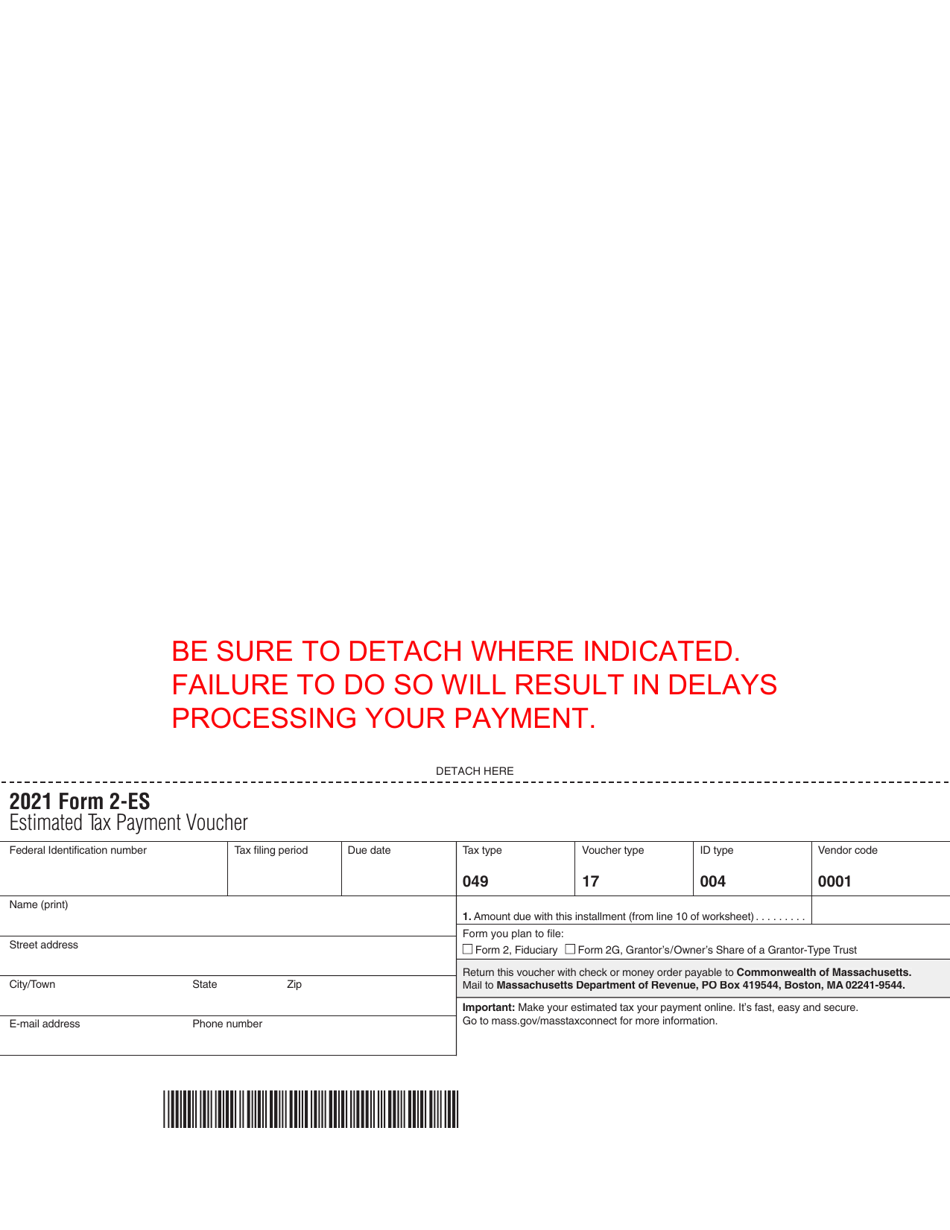

This version of the form is not currently in use and is provided for reference only. Download this version of

