This version of the form is not currently in use and is provided for reference only. Download this version of

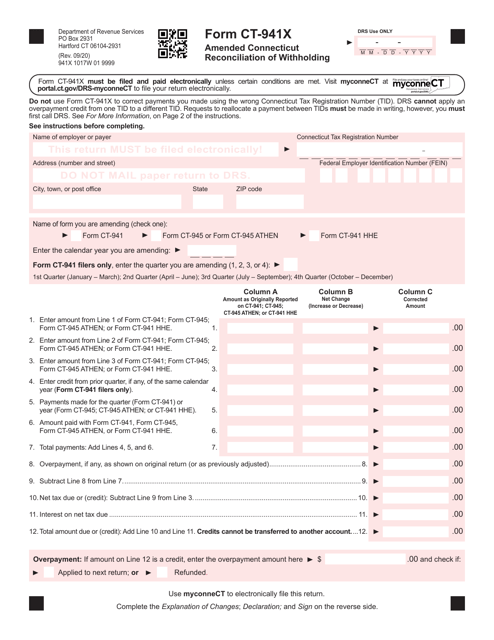

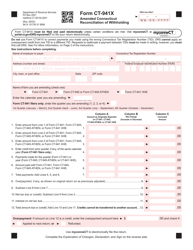

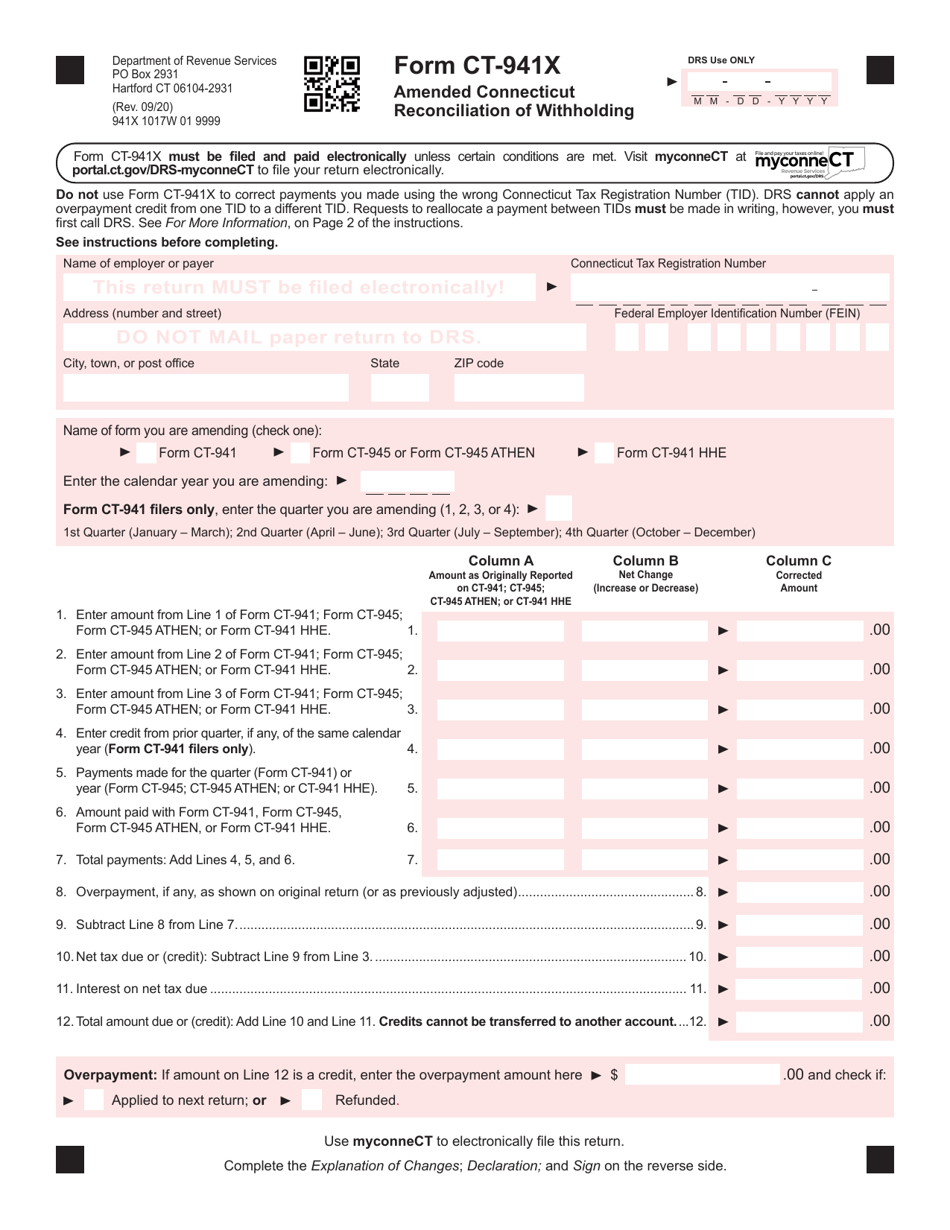

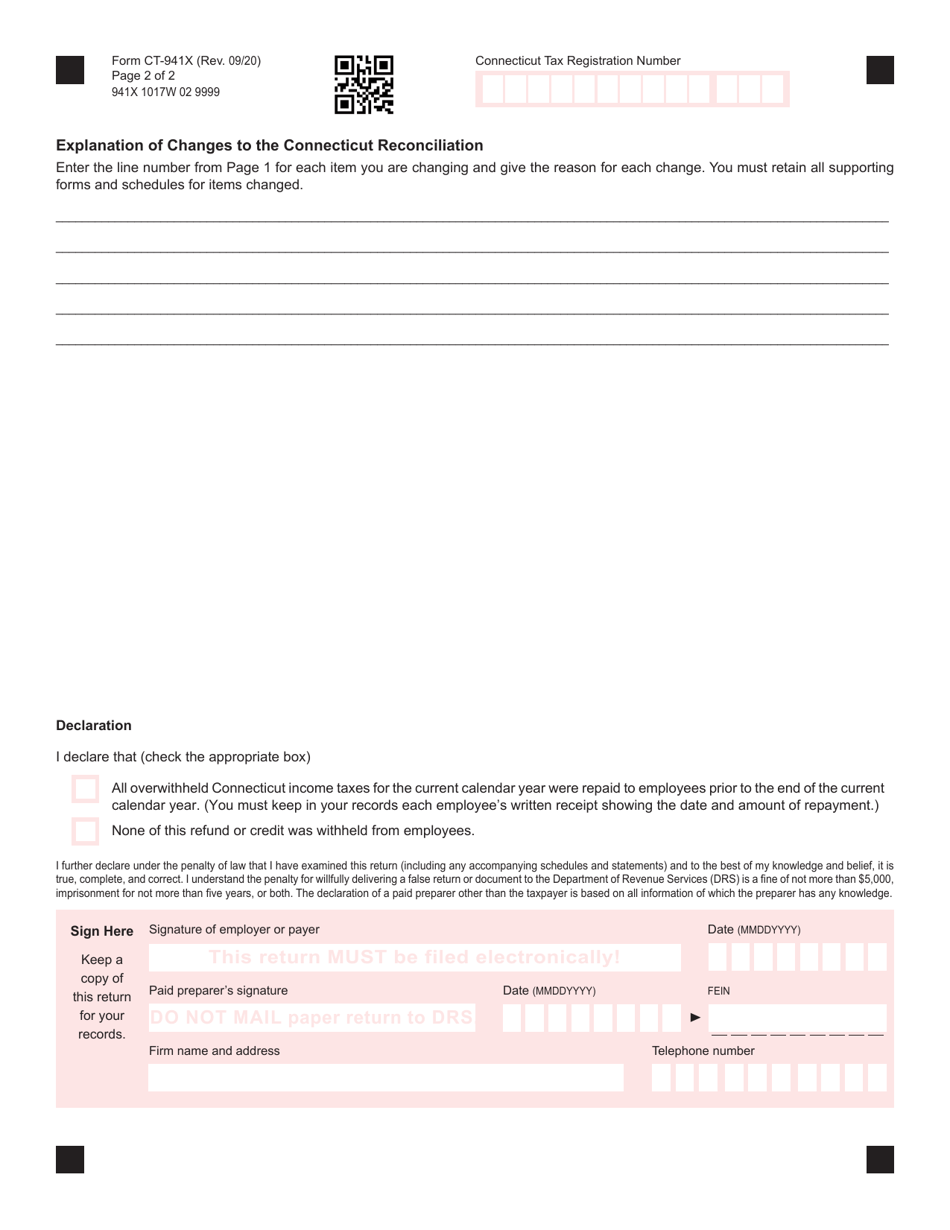

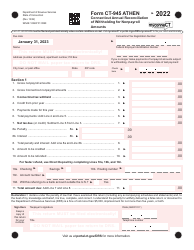

Form CT-941X

for the current year.

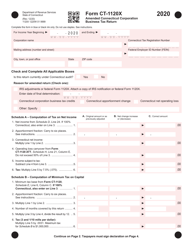

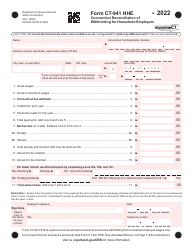

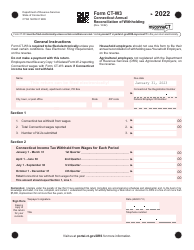

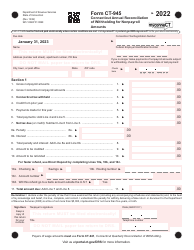

Form CT-941X Amended Connecticut Reconciliation of Withholding - Connecticut

What Is Form CT-941X?

