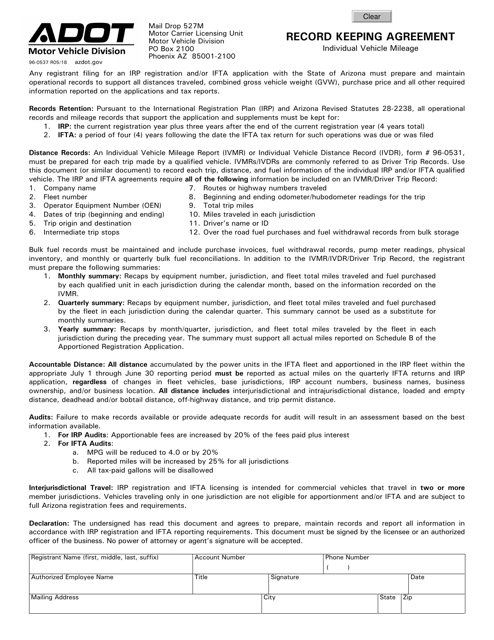

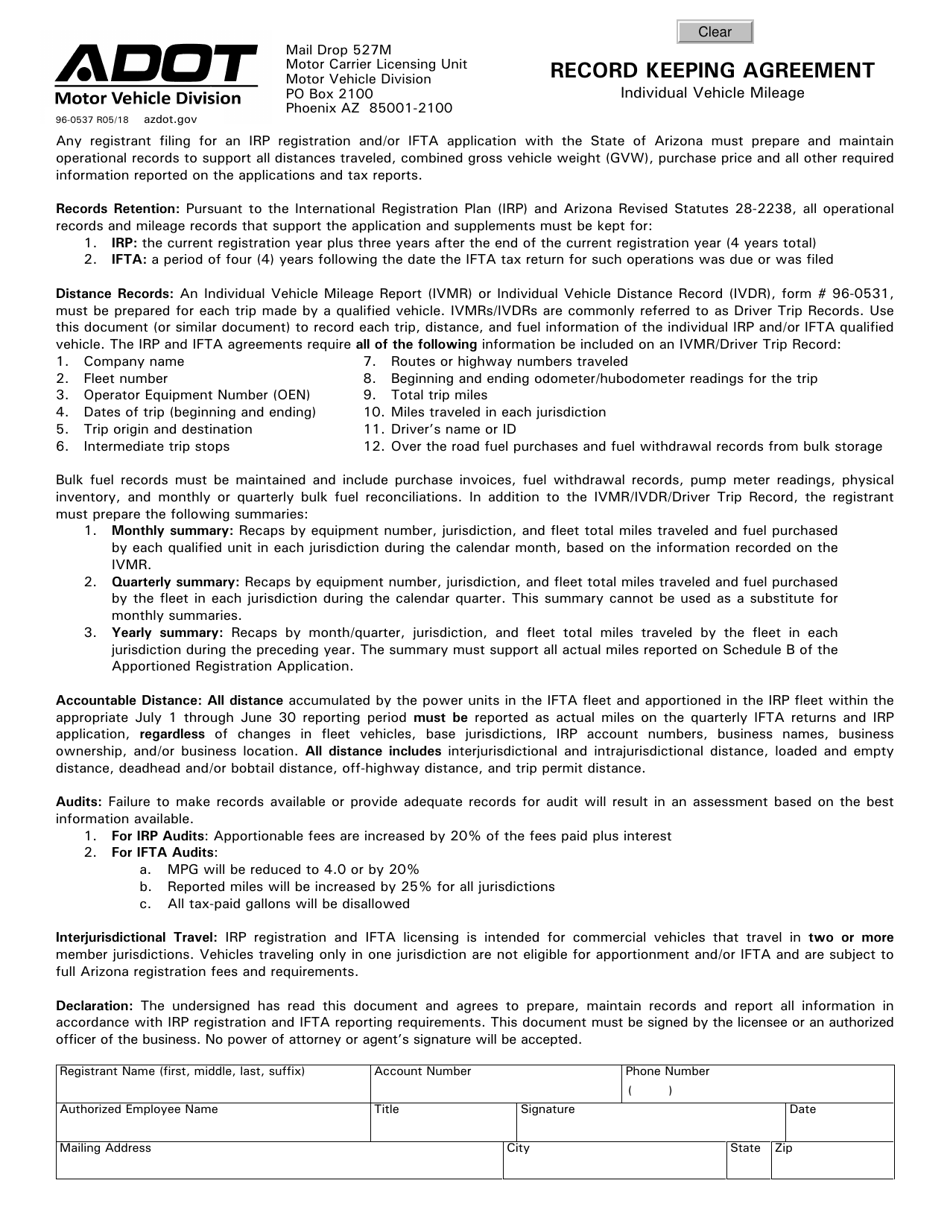

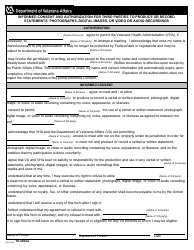

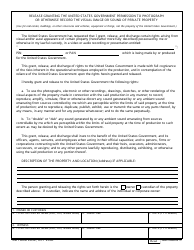

Form 96-0537 Record Keeping Agreement - Arizona

What Is Form 96-0537?

This is a legal form that was released by the Arizona Department of Transportation - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 96-0537?

A: Form 96-0537 is a Record Keeping Agreement in Arizona.

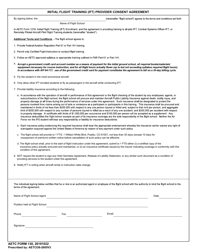

Q: What is the purpose of Form 96-0537?

A: The purpose of Form 96-0537 is to establish an agreement between a taxpayer and the Arizona Department of Revenue regarding the retention and maintenance of tax records.

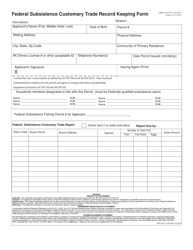

Q: Who needs to fill out Form 96-0537?

A: Taxpayers in Arizona who are subject to tax laws and regulations are required to fill out Form 96-0537.

Q: What information is required on Form 96-0537?

A: Form 96-0537 requires the taxpayer's name, address, business identification number, and details about the types of records that will be retained.

Q: How long should records be kept as per Form 96-0537?

A: Form 96-0537 requires taxpayers to keep tax records for a minimum of 4 years from the due date of the tax return or the date it was filed, whichever is later.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Arizona Department of Transportation;

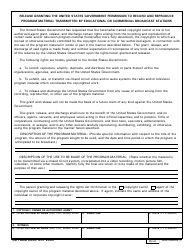

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 96-0537 by clicking the link below or browse more documents and templates provided by the Arizona Department of Transportation.