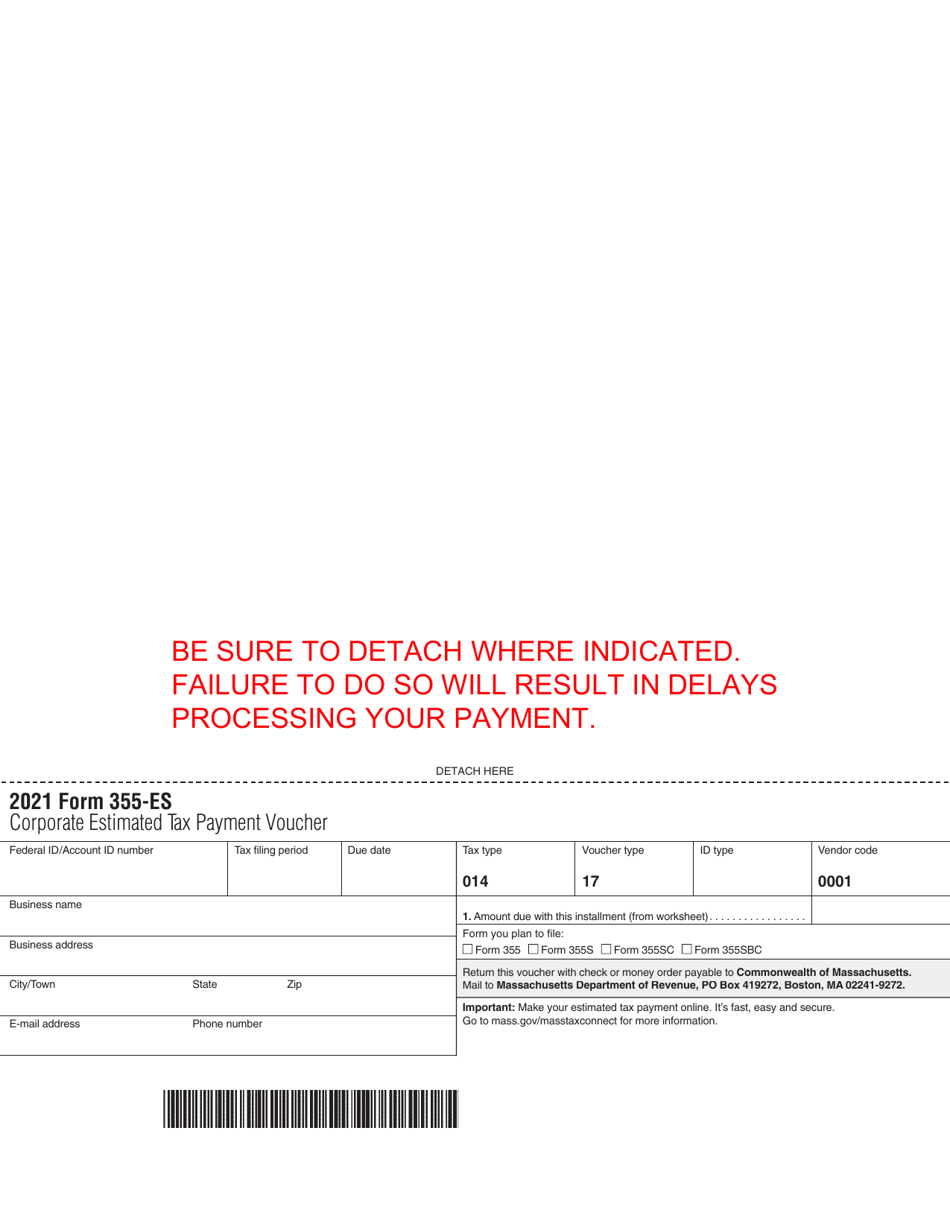

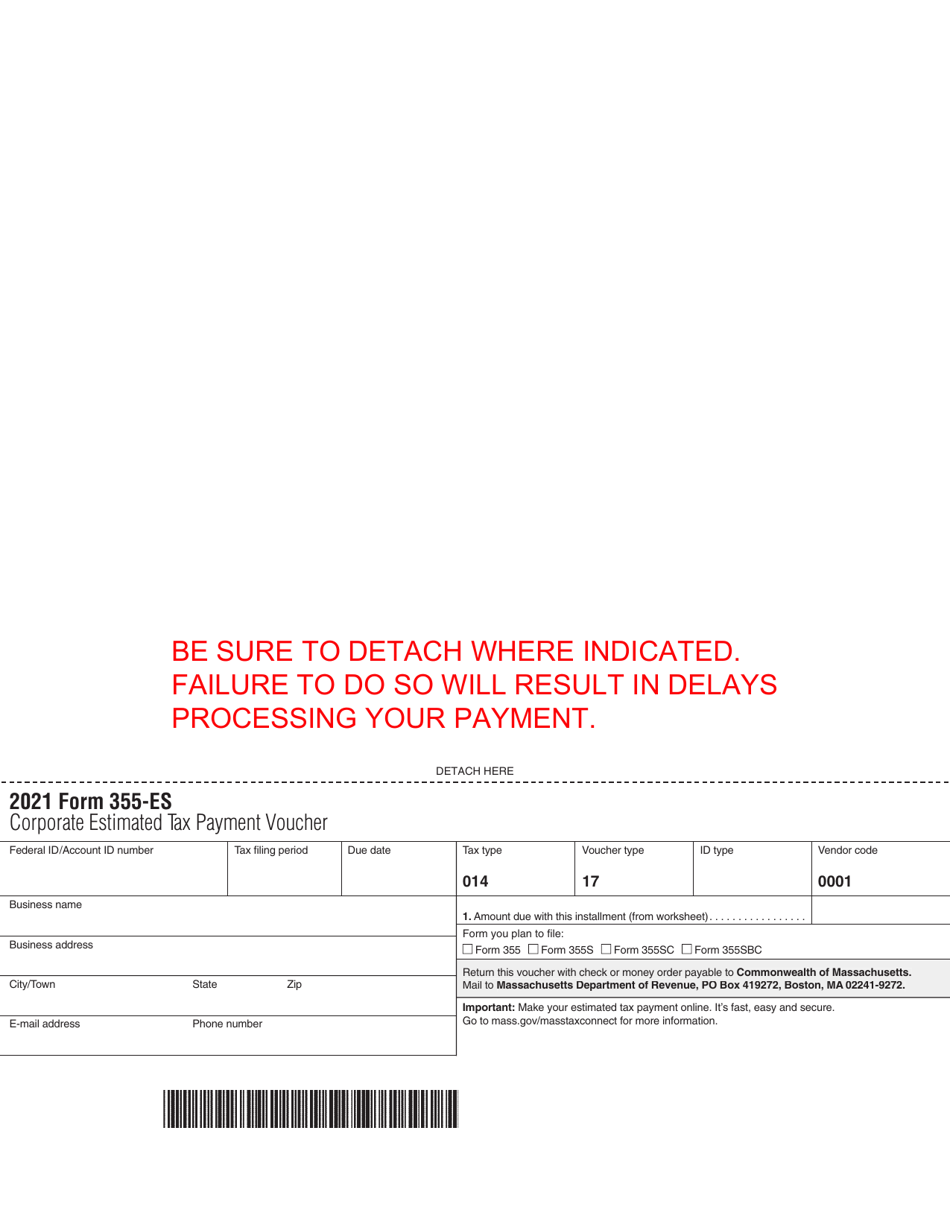