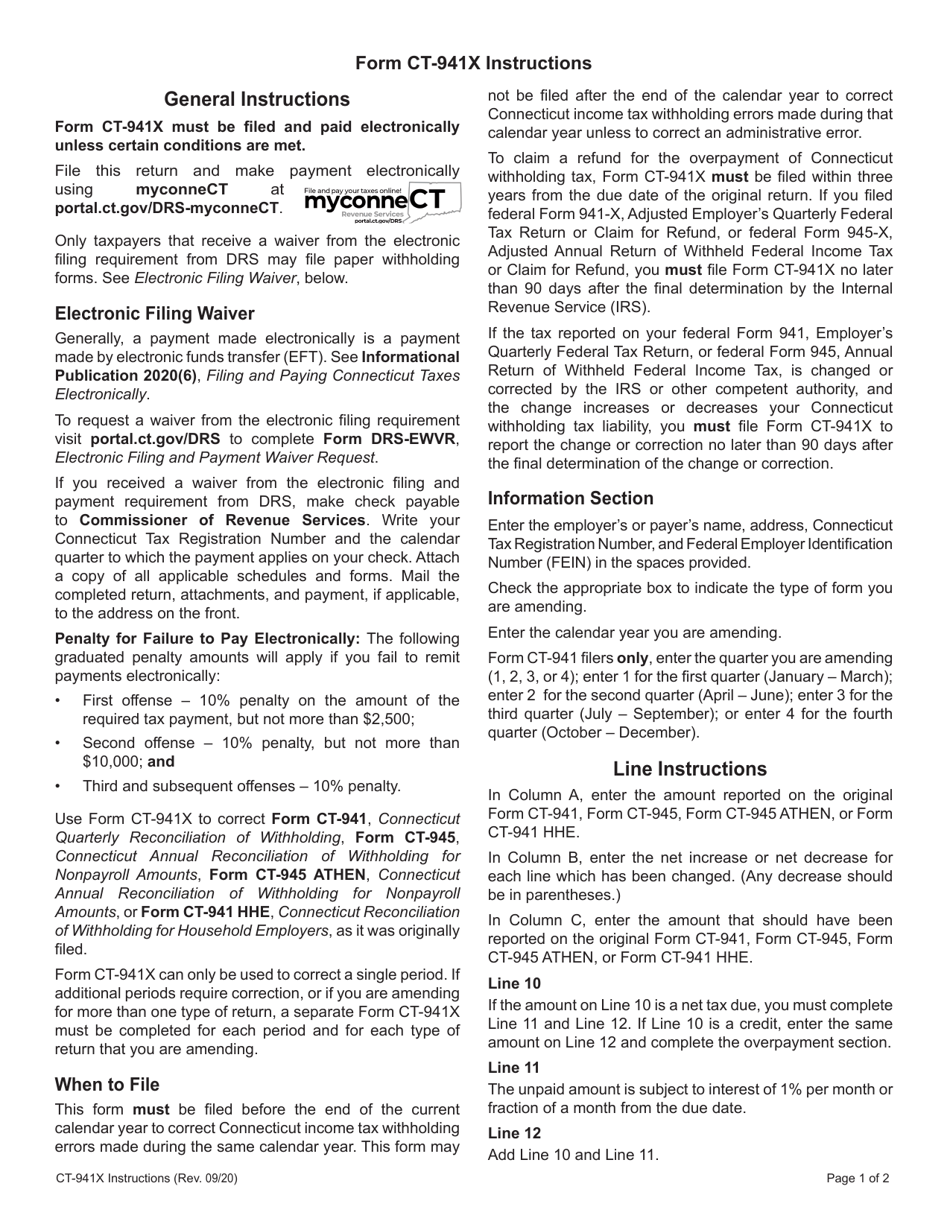

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-941X?

A: Form CT-941X is the Amended Connecticut Reconciliation of Withholding form.

Q: What is the purpose of Form CT-941X?

A: The purpose of Form CT-941X is to correct any errors or make changes to a previously filed Form CT-941.

Q: When should I use Form CT-941X?

A: You should use Form CT-941X when you need to amend your previously filed Form CT-941.

Q: How do I file Form CT-941X?

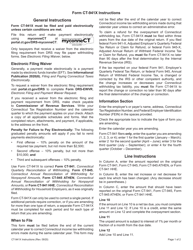

A: You can file Form CT-941X by mail or electronically through the Connecticut Taxpayer Service Center.

