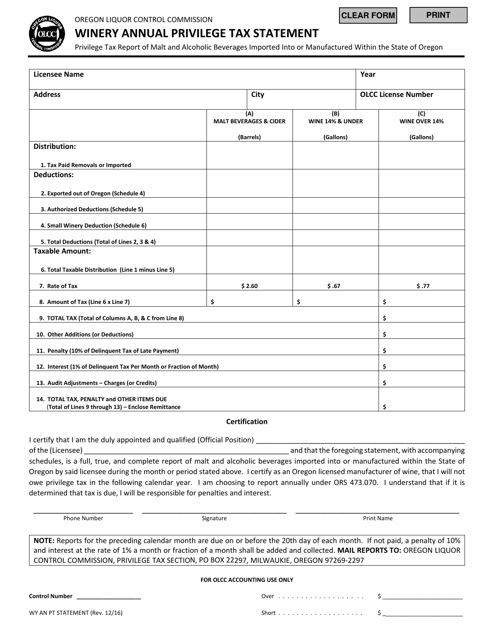

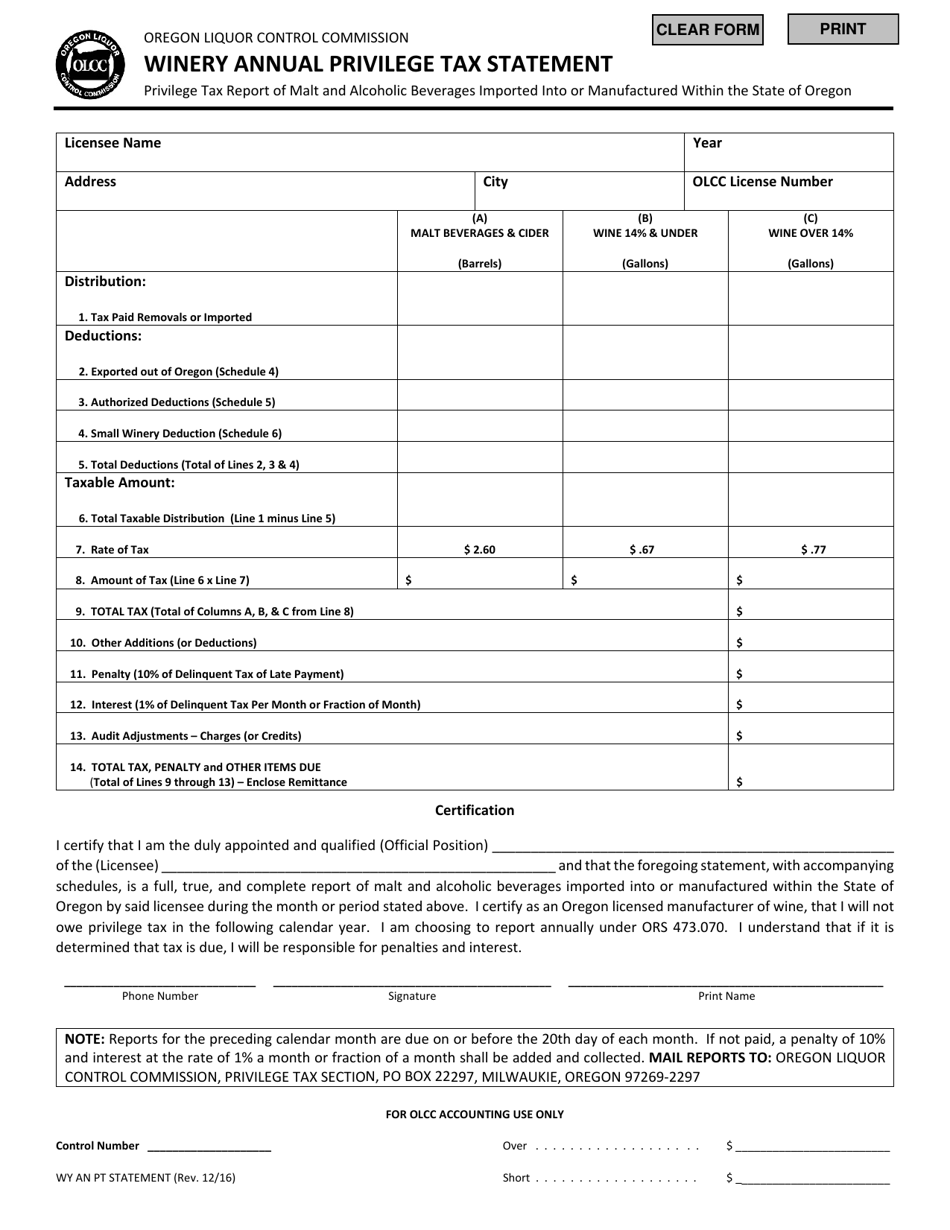

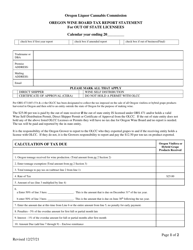

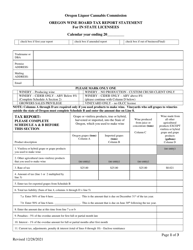

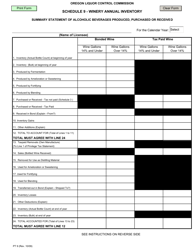

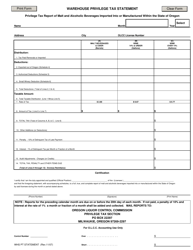

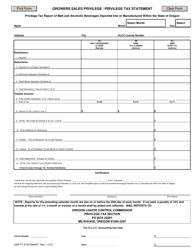

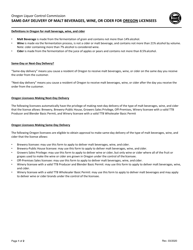

Winery Annual Privilege Tax Statement - Oregon

Winery Annual Privilege Tax Statement is a legal document that was released by the Oregon Liquor and Cannabis Commission - a government authority operating within Oregon.

FAQ

Q: What is the Winery Annual Privilege Tax Statement?

A: The Winery Annual Privilege Tax Statement is a tax statement that wineries in Oregon need to file.

Q: Who needs to file the Winery Annual Privilege Tax Statement?

A: Wineries in Oregon need to file the Winery Annual Privilege Tax Statement.

Q: What is the purpose of the Winery Annual Privilege Tax Statement?

A: The purpose of the Winery Annual Privilege Tax Statement is to report and pay the annual privilege tax for wineries in Oregon.

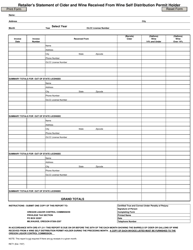

Q: When is the deadline for filing the Winery Annual Privilege Tax Statement?

A: The deadline for filing the Winery Annual Privilege Tax Statement is determined by the Oregon Department of Revenue and can vary each year.

Q: What happens if a winery fails to file the Winery Annual Privilege Tax Statement?

A: If a winery fails to file the Winery Annual Privilege Tax Statement, they may face penalties and interest charges.

Q: Are there any exemptions or deductions available for wineries when filing the Winery Annual Privilege Tax Statement?

A: There may be exemptions or deductions available for wineries when filing the Winery Annual Privilege Tax Statement. It is advisable to consult with a tax professional or refer to the guidelines provided by the Oregon Department of Revenue.

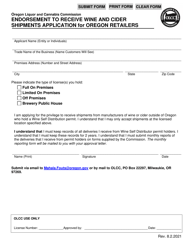

Form Details:

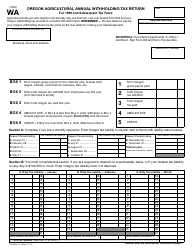

- Released on December 1, 2016;

- The latest edition currently provided by the Oregon Liquor and Cannabis Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oregon Liquor and Cannabis Commission.