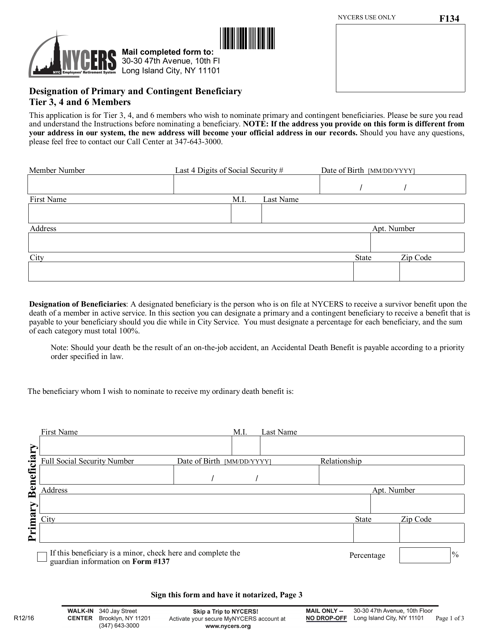

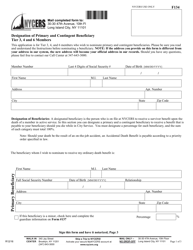

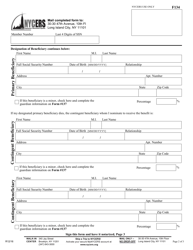

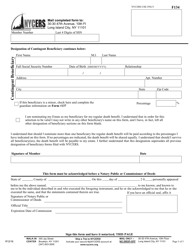

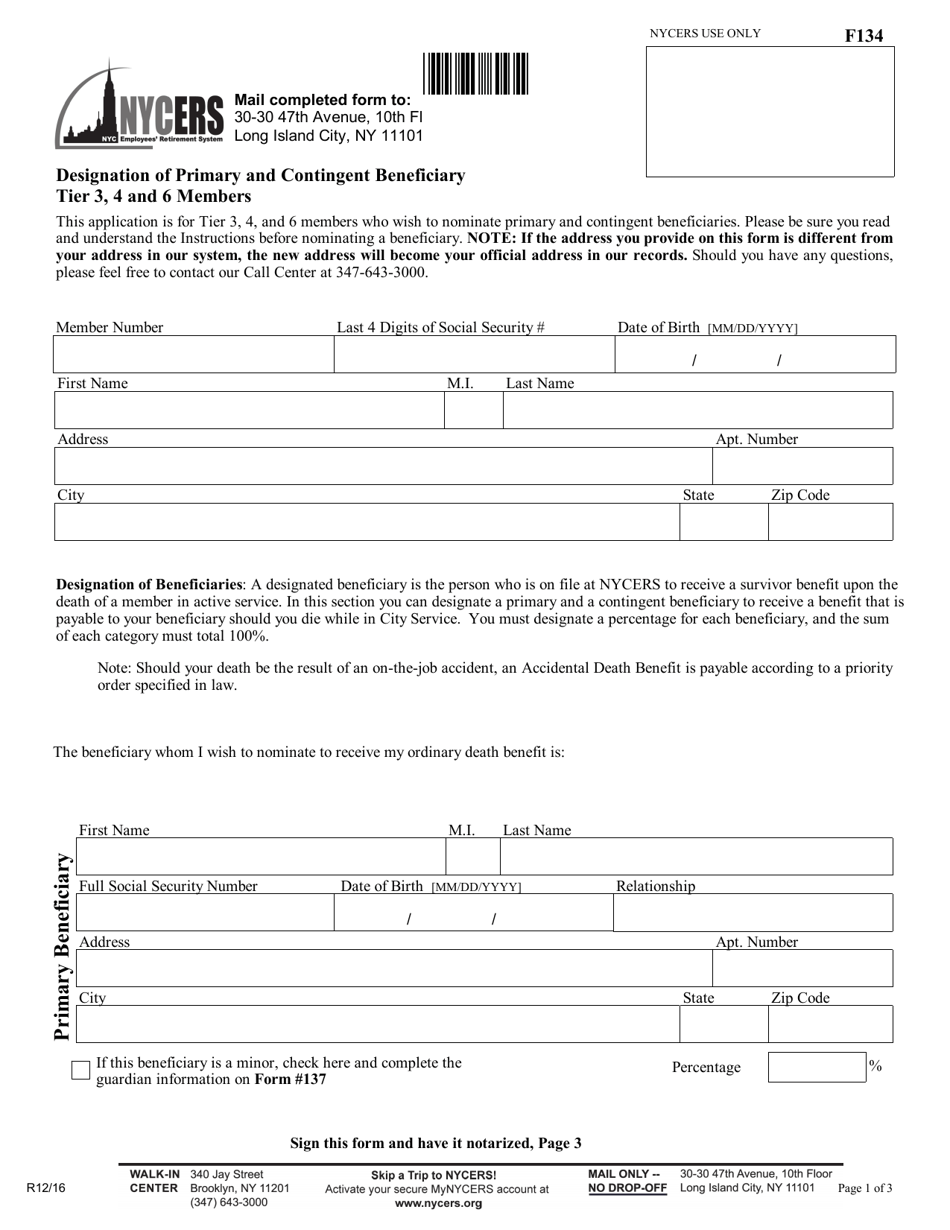

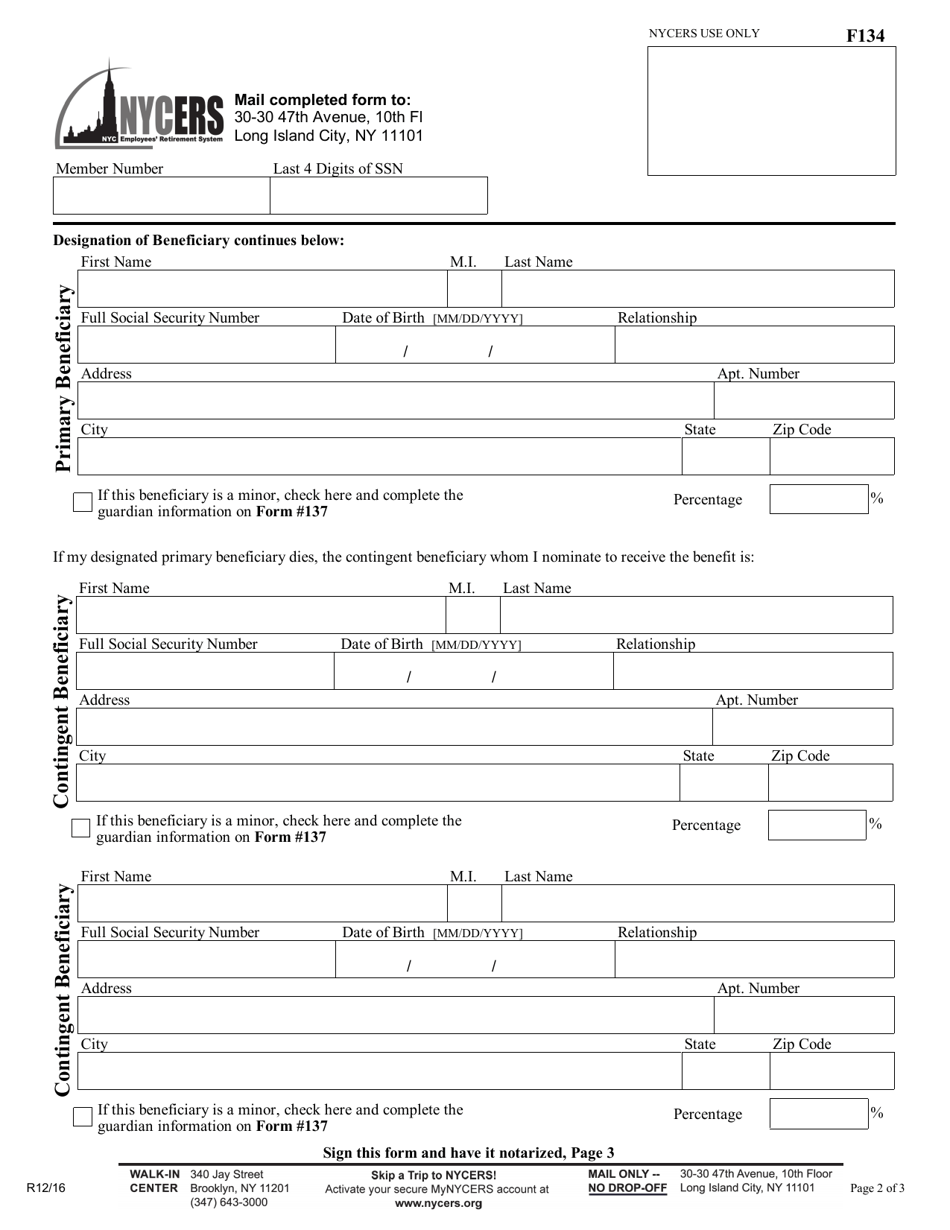

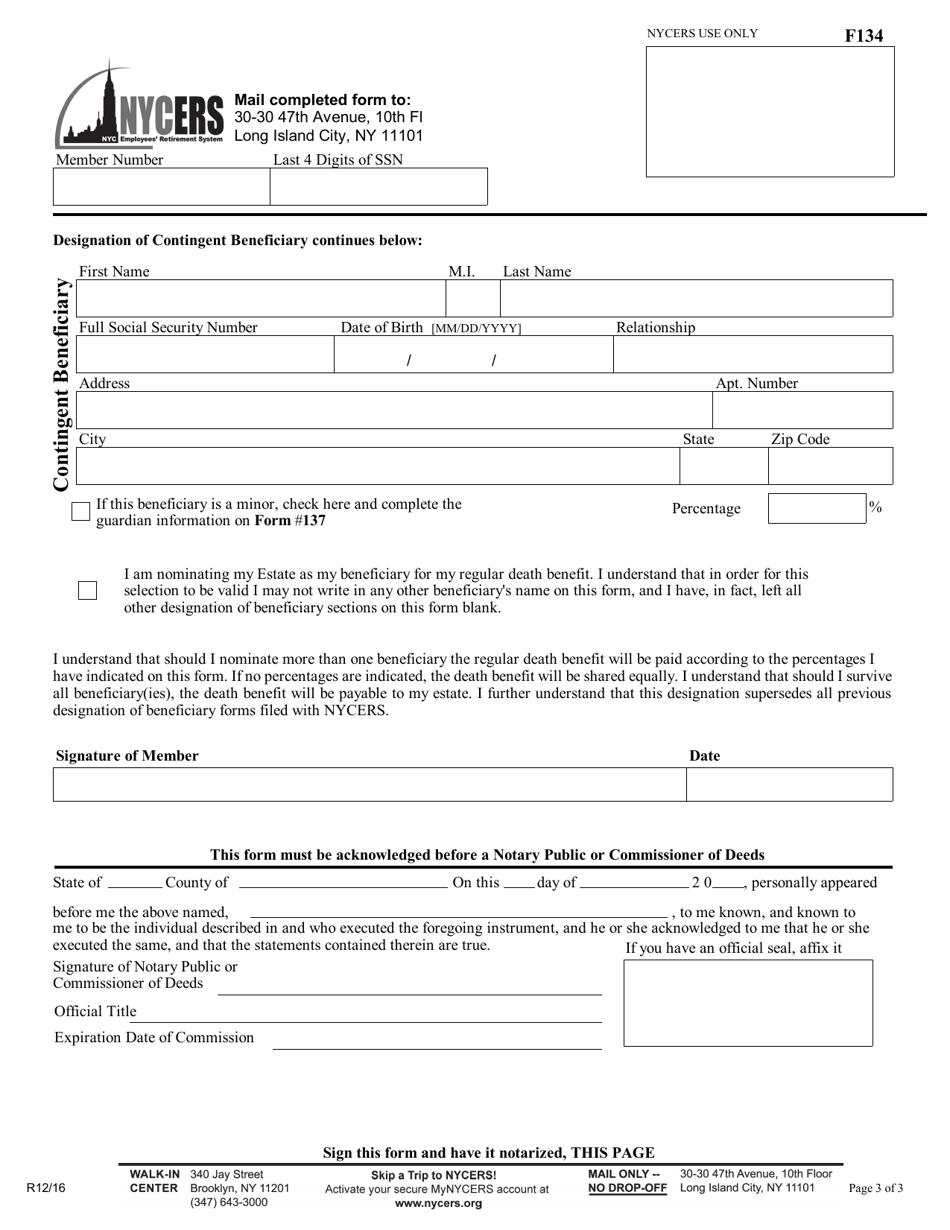

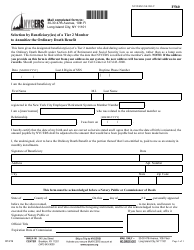

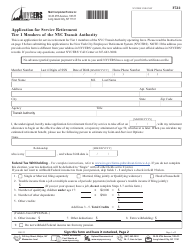

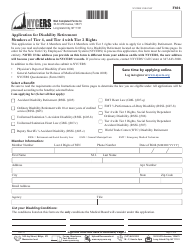

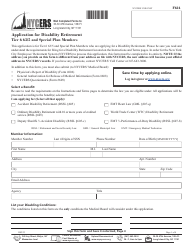

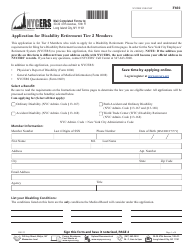

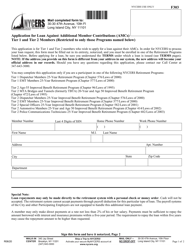

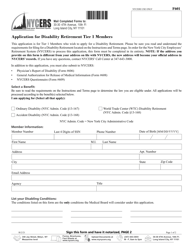

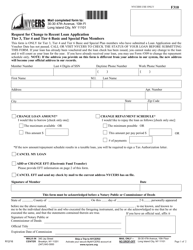

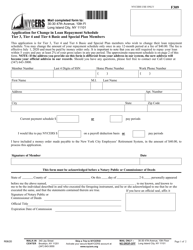

