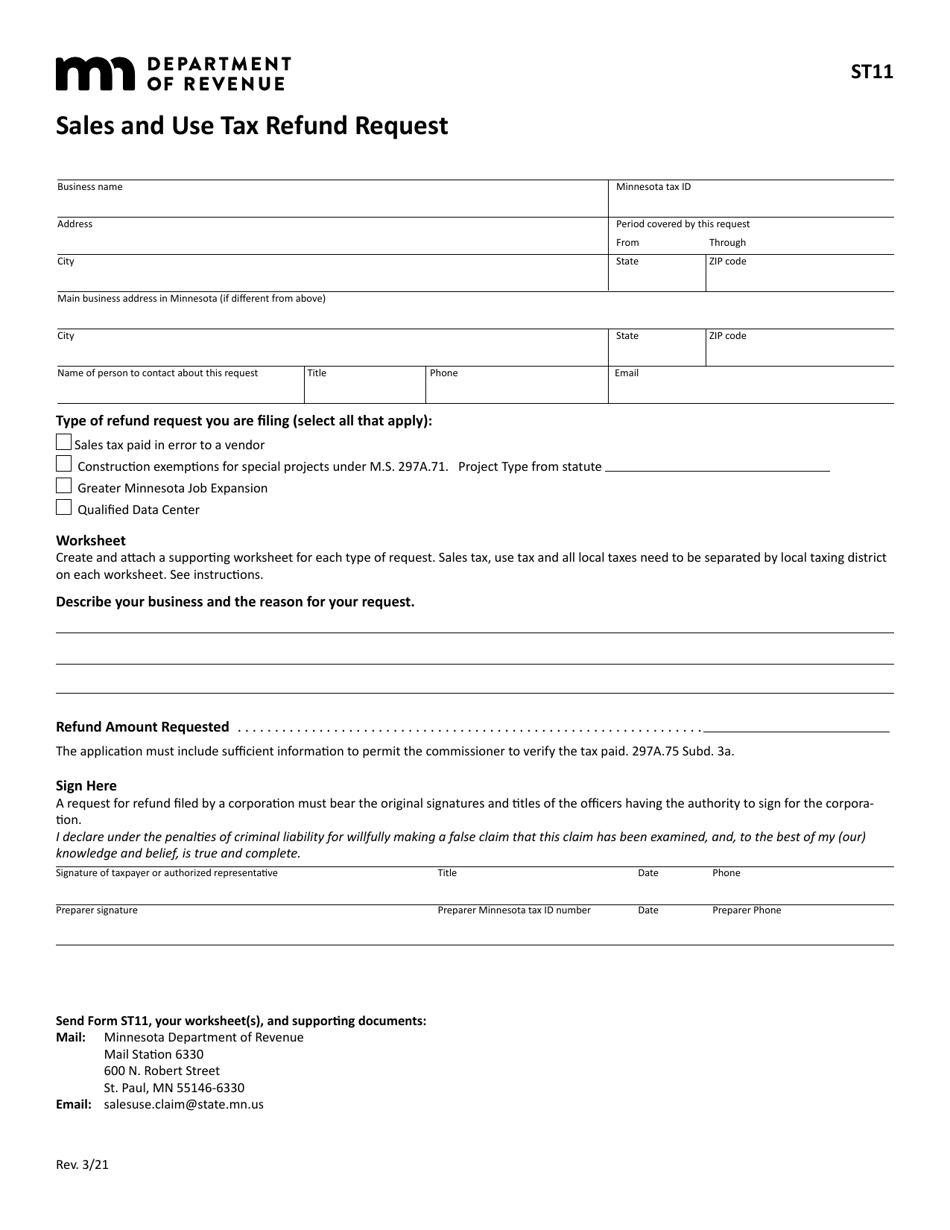

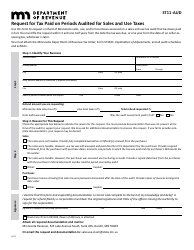

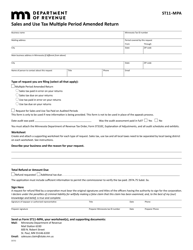

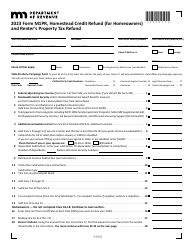

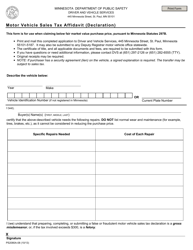

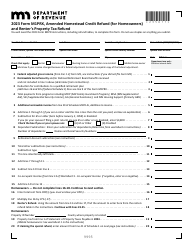

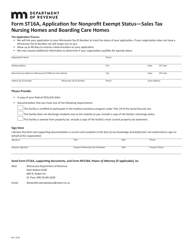

Form ST11 Sales and Use Tax Refund Request - Minnesota

What Is Form ST11?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST11?