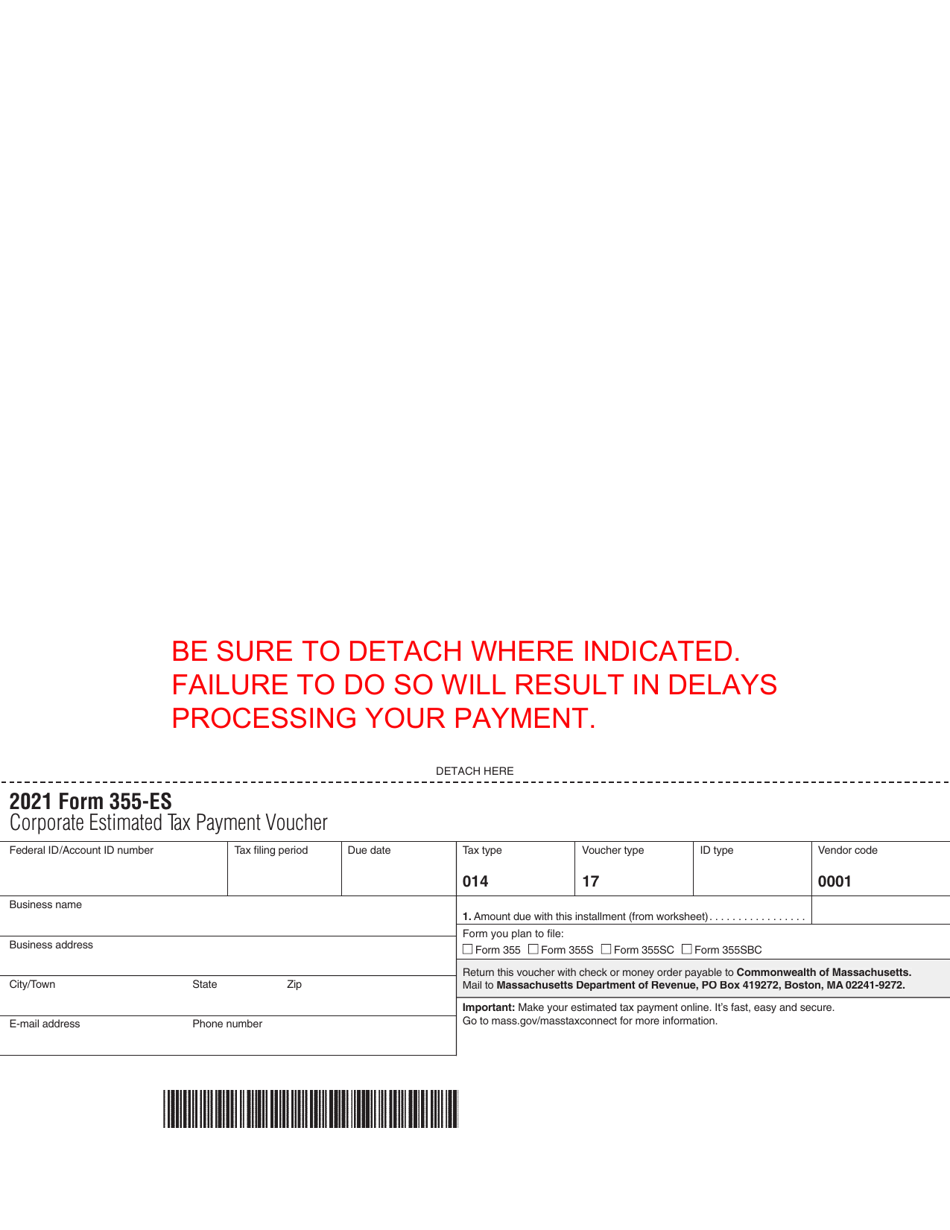

