This version of the form is not currently in use and is provided for reference only. Download this version of

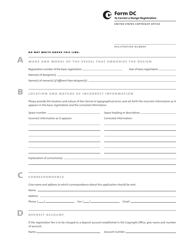

Form ABR

for the current year.

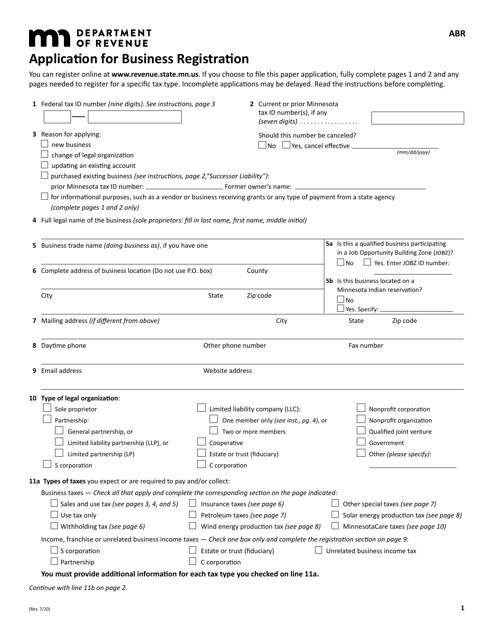

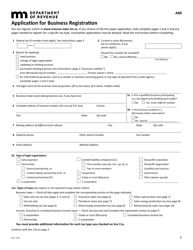

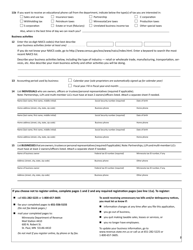

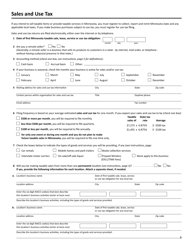

