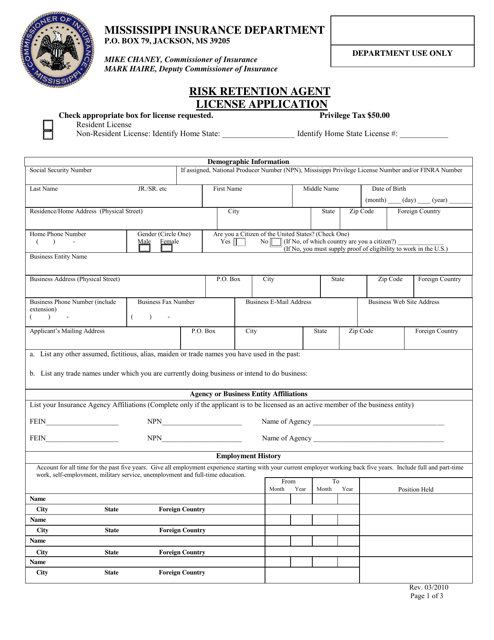

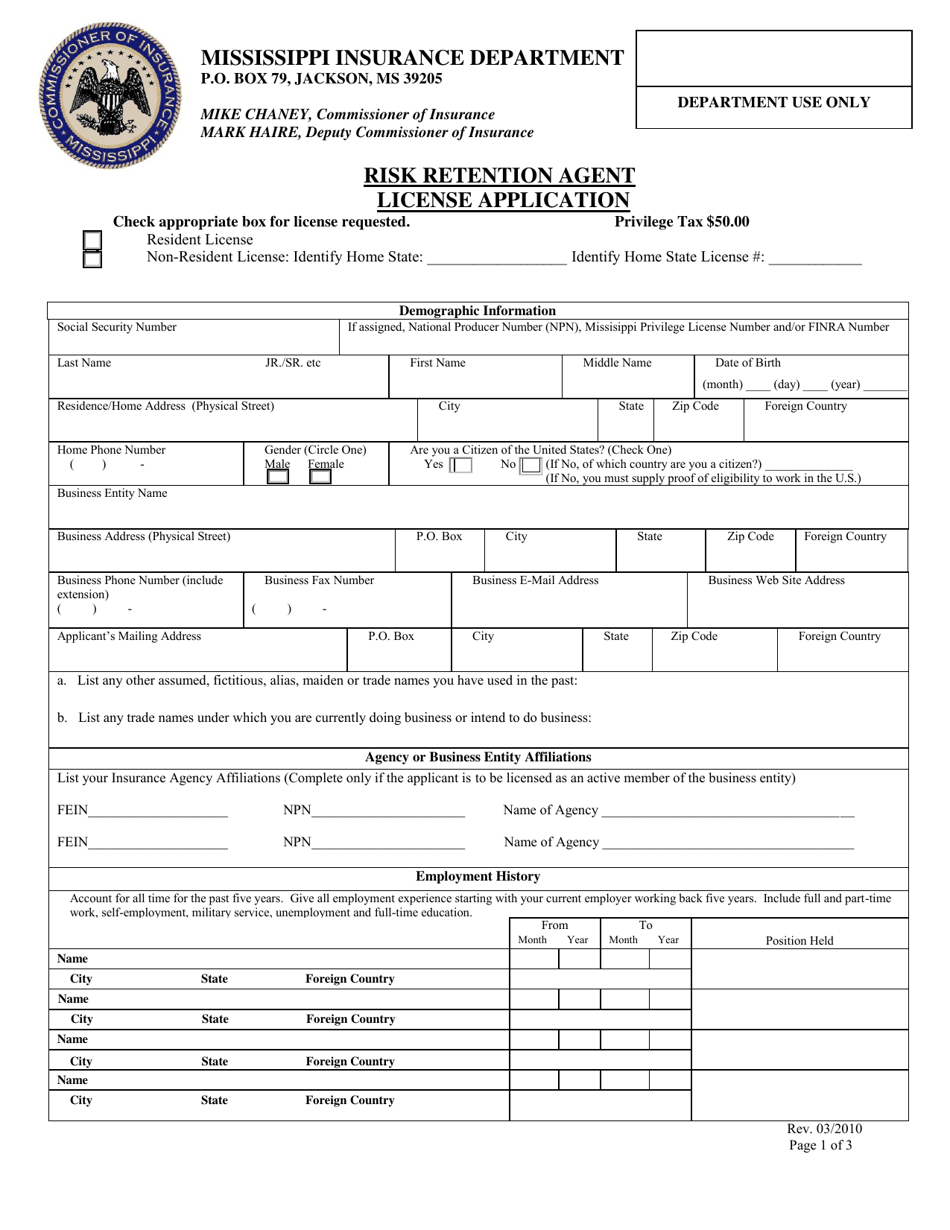

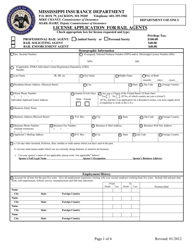

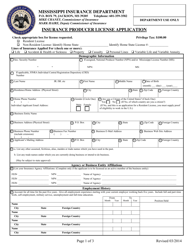

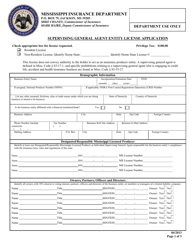

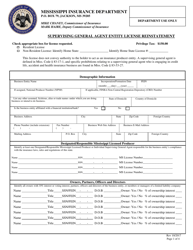

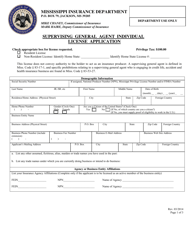

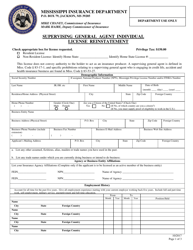

Risk Retention Agent License Application - Mississippi

Risk Retention Agent License Application is a legal document that was released by the Mississippi Department of Insurance - a government authority operating within Mississippi.

FAQ

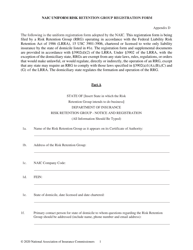

Q: What is a Risk Retention Agent License?

A: A Risk Retention Agent License is a license that allows an individual or entity to act as a risk retention agent in Mississippi.

Q: What is a risk retention agent?

A: A risk retention agent is an individual or entity that facilitates the formation and regulation of risk retention groups.

Q: Who needs a Risk Retention Agent License in Mississippi?

A: Any individual or entity that wishes to act as a risk retention agent in Mississippi needs a Risk Retention Agent License.