A: Form ST11 is a Sales and Use Tax Refund Request form in Minnesota.

Q: What is the purpose of Form ST11?

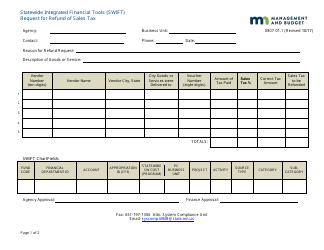

A: The purpose of Form ST11 is to request a refund for sales and use tax paid in Minnesota.

Q: Who can use Form ST11?

A: Any individual or business that has paid sales and use tax in Minnesota and is eligible for a refund can use Form ST11.

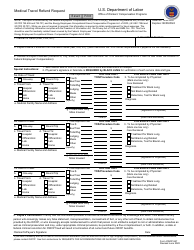

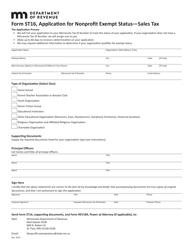

Q: How do I fill out Form ST11?

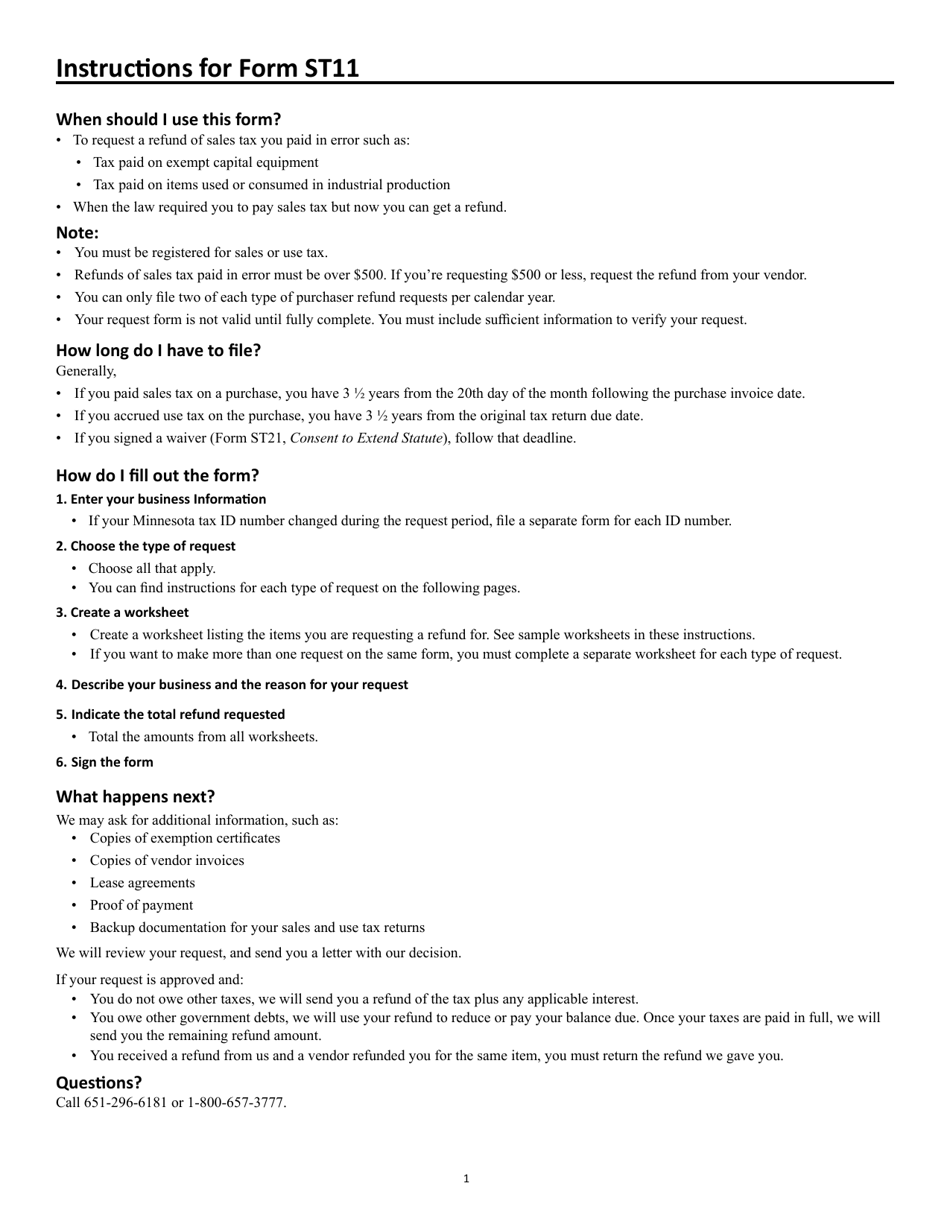

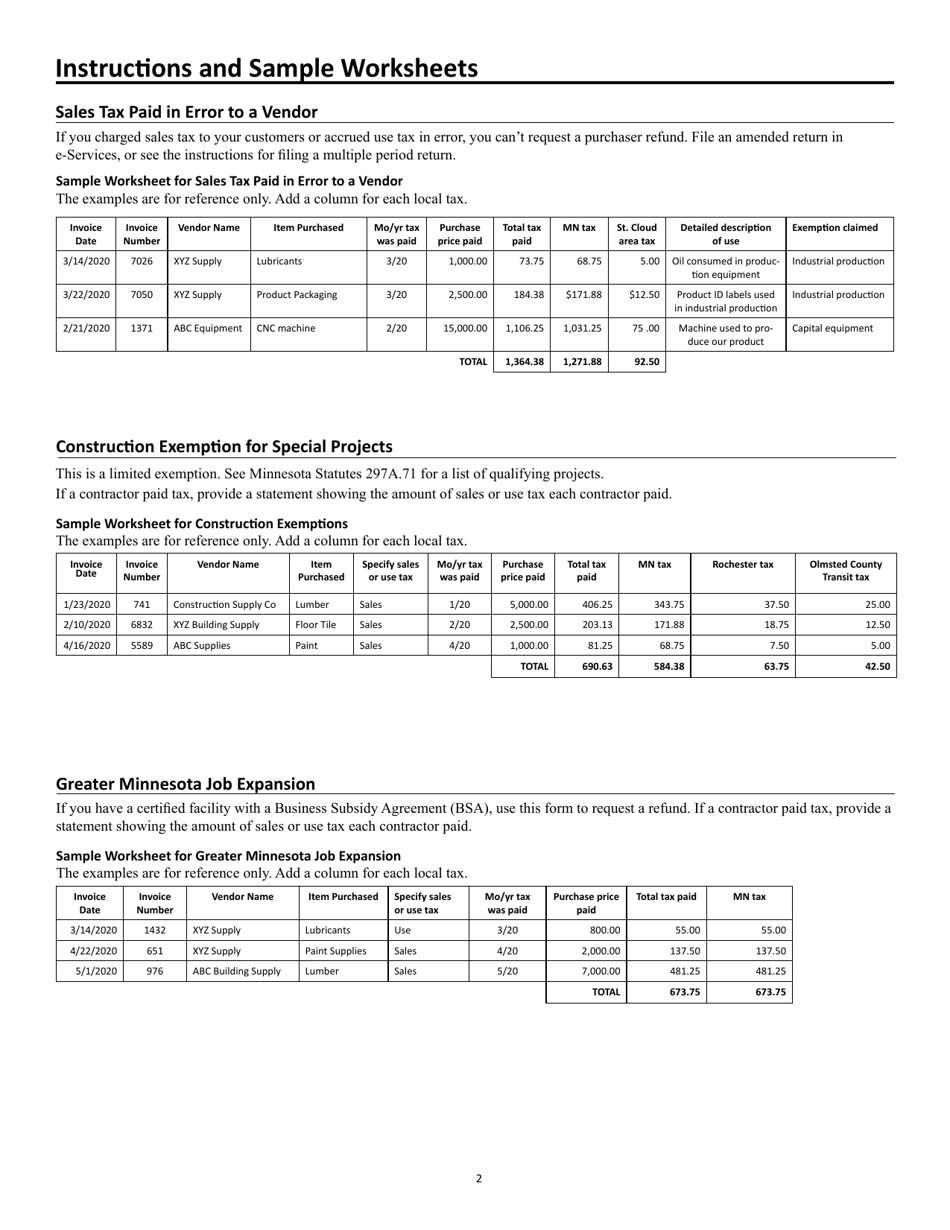

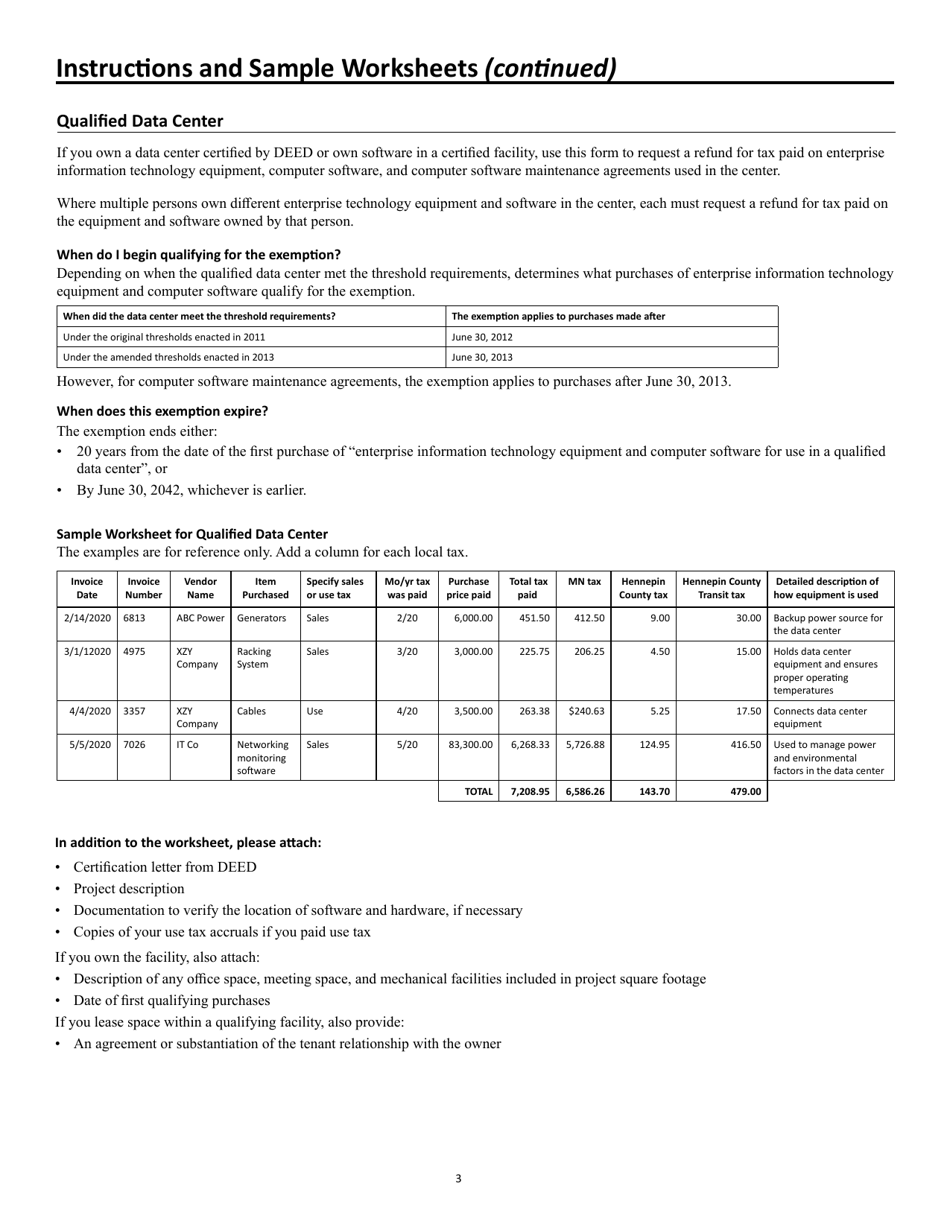

A: You need to provide your contact information, information about the tax period and the amount of tax you are requesting a refund for, and any supporting documentation.

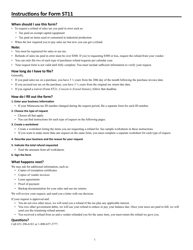

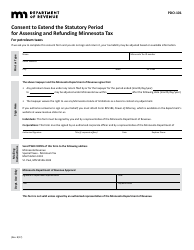

Q: Are there any deadlines for submitting Form ST11?

A: Yes, you must submit Form ST11 within 4 years from the due date of the return or within 1 year from the date of overpayment, whichever is later.

Q: How long does it take to receive a refund after submitting Form ST11?

A: It typically takes 4 to 6 weeks to process a refund request, but this may vary depending on the complexity of the request and the volume of requests being processed.

Form Details:

- Released on March 1, 2021;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST11 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.