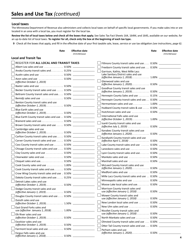

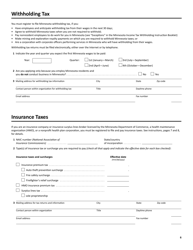

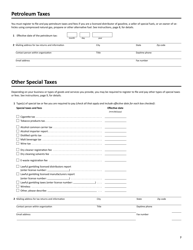

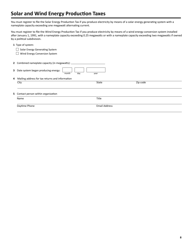

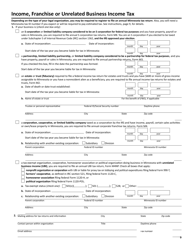

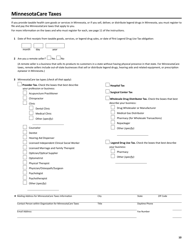

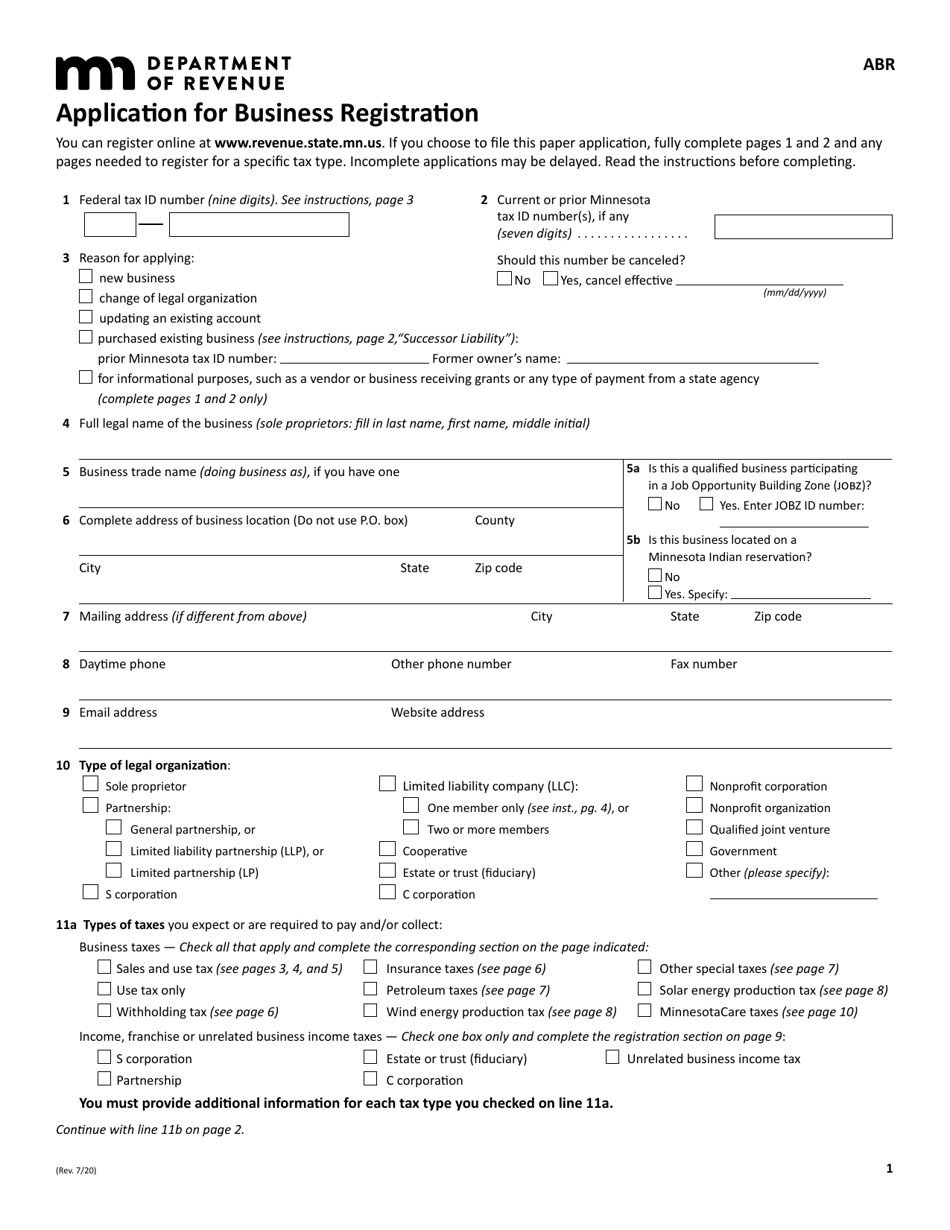

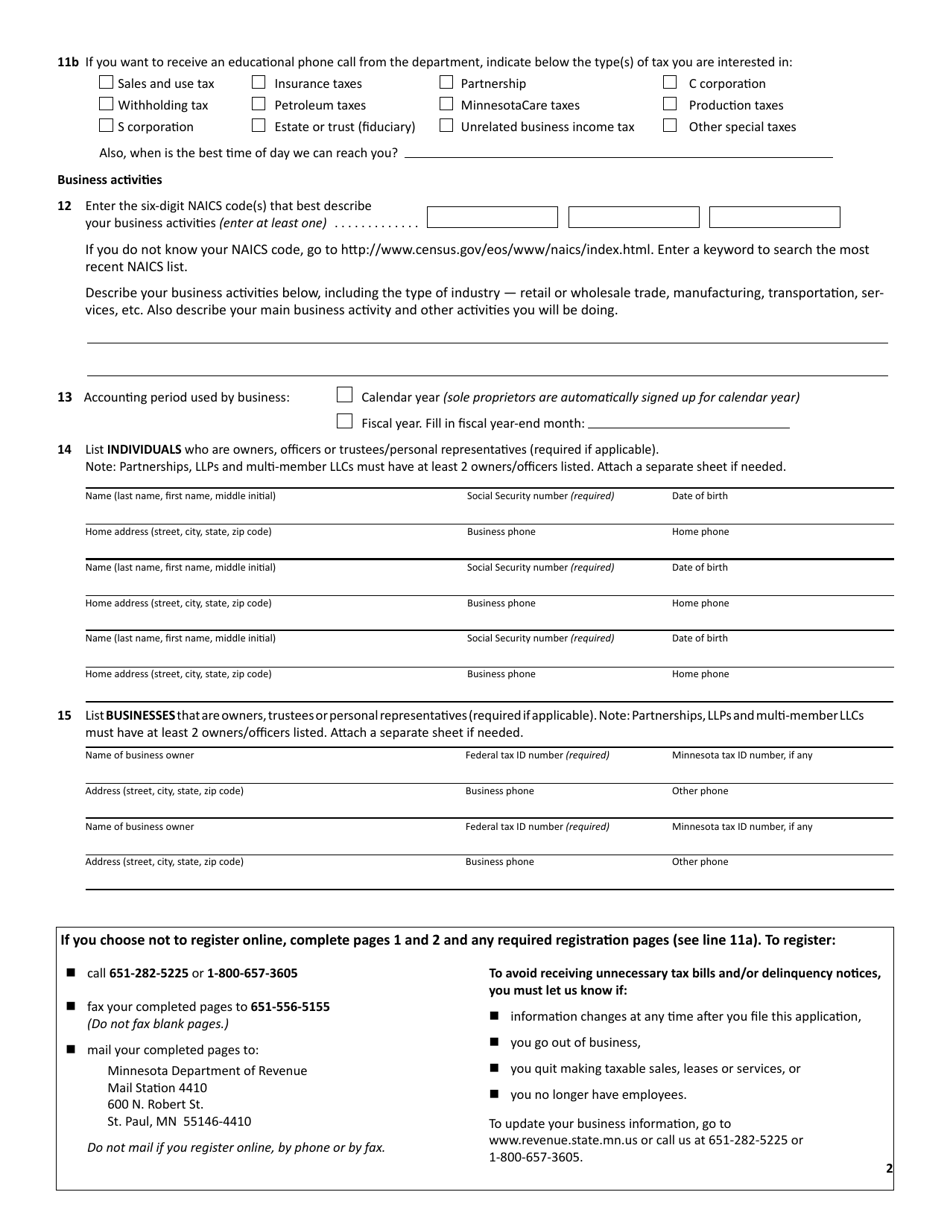

