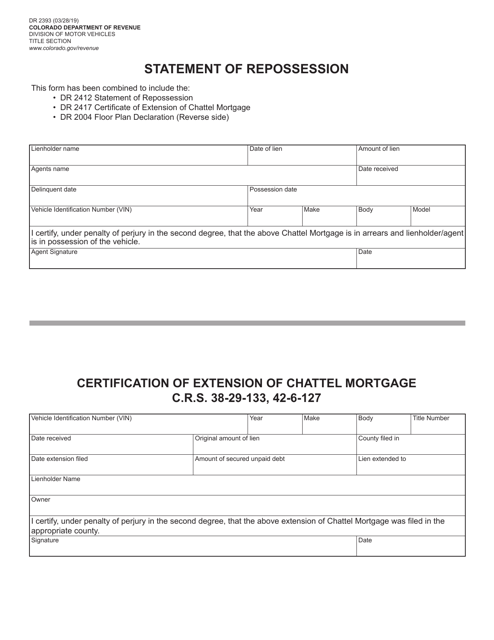

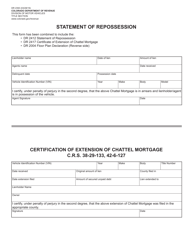

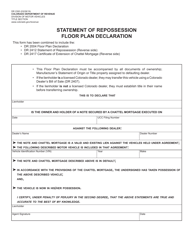

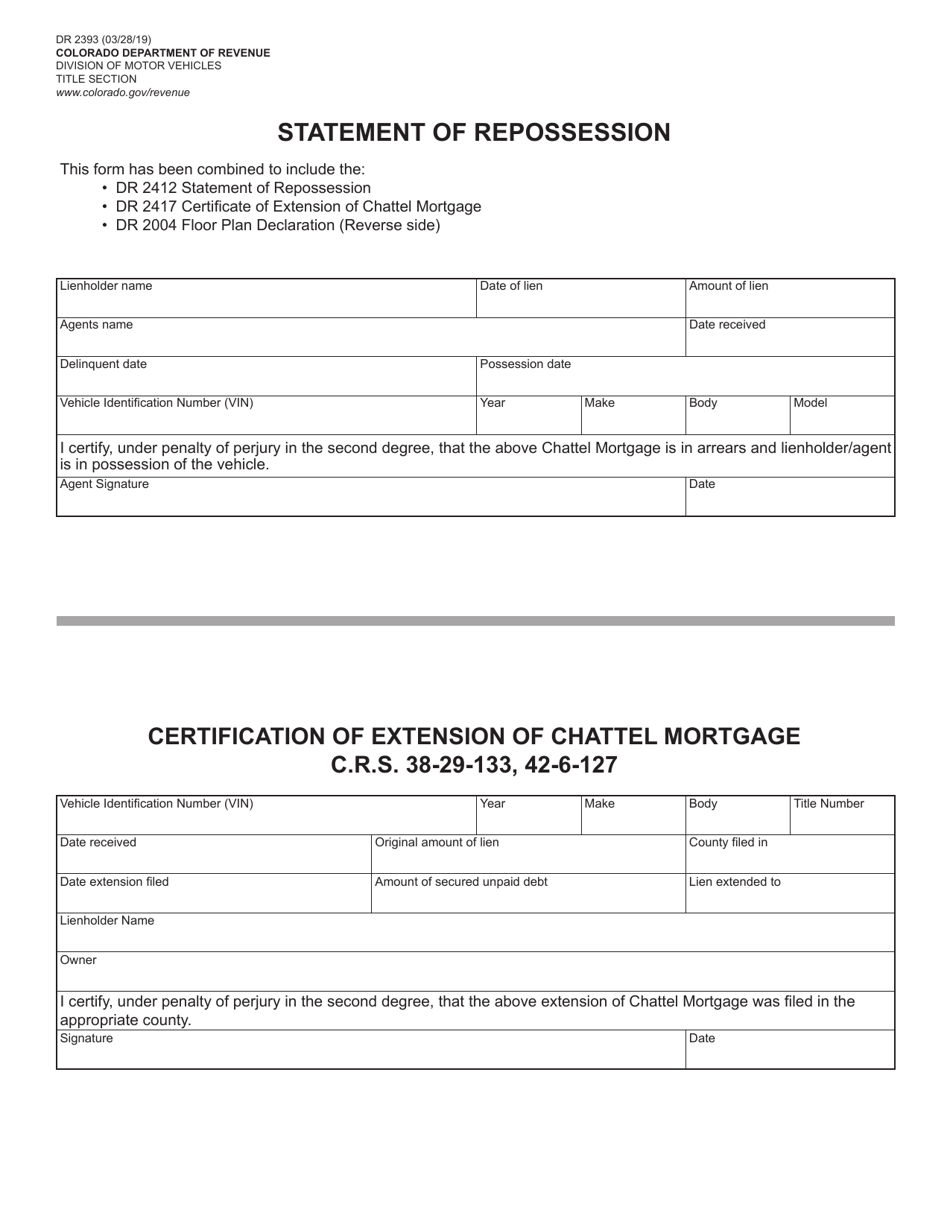

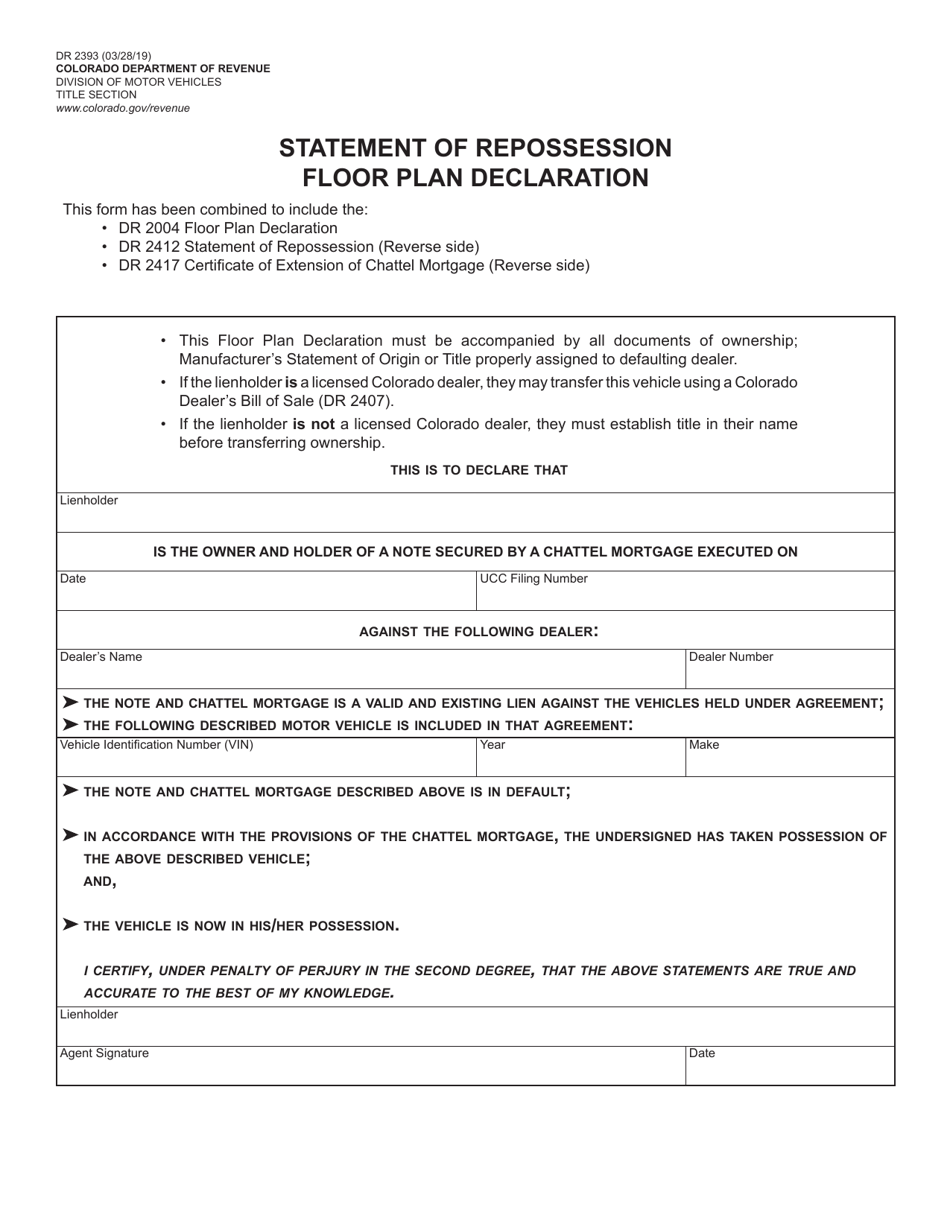

Form DR2393 Statement of Repossession - Colorado

What Is Form DR2393?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR2393?

A: Form DR2393 is the Statement of Repossession in Colorado.

Q: When is Form DR2393 used?

A: Form DR2393 is used when there has been a repossession of a Colorado titled motor vehicle.

Q: What information do I need to complete Form DR2393?

A: You will need to provide the vehicle information, details about the repossession, and contact information of the parties involved.

Q: Is there a deadline for filing Form DR2393?

A: Yes, Form DR2393 must be filed within 30 days of the repossession.

Q: Are there any fees associated with filing Form DR2393?

A: No, there are no fees associated with filing Form DR2393.

Q: What happens after I submit Form DR2393?

A: After submission, the Colorado Department of Revenue will update their records to reflect the repossession.

Q: Is it necessary to notify the lienholder about the repossession?

A: Yes, it is necessary to notify the lienholder about the repossession.

Q: Can I use Form DR2393 for a repossession in another state?

A: No, Form DR2393 is specific to repossession in Colorado.

Form Details:

- Released on March 28, 2019;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR2393 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.