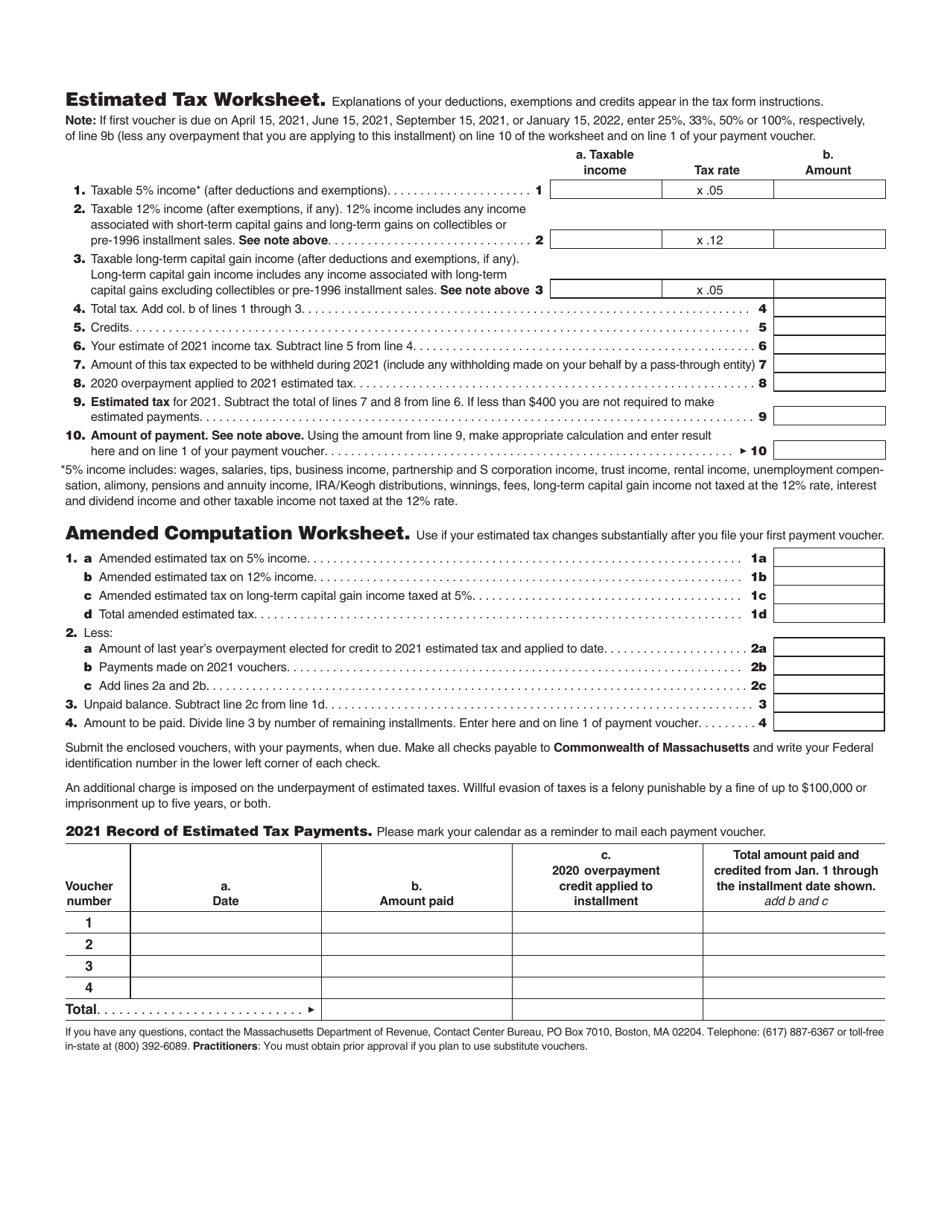

Form 2-ES

for the current year.