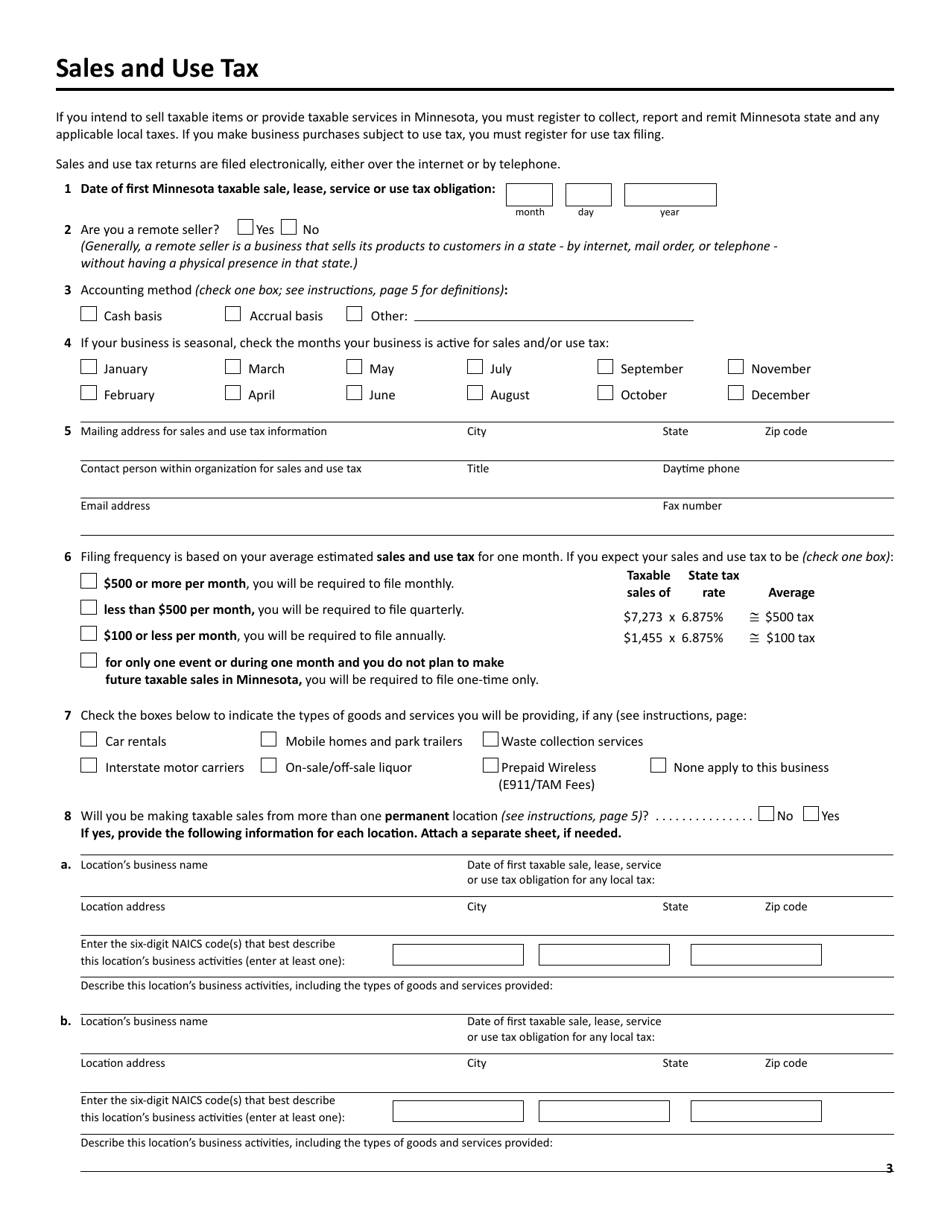

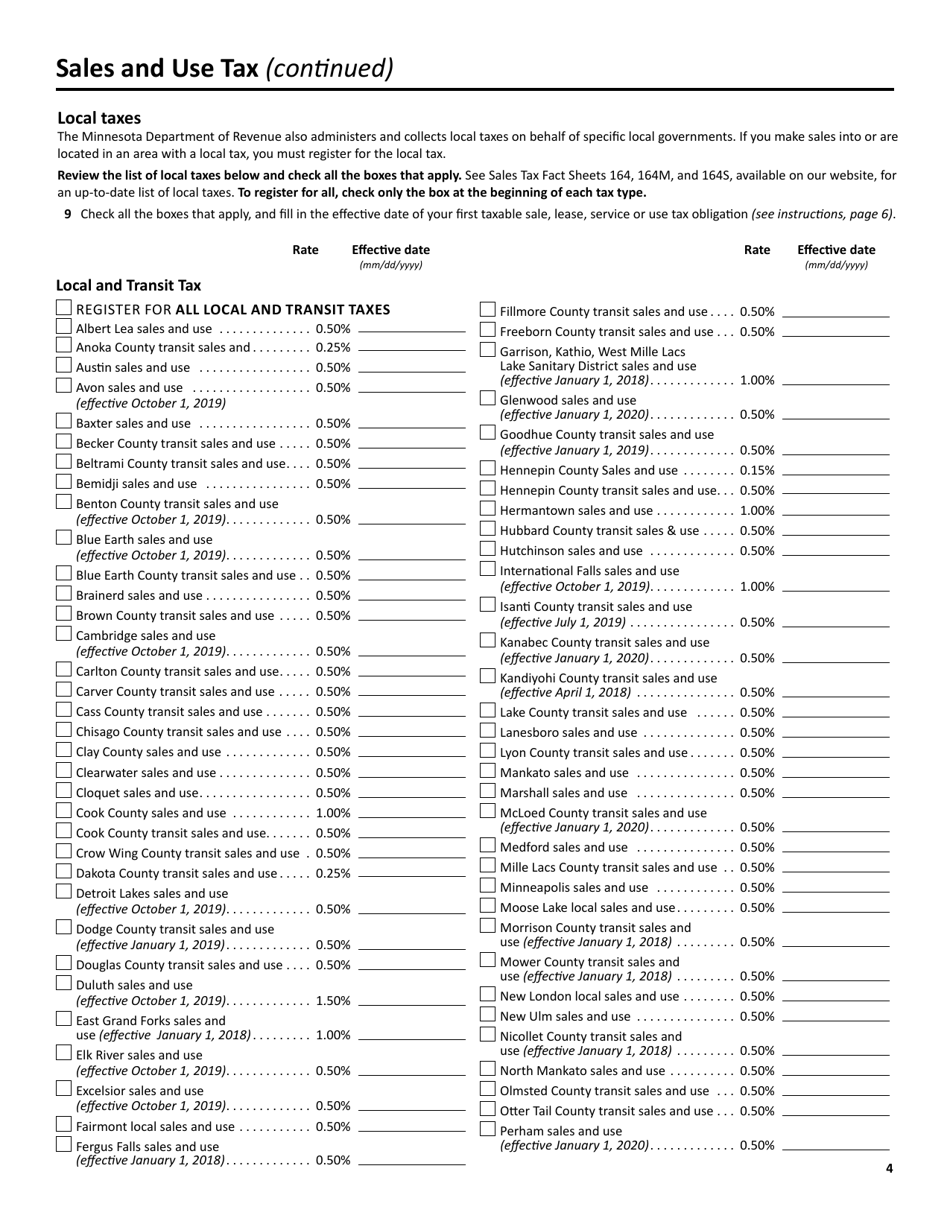

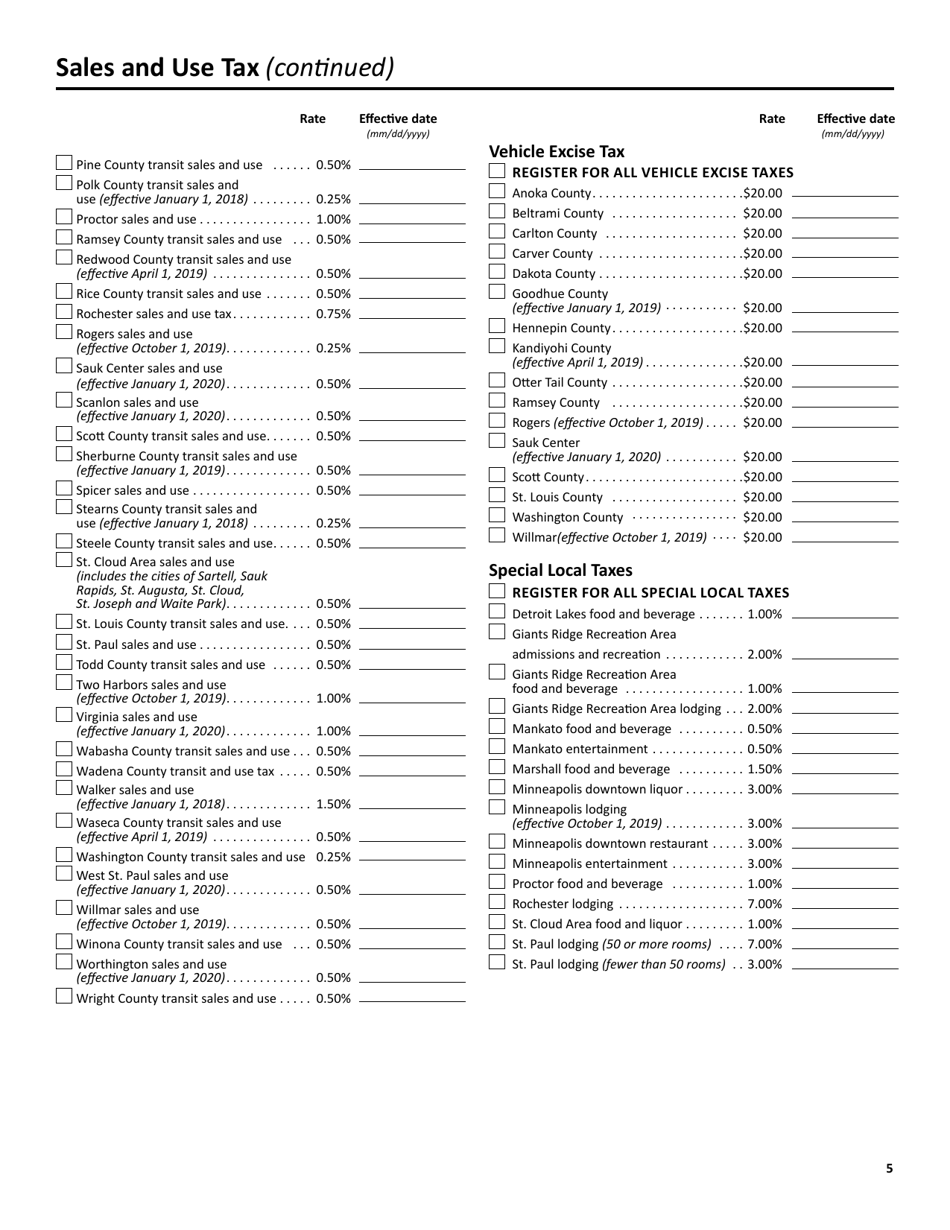

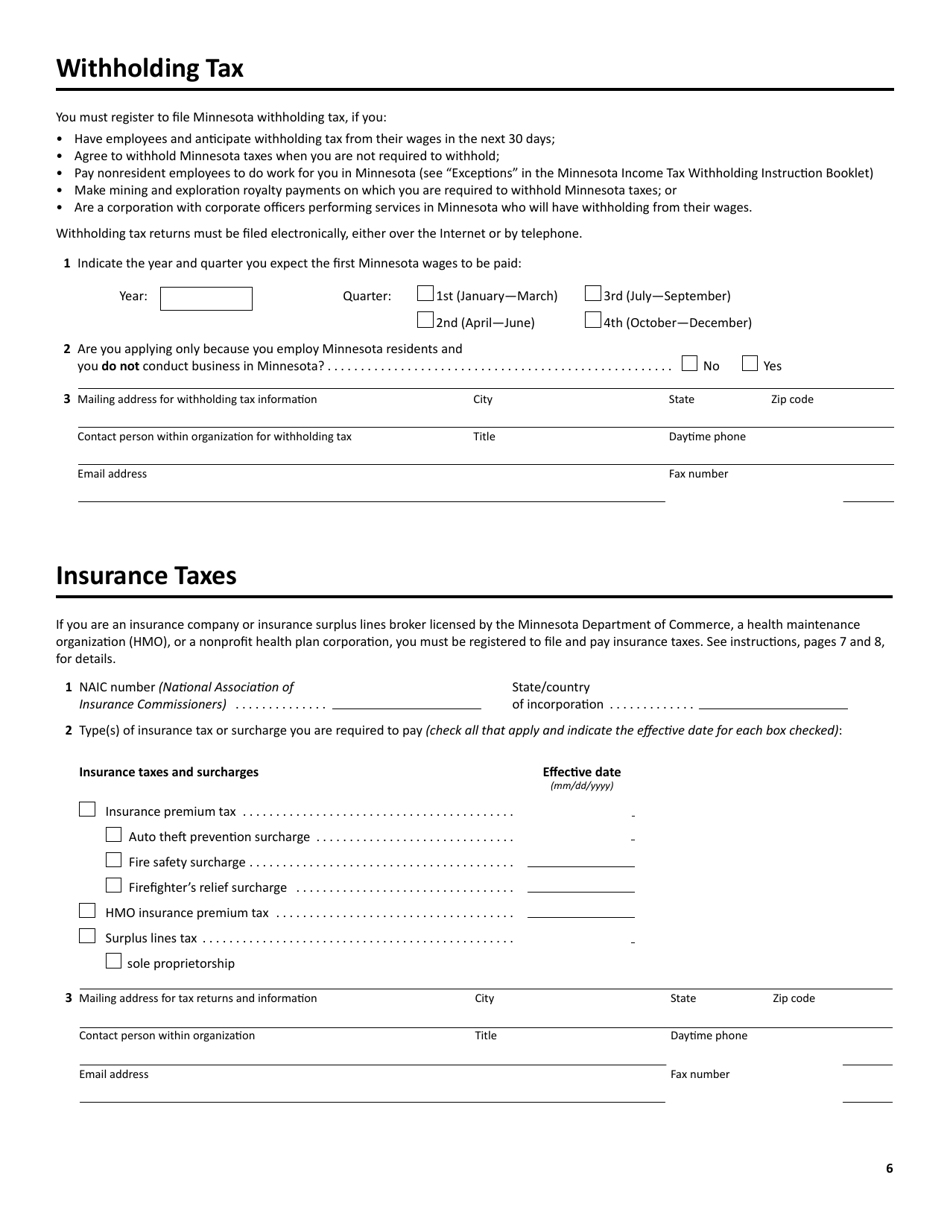

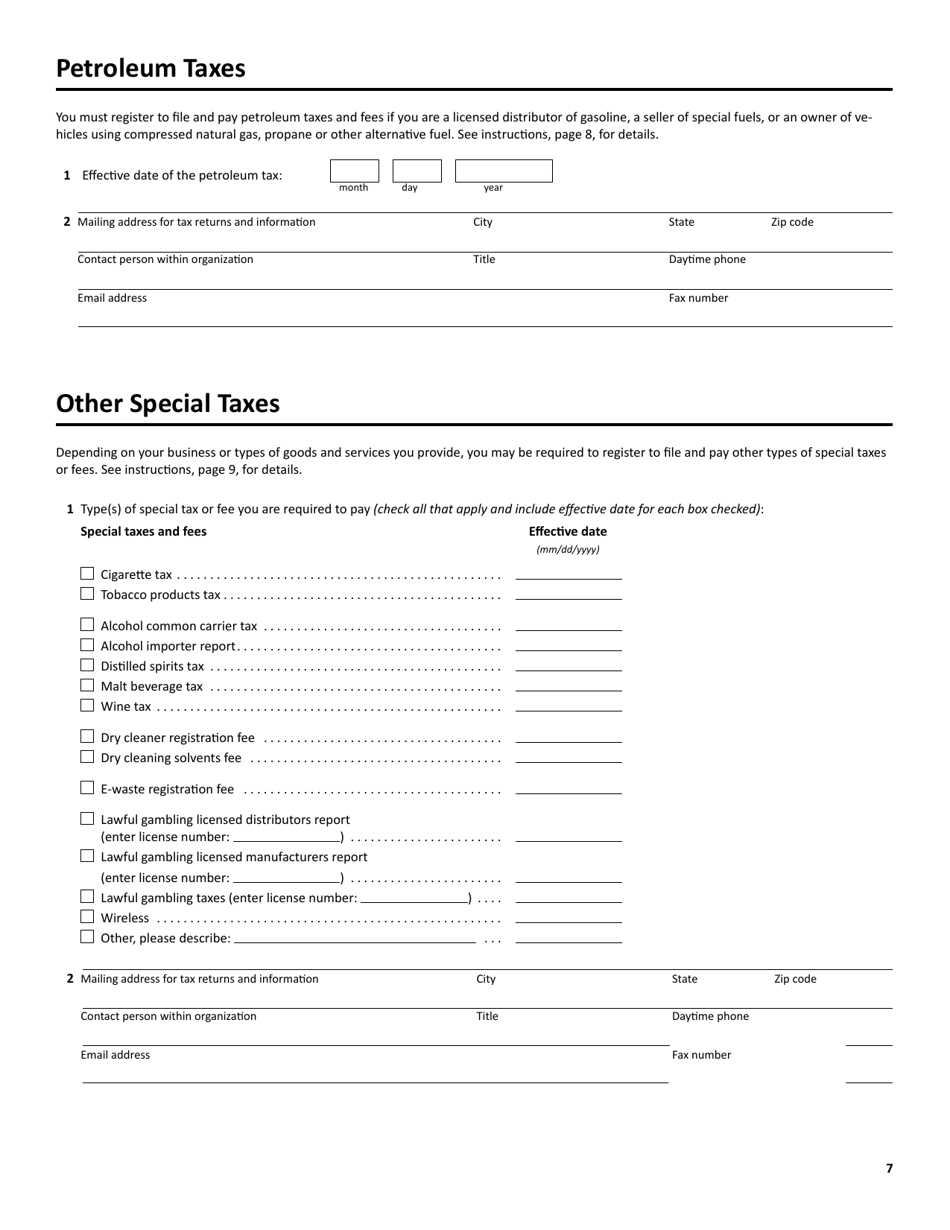

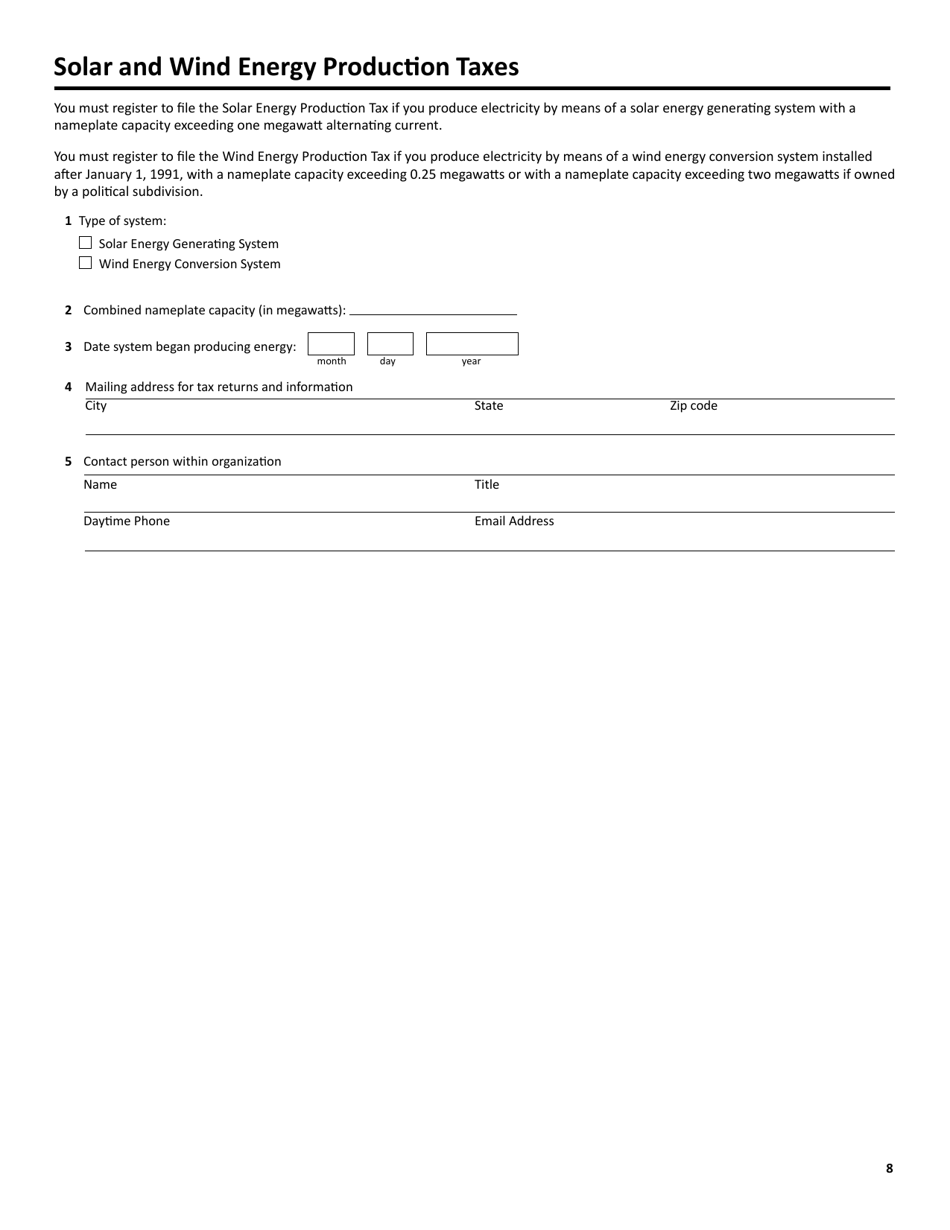

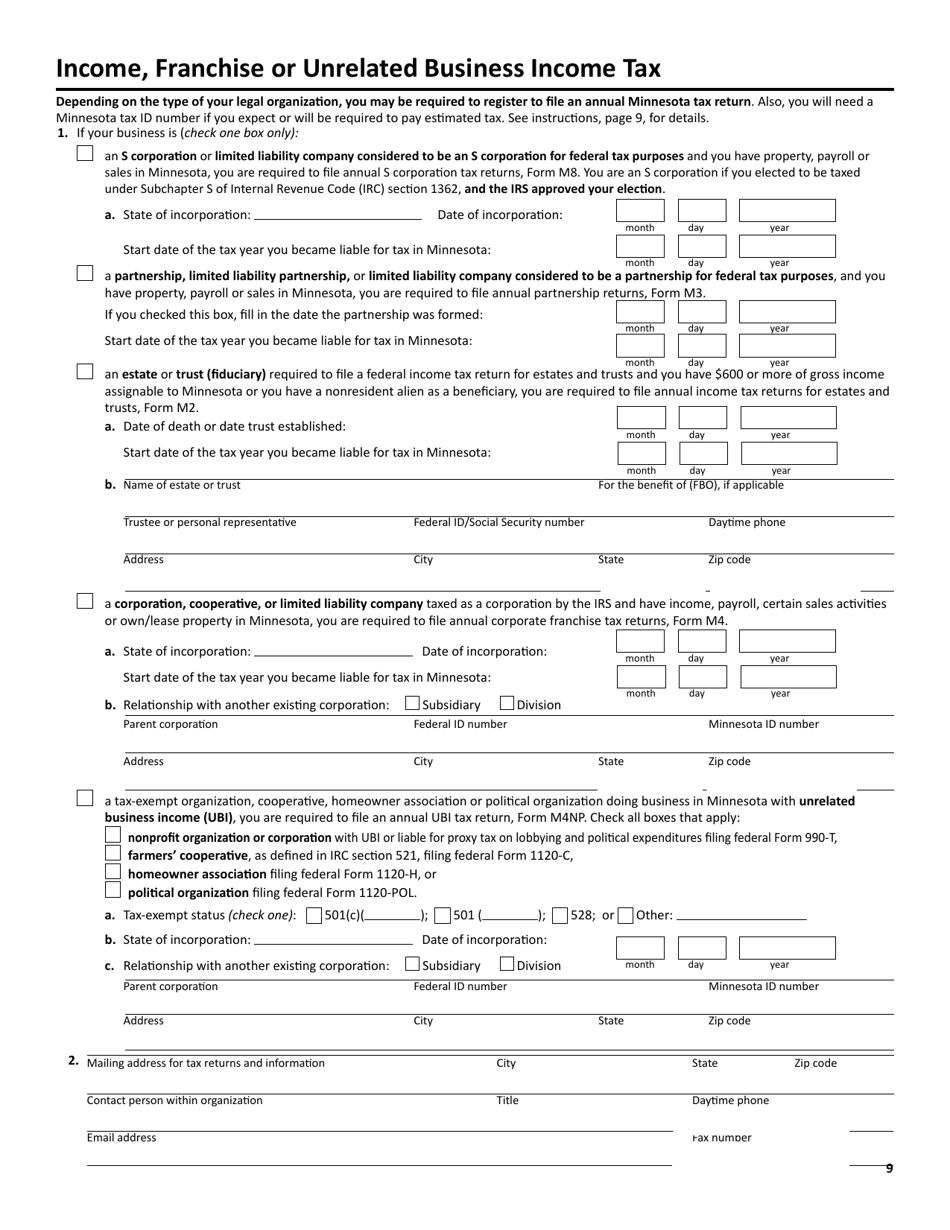

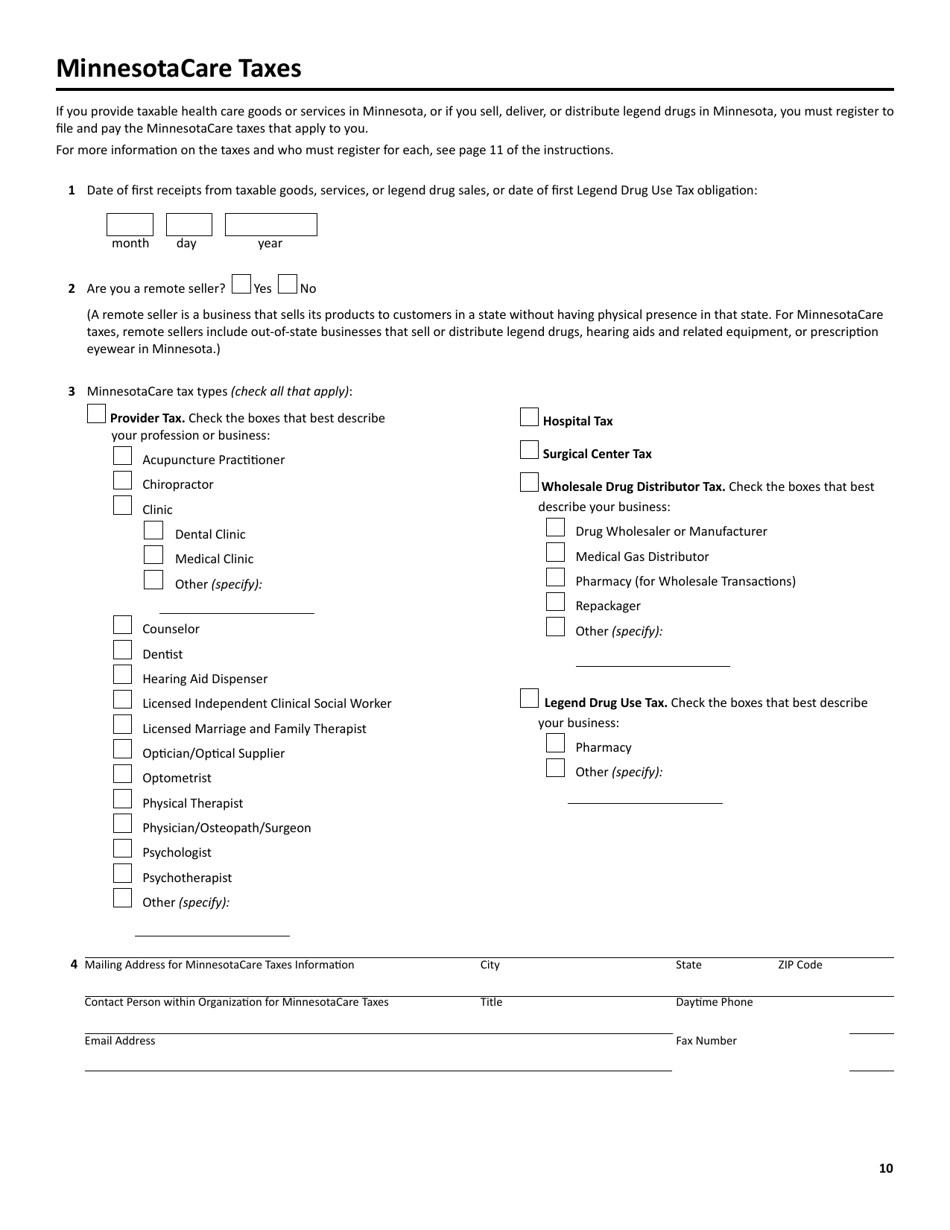