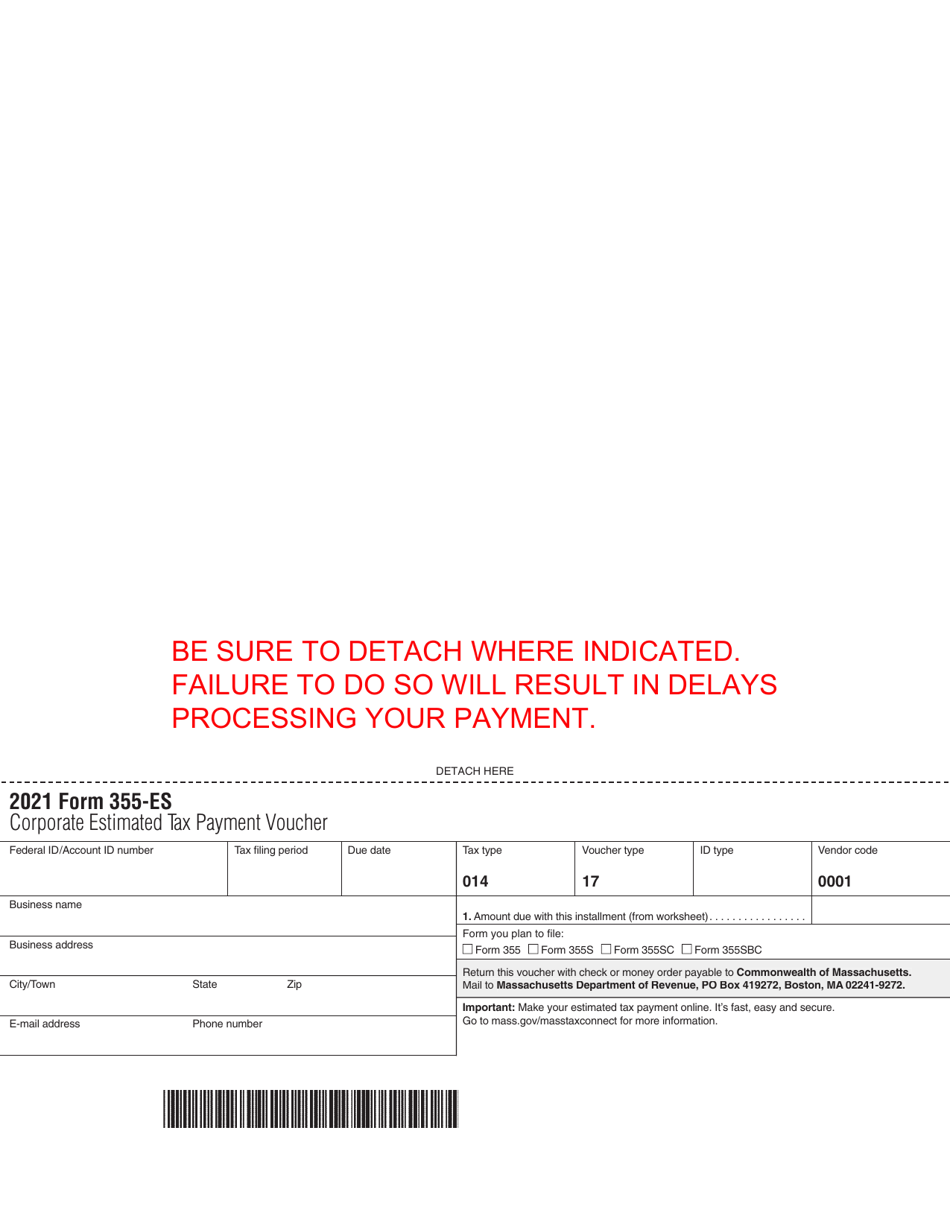

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 355-ES

for the current year.

