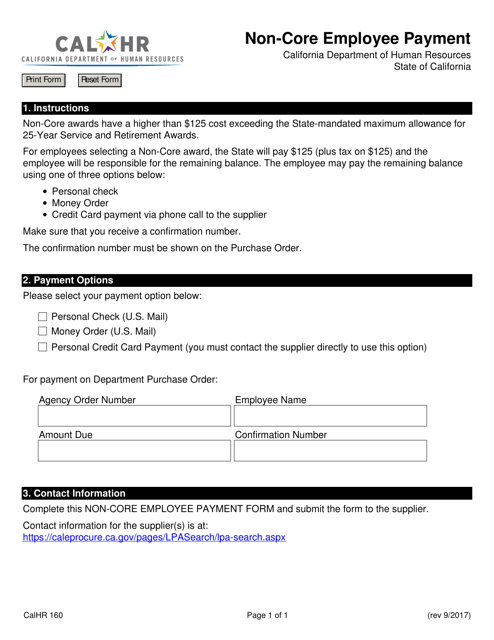

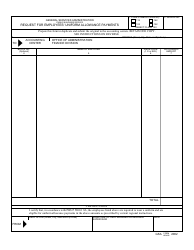

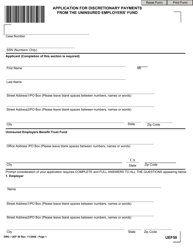

Form CALHR160 Non-core Employee Payment - California

What Is Form CALHR160?

This is a legal form that was released by the California Department of Human Resources - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

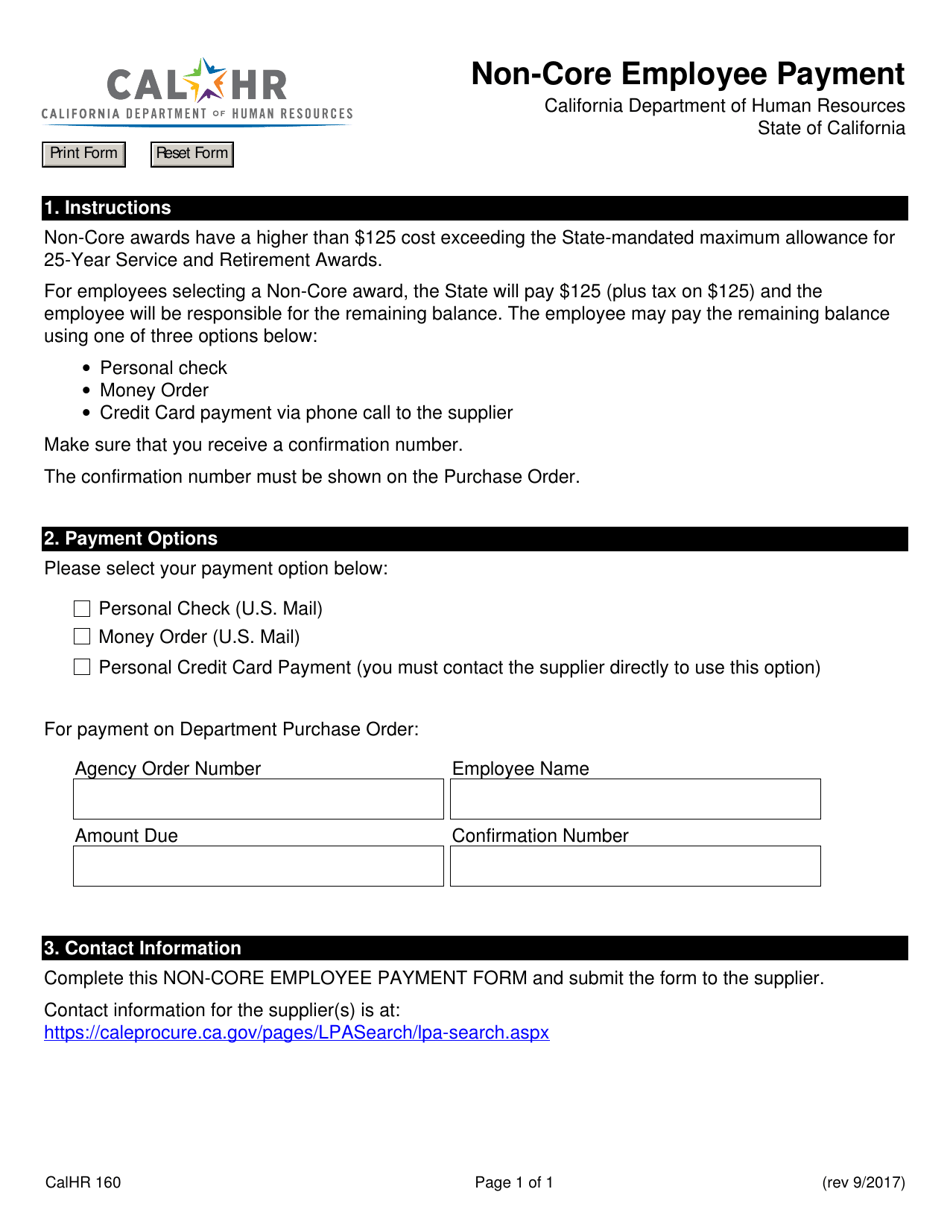

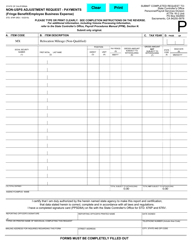

Q: What is the CALHR 160 Non-core Employee Payment form?

A: The CALHR 160 Non-core Employee Payment form is a form used by non-core employees in California for reporting additional payments outside of their regular salary.

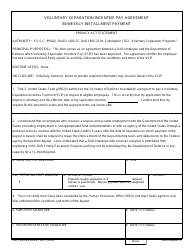

Q: Who uses the CALHR 160 Non-core Employee Payment form?

A: Non-core employees in California use the CALHR 160 Non-core Employee Payment form.

Q: What kind of payments need to be reported on the CALHR 160 form?

A: Any additional payments received by non-core employees in California, such as overtime pay, shift differentials, or one-time bonuses, need to be reported on the CALHR 160 form.

Q: How do I fill out the CALHR 160 Non-core Employee Payment form?

A: The CALHR 160 Non-core Employee Payment form requires you to provide information about the type of payment, the date of payment, and the amount. You will also need to provide your personal information and employee identification number.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the California Department of Human Resources;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CALHR160 by clicking the link below or browse more documents and templates provided by the California Department of Human Resources.