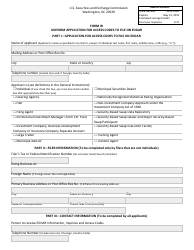

Form ABR Application for Business Registration - Minnesota

What Is Form ABR?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is an ABR Application?

A: The ABR Application is the application form used to register a business in Minnesota.

Q: Why do I need to register my business?

A: Registering your business ensures that it is recognized as a legal entity and allows you to comply with relevant laws and regulations.

Q: What information do I need to provide in the ABR Application?

A: You will need to provide details such as the business name, address, type of business, and ownership information.

Q: Is there a fee for submitting the ABR Application?

A: Yes, there is a fee required to submit the ABR Application. The fee amount may vary depending on the type of business.

Q: How long does it take to process the ABR Application?

A: Processing times can vary, but it typically takes a few business days to several weeks to process the ABR Application.

Q: What happens after I submit the ABR Application?

A: Once your ABR Application is approved, you will receive a Certificate of Assumed Name or a Certificate of Authority, depending on the type of business.

Q: Do I need to renew my business registration?

A: Yes, business registrations in Minnesota need to be renewed periodically. The renewal frequency will depend on the type of business.

Q: What is the penalty for not registering my business?

A: Failure to register your business can result in fines, legal consequences, and a loss of certain legal protections.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ABR by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.