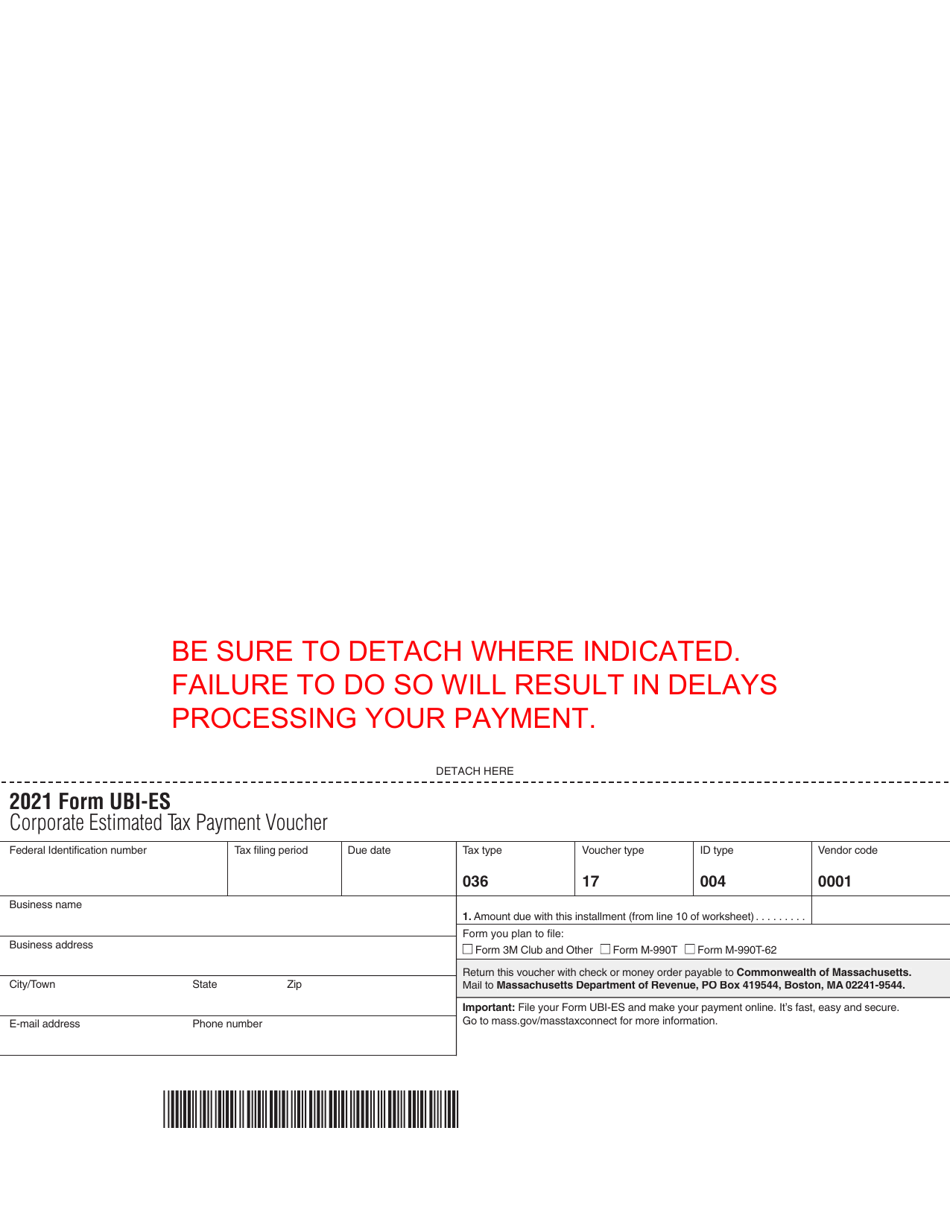

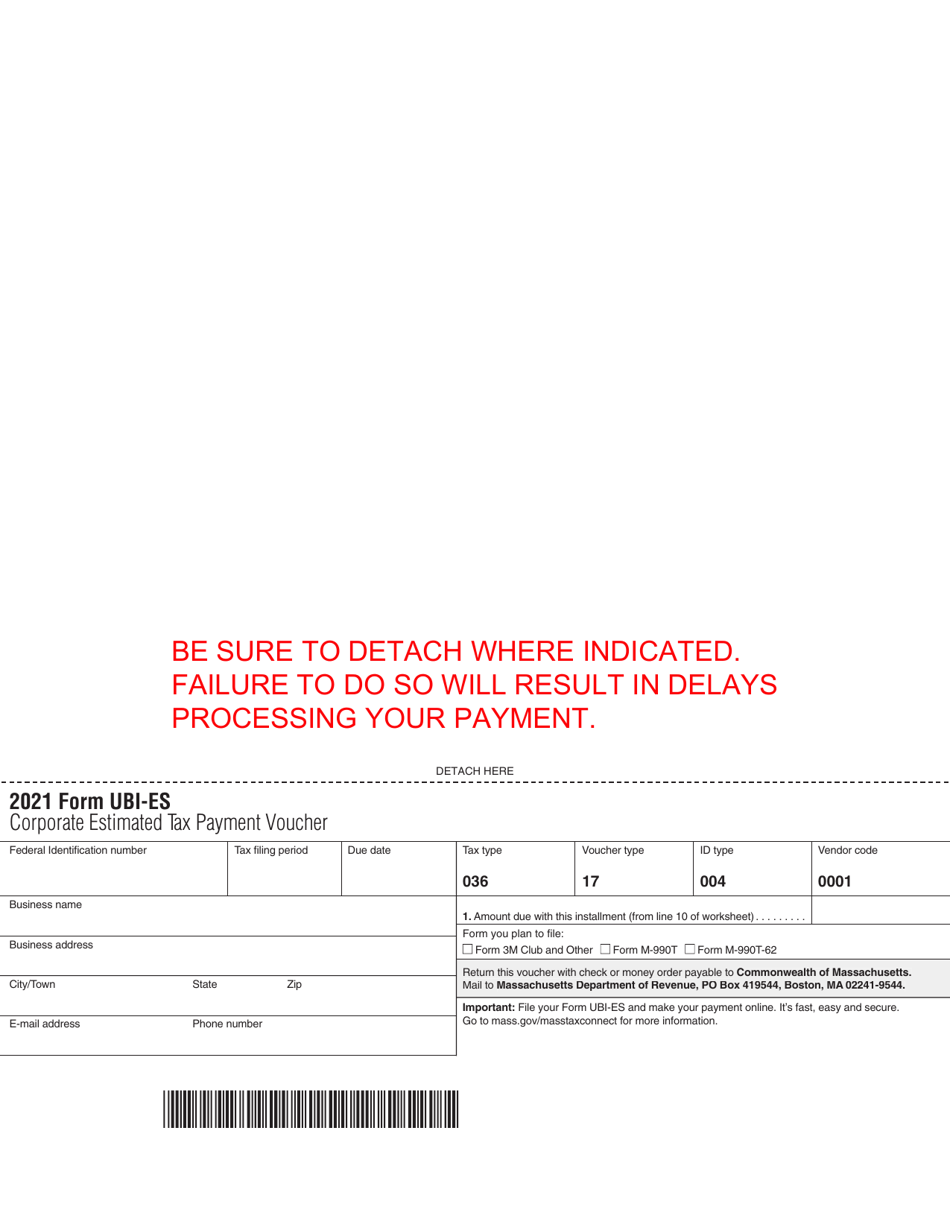

This version of the form is not currently in use and is provided for reference only. Download this version of

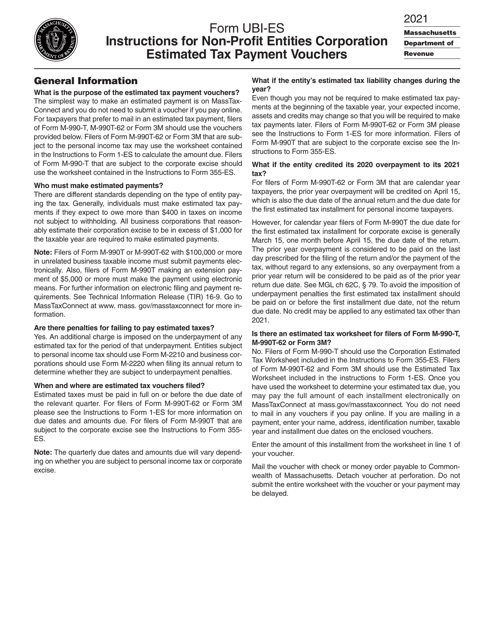

Form UBI-ES

for the current year.

Form UBI-ES Non-profit Entities Corporation Estimated Tax Payment Vouchers - Massachusetts

What Is Form UBI-ES?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is UBI?

A: UBI stands for Unrelated Business Income. It refers to income generated by a non-profit organization from activities not directly related to its tax-exempt purpose.

Q: What is an ES voucher?

A: ES voucher stands for Estimated Tax Payment Voucher. It is used by non-profit organizations to make estimated tax payments to the state of Massachusetts.