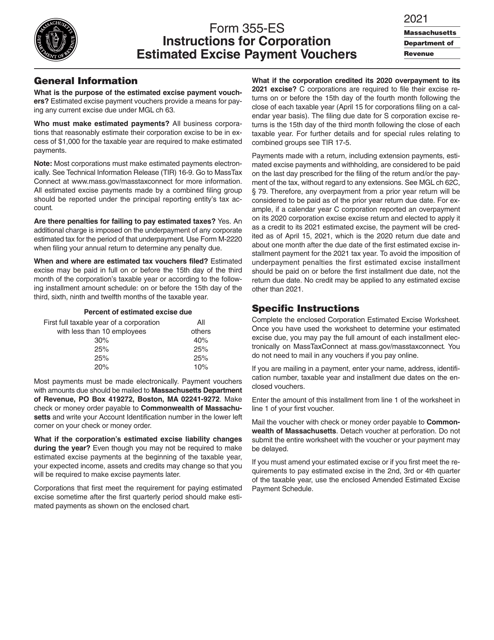

Form 355-ES Corporation Estimated Excise Payment Vouchers - Massachusetts

What Is Form 355-ES?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

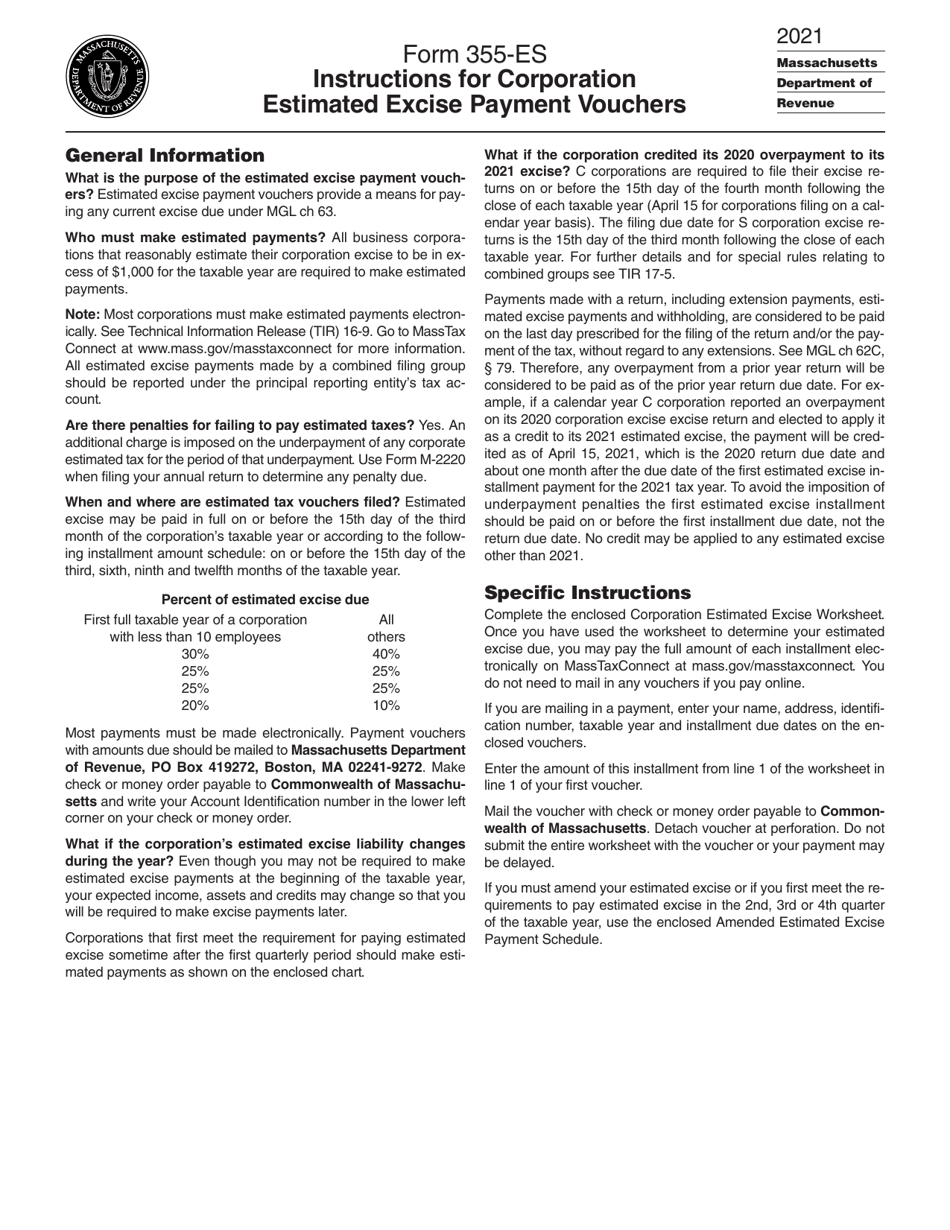

Q: What is Form 355-ES?

A: Form 355-ES is a payment voucher for corporations to remit estimated excise taxes in Massachusetts.

Q: Who needs to file Form 355-ES?

A: Corporations that are subject to excise taxes in Massachusetts need to file Form 355-ES.

Q: What are excise taxes?

A: Excise taxes are taxes imposed on the privilege of conducting business in Massachusetts.

Q: What is the purpose of Form 355-ES?

A: The purpose of Form 355-ES is to help corporations make estimated tax payments throughout the year.

Q: When is Form 355-ES due?

A: Form 355-ES is typically due on a quarterly basis, with specific due dates provided by the Massachusetts Department of Revenue.

