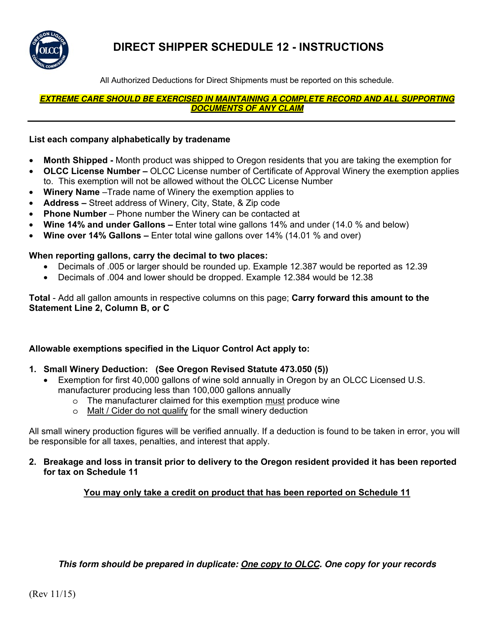

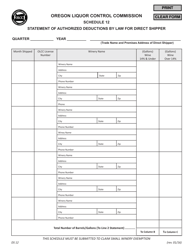

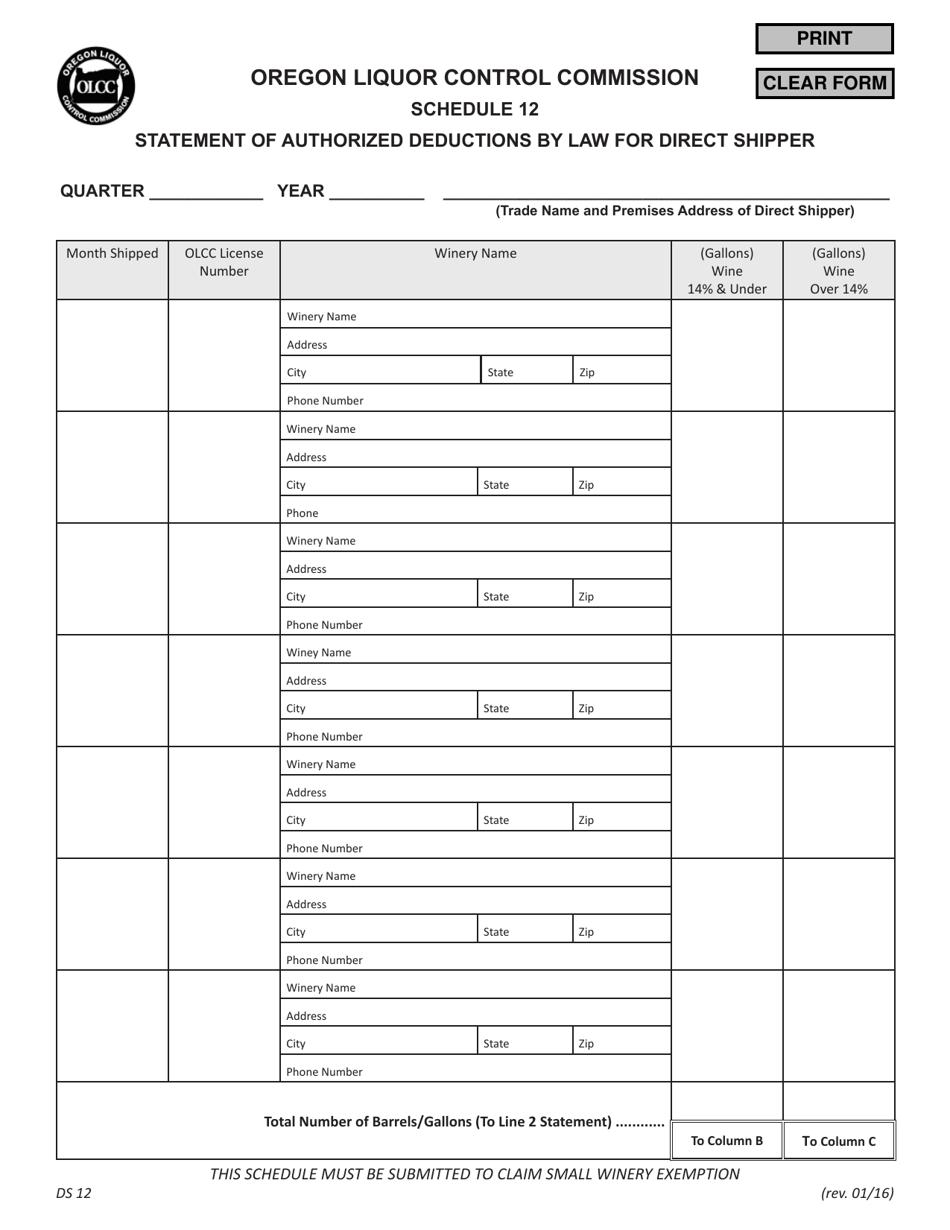

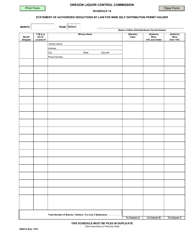

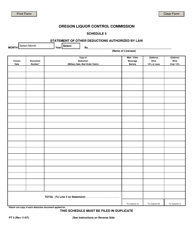

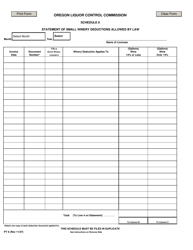

Schedule 12 Statement of Authorized Deductions by Law for Direct Shipper - Oregon

What Is Schedule 12?

This is a legal form that was released by the Oregon Liquor and Cannabis Commission - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule 12?

A: Schedule 12 is a statement of authorized deductions by law for direct shippers in Oregon.

Q: What is a direct shipper?

A: A direct shipper is someone who ships alcoholic beverages directly to consumers in Oregon.

Q: What are authorized deductions by law?

A: Authorized deductions by law are deductions that direct shippers can legally make on their tax returns in Oregon.

Q: Why do direct shippers need Schedule 12?

A: Direct shippers need Schedule 12 to report their authorized deductions on their tax returns in Oregon.

Q: What information is included in Schedule 12?

A: Schedule 12 includes information about the authorized deductions made by direct shippers in Oregon.

Q: Who is required to file Schedule 12?

A: Direct shippers in Oregon are required to file Schedule 12.

Q: Is Schedule 12 specific to Oregon?

A: Yes, Schedule 12 is specific to direct shippers in Oregon.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Oregon Liquor and Cannabis Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule 12 by clicking the link below or browse more documents and templates provided by the Oregon Liquor and Cannabis Commission.