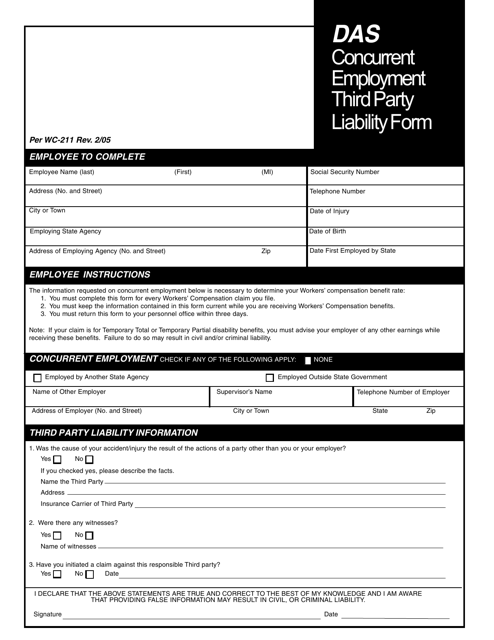

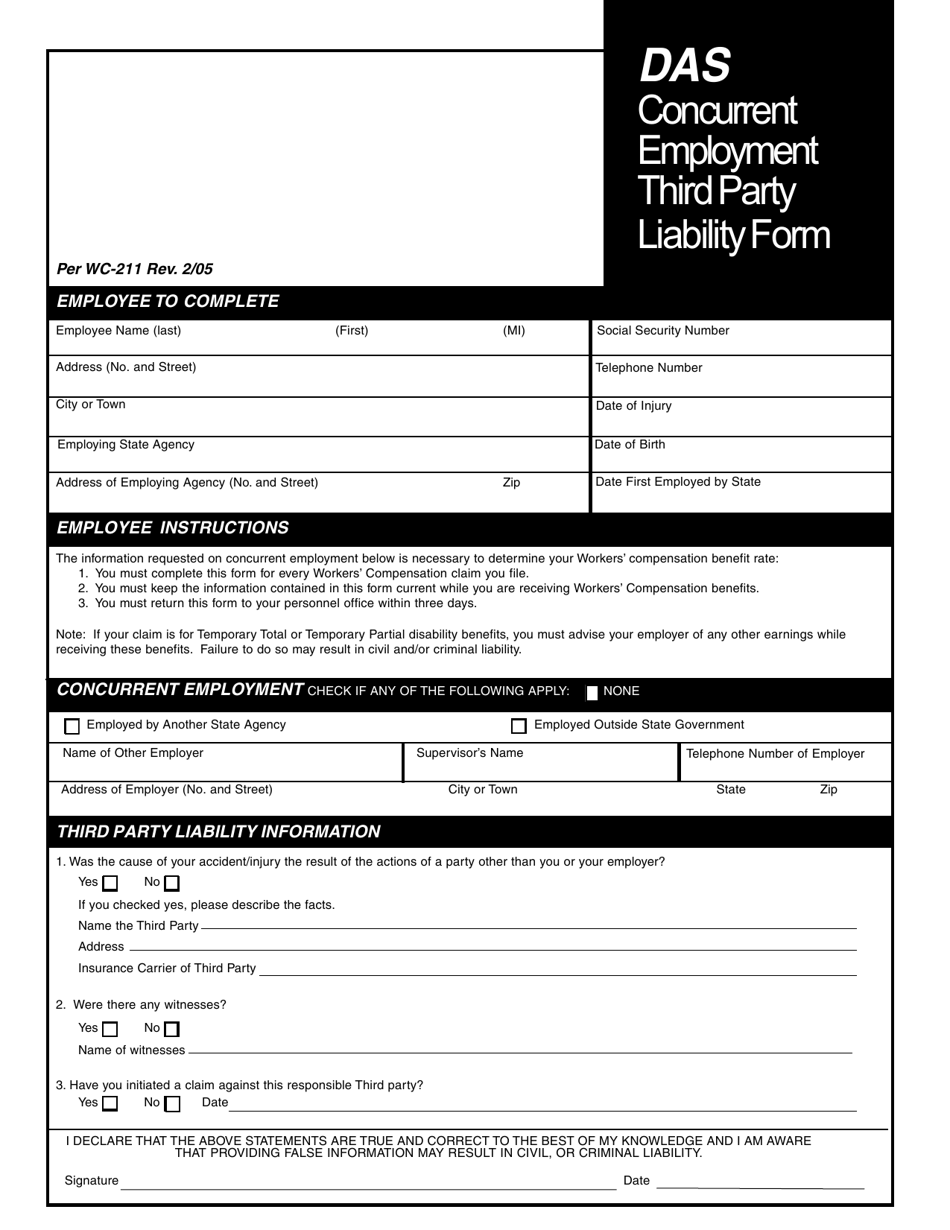

Form WC-211 Concurrent Employment Third Party Liability Form - Connecticut

What Is Form WC-211?

This is a legal form that was released by the Connecticut Department of Administrative Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WC-211?

A: Form WC-211 is the Concurrent Employment Third Party Liability Form in Connecticut.

Q: What is the purpose of Form WC-211?

A: The purpose of Form WC-211 is to provide notification of concurrent employment in workers' compensation cases.

Q: What is meant by concurrent employment?

A: Concurrent employment refers to having multiple jobs at the same time.

Q: Why is it important to complete Form WC-211?

A: Completing Form WC-211 is important to ensure proper coordination of workers' compensation benefits in cases of concurrent employment.

Q: Who needs to complete Form WC-211?

A: Both the primary employer (the employer where the employee works the majority of the time) and the secondary employer (the employer for the concurrent job) need to complete Form WC-211.

Q: When should Form WC-211 be completed?

A: Form WC-211 should be completed as soon as it is known that the employee has concurrent employment.

Q: Are there any penalties for not completing Form WC-211?

A: Failure to complete Form WC-211 may result in a penalty of up to $250 per incident, as well as potential liability for workers' compensation benefits.

Q: Is Form WC-211 specific to Connecticut?

A: Yes, Form WC-211 is specific to the state of Connecticut and its workers' compensation system.

Form Details:

- Released on February 1, 2005;

- The latest edition provided by the Connecticut Department of Administrative Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WC-211 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Administrative Services.