Q: What information do I need to complete Form CT-941X?

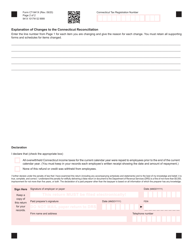

A: You will need information from your original Form CT-941, as well as any updated or corrected information.

Q: Is there a deadline for filing Form CT-941X?

A: Yes, Form CT-941X must be filed within 3 years from the original due date of the return, or within 3 years from the date the return was filed, whichever is later.

Q: Are there any penalties for filing Form CT-941X late?

A: Yes, if you file Form CT-941X late, you may be subject to penalties and interest on any unpaid tax.

Q: Can I e-file Form CT-941X?

A: Yes, you can e-file Form CT-941X through the Connecticut Taxpayer Service Center.

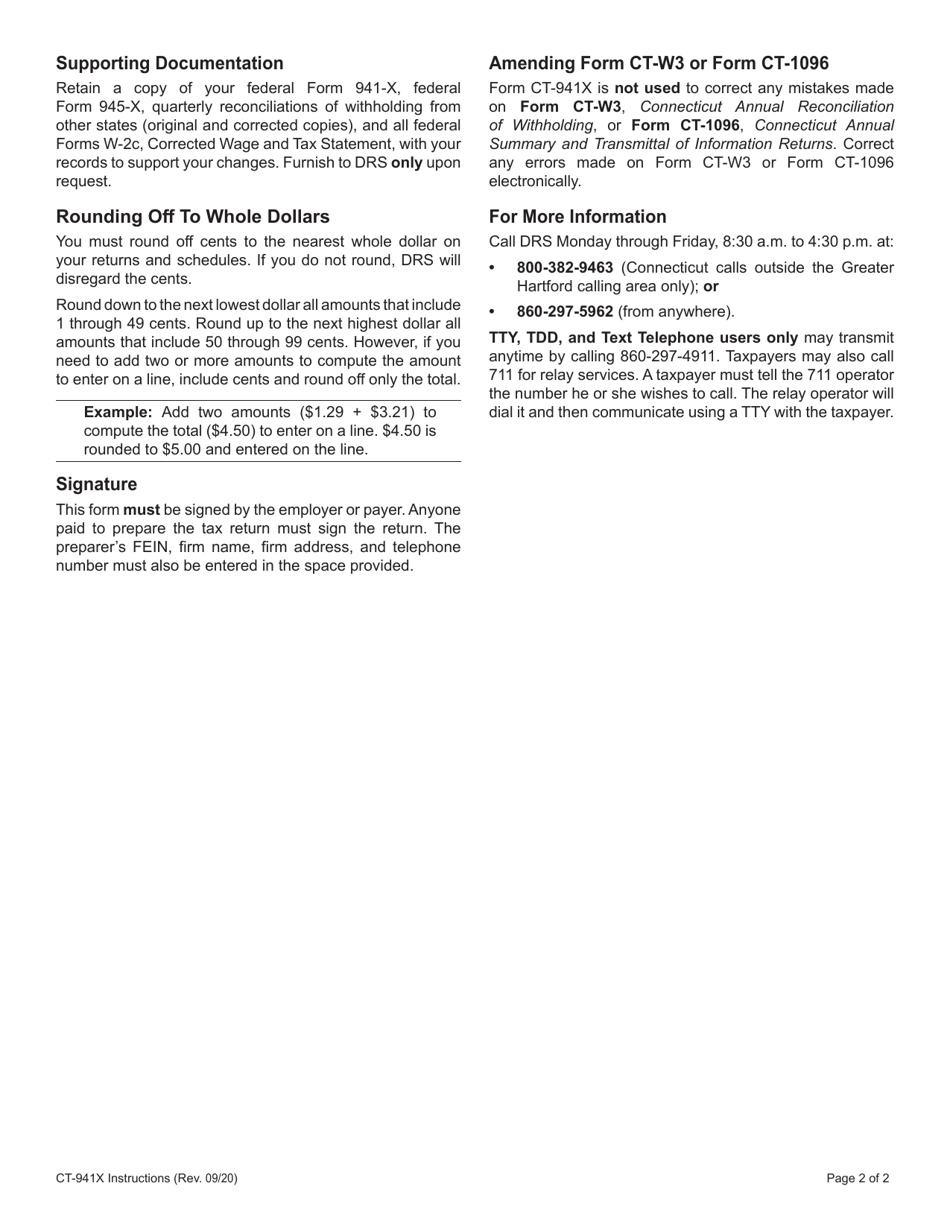

Q: Do I need to include any supporting documents with Form CT-941X?

A: You may need to include supporting documents, such as W-2 forms or payroll records, depending on the nature of the changes you are making.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-941X by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.