Q: What are Non-profit Entities Corporation Estimated Tax Payment Vouchers?

A: These vouchers are used by non-profit entities in Massachusetts to remit estimated tax payments on any unrelated business income they have earned.

Q: Who needs to use these vouchers?

A: Non-profit organizations in Massachusetts that have earned unrelated business income and need to make estimated tax payments.

Q: What is the purpose of making estimated tax payments?

A: Making estimated tax payments allows non-profit organizations to pay their tax liability throughout the year, rather than in a lump sum at tax time.

Q: When are the estimated tax payments due?

A: The due dates for estimated tax payments vary. It is advisable to consult the Massachusetts Department of Revenue for the specific due dates.

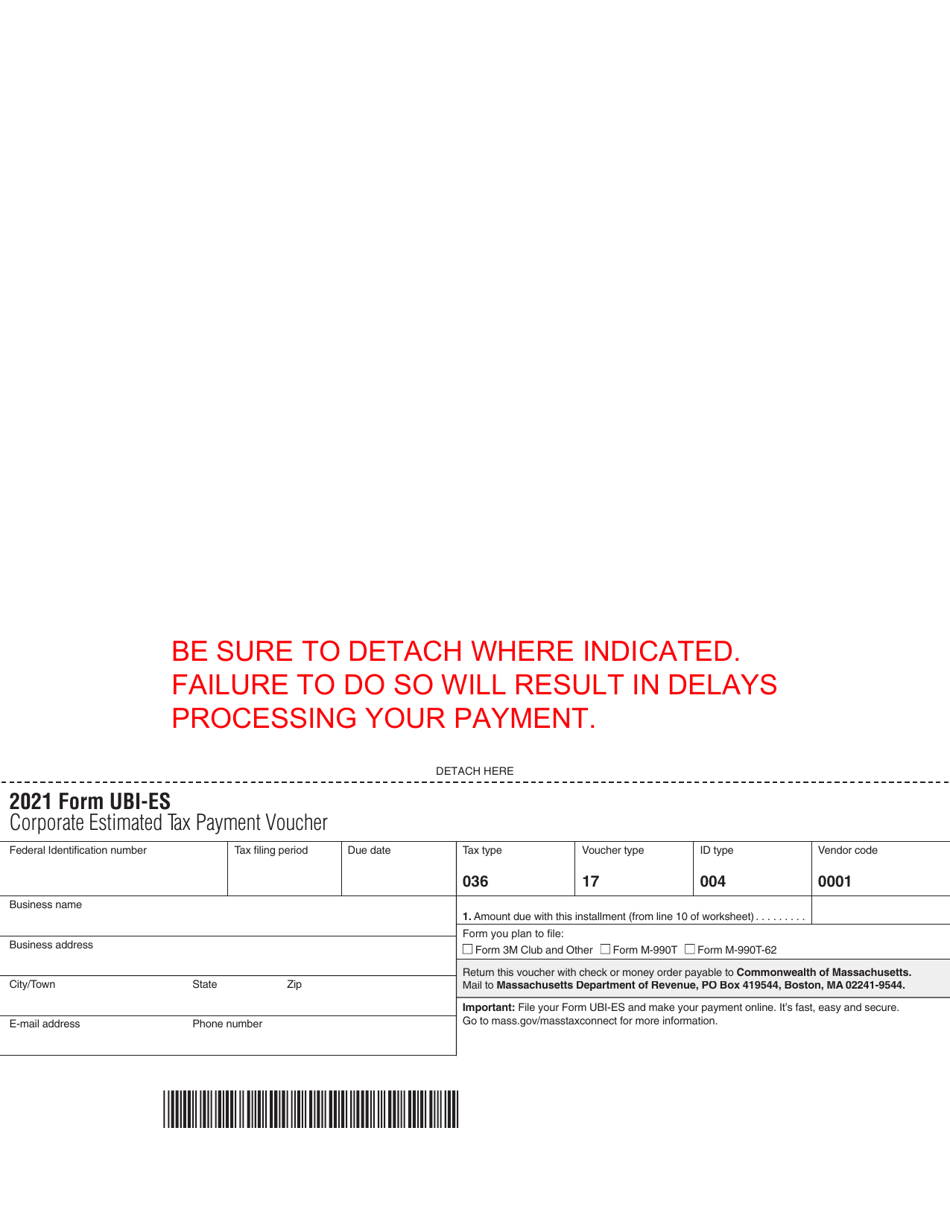

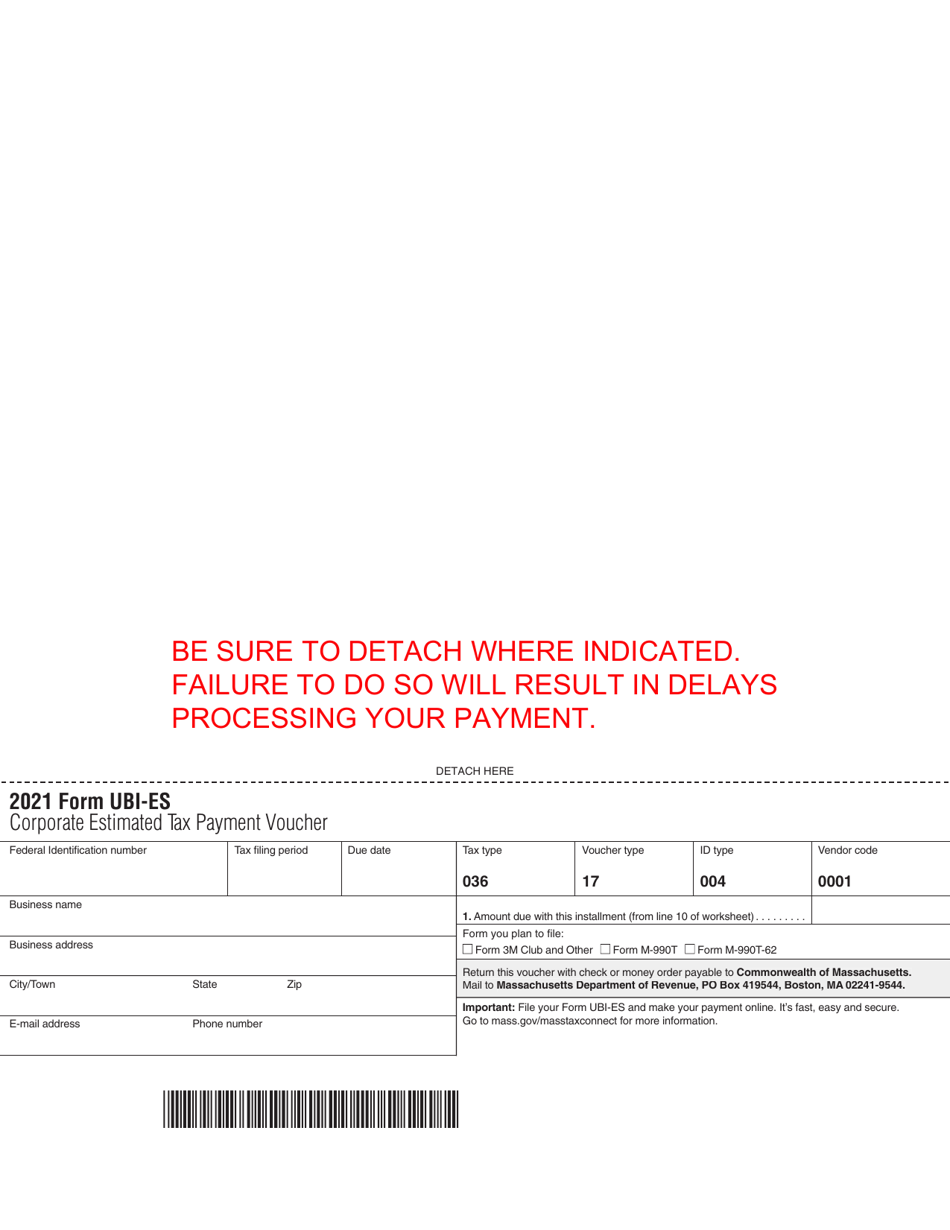

Q: How do I fill out the vouchers?

A: The vouchers require you to provide information such as your organization's name, address, federal identification number, and the amount of estimated tax payment.

Q: What happens if I don't make estimated tax payments?

A: Failing to make estimated tax payments or underpaying can result in penalties and interest charges.

Q: Can I get an extension to file the vouchers?

A: Yes, you may be able to request an extension to file the vouchers. You should contact the Massachusetts Department of Revenue for more information.

Q: Is there a penalty for late filing?

A: Yes, there may be a penalty for late filing. It is best to file your vouchers on time to avoid any penalties.

Q: Can I use these vouchers if I am not a non-profit entity?

A: No, these vouchers are specifically designed for non-profit entities in Massachusetts.

Q: What should I do if I have more questions?

A: If you have more questions or need further assistance, you should contact the Massachusetts Department of Revenue.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form UBI-ES by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.