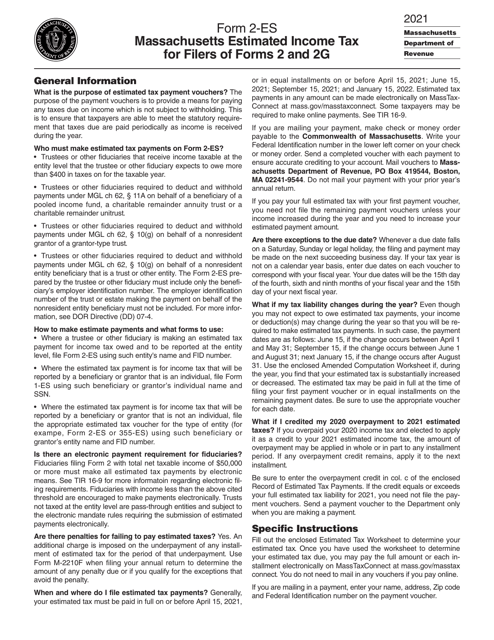

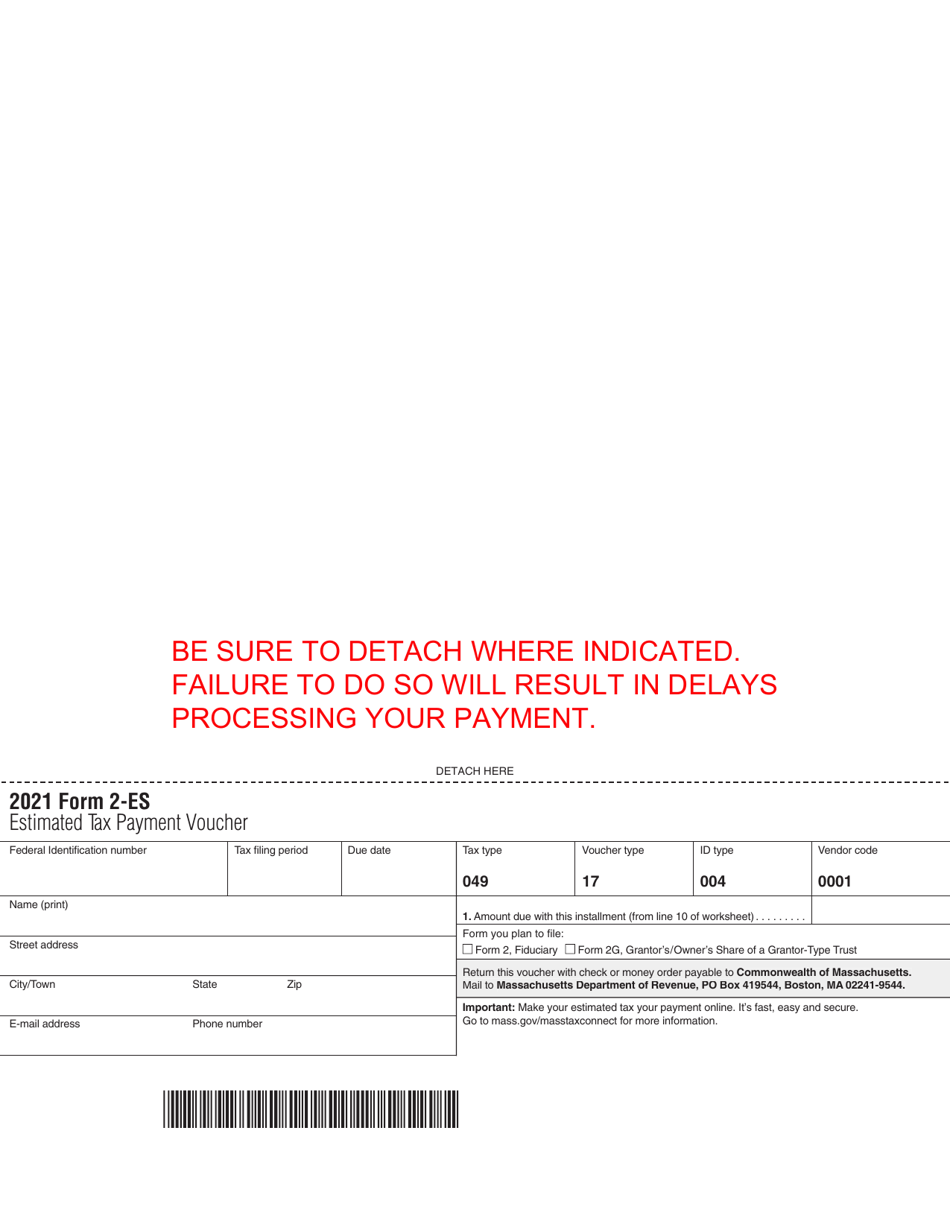

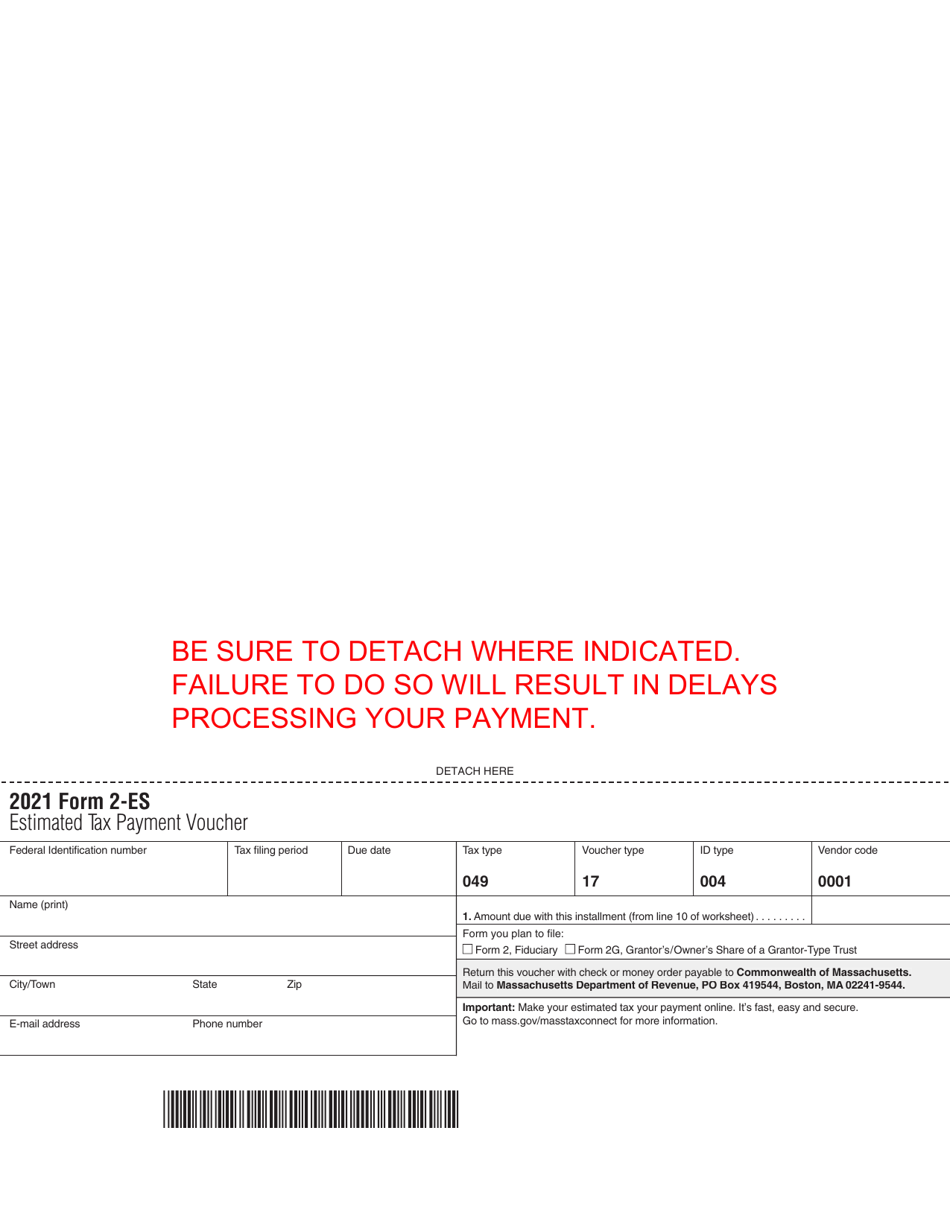

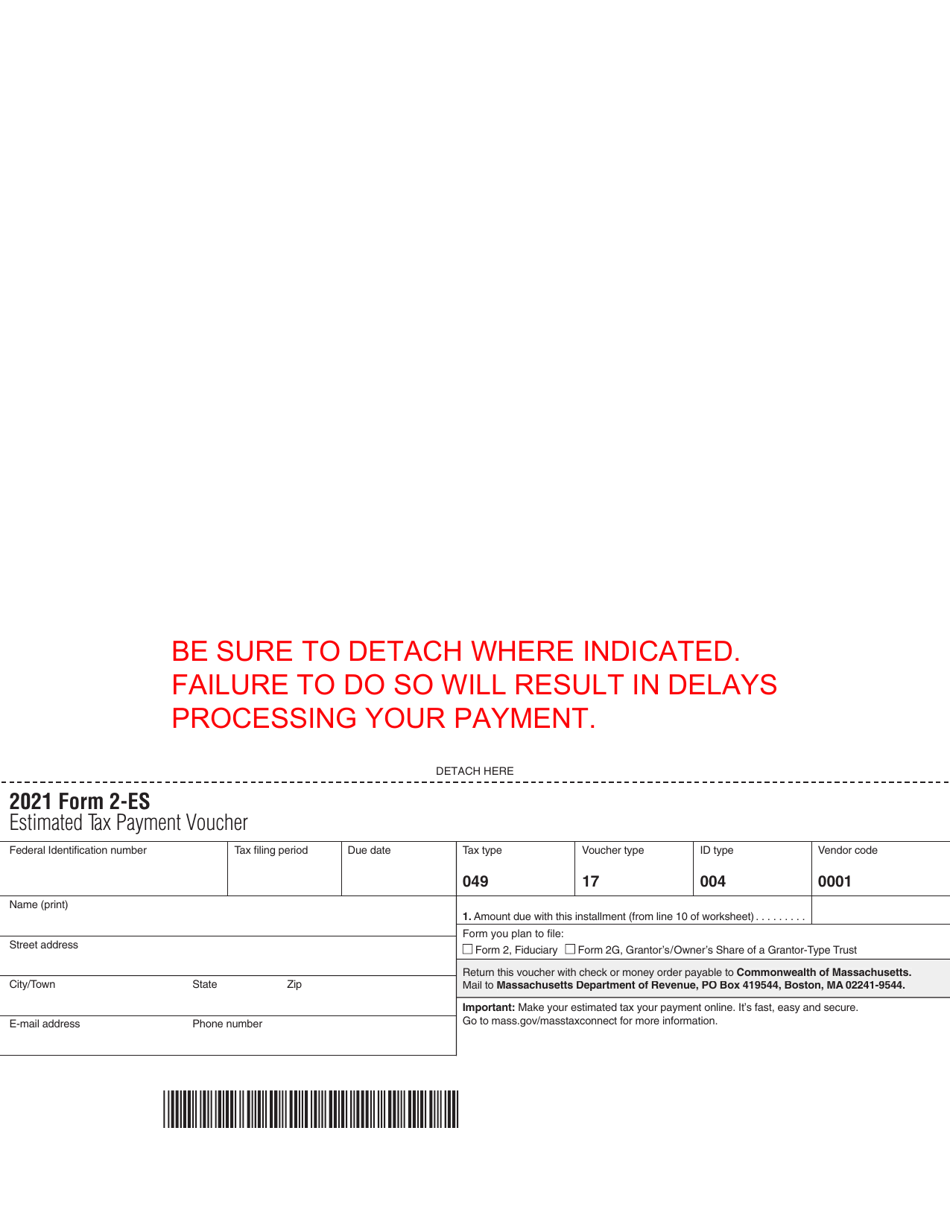

Form 2-ES Massachusetts Estimated Income Tax Payment Vouchers - Massachusetts

What Is Form 2-ES?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