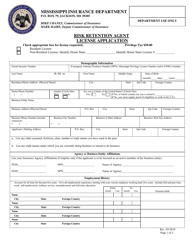

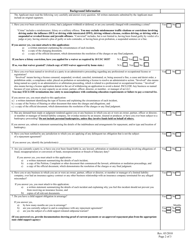

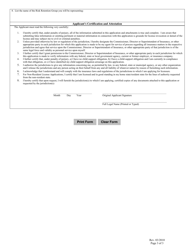

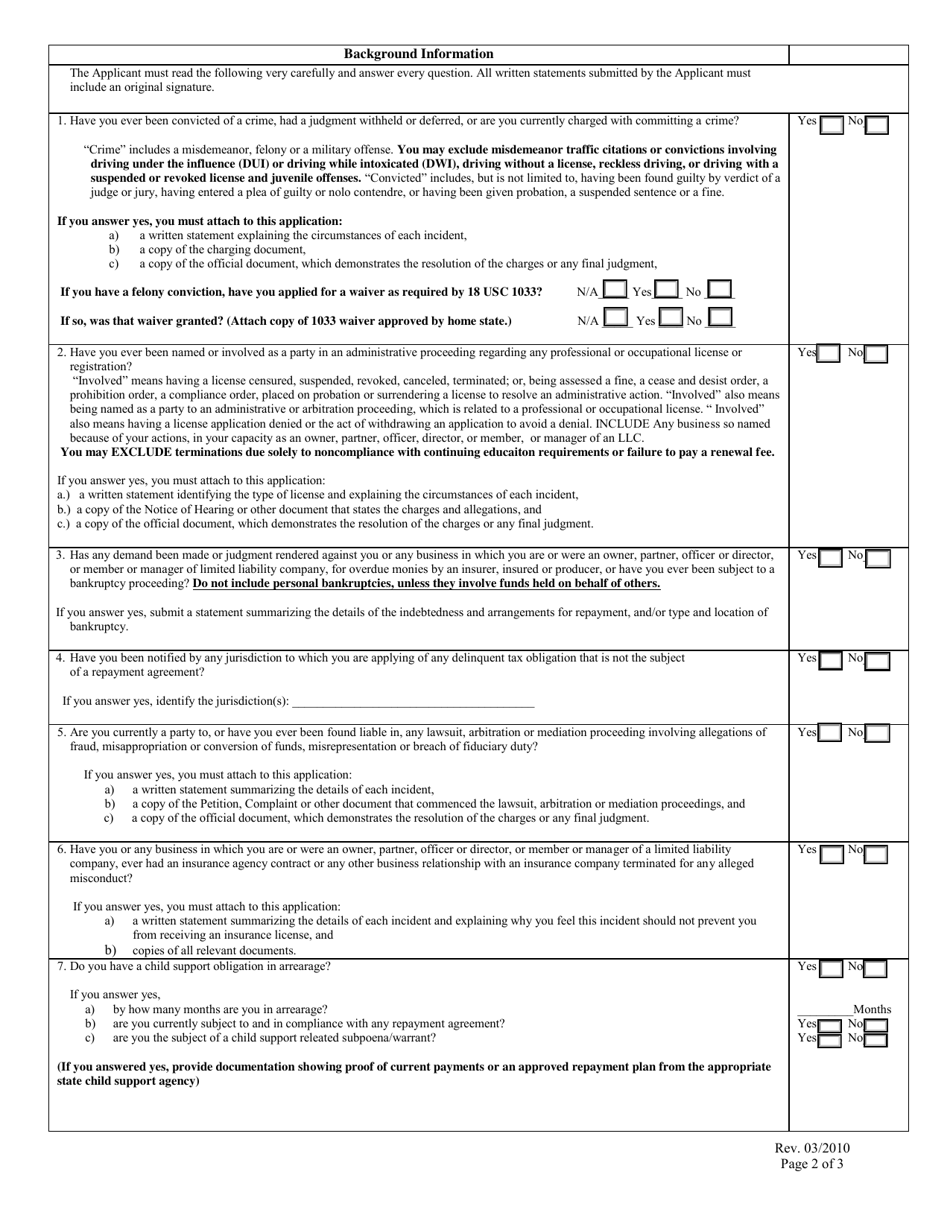

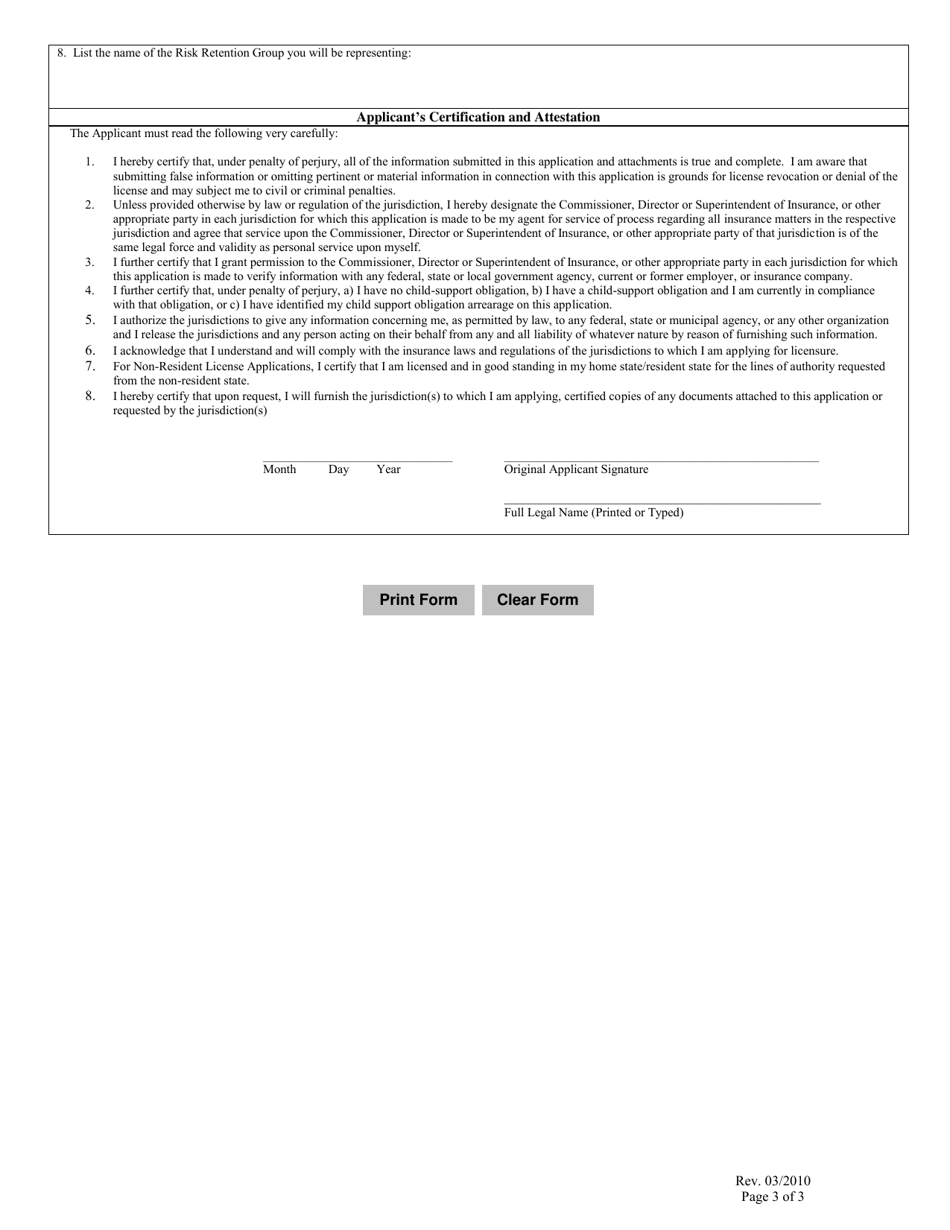

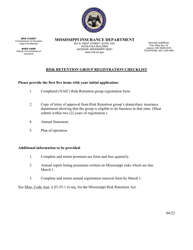

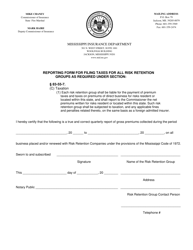

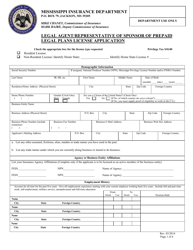

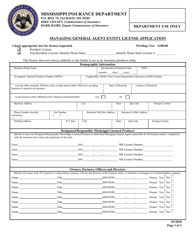

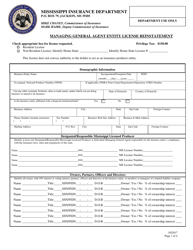

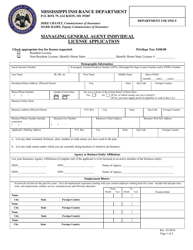

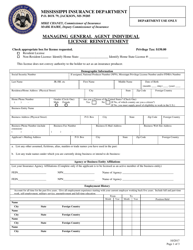

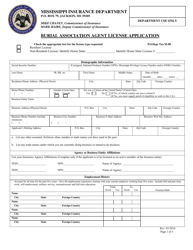

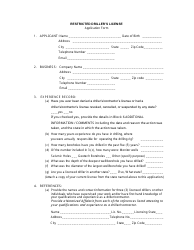

Q: How do I apply for a Risk Retention Agent License in Mississippi?

A: To apply for a Risk Retention Agent License in Mississippi, you need to complete a license application form, provide requested documentation, and pay the required fees.

Q: What documents do I need to provide with my Risk Retention Agent License application?

A: You will need to provide proof of your legal authority to act as a risk retention agent, a financial statement, and any other documentation required by the Mississippi Insurance Department.

Q: How much does it cost to apply for a Risk Retention Agent License in Mississippi?

A: The fee for a Risk Retention Agent License in Mississippi is $1,000.

Q: How long does it take to process a Risk Retention Agent License application in Mississippi?

A: The processing time for a Risk Retention Agent License application in Mississippi is typically 30-45 days.

Q: Once approved, how long is a Risk Retention Agent License valid for?

A: A Risk Retention Agent License in Mississippi is valid for two years.

Q: Can a Risk Retention Agent License be renewed?

A: Yes, a Risk Retention Agent License in Mississippi can be renewed by submitting a license renewal application and paying the required fees.

Form Details:

- Released on March 1, 2010;

- The latest edition currently provided by the Mississippi Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Mississippi Department of Insurance.