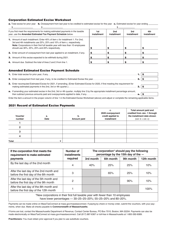

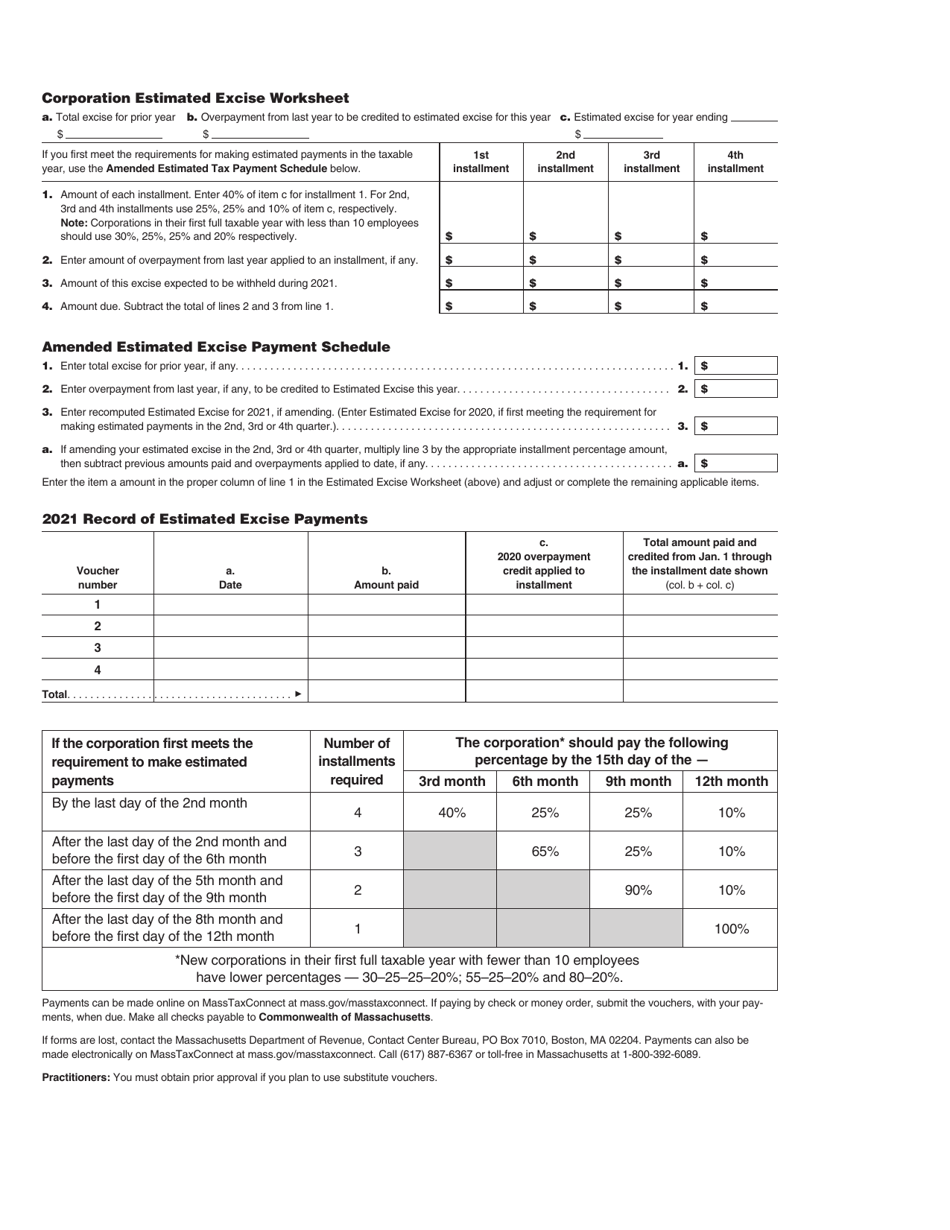

Q: How do I fill out Form 355-ES?

A: Form 355-ES requires you to enter your corporation's information, estimated tax amounts, and payment details.

Q: What happens if I don't file Form 355-ES?

A: Failure to file Form 355-ES or make the required estimated tax payments may result in penalties and interest.

Q: Can I make changes to Form 355-ES after filing?

A: Yes, you can amend your estimated tax payments by filing a revised Form 355-ES if necessary.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

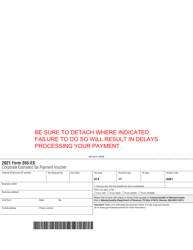

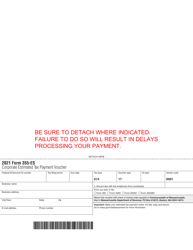

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 355-ES by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.