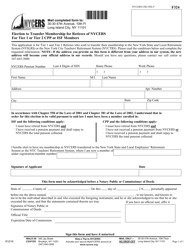

Form F134 Designation of Primary and Contingent Beneficiary Tier 3, 4 and 6 Members - New York City

What Is Form F134?

This is a legal form that was released by the New York City Employees' Retirement System - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F134?

A: Form F134 is the Designation of Primary and Contingent Beneficiary form for Tier 3, 4, and 6 members in New York City.

Q: Who needs to fill out Form F134?

A: Tier 3, 4, and 6 members in New York City need to fill out Form F134 if they want to designate their primary and contingent beneficiaries.

Q: What is the purpose of Form F134?

A: The purpose of Form F134 is to allow Tier 3, 4, and 6 members in New York City to designate who will receive their benefits in the event of their death.

Q: Can I change my beneficiaries after submitting Form F134?

A: Yes, you can change your beneficiaries at any time by submitting a new Form F134 to NYCERS.

Q: Are there any guidelines for choosing beneficiaries on Form F134?

A: There are no specific guidelines for choosing beneficiaries on Form F134. However, it is important to carefully consider who you want to receive your benefits after your death.

Q: Is Form F134 required to receive benefits as a Tier 3, 4, or 6 member?

A: Form F134 is not required to receive benefits as a Tier 3, 4, or 6 member, but it is recommended to ensure that your benefits are distributed according to your wishes.

Q: What happens if I don't fill out Form F134?

A: If you don't fill out Form F134, your benefits will be distributed according to the default rules established by NYCERS, which may not align with your wishes.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the New York City Employees' Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form F134 by clicking the link below or browse more documents and templates provided by the New York City Employees' Retirement System.