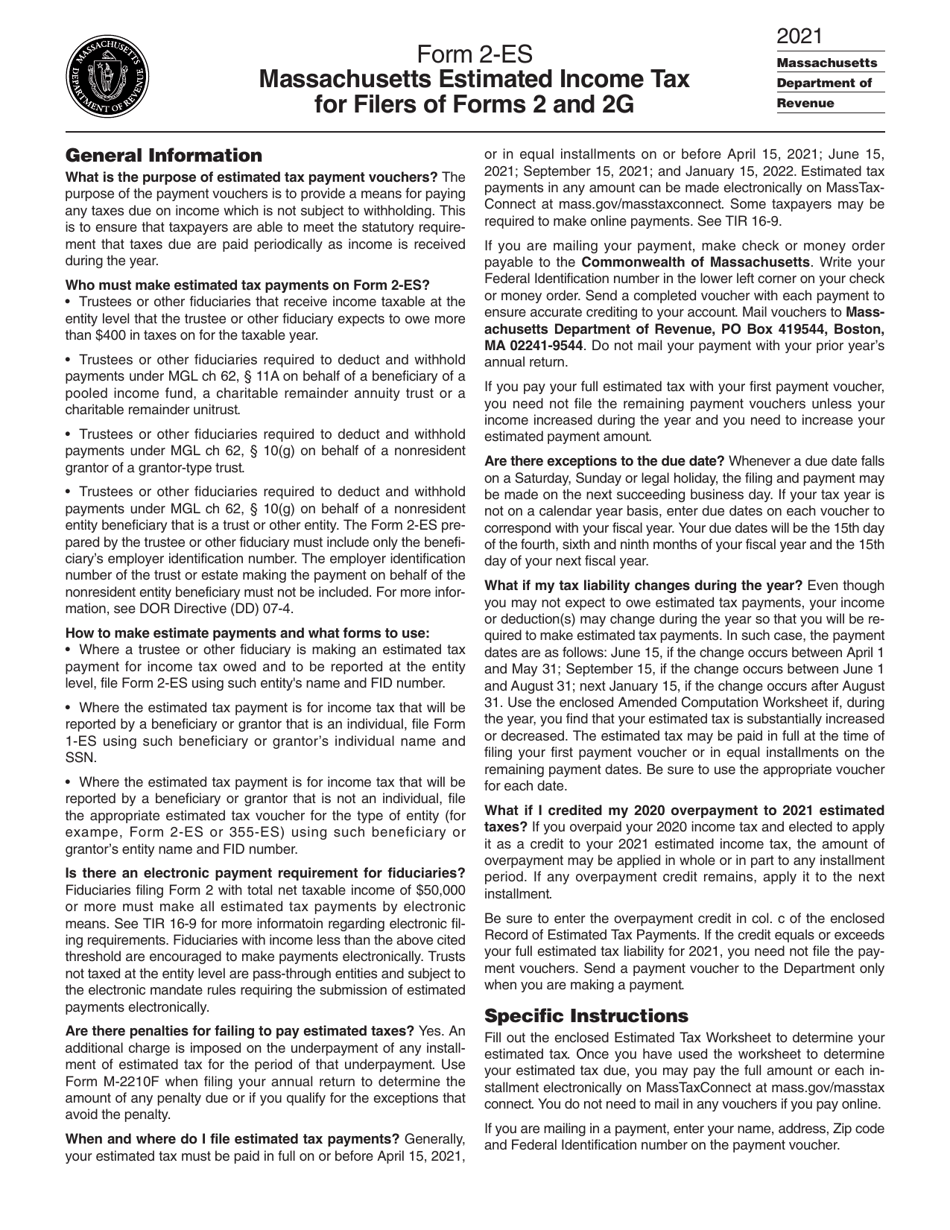

Q: What is Form 2-ES?

A: Form 2-ES is the Massachusetts Estimated Income Tax Payment Voucher.

Q: What is the purpose of Form 2-ES?

A: Form 2-ES is used to make estimated income tax payments to the state of Massachusetts.

Q: Who needs to file Form 2-ES?

A: Individuals who are required to make estimated income tax payments in Massachusetts need to file Form 2-ES.

Q: When is Form 2-ES due?

A: Form 2-ES is due on a quarterly basis. The due dates are April 15, June 15, September 15, and January 15 of the following year.

Q: Do I need to attach Form 2-ES to my tax return?

A: Form 2-ES should not be attached to your tax return. It is only used to make estimated tax payments.

Q: What happens if I don't file Form 2-ES?

A: If you are required to make estimated income tax payments and fail to do so, you may be subject to penalties and interest.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 2-ES by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.