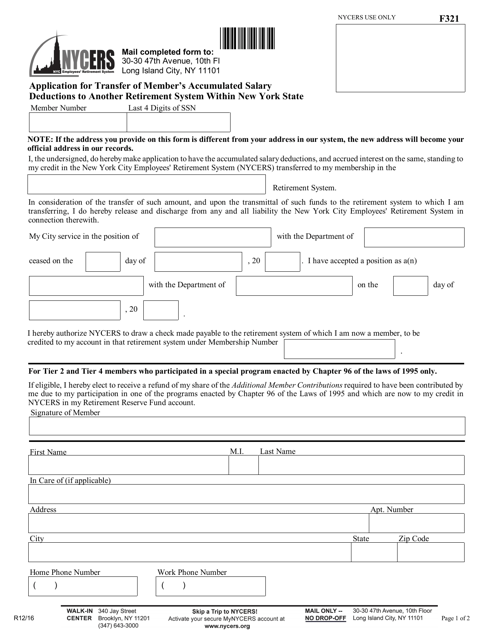

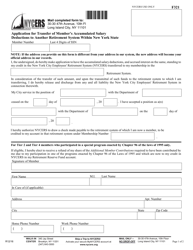

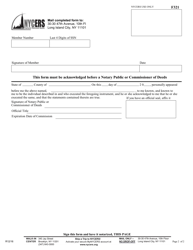

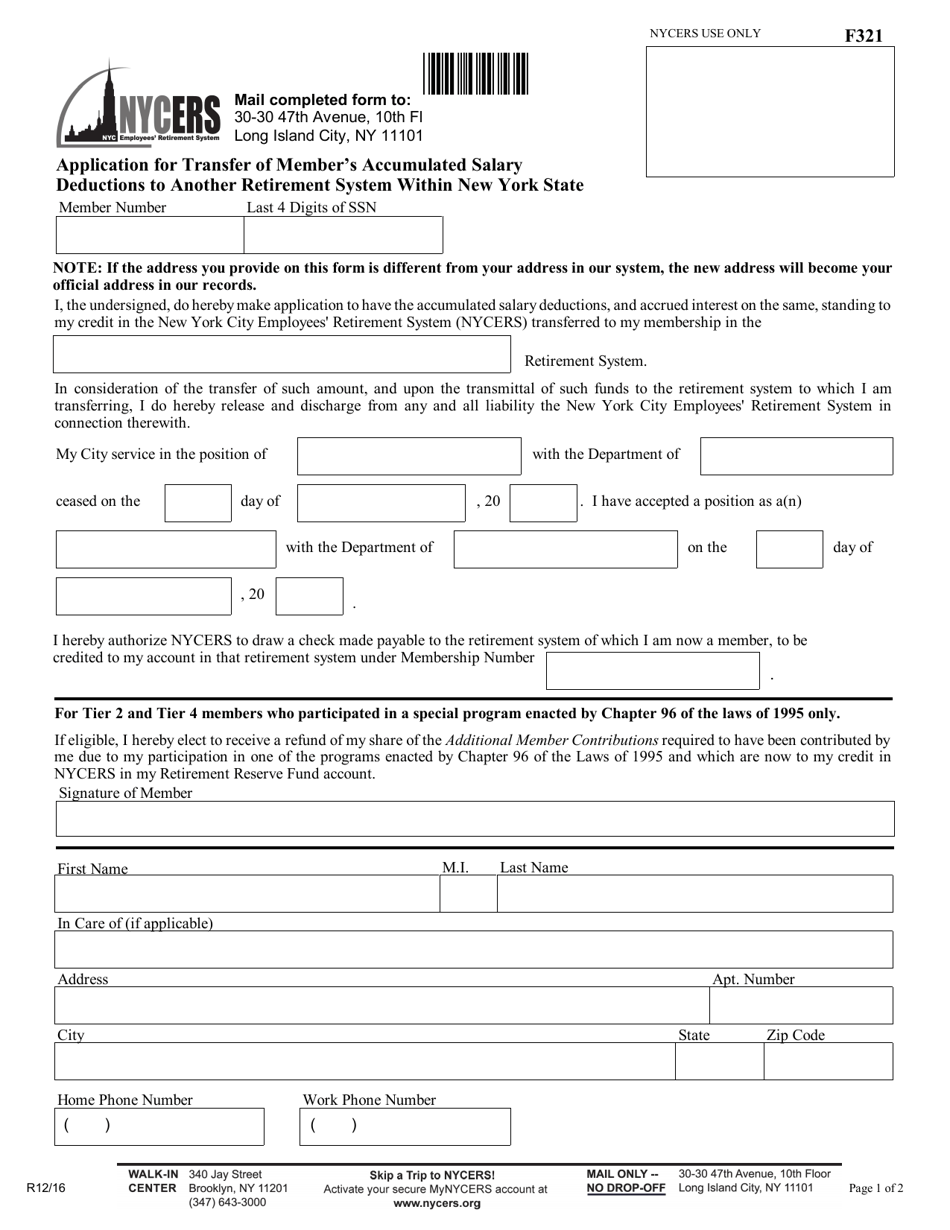

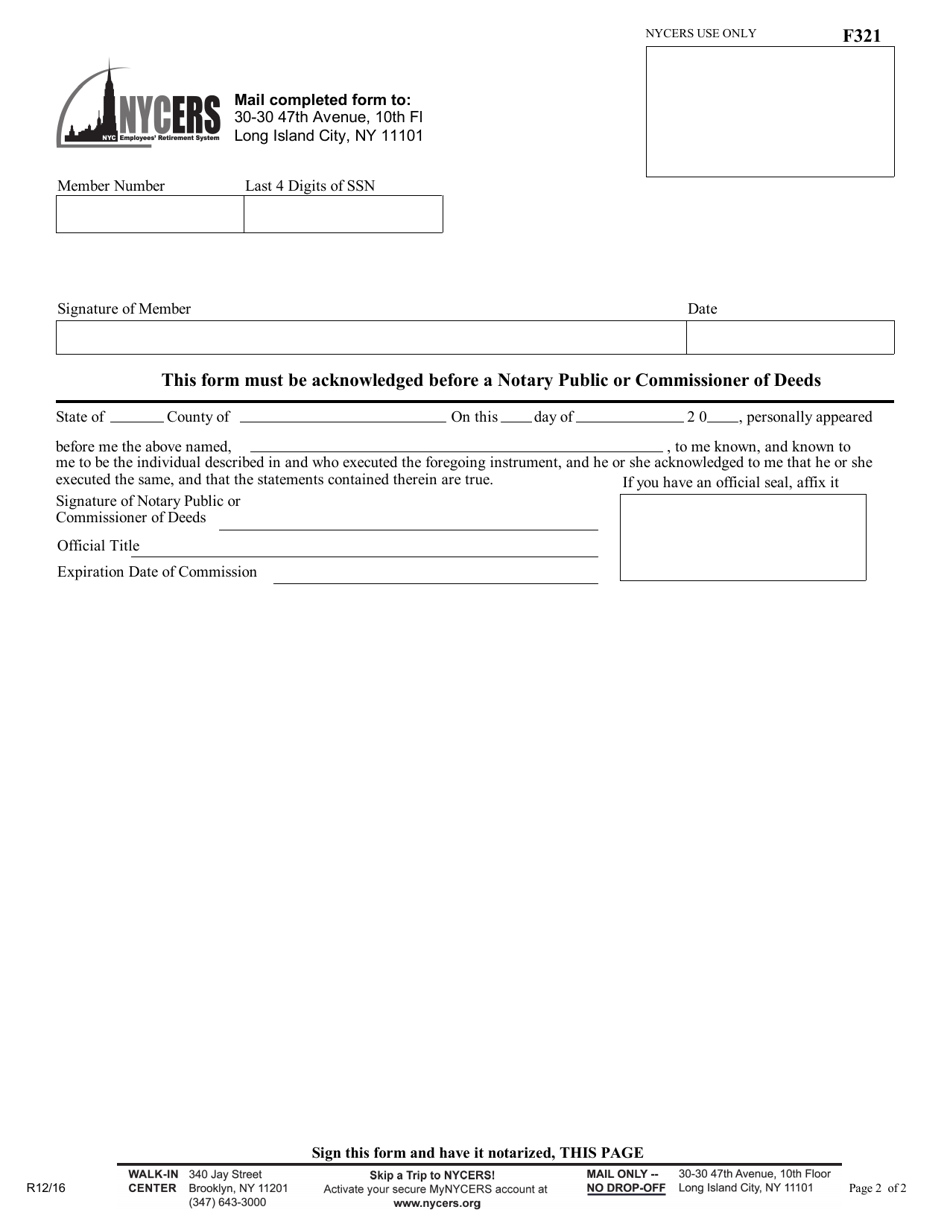

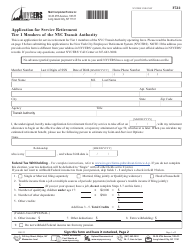

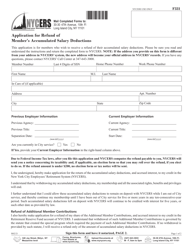

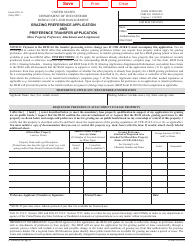

Form F321 Application for Transfer of Member's Accumulated Salary Deductions to Another Retirement System Within New York State - New York City

What Is Form F321?

This is a legal form that was released by the New York City Employees' Retirement System - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F321?

A: Form F321 is an application for transferring a member's accumulated salary deductions to another retirement system within New York State - New York City.

Q: Who is eligible to use Form F321?

A: Any member who wants to transfer their accumulated salary deductions to another retirement system within New York State - New York City can use Form F321.

Q: What is the purpose of transferring member's accumulated salary deductions?

A: The purpose of transferring member's accumulated salary deductions is to move the funds to another retirement system within New York State - New York City.

Q: Is there a fee for transferring member's accumulated salary deductions?

A: There may be a nominal fee associated with transferring member's accumulated salary deductions, which can be found in the instructions of Form F321.

Q: Are there any specific guidelines for completing Form F321?

A: Yes, there are specific guidelines provided in the instructions of Form F321. It is important to read and follow the instructions carefully when filling out the form.

Q: Can I transfer my accumulated salary deductions to a retirement system outside of New York State - New York City?

A: No, Form F321 is specifically for transferring member's accumulated salary deductions to another retirement system within New York State - New York City.

Q: What is the deadline for submitting Form F321?

A: The deadline for submitting Form F321 may vary, so it is recommended to check with the retirement system to determine the specific deadline.

Q: Is there any additional documentation required along with Form F321?

A: There may be additional documentation required, depending on the specific circumstances. It is best to consult the retirement system or the instructions of Form F321 for more information.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the New York City Employees' Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form F321 by clicking the link below or browse more documents and templates provided by the New York City Employees' Retirement System.